Sunderland endured their first season in the Championship since 2006 and it was severely unhappy one as Sunderland suffered back to back relegations after hitting rock bottom (literally).

A 24thplaced finish concluded a turbulent campaign that saw 4 managers try and steer the club to safety to no avail as the Black Cats luck was well and truly out.

Off the pitch was just as bad, as losses doubled in size, increasing from £10.2m to £19.9m (95%) as their financial problems continued to mount, a problem that is now Mr. Donald’s following his purchase of the club which is in much need of a financial saviour.

Let’s delve into the numbers.

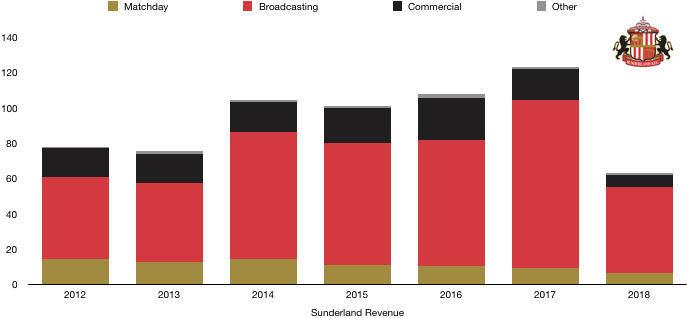

Revenue Analysis

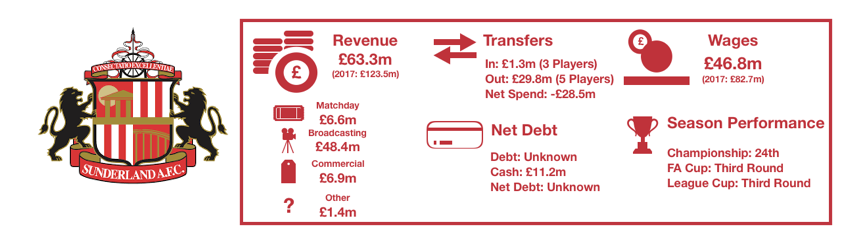

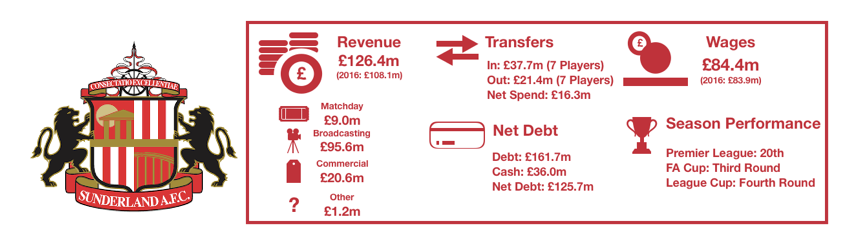

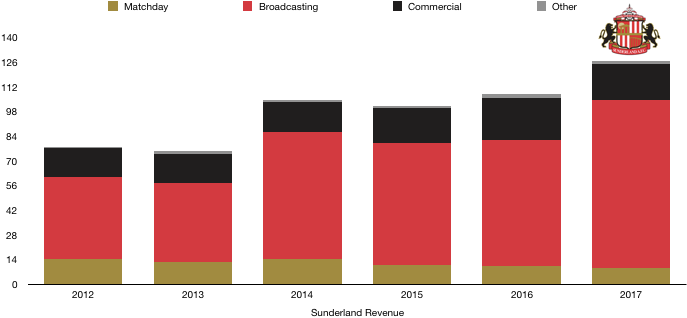

Relegation from the Premier League was a costly one as Sunderland saw their revenue halve from £123.5m to £63.3m (49%).

Matchday revenue was on the decline, falling from £9.0m to £6.6m (27%) as fans left in their droves as average attendances fell from 41,287 to 27,635 (33%) as the doom and gloom around the club saw support fade.

Broadcasting revenue plummeted, dropping from £95.6m to £48.4m (49%) as the lack of Premier League football was felt financially. The drop was cushioned by parachute payments, although the amount received will fall next year and see revenue drop significantly once again.

