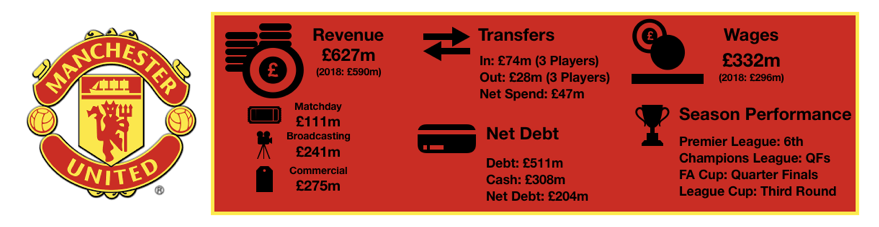

Manchester endured a turbulent 18/19 season as they struggle to return to the successes of the Ferguson years.

Following a much publicised poor start to the campaign, Jose Mourinho was sacked and replaced with club legend Ole Gunnar Solskjær, sparking an incredible run of form that saw the club appoint him full time manager.

However, form dipped following this and Manchester United laboured to a sixth placed Premier League finish and no Champions League football next year following their quarter final exit.

There was no further joy in the domestic cups with exits in both by the quarter final stage.

This didn’t stop the club posting record revenues as one of the world’s biggest clubs continue to perform off the pitch.

Let’s delve into the numbers.

