The True Costs of the Premier League 2018 Summer Transfer Window

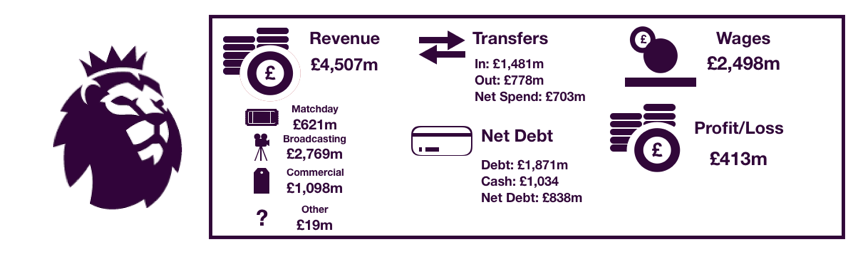

The Premier League transfer window has officially shut with over £1.2bn spent by Premier League clubs ahead of the new season.

Clubs have to be wary of Financial Fair Play when purchasing players to avoid penalties and bans (for more on this click here) and also need to ensure they are running sustainably for their owners etc.

This brings us to this article, which will explain the true costs of transfers from the 2018 summer transfer window explained briefly below:

When clubs sign a player, from an accounting perspective this is not all charged in the year of the transfer as the payments are matched to how the player will be used. So, a player signing for £50m on a 5-year contract is deemed to cost the club £10m a year, known as the amortisation cost. This is the true costs of the transfer per season for the club.

Another key element is player sales. In this regard the profit the club gain is not simply the transfer fee received minus the transfer fee paid, it is the transfer fee received less the remaining value of the player sold. So, for a £50m player on a 5-year contract, he will be ‘worth’ £50m minus the amortisation charges to date, so after two years of charges, the player will be ‘worth’ £30m. Hence, should a player be sold 2 years later for £50m, a ‘profit’ of £20m will be recorded, rather than nothing like many people believe.

This article will analyse each Premier League club’s business and compare to their counterparts.

Due to the availability of data, this excludes the costs of loans and player wages. All transfer fees and contract lengths are via Transfmartk.co.uk. In order to simplify the amortisation costs, we have ignored contract renewals which make the calculation more complex without much added insight.

