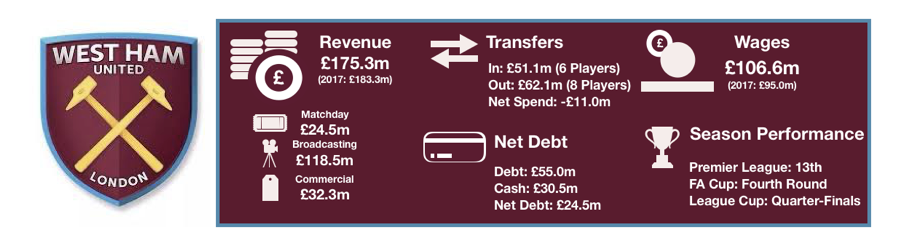

West Ham had a difficult season. A poor start under Bilic led to a relegation scare and his sacking. Bilic’s replacement, David Moyes, did well and successfully steered West Ham clear of relegation and a 13thplaced finish and League Cup Quarter-Final.

This was compounded with fan unrest over the club management of the owners due to a lack of direction and investment in the club. A lot of the complaints were right; however West Ham’s recent finances do show some factors in the owners’ favours after they paid down some debt meaning West Ham are a lot more sustainable than previously.

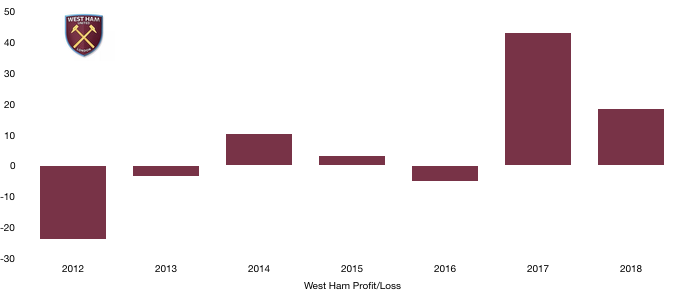

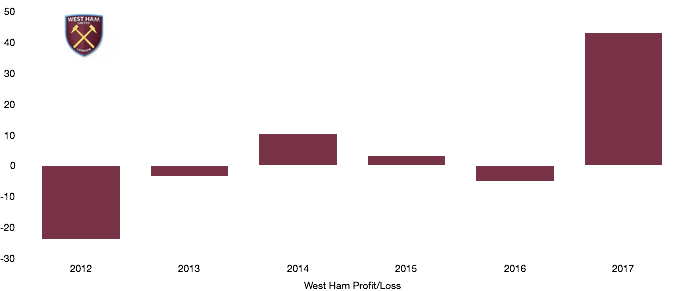

Due to a poor season however, West Ham saw their profits slump, more than having from £43.0m to £18.5m (57.4%), last year’s figure does however include the sale of the Boleyn Ground.