Revenue Analysis

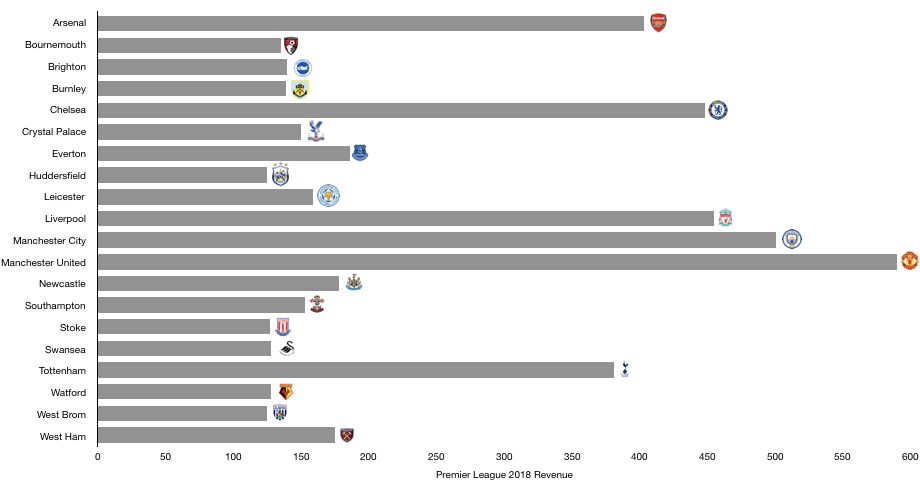

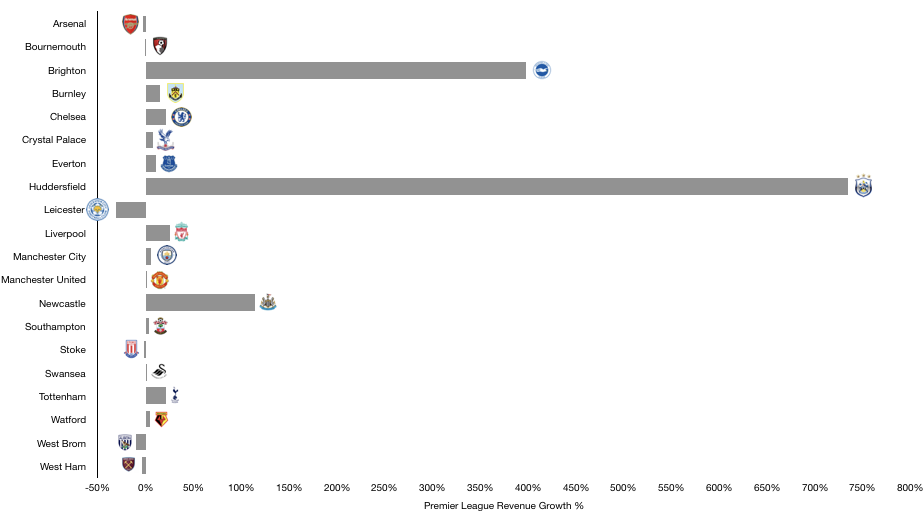

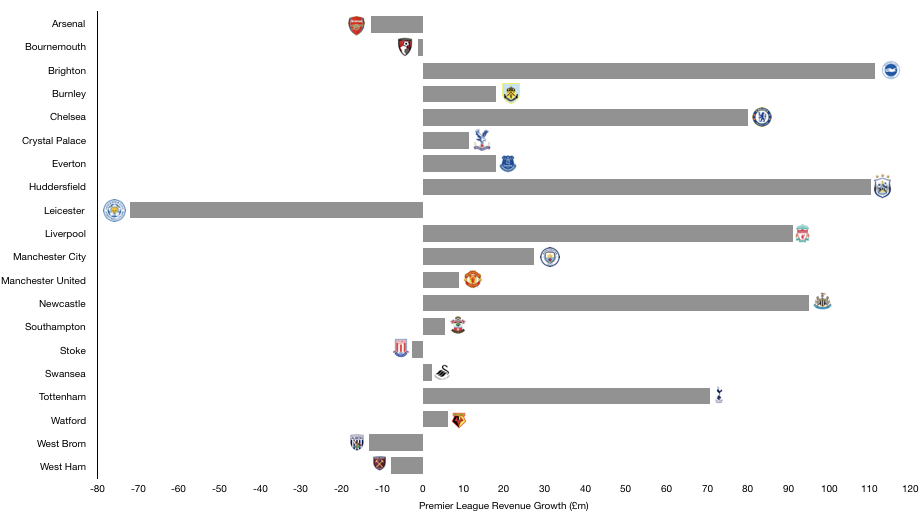

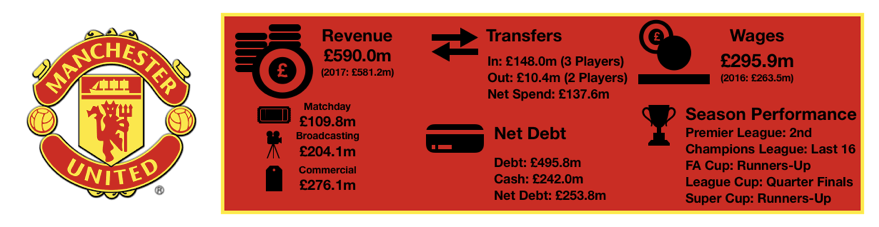

Despite a disappointing campaign on the pitch, a return to the Champions League saw Manchester United’s revenue reach record levels, rising from £590m to £627m (6%).

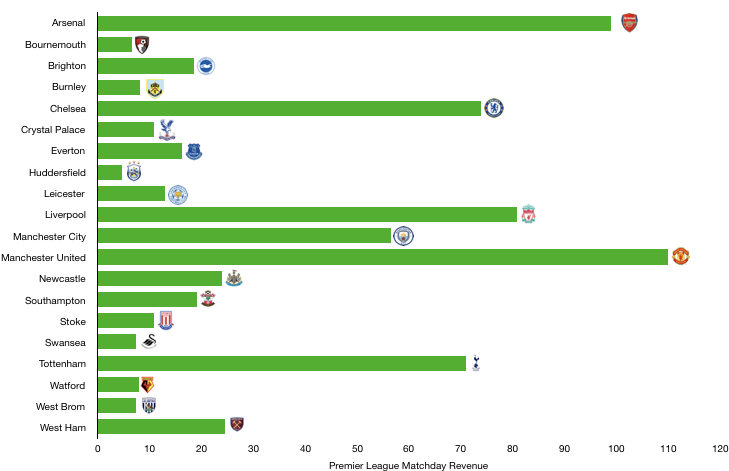

Matchday revenue remained relatively stable, increasing from £110m to £111m (1%). This rise was largely due to competing in the Champions League and the more expensive ticket prices of the competition over the Europa League.

