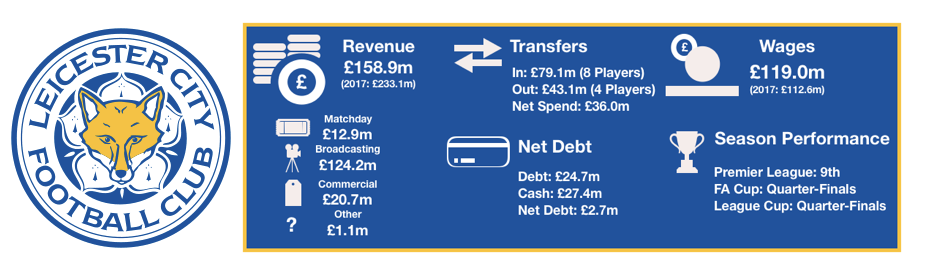

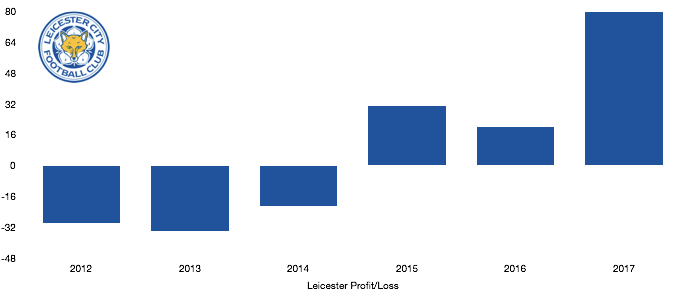

Leicester had an anticlimactic season compared to the last 2 years, finishing 9thplaced in the Premier League and reaching the quarter-finals of both domestic cups. After a roller coaster couple of years, Leicester are back to reality and are looking to consolidate their status as a top-half side and push on from there.

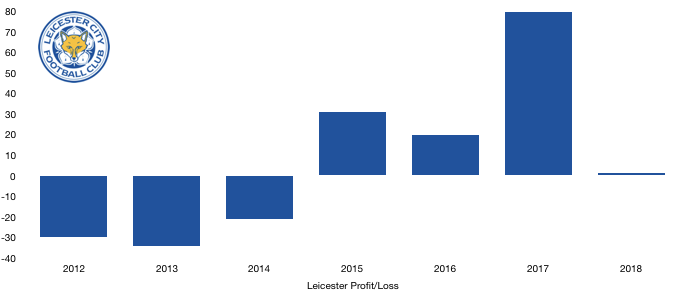

The lack of European football this year led to a steep drop in profits as they plummeted from £80.0m to £1.5m (98%), showcasing how lucrative Europe’s finest competition is.

Let’s delve into the numbers.