Commercial revenue fell off a cliff, plummeting from £17.8m to £6.9m (61%) as relegation hit and the troubles surrounding the club scared off sponsors and saw lucrative deals fall away. Until Sunderland get their affairs in order, commercial revenue will continue at these low levels.

Other revenue increased from £1.1m to £1.4m (27%).

Looking ahead, revenue will drop significantly once again as Sunderland play in League One this year. An immediate return looked on the cards for much of the season but a fall into the play-offs means promotion is far from certain.

Regardless, broadcasting revenue will fall as both parachute payments fall, and the club receive League One TV money following one year of Championship income. Commercial revenue will once again fall as Sunderland’s status drops another notch.

Matchday revenue may stabilise at its current levels after a much more promising season means attendances were high.

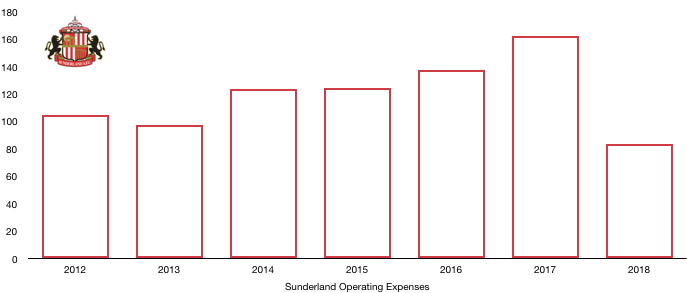

Costs Analysis

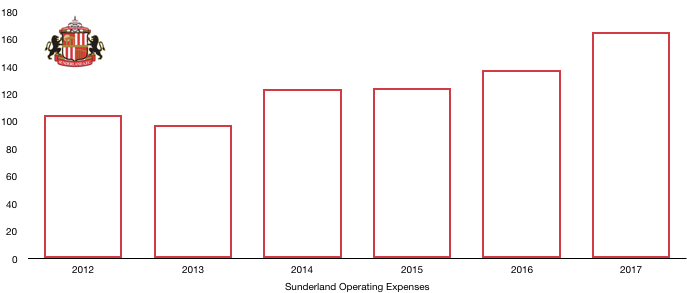

Sunderland had to get used to their new reality with revenue dropping like a stone meaning their costs had to fall as well to avoid financial oblivion.

Costs fell from £162.7m to £83.9m (48%) almost mirroring the % fall in revenue, meaning profitability (or the lack of it) was hardly affected.

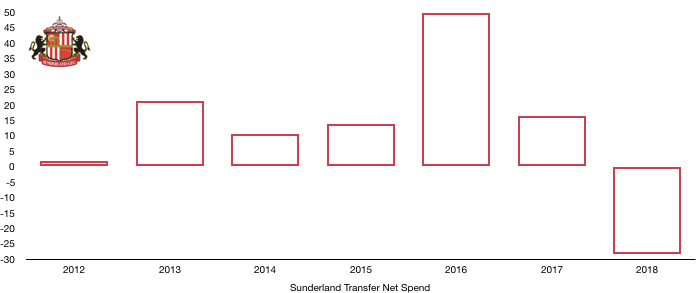

Amortisation fell from £29.4m to £10.5m (64%) as player investment ground to a halt as the club were forced into a negative net transfer spend for the first time in ages.

On top of this, poor signings and relegation led to some previous expensive signings being deemed worthless and leaving on free transfers which saw Sunderland record an impairment expense on these players of £12.4m.

Interest costs fell from £7.9m to £6.3m (20%) as bank interest fell as loans were repaid following their takeover.

Sunderland paid no tax due to their recent financial troubles and the losses this has created.