Let’s delve into the numbers

Revenue Analysis

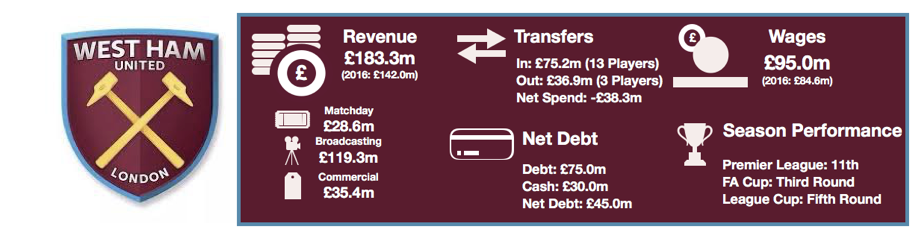

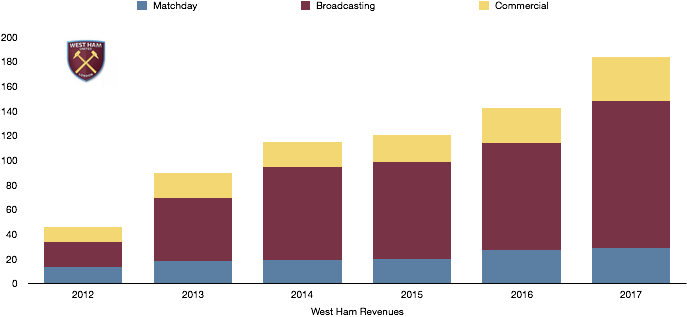

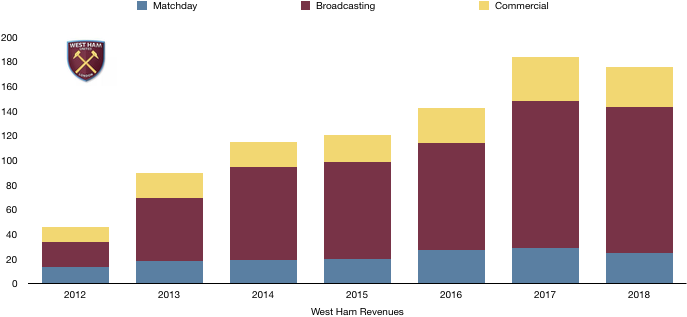

Revenue fell from £183.3m to £175.3m (4.4%) after a disappointing campaign, halting a significant period of year on year growth. West Ham’s accounts note that £5.8m of the £8m fall in revenue relates to one-off events that were held last year at the ground.

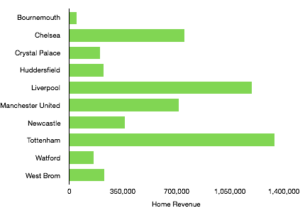

Matchday income fell from £28.6m to £24.5m (14.3%) with disgruntled fans spending less at games. This was compounded by a fall in the amount of home games West Ham had due to a shorter cup run and no Europa League football this year. Season tickets once again sold out in 2018.

Broadcasting revenue remained relatively stable, falling from £119.3m to £118.5m (0.7%) after a poor season meant that the slight increase in Premier League prize money was negated by a fall in league position plus the lack of Europa League prize money meant broadcasting revenue unsurprisingly fell.

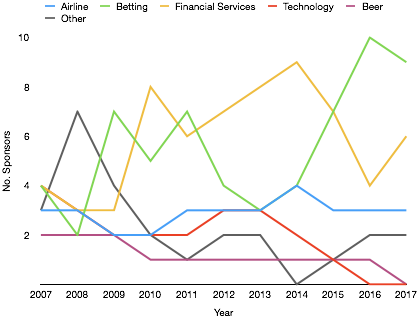

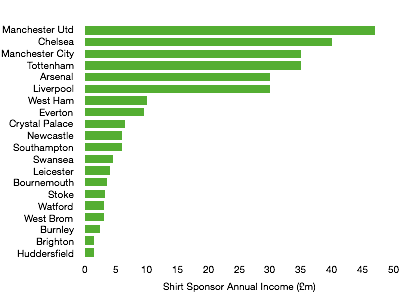

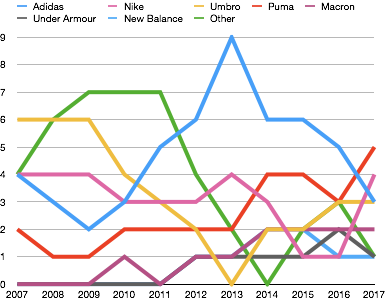

Commercial income also dropped, falling from £35.4m to £32.3m (8.8%) primarily due to one-off events held at the Olympic Stadium in 2017. Retail income and commercial income fell by £1.4m and £1.8m respectively. West Ham note that excluding one-off items, commercial revenue only fell by £0.9m, this still indicates that West Ham’s commercial strategy was ineffective in 2018 and needs to be revisited.

West Ham would expect to see revenue rise in 2019 with performances improving again and a higher league finish on the cards. Matchday income should remain robust as season tickets once again sold out. West Ham will be hoping for an improved commercial strategy to increase commercial revenue and take advantage of their large fan base that should attract more sponsors than it currently is.