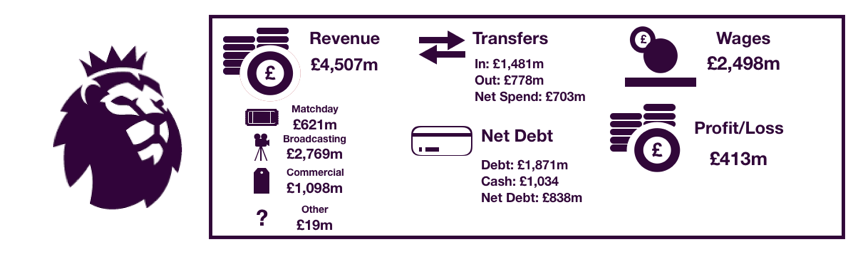

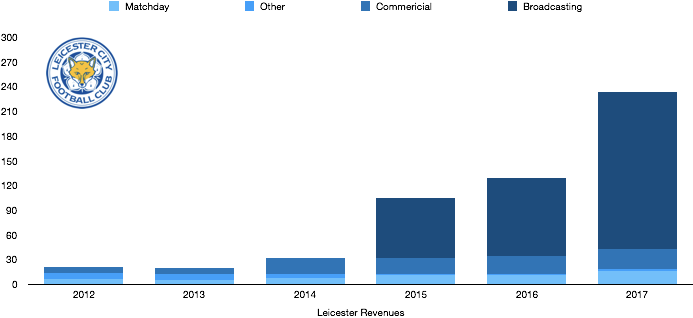

Revenue Analysis

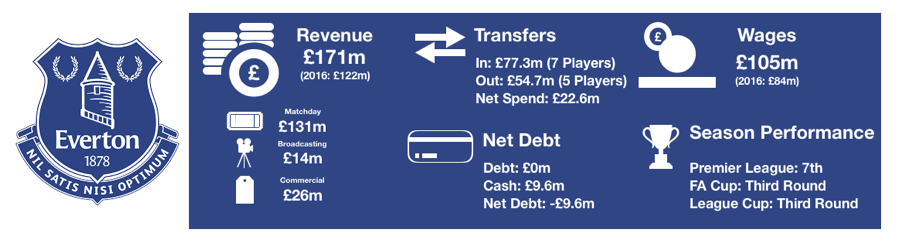

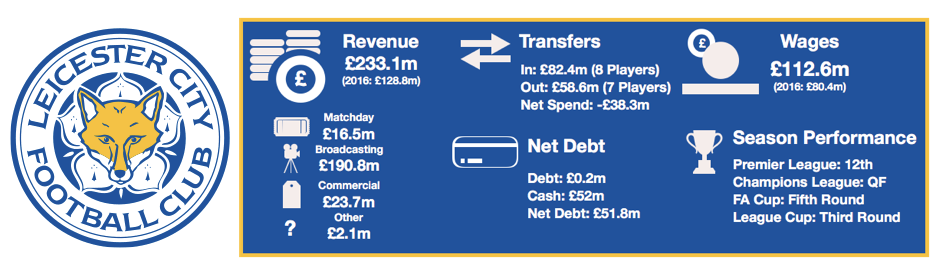

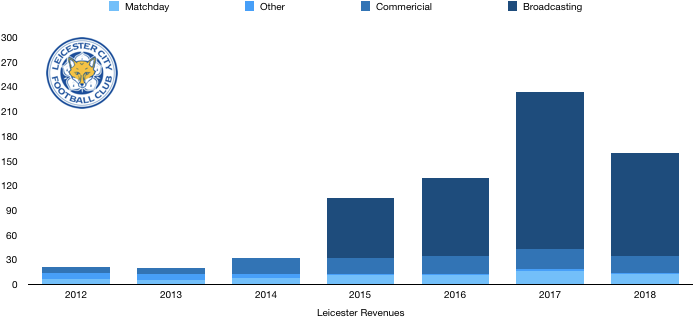

As mentioned, the lack of Champions League football led to revenue dropping by a third, falling from £233.1m to £158.9m (32%).

Matchday revenue fell from £16.5m to £12.9m (22%) as the club had less home games and lacked the lucrative European ties that boosted this revenue last year. Matchday revenue is still increasing if last year’s one-off European adventure isn’t taken into account as matchday revenue was still higher than the £11.9m recorded in their Premier League winning campaign.

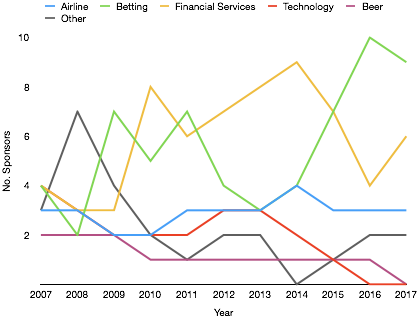

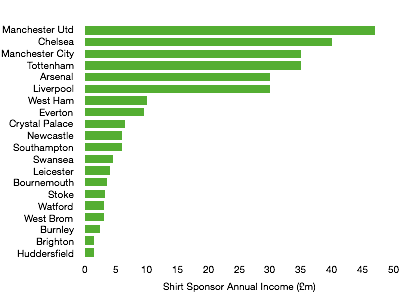

Commercial revenue disappointingly fell, falling from £23.7m to £20.7m (13%) as their move back to mid-table dampened the fanfare around the club and lucrative sponsorship deals faded slightly. Leicester will be hoping they can stabilise commercial revenue at this point to avoid a drop in an important income stream for the club.