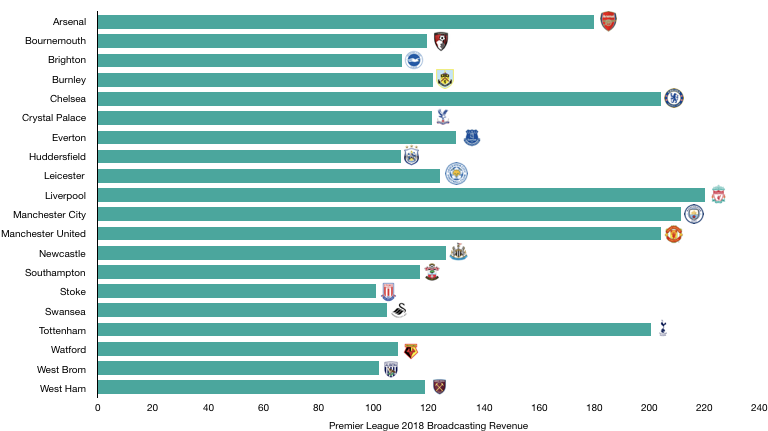

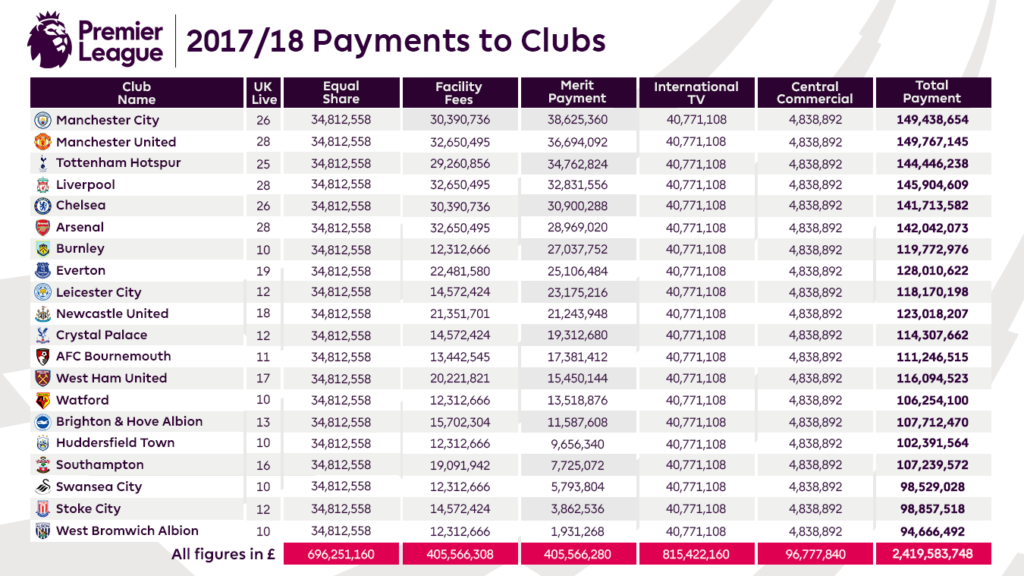

Broadcasting revenue was up significantly, rising from £204m to £241m (18%), mainly due to a return to the Champions League and UEFA’s new licensing agreement. This offset the £7m revenue loss Manchester United suffered by finishing 4 places lower in the Premier League.