Expense Analysis

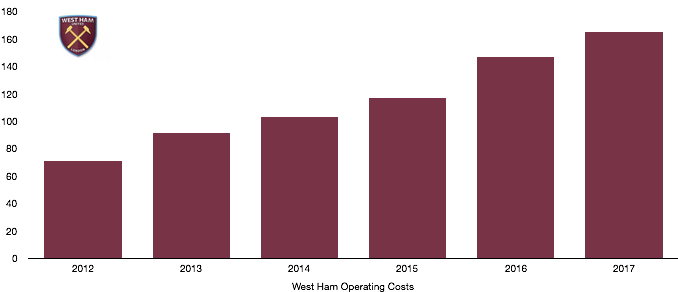

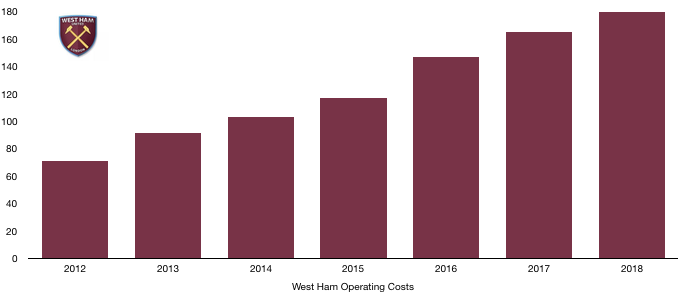

Despite revenue falling, costs saw no sign of slowing down as costs continued to rise year on year. Cost rose from £165.4m to £183.6m (11.0%), reducing profitability significantly.

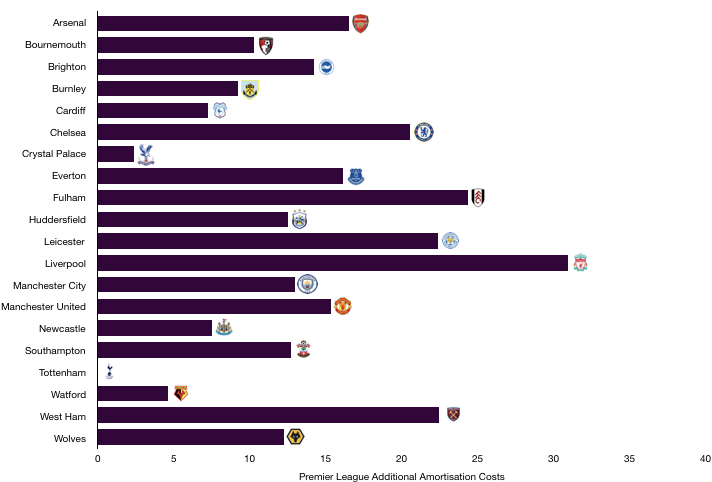

Amortisation is the clearest sign available of player investment, so this unsurprisingly fell in 2018, dropping from £45.4m to £41.0m (9.7%) after a lack of investment by the owners in the playing squad as voiced (loudly) by their fans.

The lease costs of the Olympic Stadium rose from £2.4m to £2.9m (20.8%) as part of the ongoing agreement with the Mayor and the City of London.

Net interest paid, fell from £5.0m to £3.7m (26.6%) as the owners decided to pay down some debt, reducing interest payments which may be seen by some not affiliated with West Ham as a smart decision despite a lack of investment.