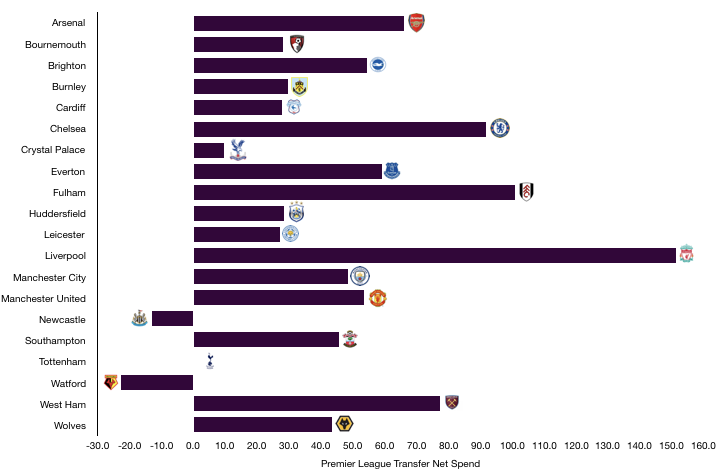

Let’s Not Talk About Spend, Let’s Talk About Net Spend

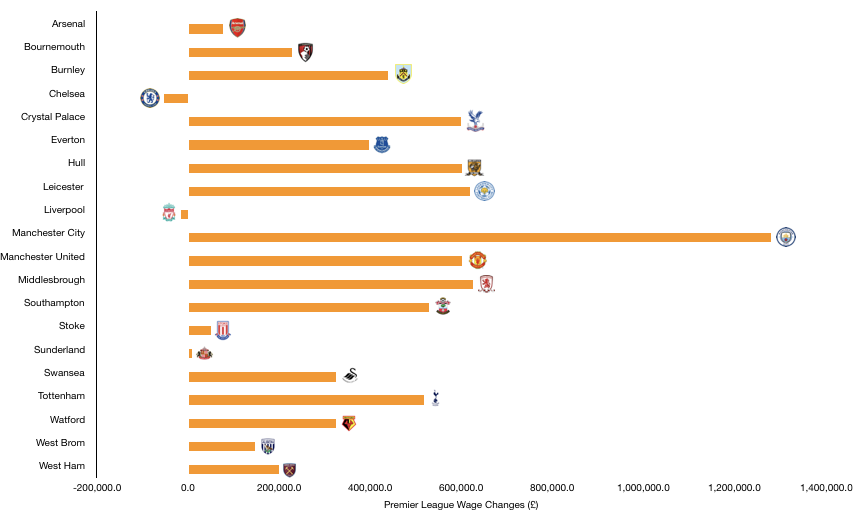

Premier League clubs had an active transfer window despite its shortening, spending over £1.2bn, receiving only £353m in return, leaving the club with an astronomical net spend of £909m.

This was due to higher spending by certain clubs, with Liverpool leading the way by a distant after investing heavily following their Champions League heartache with Naby Keita, Fabinho, Alisson and Shaqiri joining while only Danny Ward left, leaving the merseysiders with a net spend of £151m.

Fulham became the first promoted club to ever break the £100m barrier after a barnstorming transfer window with 7 players arriving for transfer fees and only 1 leaving. This led to the club having a net transfer spend of £101m with Seri the pick of the players signed.

Fellow West Londoners Chelsea had the third biggest net spend at £92m after breaking the world transfer record for a goalkeeper in the £72m paid for Kepa after losing Courtois to Real Madrid and they also signed Jorginho.

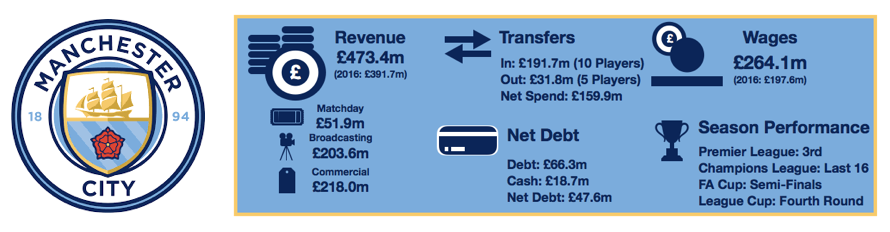

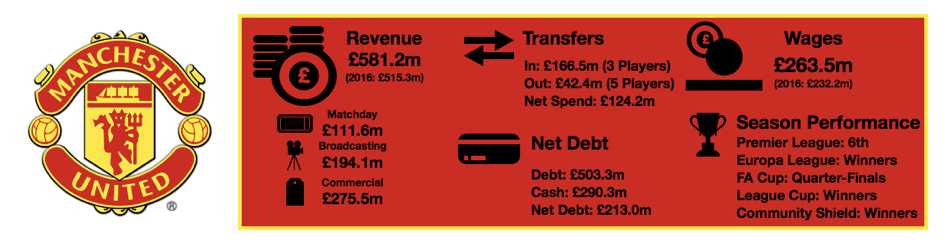

Manchester United and Manchester City had quiet windows with both making one big purchase a piece with Fred joining United (along with Dalot and Grant) and Mahrez joining City.

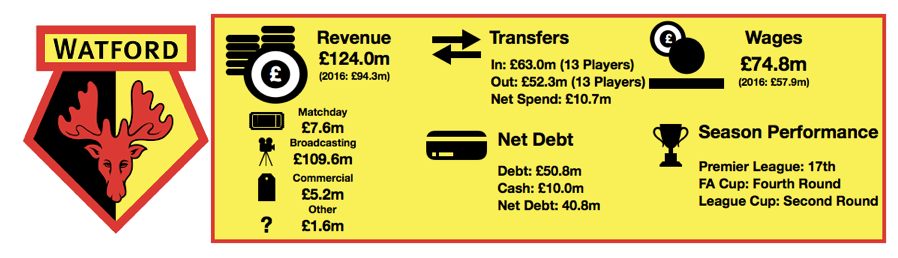

At the other end of the scale were Watford with a net transfer spend of minus £23m after not reinvesting all of their Richarlison windfall. Newcastle also were in the black after recording a net transfer spend of minus £13m as Mike Ashley used transfer cash received to purchase House of Fraser rather than reinvest in the Toon.