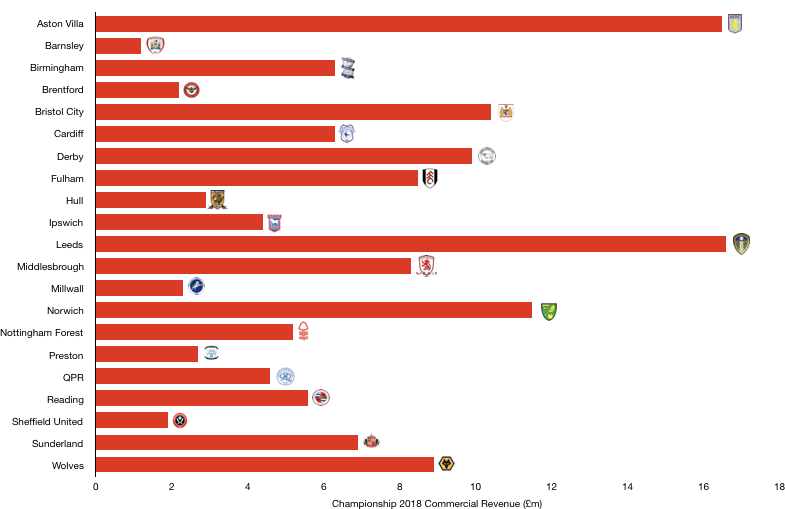

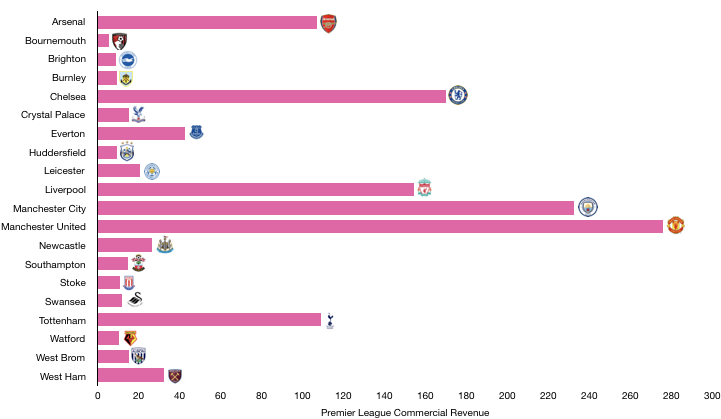

Commercial revenue was pretty much stable, falling from £276m to £275m (0.4%). Sponsorship revenue remained the same as Manchester United reach what may be a critical mass in sponsors until their next deal cycle. Interestingly, the fall in revenue was down to a decline in merchandise and retail sales, which fell to £102m.

Looking ahead, Manchester United are likely to see a drop in revenue after they failed to qualify for the Champions League. With a title winning campaign unlikely, there is no other way for the club to bridge the loss revenue from the lack of a Champions League campaign except strong commercial growth.

Such growth commercially has not occurred in the last 3 years and this will need to change to protect revenue from falling.

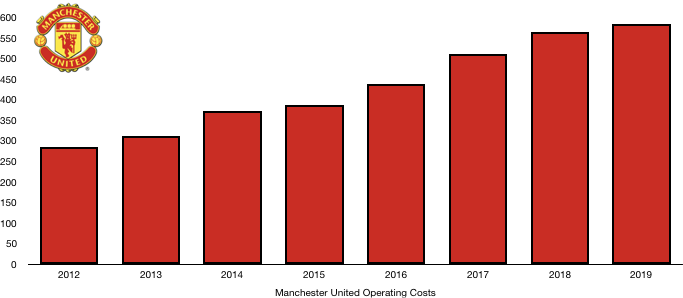

Costs Analysis

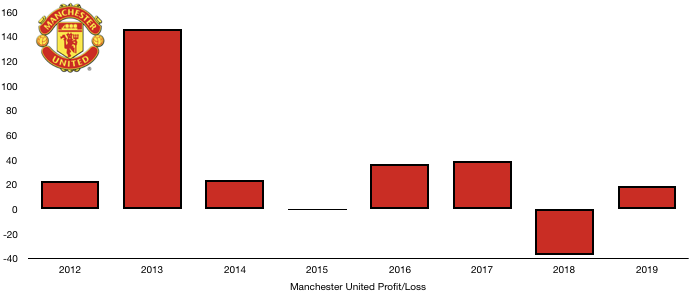

Manchester United saw a modest rise in costs given the rise in revenue in 18/19, with costs rising from £564m to £583m (3%). This 3% rise is half the rise in revenue (6%), which has saw Manchester United’s profitability improve last season.