Broadcasting revenue dropped by over a third, falling from £190.8m to £124.2m (35%) as the lack of European football was a £70m hit to their finances, being offset slightly by a decent cup campaign and an improved Premier League finish.

Other revenue dropped from £2.1m to £1.1m (48%)

Looking ahead, Leicester should expect revenue to stabilise at around the £160 – £180m mark with rises and falls down predominately to cup performances and the success of their commercial team. A move up the table from mid table may boost revenue significantly and a return to Europe via the Europa league should be the main aim to boost revenue.

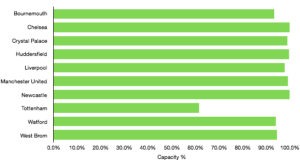

Leicester have begun putting in place plans to expand the King Power stadium, this would boost the matchday revenue of the club significantly. The King Power was revalued this year also, falling slightly in value from £39.1m to £38.2m.

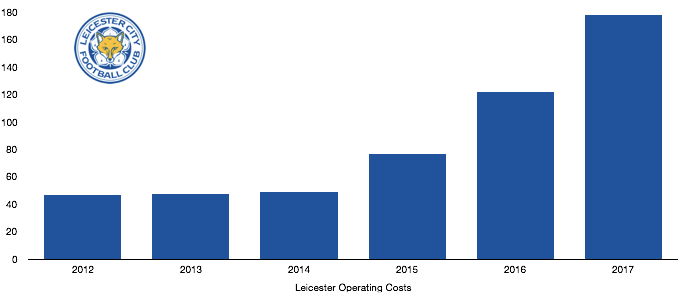

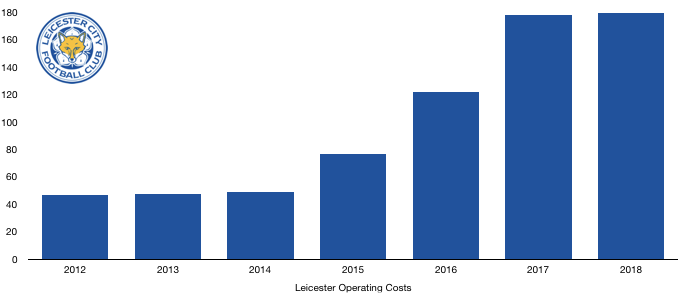

Costs Analysis

Leicester saw costs increase despite falling revenue, hurting profitability significantly. Costs rose from £178.0m to £193.4m (9%).