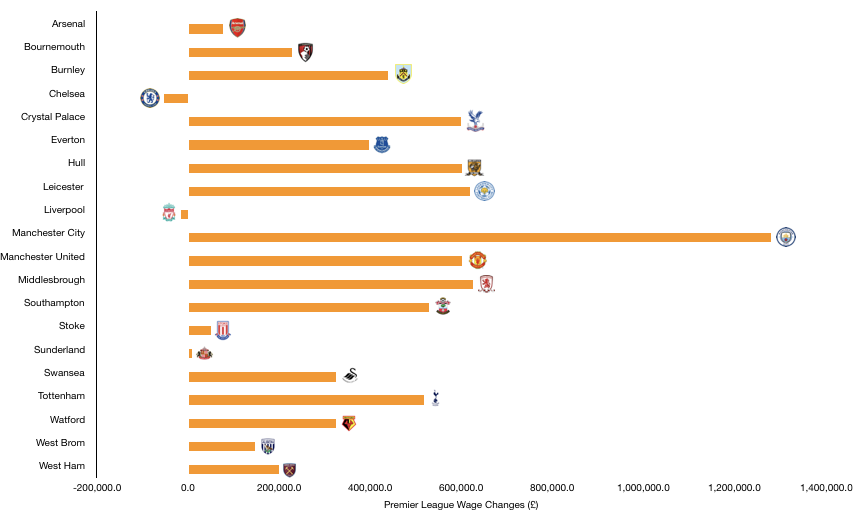

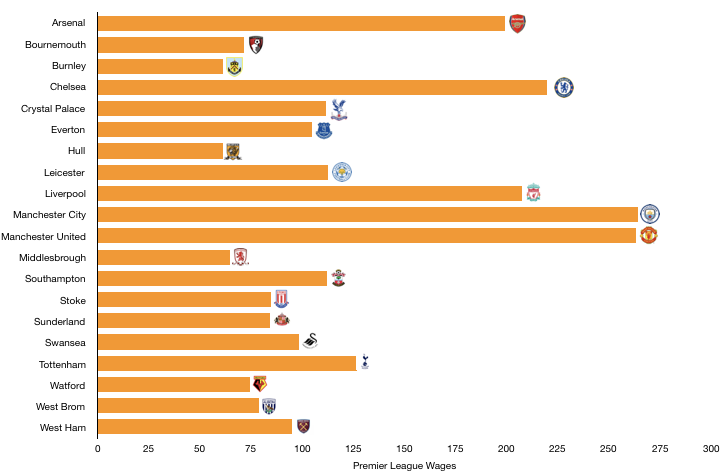

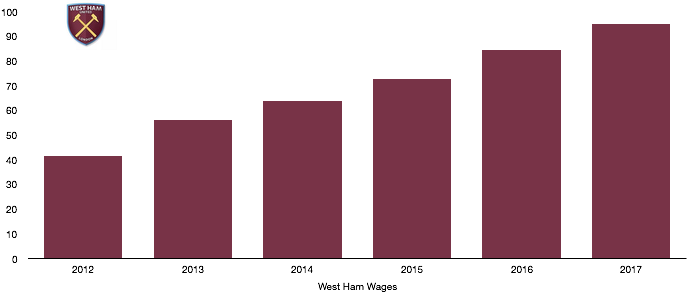

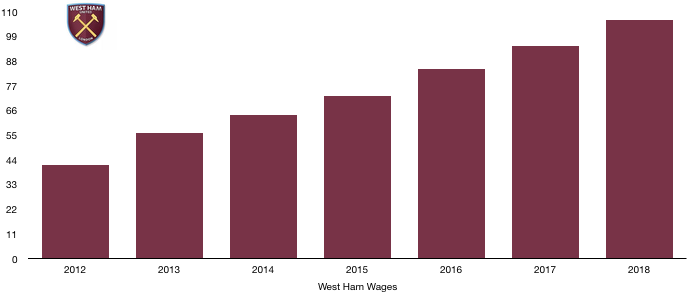

Wages were on the rise, increasing from £95.0m to £106.6m (12.2%) due to new signings such as Arnautovic, Chicharito and Zabaleta being much higher earners than the departures from West Ham.

This wage increase works out at an extra £223k a week on wages.

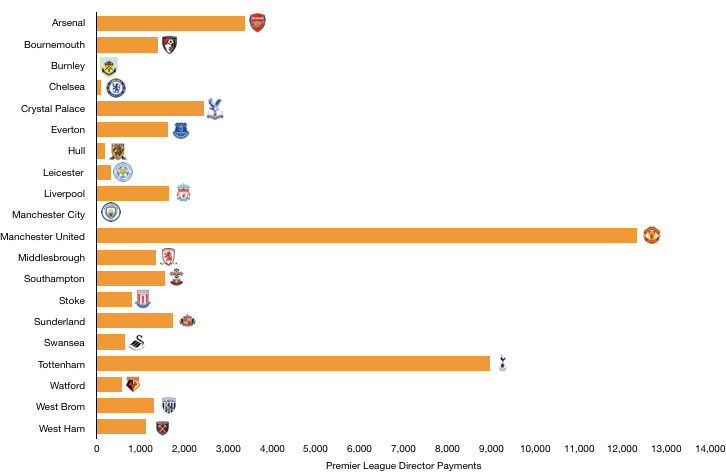

Directors saw their wages rise despite a poor season as pay increased from £1.3m to £1.4m while the highest paid director (most likely David Sullivan) saw wages increase from £868k to £898k.

West Ham paid £932k in taxes during the year, an effective tax rate of only 4.9% compared with the current tax rate of 19%. This is due to West Ham having large tax losses from previous years which has been used now to reduce their tax in profitable years. West Ham still have £62.3m in such tax losses so West Ham’s tax bills are likely to remain small for the foreseeable future.

West Ham can expect costs to continue to rise next year after significant player investment in the summer which will cause wages and amortisation to both rise significantly.

Transfer Analysis

Now we come to the area that angers most West Ham fans, transfers.