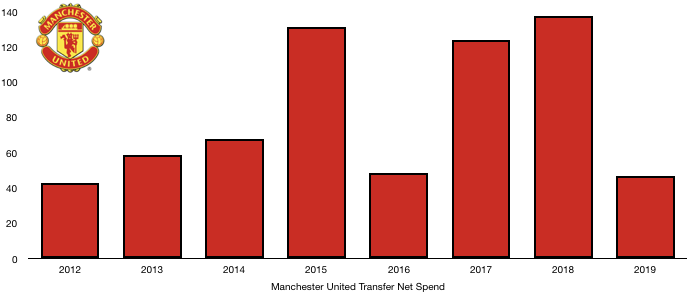

Amortisation fell from £138m to £129m (7%) on the back of a relatively quiet season by Manchester United standards, with their smallest net transfer spend since 2012 (see transfer analysis section).

Net interest costs increased from £18m to £23m (27%), this was largely due to the strengthening of the dollar against the pound, showing the effects Brexit and other macro-economic factors can have on a football club.

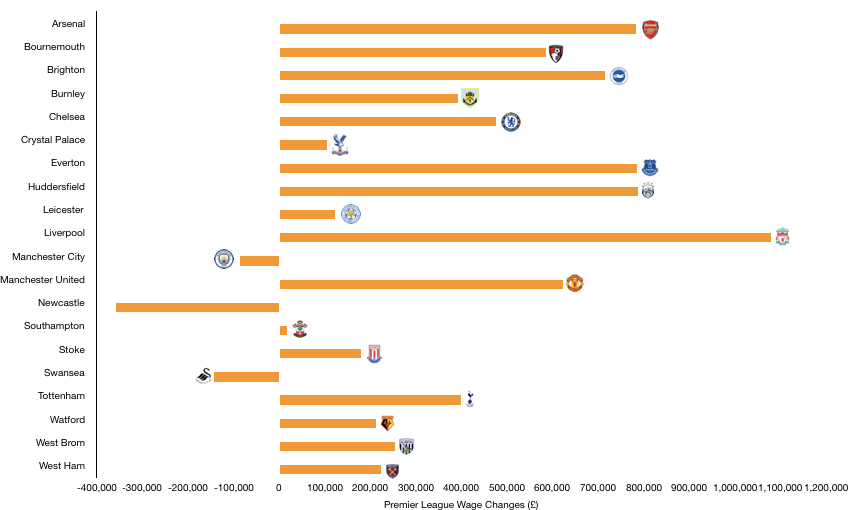

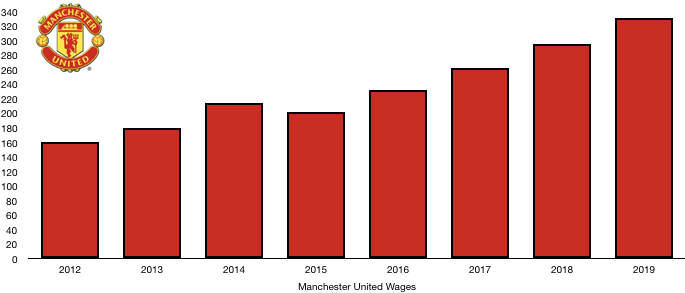

Manchester United saw wages rise significantly despite a quiet transfer season, increasing from £296m to £332m (12%). This was largely due to contract renewals (Shaw, Smalling, Jones) as well as new signings that entered plus a full season of Alexis Sanchez’s much publicised wages.

This increase in wages works out as an extra £692k a week and interestingly, wages also increased by 12% last year, showing an increasing trend in wage growth in football.

Further to their staff costs, Manchester United shelled out £20m in compensation to Jose Mourinho following his sacking. Such costs are one-offs and will not occur this season (Ole is reportedly on much lower wages and contract term than Mourinho was) and should go some way to offsetting the fall in revenue expected from no Champions League.

Other costs fell from £117m to £108m (8%), largely due to the World Cup which meant a shorter preseason tour and there was also a reduction in domestic cup costs.