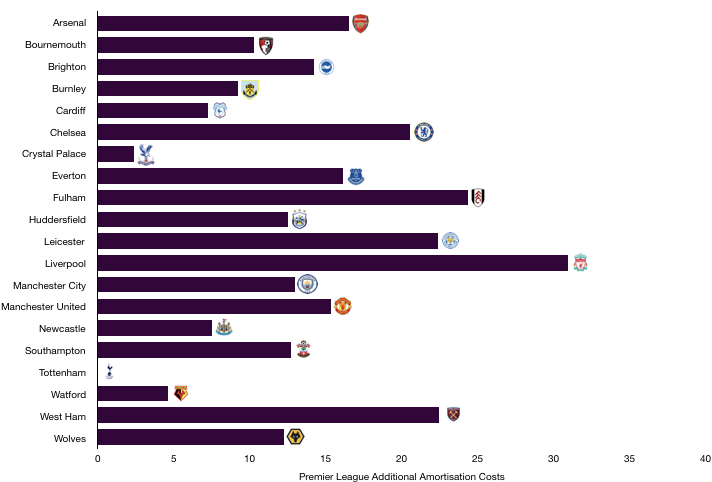

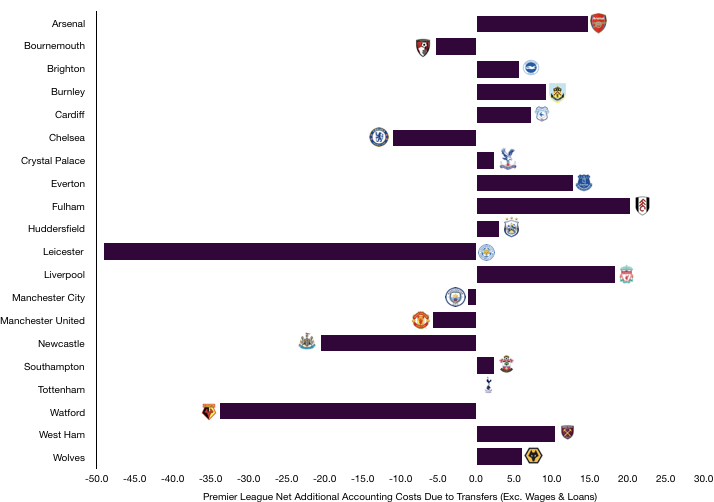

A main reason for this was an increase in player investment as amortisation rose from £29.7m to £48.8m (64%). Leicester showed their ambition with another year of large investment as they look to consolidate their top-half status and push on, utilising the huge revenue boosts in the last couple of memorable years.

Net interest costs rose from £2.3m to £2.7m (17%) as interest costs on transfer fees rose due to increased transfer activity that is due in instalments.

Brexit also had an impact on Leicester, causing a foreign exchange loss of £1.0m on loans and other monetary items.

Stadium related expenses increased from £3.9m to £4.6m (18%).

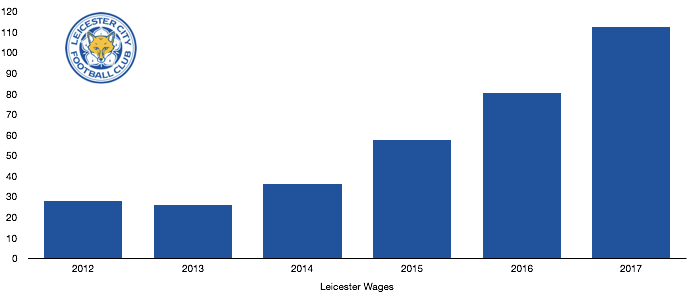

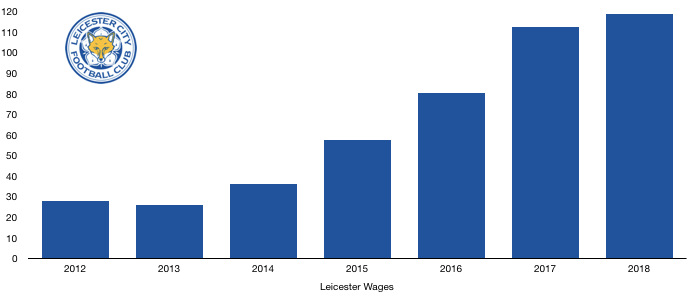

Wages increased slightly, rising from £112.6m to £119.0m (6%) as Leicester’s new signings commanded higher wages than the departing foxes.

The wage rise works out an extra £123k a week, which for a team like Leicester is sizeable but nothing out of the ordinary.

Key managements saw their wages fall slightly from £325k to £308k (5%).

Lastly, Leicester paid £85k of tax this year, an effective tax rate of only 5.3%, well below the tax rate. This is mainly due to certain complex tax rules that have reduced their tax liability in line with those rules.