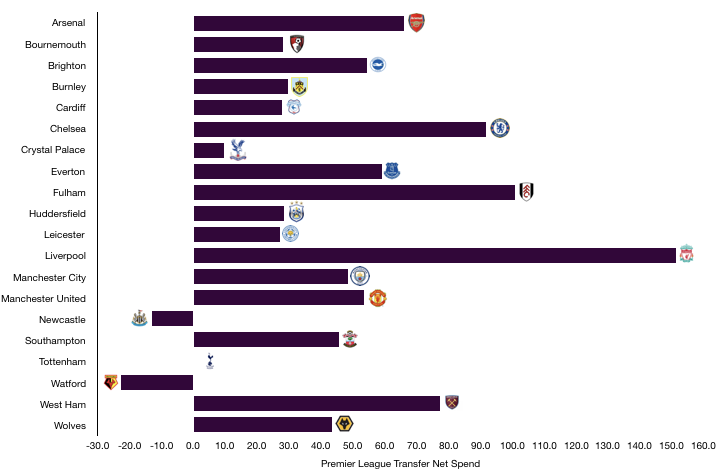

West Ham brought in Arnautovic (£20.1m), Chicharito (£16.0m), Hugill (£9.2m), Haksabanovic (£2.7m), Hart (Loan – £2.1m), Mario (Loan – £1.1m) for a combined £51.1m.

Out went Ayew (£20.5m), Sakho (£9.0m), Nordtveit (£7.2m), Fletcher (£6.6m), Randolph (£5.0m), Fonte (£5.0m), Valencia (£5.0m) and Feghouli (£3.8m) for a combined income of £62.1m.

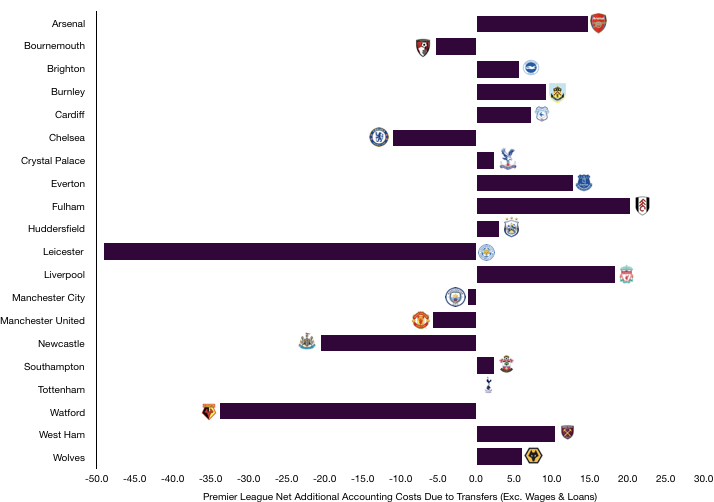

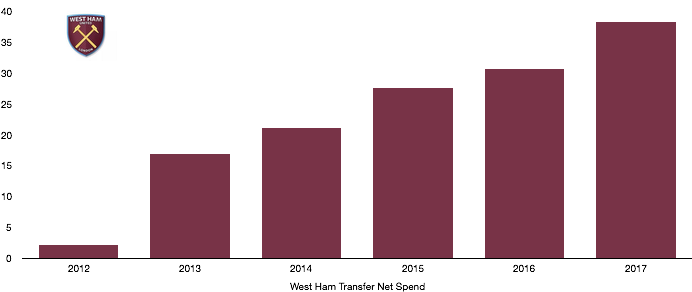

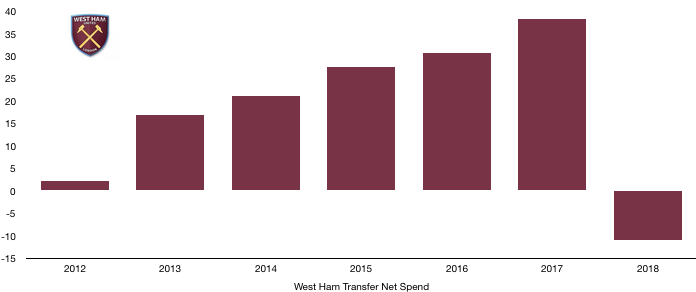

This led to a net transfer income of £11.0m compared to a net spend of £38.3m in 2017. Net transfer incomes are incredibly frowned upon in this modern era with the riches available to clubs.

The signings had a lot of promise with fans initially excited by the signings however they all flattered to deceive except for Arnautovic who proved a great signing.

