Middlesbrough were back in the Championship after a very brief 1-year return to the Premier League. The club had one aim; to make their Championship stay as short-lived as their most recent Premier League one.

Middlesbrough were close to meeting this objective, being in the automatic promotion chase for much of the season and despite falling short, they qualified for the play-offs with as much a chance of promotion as anyone. However, a semi-final exit saw the club’s deepest fears realised as they failed to escape the Championship at the first time of asking, a further hit to their finances after investing significantly to bounce straight back to the Premier League.

Middlesbrough were loss-making once again following relegation, as a £11.5m profit turned into a £6.6m loss, with a prolonged stay in the division likely to only increase the size of their losses.

Let’s delve into the numbers.

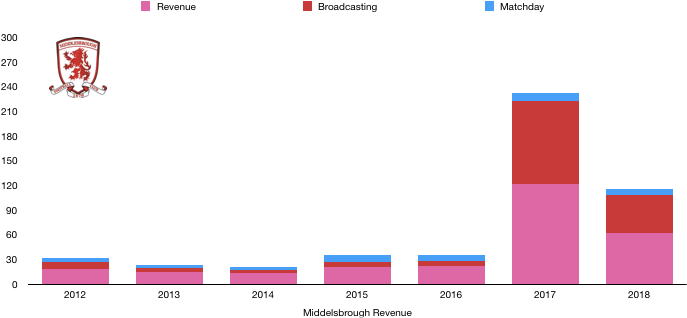

Revenue Analysis

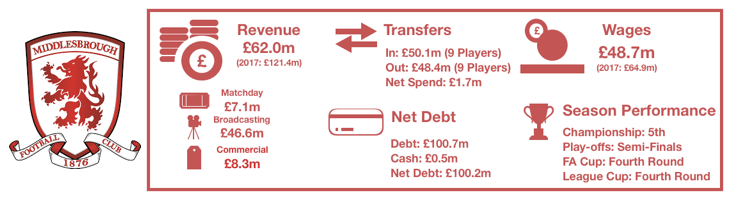

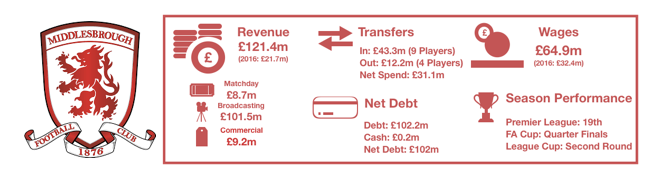

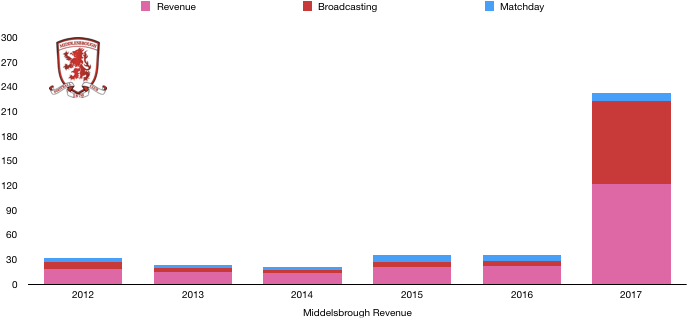

Middlesbrough unsurprisingly saw revenue plummet following relegation, nearly halving from £121.4m to £62.0m (49%).

This was predominately due to broadcasting revenue more than halving from £101.5m to £46.6m (54%), as the club counted the cost of relegation with an eye-watering drop in TV/Prize money of £55m. This was even with receipt of sizeable parachute payments all clubs receive for a few years following relegation.

Matchday revenue fell significantly considering its normally stable nature. Matchday revenue fell from £8.7m to £7.1m (18%) as it fell below even 2016 levels due to lower ticket prices and match attendances. With Tony Pulis in charge, the style of football at the Riverside Stadium is not the most pleasing and will struggle to put bums on seats in the absence of results which is likely to suppress matchday earnings going forward.