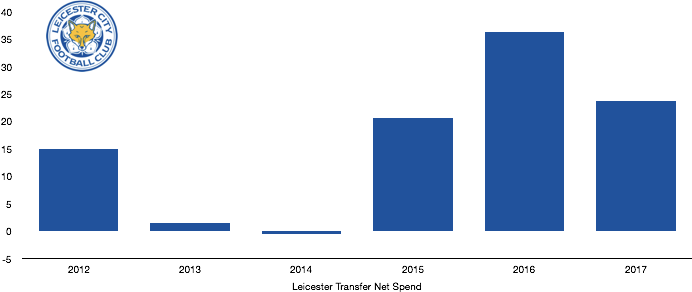

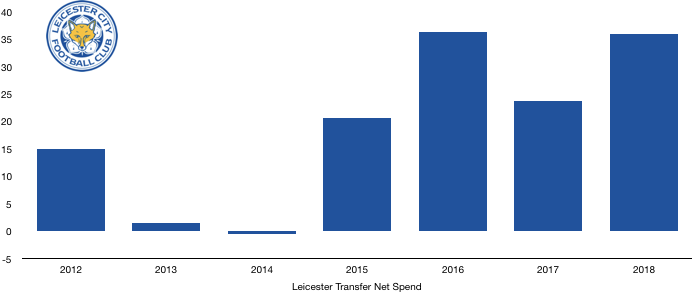

Transfers Analysis

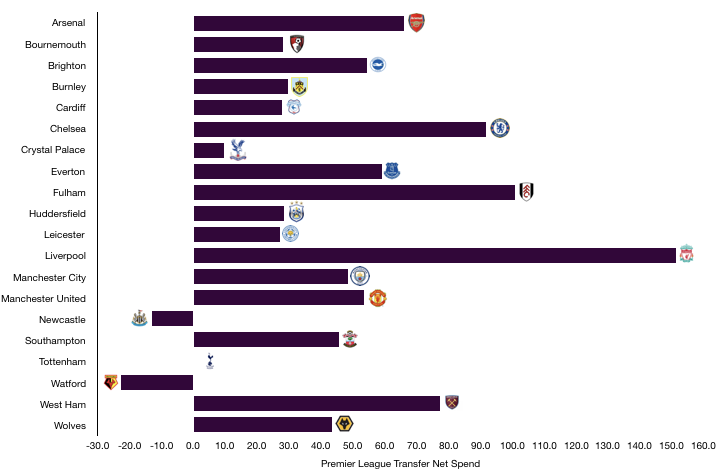

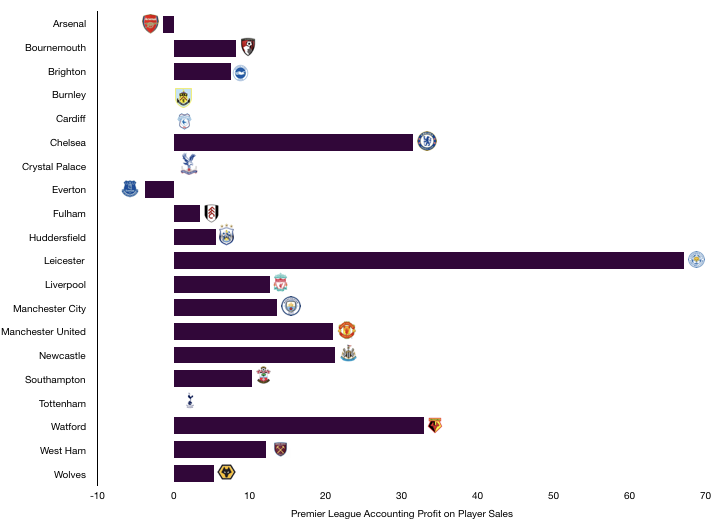

Leicester were very active in the transfer market seeing 8 arrivals and 4 departures.

In came Iheanacho (£24.9m), Silva (£22.1m), Iborra (£13.5m), Maguire (£12.3m), Dragovic (Loan – £2.3m), Jakupovic (£2.1m), Diabate (£1.8m) and Hughes (£0.1m) for a combined £79.1m

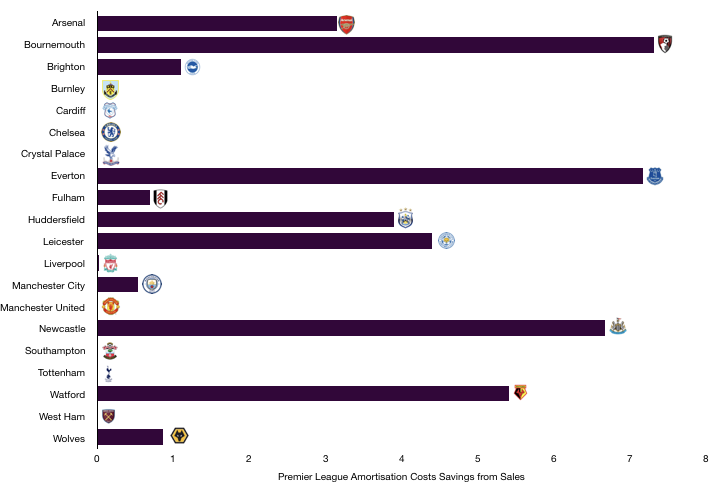

Leaving the King Power were Drinkwater (£34.1m), Lawrence (£5.6m), Zieler (£3.6m) and Kaputska (Loan – £0.5m) for a combined £43.1m.