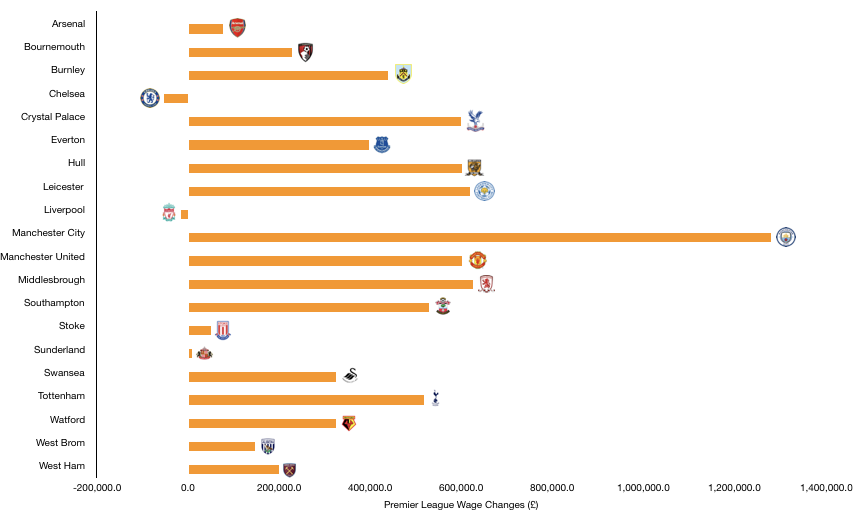

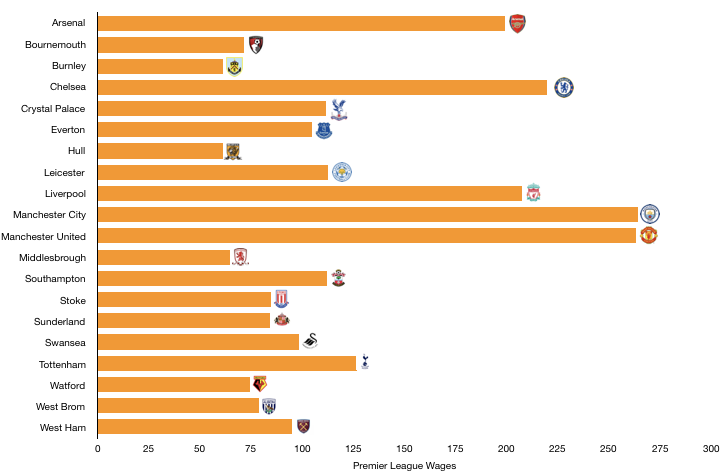

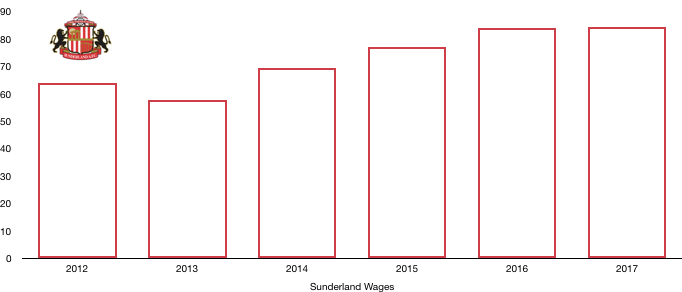

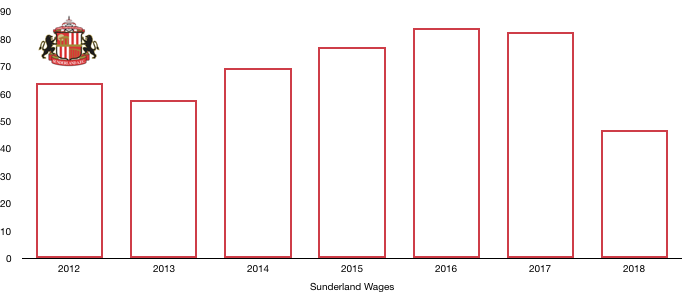

Wages nearly halved, falling from £82.7m to £46.8m (43%) as high earners departed and relegation wage drops came into effect.

This £47m of wages was still a fairly high wage for the Championship and therefore will be heads above the level in the League One and will once again need reducing.

The wage drop saved Sunderland £690k per week in wages, an unheard of drop in wages as Sunderland begun to shed years of poor signings and high wages that were far from deserved.