Commercial revenue also experienced a relegation hit, falling from £11.2m to £8.3m (26%) as sponsors ran away due to the fall in global appeal of Middlesbrough following the loss of their newly earned Premier League status. Middlesbrough’s commercial team failed to manage sponsors and saw people leave as well as relegation clauses that led to lower payments come into effect. Middlesbrough will find it difficult to recoup the losses here in the absence of Premier League football.

Looking ahead, Middlesbrough will unfortunately see a further dip in revenue following a second successive season in the Championship. Parachute payments will fall which will reduce broadcasting revenue significantly again. Matchday revenue is likely to stabilise at between £7-8m while commercial income will likely see a further small dip if promotion is not achieved.

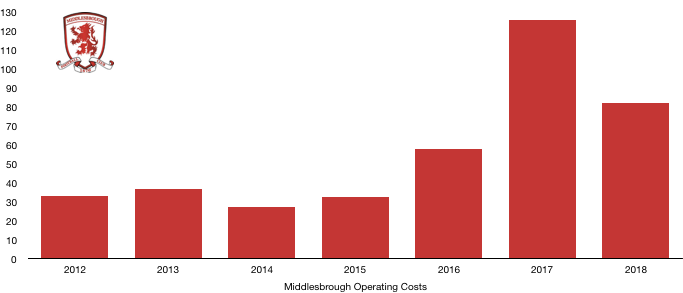

Costs Analysis

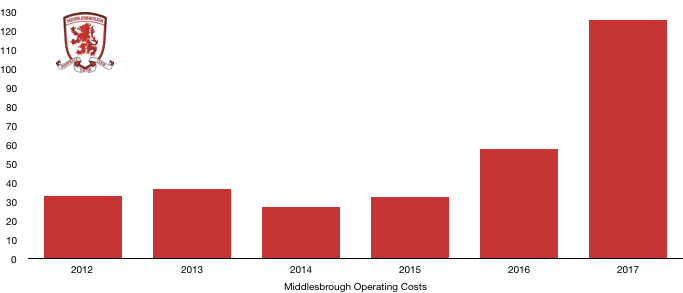

Middlesbrough managed to reduce costs as they re-acclimatised to the Championship. Costs fell by a third from £125.6m to £82.3m (34%), confirming that profitability has dipped as cost dropped at slower rate than revenue dropped.

Amortisation cost fell from £28.4m to £24.5m (14%). Although this usually signifies a drop-in investment relative to previous years, in actual fact Middlesbrough’s investment was fairly stable as last year the club impaired the value of some players following relegation. If this figure of £4m is omitted from the above, amortisation actually increased slightly, signifying stable investment.

Interest charges increased significantly in the year, rising from £0.3m to £1.5m (400%) after the introduction of new loans into the club (more on this later).