This led to a net spend of £36.0m, up 51% on the previous season.

Leicester City were not entirely successful in the transfer market last season. Maguire was an inspired signing, however the likes of Iborra and Silva failed to settle and live up to their price tags while Iheanacho had a mixed season.

The sale of Drinkwater was a good one as he has failed to impress at Chelsea while the other departures were not missed, although the sale of Tom Lawrence may have been premature considering the fee received.

Selling Drinkwater assisted the club massively financially as Leicester recorded a profit on player sales of £38.3m, meaning without the sale of Drinkwater, Leicester would have made a sizeable loss.

Leicester spent a huge amount in cash terms of £79.1m while only receiving £28.9m, a net cash outlay on transfers of £50.2m.

In terms of transfer fees owed, Leicester are due £24.3m in transfer fees. However, Leicester owe £67.8m of which £46.5m is due this year which may impact transfers in the coming year or two.

Leicester could also potentially owe a further £19.6m in contingent transfer fees if certain clauses are met by players.

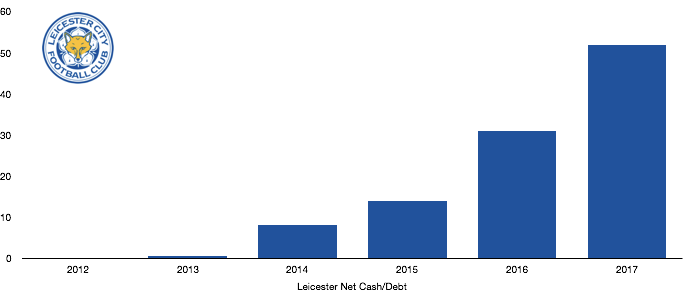

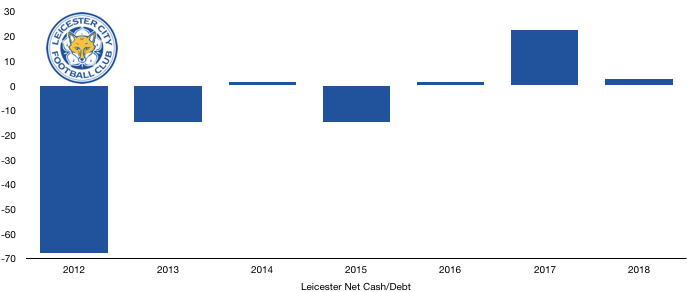

Debt Analysis

Leicester saw their cash balance depleted during the year as they began investing their sizeable cash reserve of £52m in players and club facilities. Cash levels nearly halved from £52.0m to £27.4m (47%).

Leicester this year saw a huge cash outlay on transfers as mentioned above while they also repaid some debt and also spent some cash on improving facilities.

This is going to stop here as they invested further in transfers in the summer (net spend of around £25m) and committed to spending £9.4m on facilities comprising of a new training ground (£3.3m), stadium expansion costs (£3.0m), improving the fan store (£0.9m), new screens at the stadium (£0.8m) and IT upgrades (£0.2m) as they looked to boost matchday revenue and commercial opportunities.

Leicester also donated £1.0m to the Vichai Srivaddhanaprabha Foundation (prior to his passing). May he rest in peace after all he has done for the club to get them to the point they are now.

Leicester did see debt fall, decreasing from £29.2m to £24.7m (15%) as they repaid some debt to their owners after as successful couple of seasons.

Leicester saw their net cash position fall from £22.8m to £2.7m (88%) after a sizeable depletion of their cash balance.

Leicester as you can see are a financially stable club that is self-sufficient in reaching its goals after the huge revenue rises over the last couple of seasons. A return to normality will see their finances stretched slightly as their profitability has dropped massively, however a consistent top half finish and smart investment will mean their finances give them the chance to be competitive and hopefully challenge the top 6 going forward.

With a few young stars in the squad and the finances to invest, Leicester have a solid financial foundation on which they can build towards growing as a club under Brendan Rodgers.

Thanks for reading, share with a Leicester City fan!