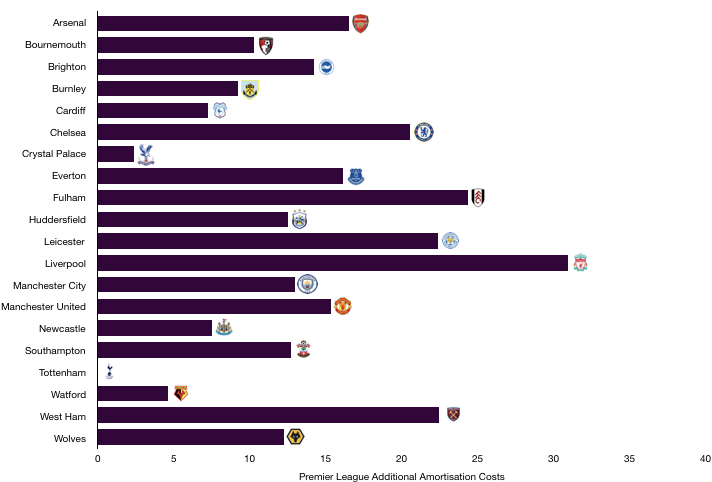

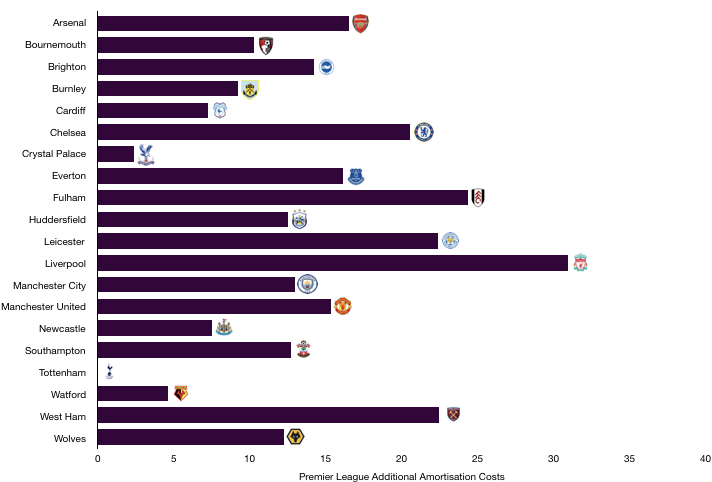

Additional Amortisation Costs

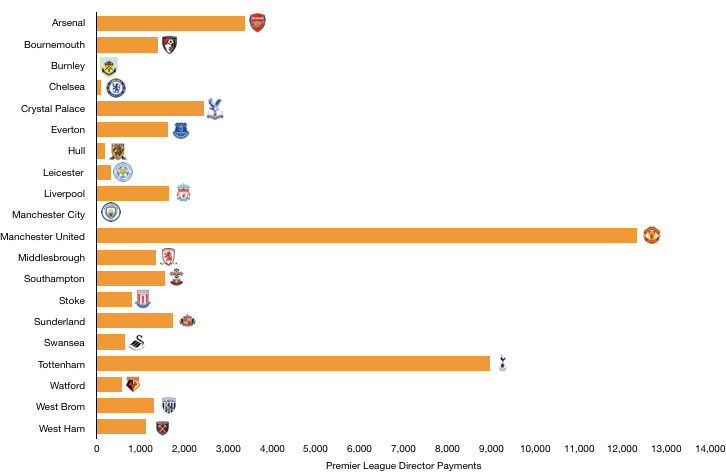

Premier League clubs face additional transfer costs of £275m this year alone after a huge transfer spend of over £1.2bn, with this cost spread of the players signed contracts which average at just over 4-year contracts.