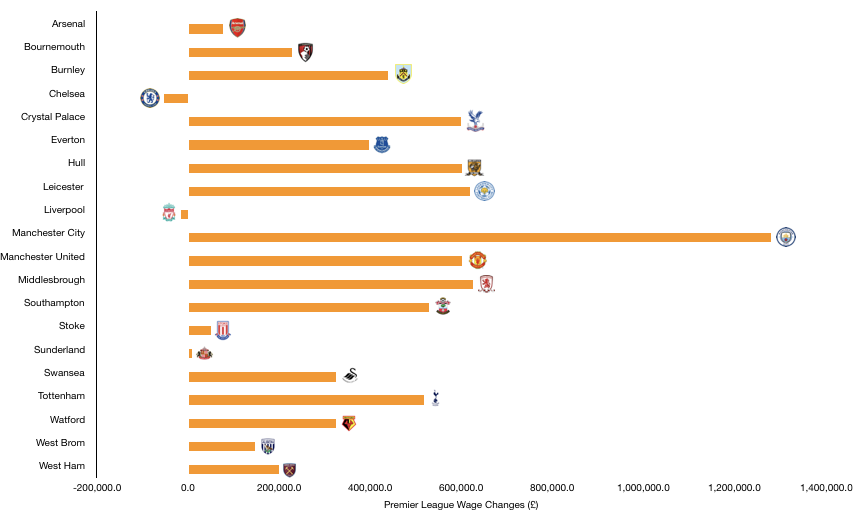

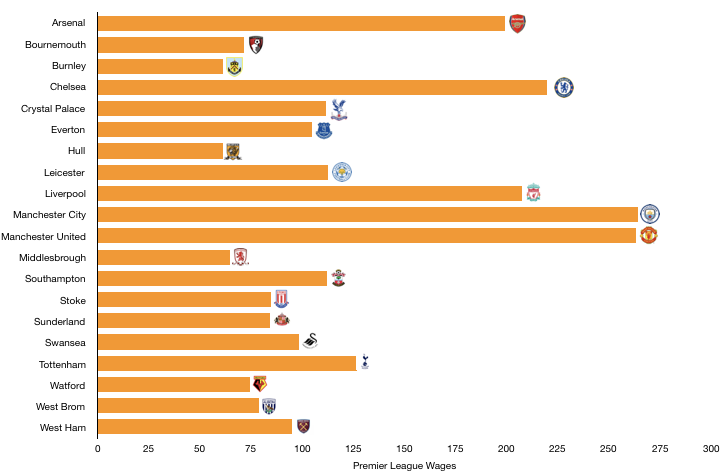

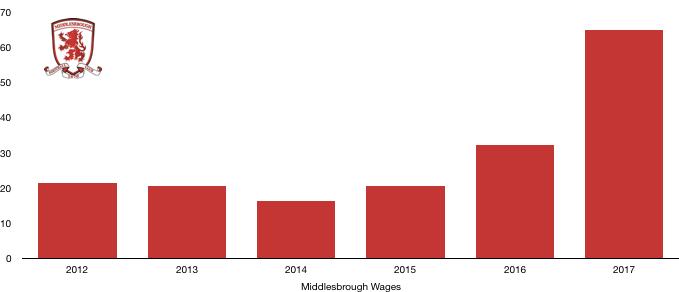

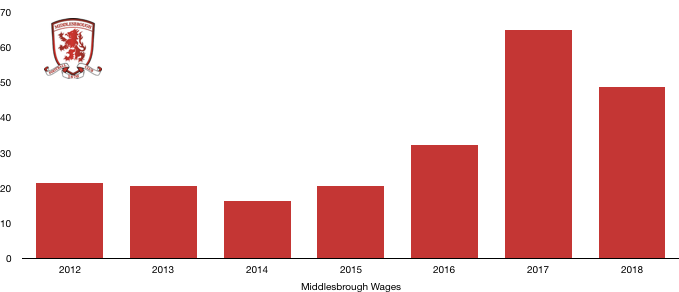

Middlesbrough saw a large drop in wages as wages fell from £64.9m to £48.7m (25%) as high-earners departed the Riverside and relegation wage-drop clauses came into effect.

The drop-in wages work out at a cool saving of £312k a week to the club which was much-needed following the fall in revenue following relegation.

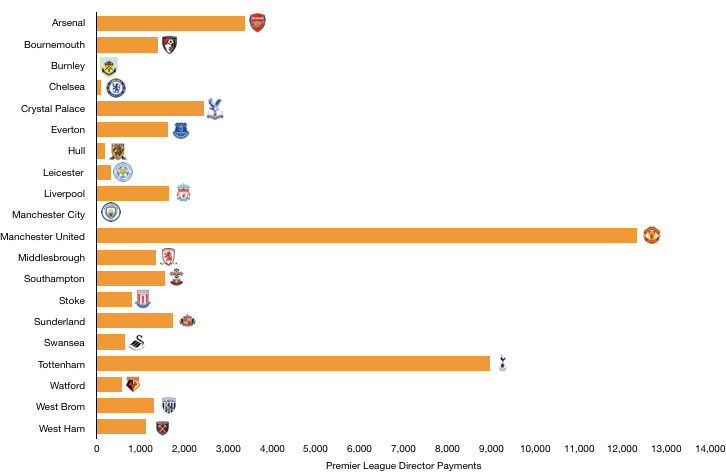

Interestingly, Middlesbrough paid directors a measly £5k through their main company. It is likely (almost certain) that the actual figure is considerably bigger, this would either be because it just hasn’t been disclosed, paid elsewhere or the director was paid with shares.