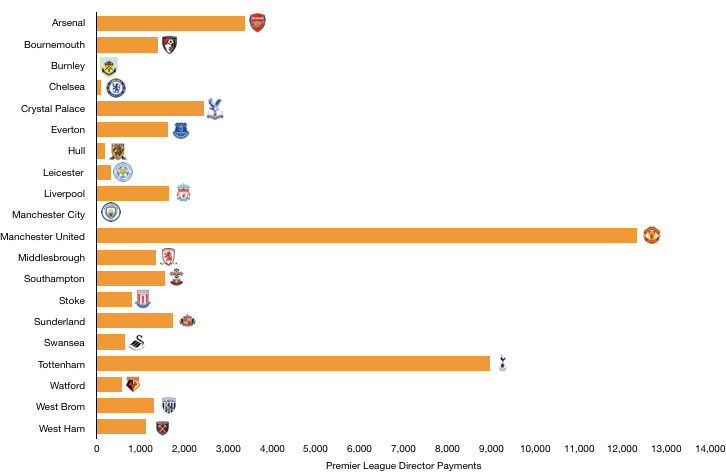

Surprisingly, directors saw their remuneration INCREASED despite the troubles the club find themselves in. Remuneration rose from £1.7m to £2.0m (18%) as the departing director was paid £1.1m to leave his role, lucky for some.

Looking ahead, costs will once again fall as further high earners leave after seeing out their lucrative contracts. Relegation wage drops will come into effect after the fall into League One while amortisation will fall following little player investment yet again.

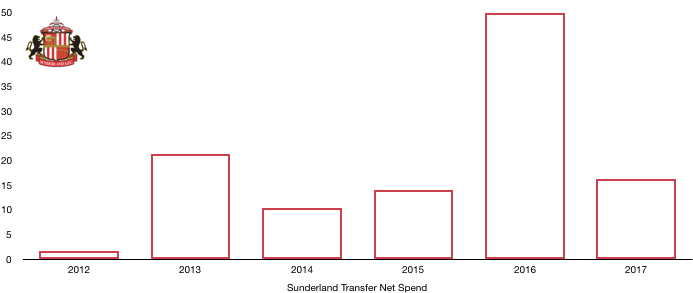

Transfers Analysis

It was a busy window for Sunderland as they looked to offload deadwood and reduce wages.

In came Vaughan (£0.5m), Steele (£0.5m) and McGeady (£0.3m) for a combined £1.3m.

Out went Pickford (£25.7m), Mannone (£2.1m), Lens (Loan – £1.4m), Borini (£0.5m) and Vaughan (£0.3m) for a combined £29.8m, while a host of players left on free transfers.

This led to a net transfer income of £28.5m, the first time that has happened in recent memory.

The signings failed to galvanise a team low on confidence and morale, while despite the poor season, I don’t think those who left were missed as their heart was no longer in it.

McGeady is the one bright spark, beginning to show his quality this season.

The sales led to a profit on players sales of £6.6m, with the sale of Pickford included in last years accounts due to the accounts being to 31 July. A couple of this summer’s departures were hence also included in this figure.

Sunderland somehow still owe £18.6m in transfer fees (£15.1m due this year) as they continue to pay for past transfer mistakes. Sunderland are however owed £16.2m (£11.8m due this year), meaning they owe only £2.4m net which is still £2.4m too much at present.

This burden has further constrained their transfer activity as they need to pay off these transfers with cash they really can’t afford to spare.

Debt Analysis

Sunderland saw their sizeable cash balance depleted, falling from £35.7m to £11.2m (69%) as the losses mount and relegation sees their funds severely stretched.

On a debt front, Sunderland are relatively debt free following their takeover with all debt owed to the previous owner taken over by Mr.Donald and this debt was then written off by Mr. Donald.

The debt position this year is unclear following the takeover with the accounts not currently providing an accurate position of their debt, although I believe this to be minimal currently.

Going forward, further funding will be needed as Sunderland’s finances continue to worsen and their troubles will grow even more if promotion is not achieved back to the Championship this season.

A failure to gain promotion will see revenue plummet again and also mean further cuts to costs will be necessary, meaning Sunderland will become less and less competitive as they look to comply with Financial Fair Play and also avoid financial oblivion.

Hopefully for Sunderland, the owners are willing to invest and get the club through these hard times as if they can, he will have a legion of fans and a wonderful club at his hands.

Thanks for reading – Share with a football fan!