Amortisation costs are, as explained above, based on transfer spend and contract lengths and as such the costs are higher for larger spends and also higher when contract lengths are shorter. A key example is Kepa, a £72m keeper who signed a 7-year contract, costing Chelsea just over £10m a year. While Mahrez, a £61m purchase on a 5-year contract cost Manchester City more at just over £12m a year despite the smaller transfer fee.

Liverpool unsurprisingly lead the way after their impressive transfer window where they spent £164m with Alisson signing a 6-year contract while Keita, Fabinho and Shaqiri signed 5-year deals. Liverpool will have additional costs of £31m after these deals.

Fulham had the second highest net spend after their £105m 7 player splurge with contracts lengths 4 years on average, bringing amortisation costs of £24m over that period.

Leicester despite their relatively small net spend have a large transfer costs due to their £103m spend with the Mahrez deal diluting their net spend after the club reinvested the Mahrez cash and then some, leading to an amortisation cost of £22m.

Chelsea and West Ham also had large amortisation costs above £20m after their productive transfer windows.

Tottenham were at the other end of scale after an inactive transfer window, becoming the first club since the transfer window came into effect in 2003 not to purchase or sell a player.

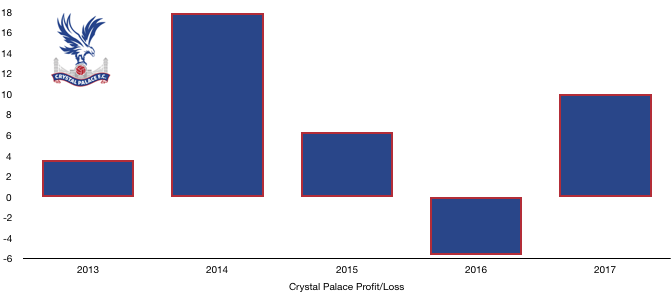

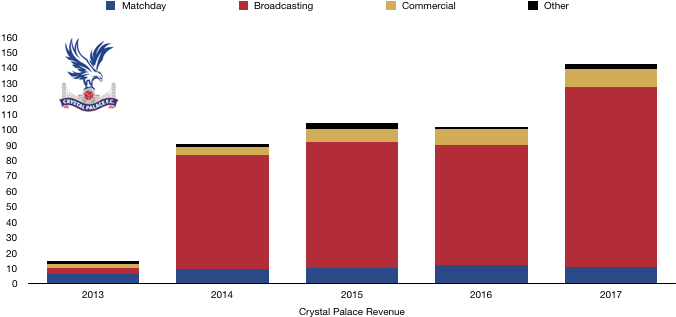

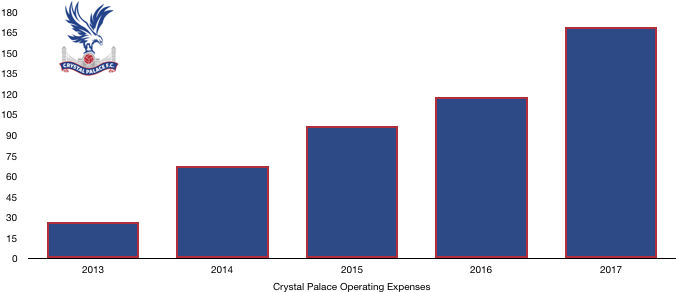

Crystal Palace were the only other club to have an additional amortisation cost below £5m.