The players sold were not missed however and the fees received for most would be considered a good deal however fans would have hoped more of the fees would have been reinvested.

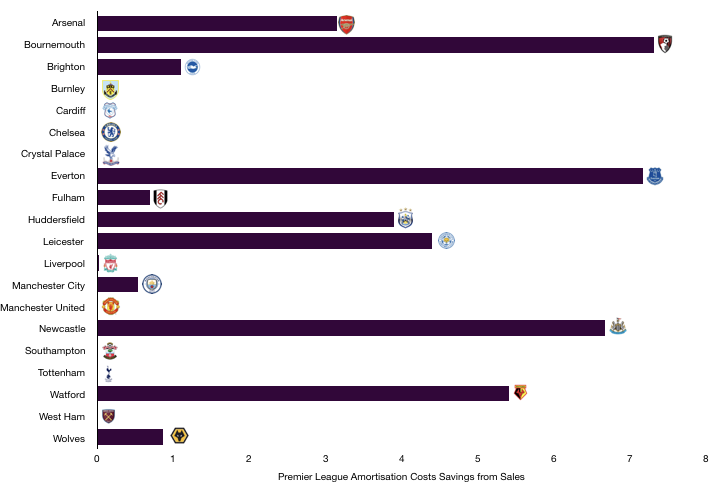

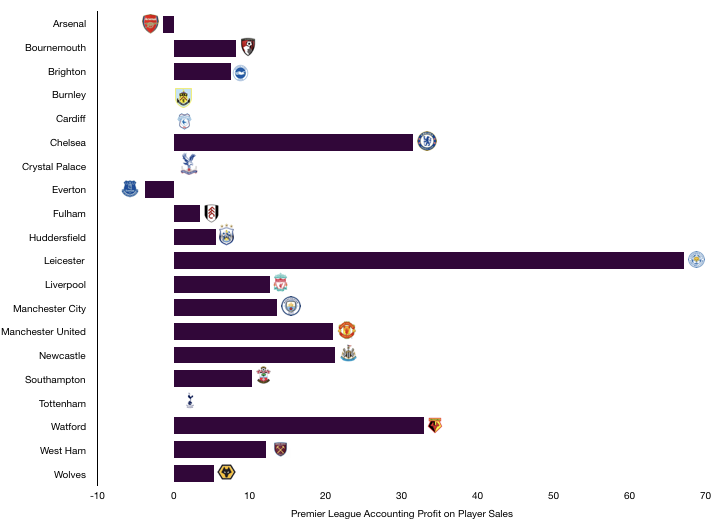

West Ham recorded a profit on player sales of £29.9m from an accounting perspective mainly due to the sales of Ayew, Fletcher, Nordtveit and Randolph.

In relation to this, West Ham owe £25.2m to other clubs in transfer fees with £15.7m of this owed in 2019.

West Ham are surprisingly owed a lot more, with clubs owing them £57.0m with £32.5m being owed in 2019. This may explain the lack of investment with the club yet to receive a large portion of transfer fees for players sold due to the deals negotiated not being favourable. Receiving £32.5m in 2019 may explain why they have spent more heavily this summer.

West Ham potentially have another £4.8m in contingent transfer fees they will owe other clubs if certain clauses are met.

Asset/Liability Analysis

West Ham have kept cash levels relatively stable over the last couple of years, Cash increase from £30.0m to £30.5m (1.7%). This is largely due to increases in cash from transfers and profits which were used to reduce debts as explained below.

Debt levels fell by £20m, decreasing from £75.0m to £55.0m (26.7%) as the owners used cash to reduce bank debt by £20m which has interest of 4-6% due on it.

Shareholder debt remained at £45.0m.

This may be a shrewd move by the owners to make West Ham more self-sufficient however they have heeded fan concerns and spent more this year which may bring about more debt, offsetting the reduction of this year.

West Ham received new loans of £33.0m in total (not reflected in finances above) in August and October 2018 which is due to be repaid in July 2019.

West Ham also repaid £4.6m in shareholder loans in August 2018 (not reflected in finances above).

West Ham’s net debt hence nearly halved, falling from £45.0m to £24.5m (45.6%) which is a much more positive position to be in from a sustainability perspective. However as mentioned above, fan unrest has seen spending increase and it remains to be seen whether this sustainability strategy will take a back seat which may be a risk, but fans will be willing to take it.

Thanks for reading – Please share with a West Ham fan!