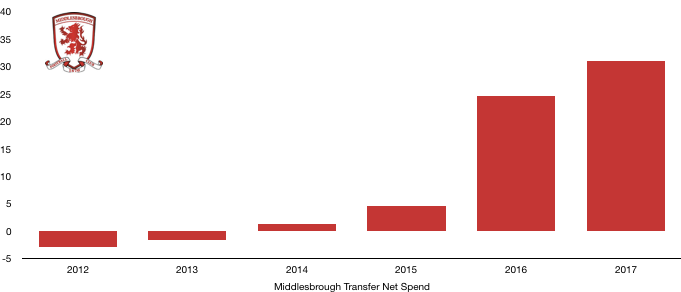

Transfer Analysis

Middlesbrough were very active in the transfer window in 2018 as they overhauled the squad to prepare for a different challenge in the Championship as 9 players entered and 9 departed the Riverside Stadium.

In came Assombalonga (£15.4m), Braithwaite (£10.2m), Fletcher (£6.6m), Howson (£5.1m), Randolph (£5.0m), Shotton (£2.9m), Christie (£2.5m) and Johnson (£2.4m) for a combined £50.1m.

This was almost entirely funded by departures as De Roon (£12.2m), Rhodes (£10.5m), Ramirez (£8.1m), Forshaw (£4.6m), Espinosa (£4.1m), Christie (£3.1m), Fischer (£2.7m), Stuani (£2.3m) and Husband (£1.0m) left the club for a combined £48.4m.

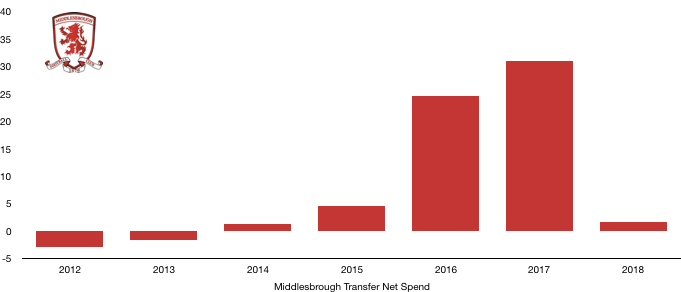

This meant a net spend of £1.7m, down 95% on last year as the club had to balance the books. Relatively speaking, having a net spend at all after relegation shows a good level of ambition as clubs have to watch their finances after a large drop in revenue.

The signings were a mixture of successes with Assombalonga performing well while others were the sort of signings you need to succeed in the Championship. Those who left were not missed greatly with their performances at the club a major reason they were relegated in the first place.

Aiding performance was a sizeable profit on player sales of £15.3m, which stopped the loss being any larger as the club made a profit on a number of players who departed.

Middlesbrough do have some transfer worries financially as although £26.9m is owed to the club in terms of transfers and similar in the next few years, the club owe a whopping £56.2m in transfer fees to clubs from their failed Premier League campaign and this year. Of this fee, £40m of it is due this year which may be a concern should the club fail to gain promotion.

The club also has contingent transfer fees of £6.2m that may become payable should certain clauses be met.

Debt Analysis

Middlesbrough saw a steady rise in debt over the last few years to £100m, at which point it has begun to stabilise at that level. As with most Championship clubs, cash can be in short supply and the club need to utilise all their cash reserves to be competitive.

Cash more than doubled from a measly £0.2m to £0.5m as Middlesbrough’s cash balance remained fairly low with the club needing all the transfer fees and revenue received to push for promotion.

Debt levels remained fairly stable, falling slightly from £102m to £100.2m (1%) as the owners surprisingly didn’t feel the need to inject any new funds following relegation with the club able to fund itself. This may bode well if this means he has excess capital he can still put in should their promotion bid falter again, or it could signal and tone-down in investment from above.

The club also has a bank loan of £7.1m which it took out at £8.6m last year, paying down £1.5m in 2018. They will probably pay down a further £1.5m next year, an expensive interest charge that significantly increased their interest charge as mentioned in the cost section.

Middlesbrough seem relatively financially secure for the time being, however should the club remain in the Championship for a few seasons, their picture may change dramatically as their financial structure is one built for the Premier League.

Thanks for reading – Share with a Middlesbrough fan!