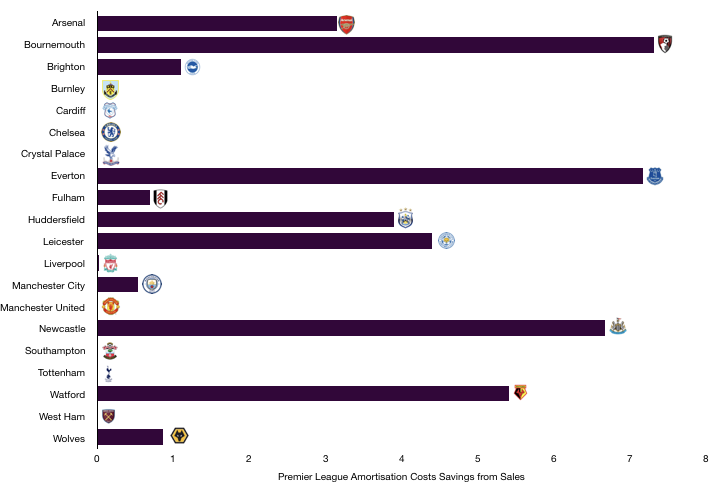

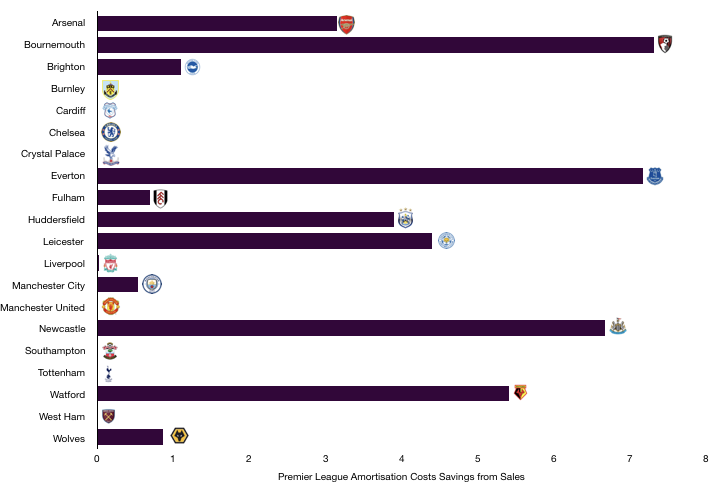

Amortisation Costs Savings

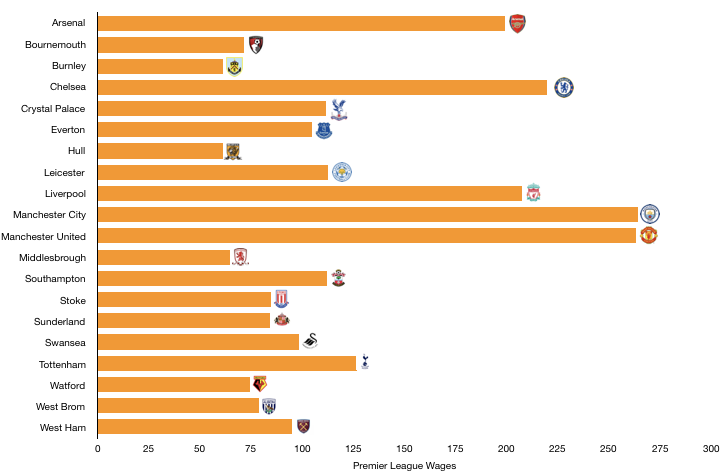

Premier League clubs saved £41m on amortisation cost after after player sales of £353m with many players sold either brought cheaply or have been long serving players that no longer attract amortisation costs after staying longer than their original contract.

Amortisation costs savings are driven again by the transfer fee paid when the player was brought and their original contract length. So, for instance Daley Blind signed for Manchester United 4 years ago for £15.8m on a 4-year contract, costing Manchester United just under £4m a year for those 4 years. Now that the 4 years are up, Blind costs United nothing from an accounting perspective, so no amortisation costs are saved and hence no savings included in our calculations.

As such many Premier League clubs didn’t recorded any savings as the players sold had already seen their entire transfer fee amortised. This includes players signed as youths such as Danny Ward at Liverpool or long serving players such as Courtois at Chelsea.

In a couple of situations, players were signed and immediately sold. This was the case for Benik Afobe at Wolves and Mikel Merino for Newcastle. In both these cases the amortisation costs were excluded when calculating additional costs and savings.