Looking ahead, Manchester United are likely to see a similar level of costs next year. The lack of severance pay next year as noted will see an immediate £20m reduction in costs. This plus the exit of high earners such as Herrera, Lukaku and Valencia (most of Sanchez’s wages are still being paid by Manchester United), should more than cover the increase in wages from their latest signings.

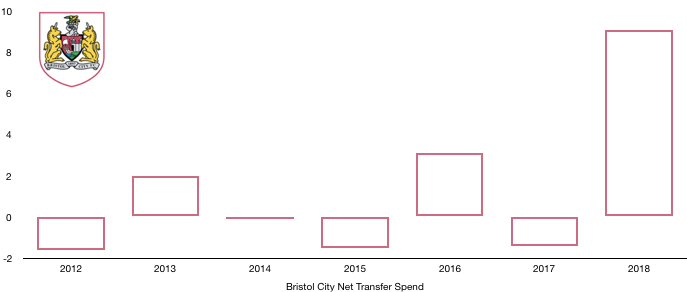

Transfers Analysis

Manchester United saw three players join and three leave for transfer fees in 18/19.

In came Fred (£53m), Dalot (£20m) and Grant £2m for a combined £75m. Out went Blind (£14m), Johnstone (£7m) and Fellaini (£7m) for a combined £28m, leading to a net spend of £48m, down 66% of last year’s net spend of £138m.

The big new signing Fred struggled to get into side and has disappointed fans with his performances. Dalot impressed in spells and clearly has potential.

None of the departed players were particularly missed, however with things proving difficult for Mourinho and co, the new signings Fred and Dalot were clearly not enough to keep Manchester United challenging.

The sales of Fellaini, Blind and Johnstone led to Manchester United recording a profit on player sales of £26m which was £8m up from the prior season and helped the club record a profit.

In cash terms, Manchester United spent £178m on players in 18/19, primarily due to instalments due from previous signings.

In contrast Manchester United received £43m, leading to a net cash outflow of £135m, explaining partly why last summer was a lighter year transfer wise for the club.

Manchester United are owed £18m in transfer fees, of which £10m is due this year.

However, Manchester owe a huge £188m, of which £111m is due this year.

This means that net, Manchester United owe clubs £170m, of which £101m is due this year, further showing why the club didn’t back Mourinho last summer with more signings.

In contingent transfer fees, Manchester United could also pay a maximum of £74m should certain clauses in player contracts be met, although it is unlikely this full amount will ever become payable.

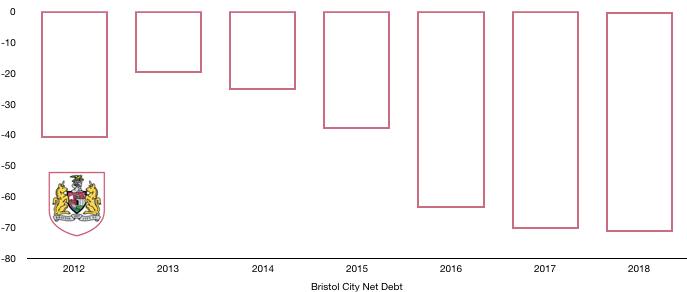

Debt Analysis

Manchester United are notoriously run via debt however this has been a model that has worked for the club ever since the Glazers took over.

On the cash side, Manchester United are at their most cash rich point ever after cash reserves rose from £242m to £308m (27%). This was primarily due to an improvement in cash from operations and an increase in revenue.

On the other side, debt levels also increased to new highs, rising from £496m to £511m (3%), this £15m increase is primarily due to changes in the exchange rate as the dollar strengthens/pound weakens.

Overall, this means Manchester United’s net debt has fallen from £254m to £204m (20%). This will please fans who feel the club should be becoming more sustainable and will also lessen any Financial Fair Play concerns UEFA or other parties have.

Looking ahead, it is clear Manchester United have a rebuilding job on their hand which may take some time. However, the key financially is to remain in the Champions League, something they have failed to do.

Commercial revenue and matchday revenue will remain robust, so the shortfall is likely to only be due to performances on the pitch which can only be improved by better management and/or players which is easier said than done.

Thanks for reading! Share with a Manchester United fan.