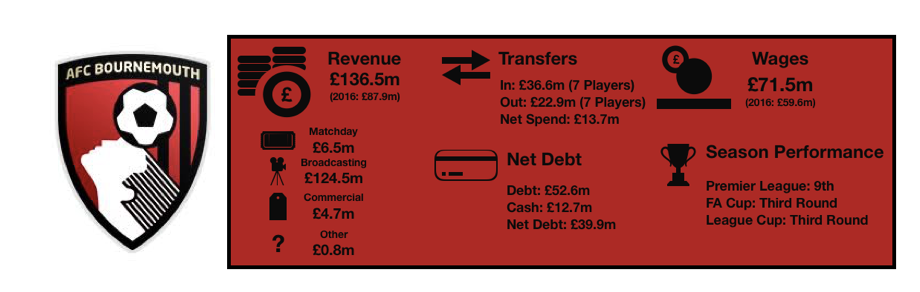

Bournemouth were the biggest savers, saving just under £8m after the sales of the after mentioned Benik Afobe to Wolves (before Wolves later sold him to Stoke), Lewis Grabban and Max Gradel.

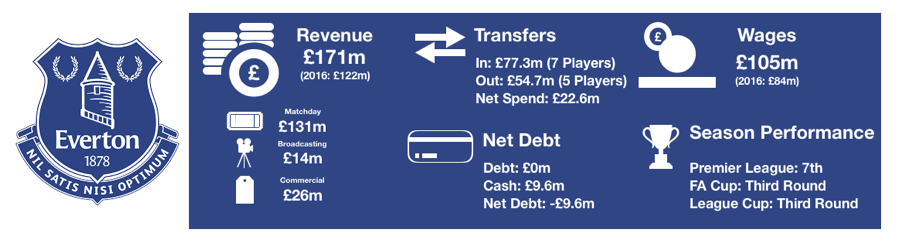

Everton (£7m), Newcastle (£6m) and Watford (£5.5m) were the only other clubs to save in excess of £5m on player sales after the sales of the likes of Klassen, Mitrovic and Richarlison.

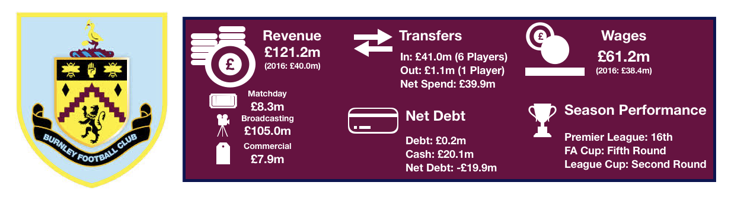

Burnley, Cardiff, Crystal Palace and Tottenham sold no players hence the reason for their lack of amortisation costs savings.

Chelsea, Liverpool, Manchester United, Southampton and West Ham also had no amortisation costs savings despite player sales due to the players sold having been at the club for at least their original contract lengths such as Courtois, Danny Ward, Blind, Tadic and Kouyate.

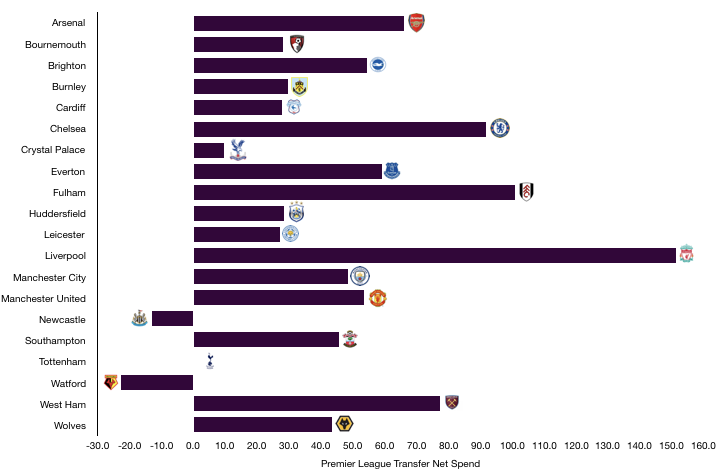

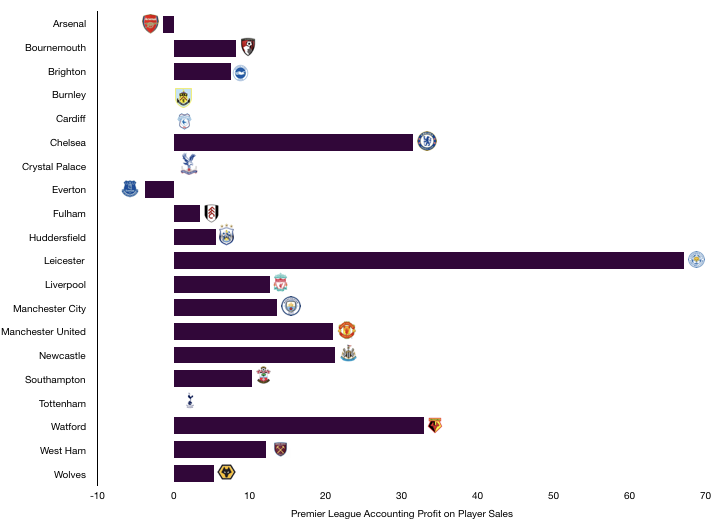

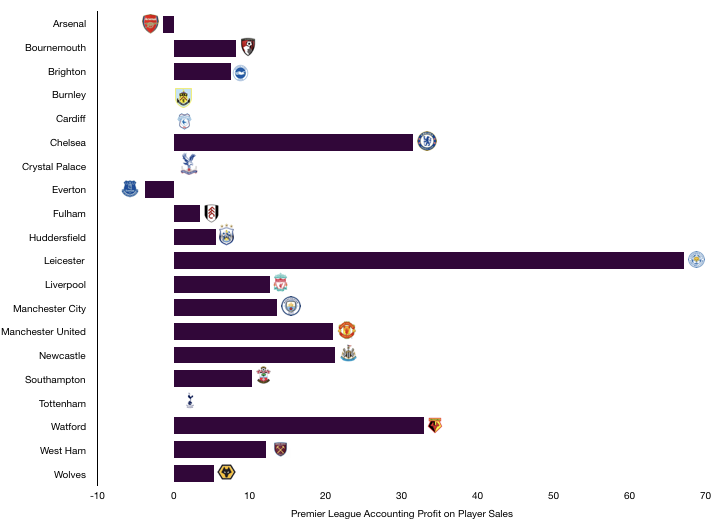

Profit, Profit, Profit (Or Loss)

Premier League clubs due to this made profits on their sales of £247m after selling players for £353m, a 70% return on investment.

When players are sold, as seen above, this may not lead to amortisation costs savings if the players amortisation costs were low due to the price paid or they have been at the club a long time.

This doesn’t mean they receive nothing, as the amount earned is recorded as a profit on player sales. This is recorded as the transfer fee received minus their remaining value as explained in the introduction. However, to avoid you having to scroll up, here is an example from this season using Courtois.

Courtois cost Chelsea £8m 7 years ago on a 5-year contract, costing the club £1.6m a year initially. Each year he is worth less of his transfer fee, so after 1 year he is worth £6.4m and after 2 years £4.8m etc. After 5 years he is worth essentially zero, at this point when he is sold the transfer fee received is all profit, so Chelsea record a profit of £31.5m.

Clearly the biggest benefiters here were Leicester after their sale of Mahrez was essentially all profit and hence the club recorded a profit of £67.1m.

Chelsea also benefited as described above, whilst Watford were the only other club to record a profit of more than £30m after their sale of Richarlison.

Everton were one of only two clubs to make a loss after the costly purchases of Klassen and Funes Mori who they both made a loss on after buying them recently and then selling on the cheap. Leading to a loss of £3.8m.

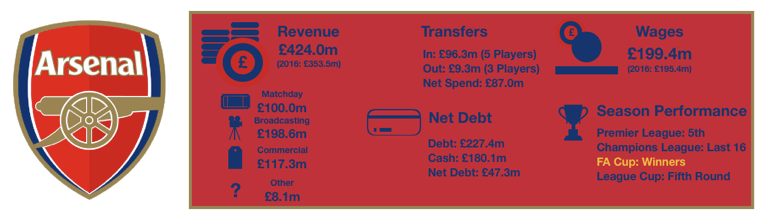

Arsenal also made a loss on the flop transfer of Lucas Perez, diluted slightly by the sale of academy graduate Akpom.

Burnley, Cardiff, Crystal Palace and Tottenham made no transfer sales and hence recorded no profit or loss this year.

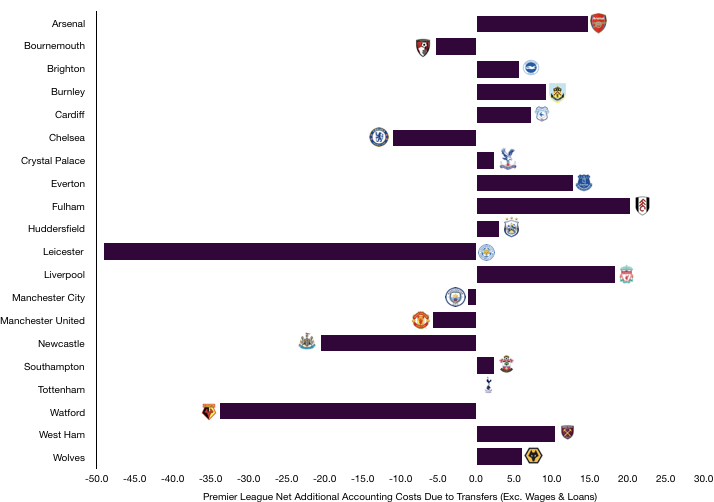

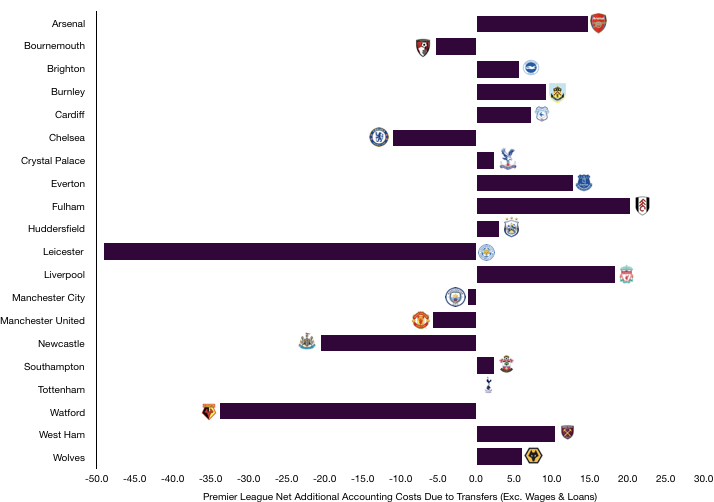

The Summary – The True Cost

To work out the true cost of this transfer window we use the following formula:

Additional amortisation costs – Amortisation costs saved -/+ Profit/Loss on player sales.

This gives an interesting picture for Premier League clubs with a net transfer costs of minus £13.9m! Meaning Premier League clubs as a whole have saved on transfers this year from a Financial Fair Play perspective.

This is heavily skewed due to the net savings made by Leicester, Watford and Newcastle in particular.

Leicester, due to the Mahrez deal have made a saving of approximately £50m after their new signings, while Watford and Newcastle have also saved in excess of £20m.

Both Manchester clubs are in the black after making one big purchase each and selling a couple fringe players.

Chelsea are also in the black after selling Courtois.

Fulham have the highest cost of £20m after their sensation transfer window in which they spent hugely for a Premier League newcomer, making a statement on their ambitions.

Liverpool were unsurprisingly up there with a net cost of £18m. Everton and Arsenal were the only other clubs with a net cost exceeding £15m.

To put this all into perspective there is a mismatch. The profits received are all given in the period of sale, while new transfers are spread over their contract. This means that Chelsea, despite making a profit on Courtois, and hence their net costs are negative, will indeed see amortisation costs rise in the long run as next year they will not have that Courtois profit.

The same is the case for amortisation costs saved, for some of the players sold, they may only have had one more year of amortisation costs and as such this saving will not be there next year and hence they will see amortisation costs rise the following year.

Amortisation costs have risen over the years and will continue to as long as clubs net spends are still as large as they are.

I hope you found this article insightful, share with a friend!

Please follow and like us: