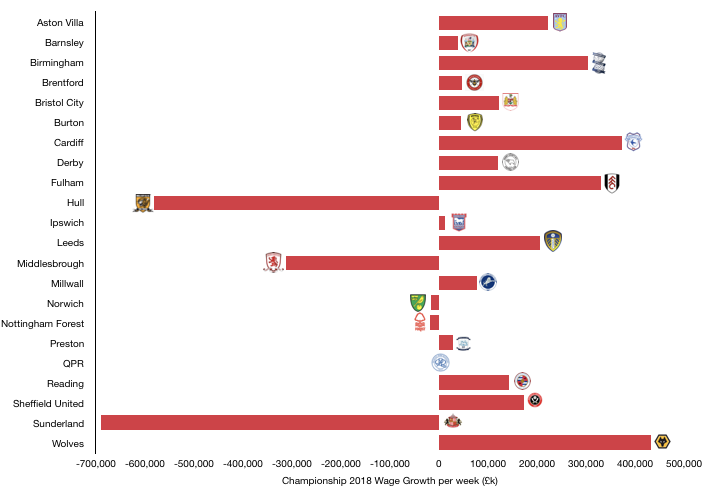

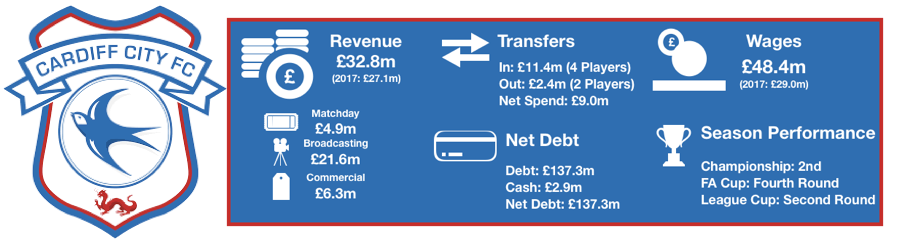

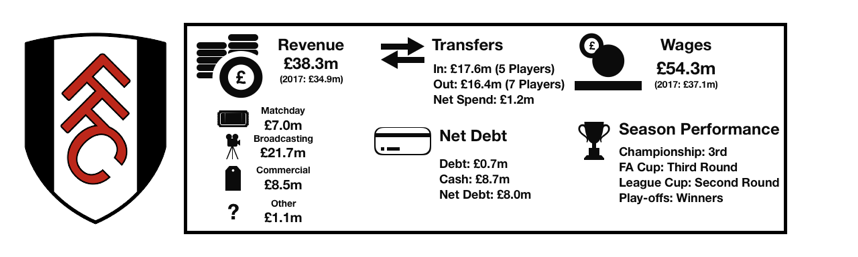

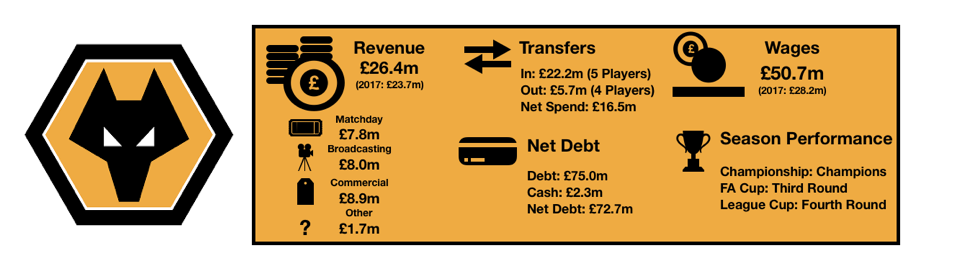

2018 was another unpredictable season in the Championship with Wolves’ mega spending seeing them clinch promotion and the title. However, Cardiff were the surprise package, sealing the other automatic promotion spot while Fulham went up via the play-offs.

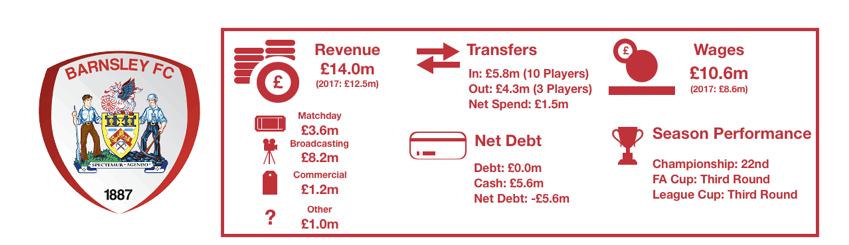

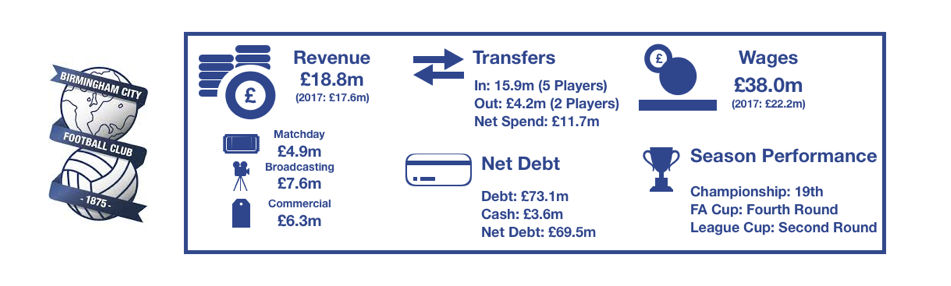

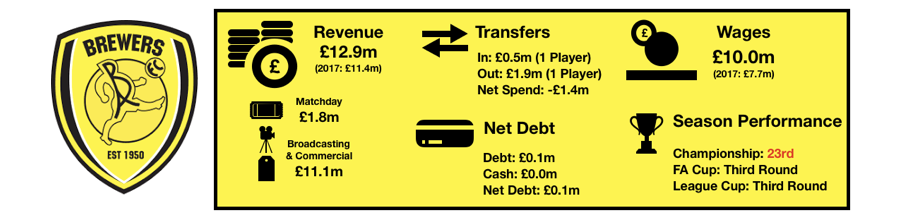

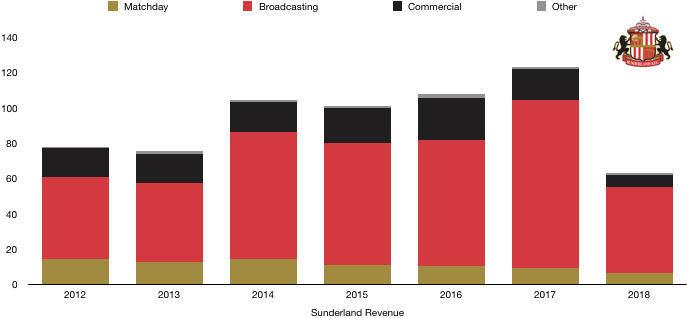

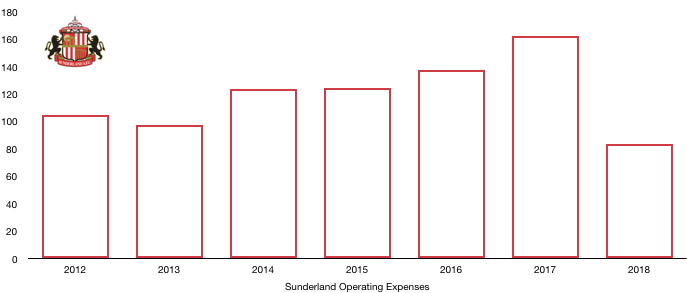

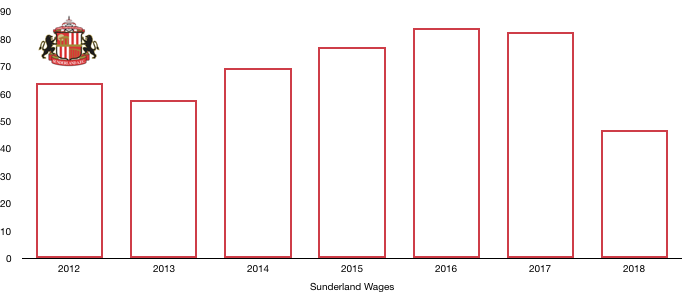

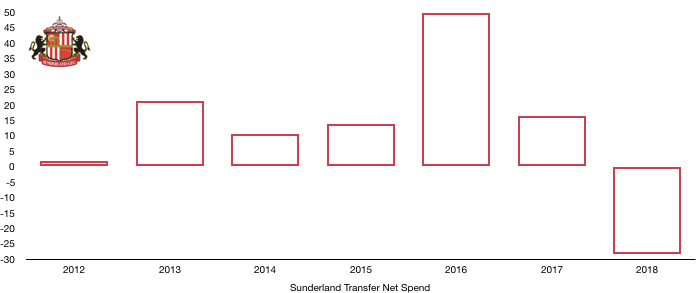

At the bottom of the table it was misery for Sunderland who were condemned to back-to-back relegations alongside Barnsley and Burton to League One.

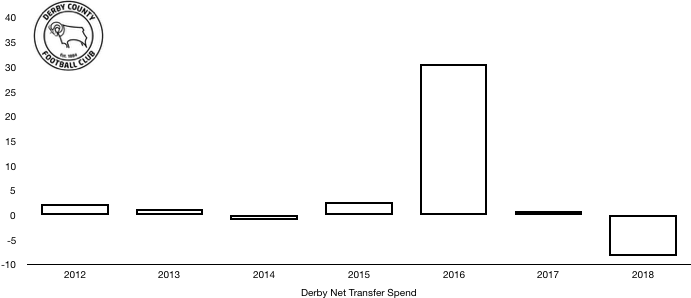

However, this article is about finances, and more specifically revenue and which clubs are bringing in the cash and who is in desperate need of some.

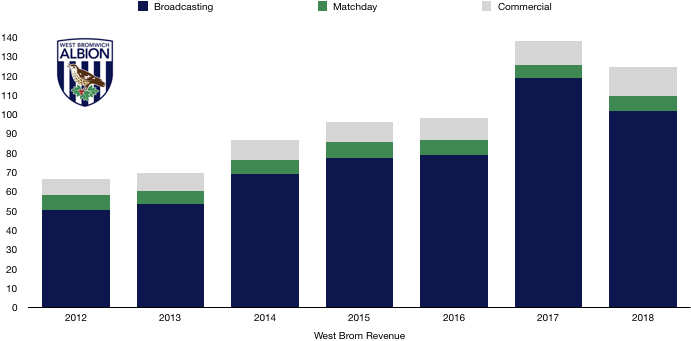

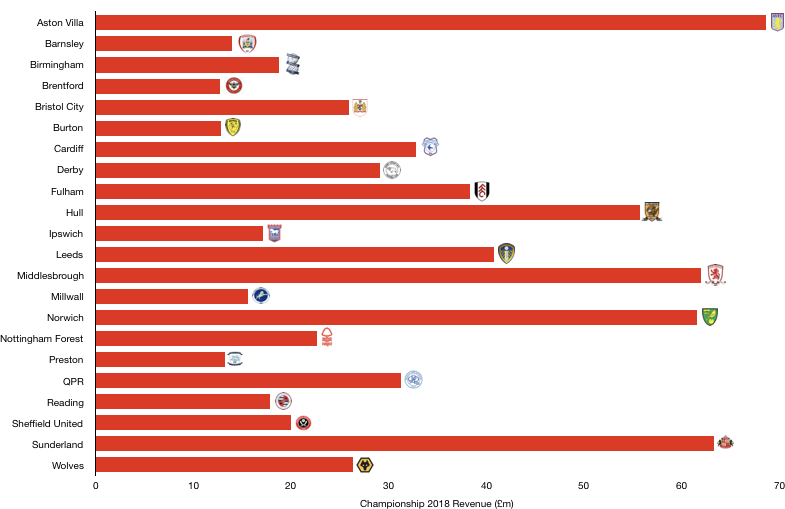

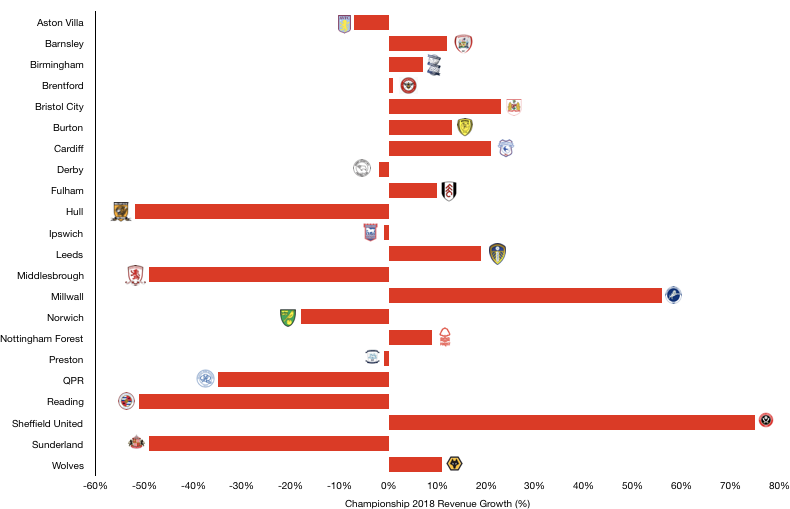

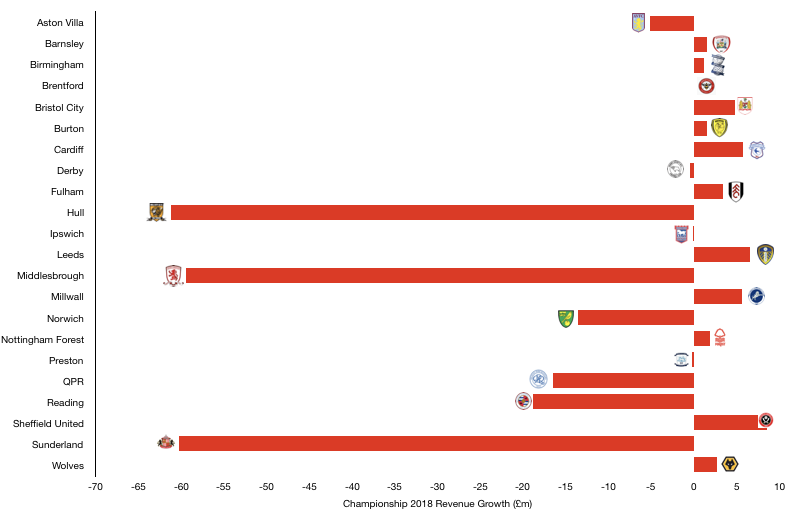

Revenue actually fell from £893m to just £701m (22%), primarily due to the relegated clubs who saw their revenue drop by a combined painful £181m! Excluding these clubs from the analysis leads to only a 2% drop in revenue which is still a concern.

This is fall is largely driven by falls in broadcasting revenue as due to poor cup campaigns for many clubs and also a general fall in the commercial appeal of clubs in England’s second division which has only widened the Chasm between the Premier League and Championship.

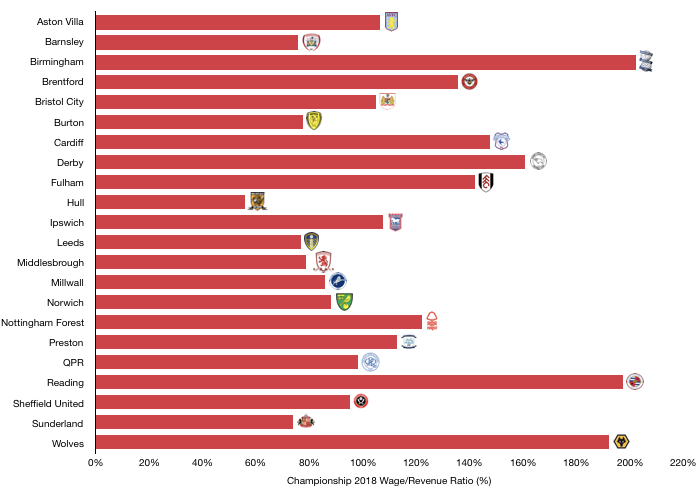

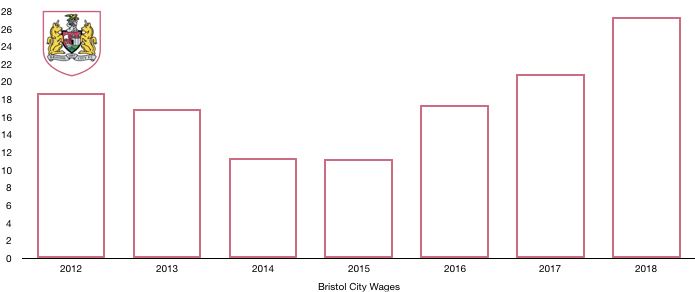

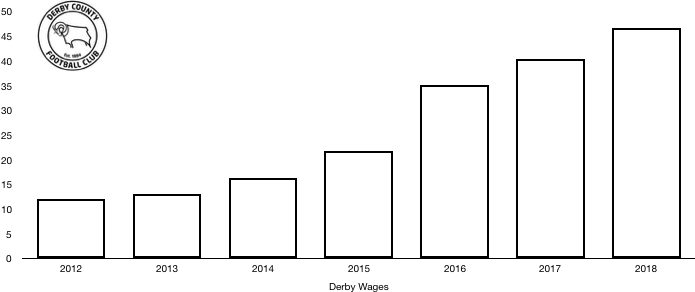

To compare, Premier League clubs earned nearly 7 times as much as Championship clubs in 2018, showcasing why Championship clubs have been going for broke with unsustainably high wages as of late, gambling on reaching the big time and big bucks.

The average revenue of a Championship clubs is only £32m compared to roughly £240m among Premier League clubs! This average falls to a measly £27m when excluding the relegated clubs who benefit significantly from parachute payments following their relegations.

Please note that Bolton are yet to release their finances due to their ongoing financial troubles while Sheffield Wednesday have so far yet to file their accounts which are long overdue.

Revenue Rumbled

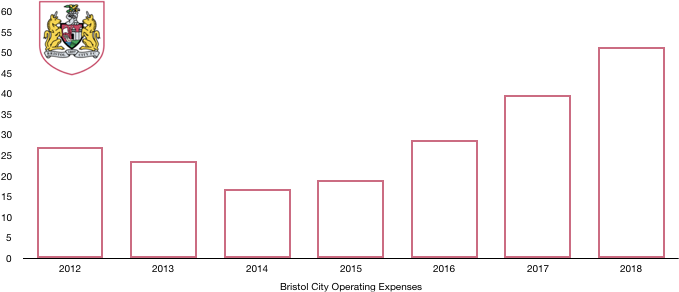

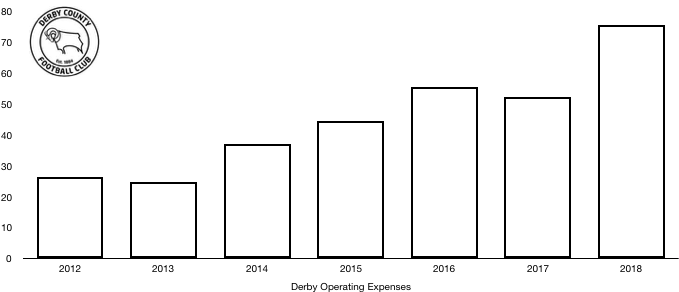

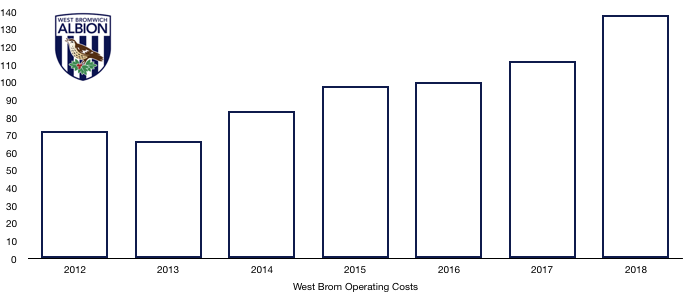

As mentioned, Championship revenue fell by 22% to £701m due to the drop in revenue of the relegated clubs. This drop does fall to 2% when excluding those clubs however still points to a revenue slow down which will be a concern to many Championship clubs and their owners who are leaking money due to high wages.

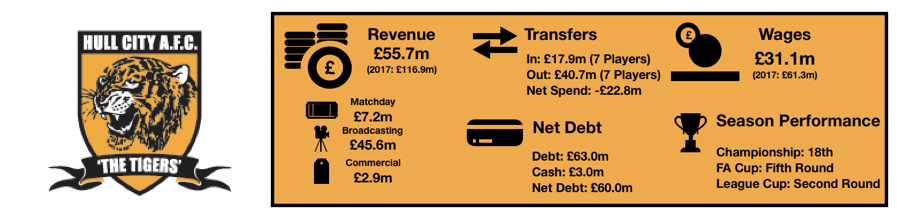

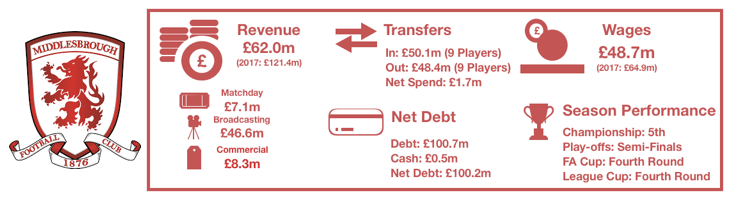

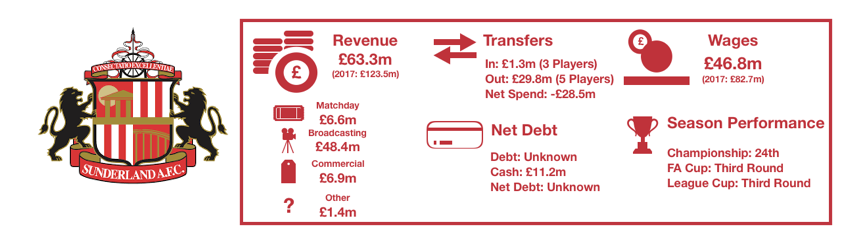

Let’s start with those relegated clubs, Hull (£56m), Middlesbrough (£62m) and Sunderland (£63m) saw their revenue fall by 52%, 49% and 49% respectively following relegation, losing out on incredible £181m in the process, showing the huge immediate costs of relegation.

And this isn’t even the end of it, parachute payments will continue to fall, further hurting revenue unless a quick return to the Premier League is secured.

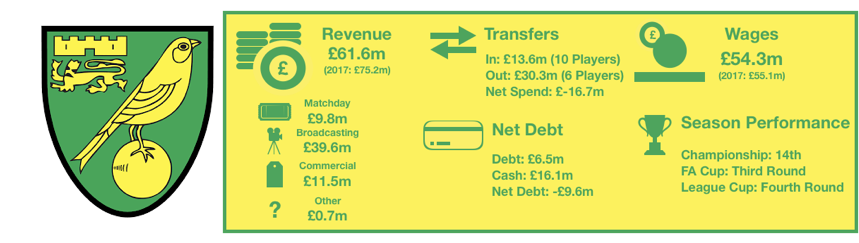

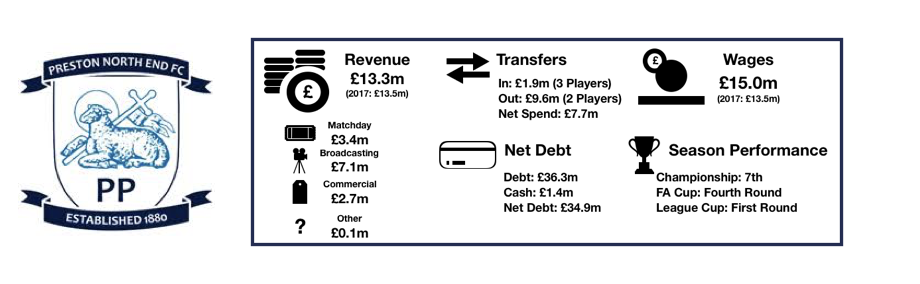

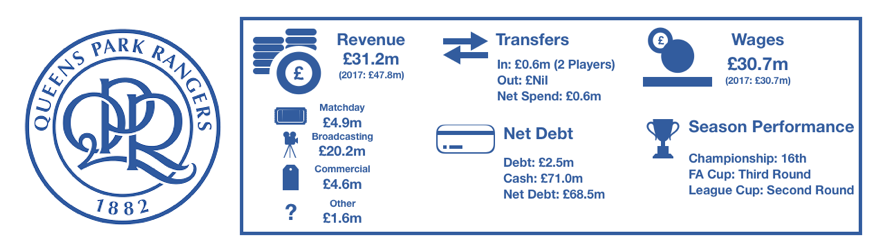

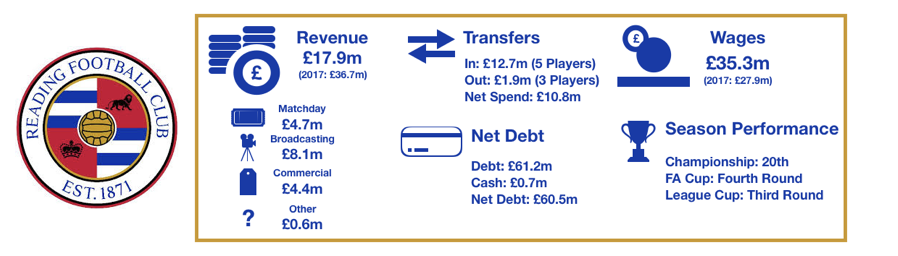

Other big revenue losers were Reading (£18m), QPR (£31m) and Norwich (£62m) who all saw heavy reductions in the above mentioned parachute payments, leading to drops in revenue of 51%, 35% and 18% respectively.

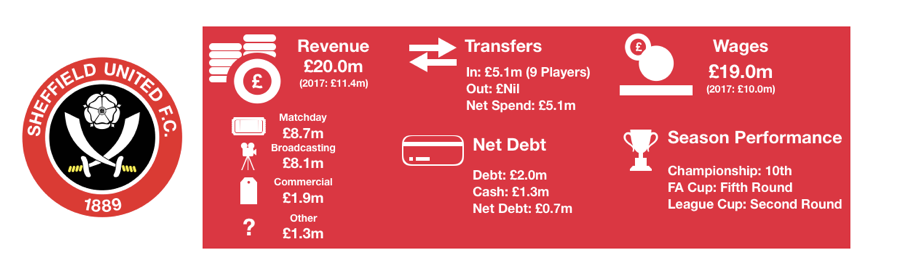

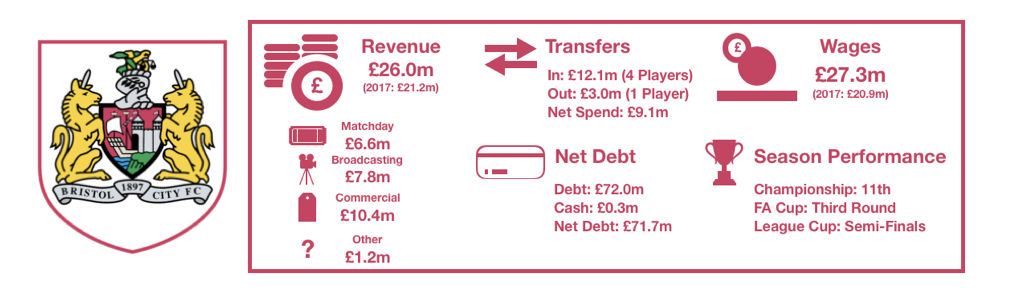

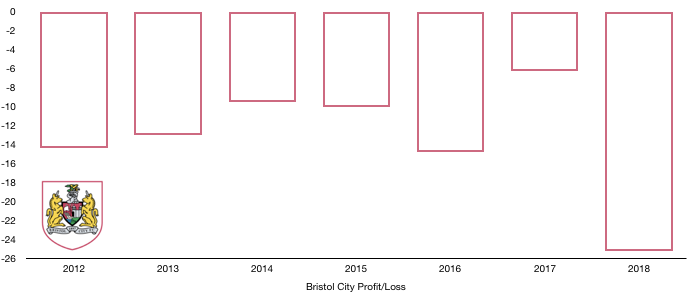

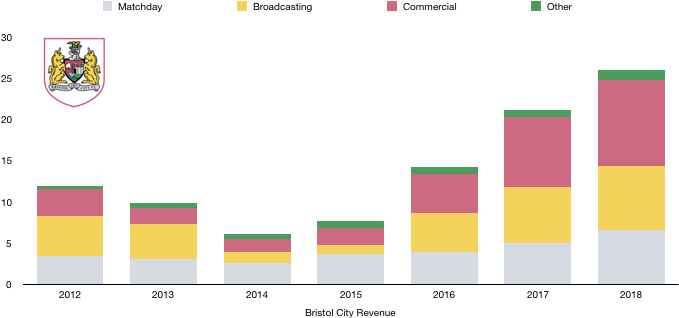

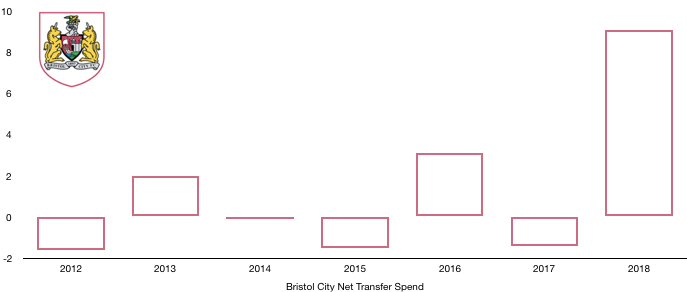

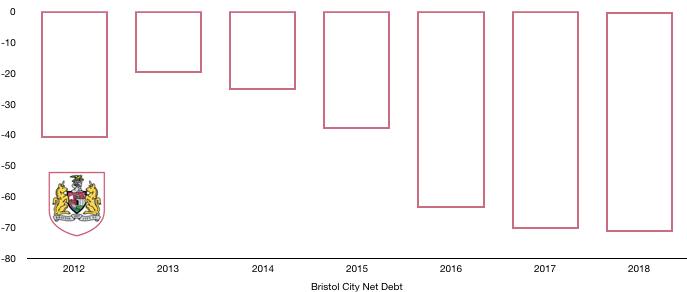

On the end of the scale were Sheffield United (£20m), Millwall (£16m), Bristol City (£26m) and Cardiff (£33m) for all too different reasons.

Sheffield United and Millwall benefitted from promotion back to the Championship which helped them revive their dwindling commercial appeal after both secured top half finishes, increasing their revenue by 75% and 56% respectively.

Bristol City saw a sharp uptake in revenue of 23% due to a remarkable run to the EFL cup semi finals that significantly boosted revenue after a giant-killing win over Manchester United caught everyone’s attention.

Lastly Cardiff saw a 21% boost in revenue after securing promotion. This increase however pales in comparison with the riches they will gain from promotion despite an immediate return to the Championship.

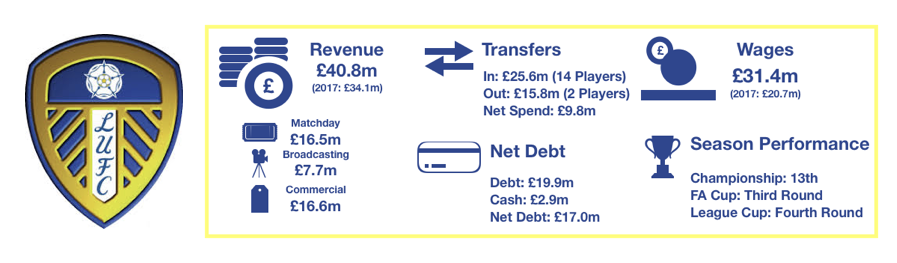

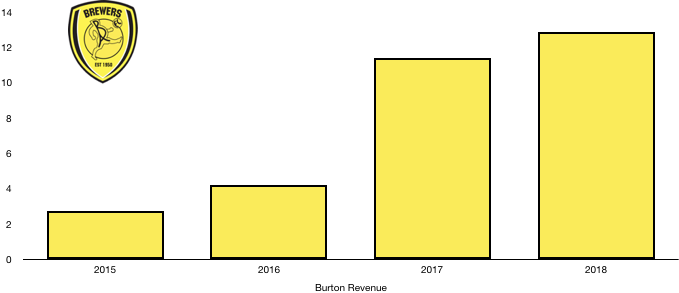

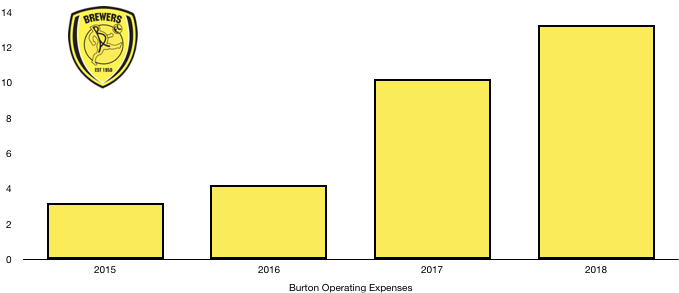

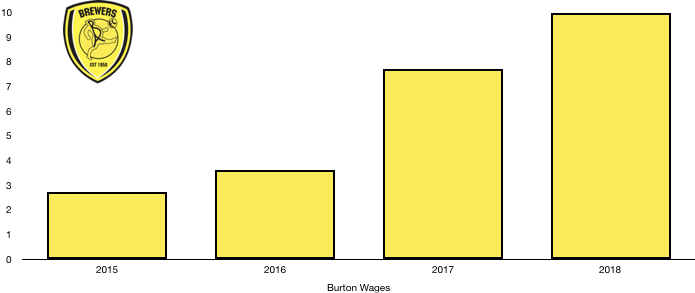

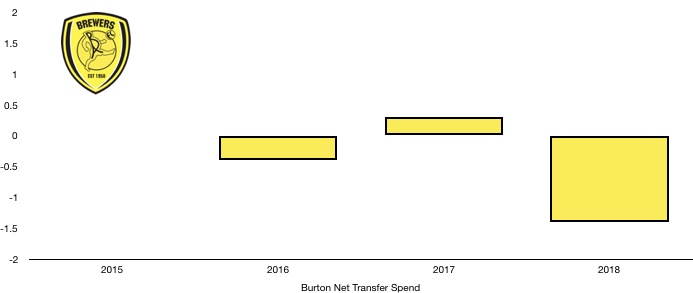

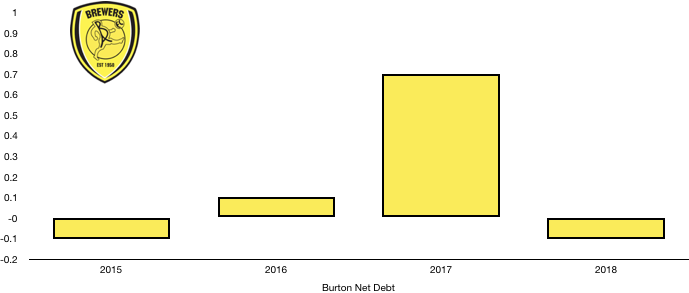

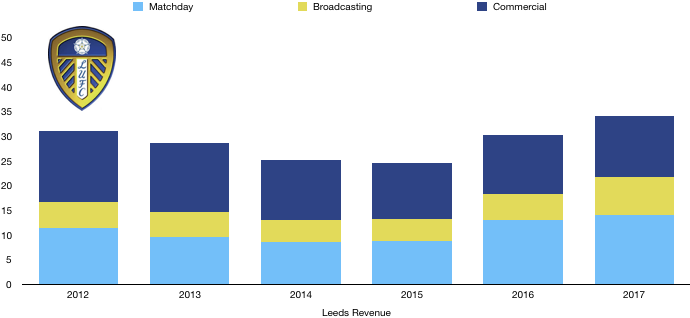

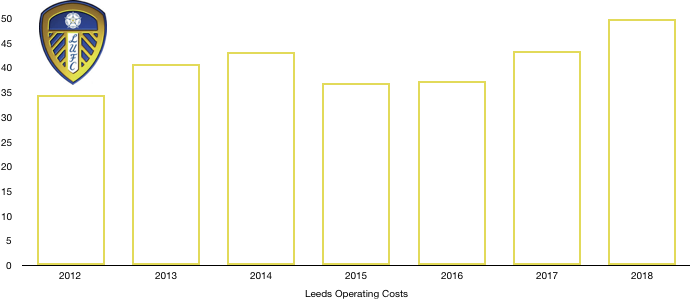

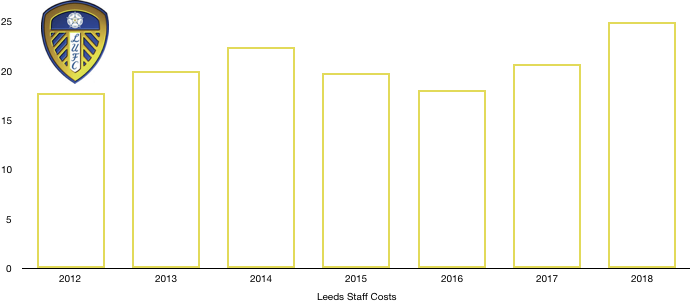

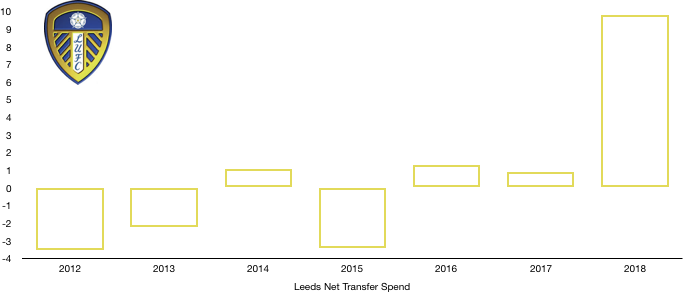

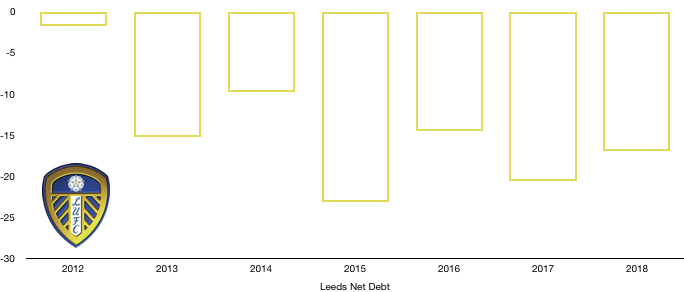

Outside of this, Leeds (£41m), Fulham (£38m) and Wolves (£26m) all experienced double digit growth as they began returning to prominence. Likewise, Burton (£13m) and Barnsley (£14m) also experienced double-digit growth from their lowly revenue figures.

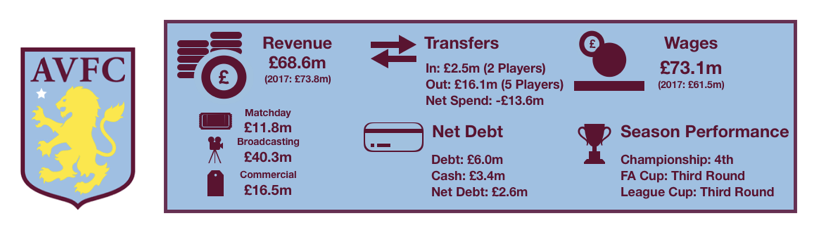

Aston Villa (£69m) on the other hand saw revenue fall by 7% after another season in the Championship. This will fall further in 2019 following a drop in parachute payments, however a timely promotion has saved the day.

Matchday Money

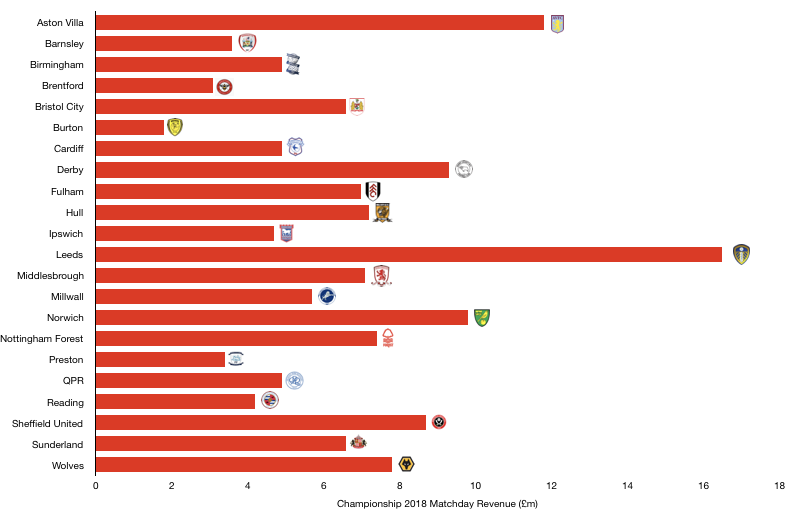

Championship clubs saw a 4% drop in matchday revenue to £143m after poorer cup runs by the majority and a fall in fan appetite that saw attendances fall and spending on matchdays decrease.

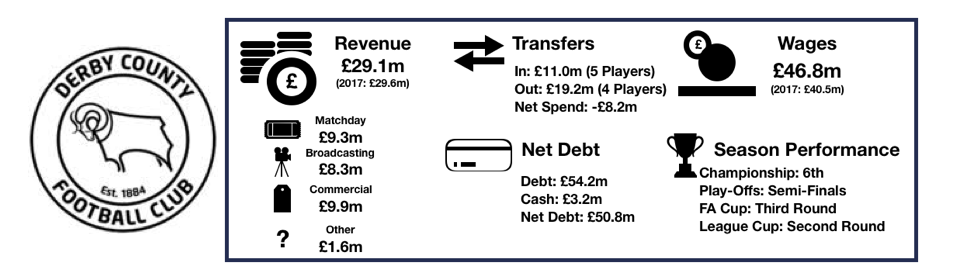

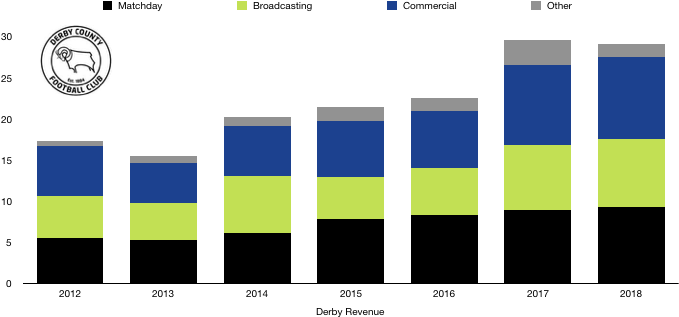

Matchday revenue is largely driven by attendances and stadium capacity so its no surprise that the biggest earners are Leeds (£17m), Aston Villa (£12m), Norwich (£10m), Derby (£9m) and Sheffield United (£9m) who all have stadiums with capacity exceeding 27,000.

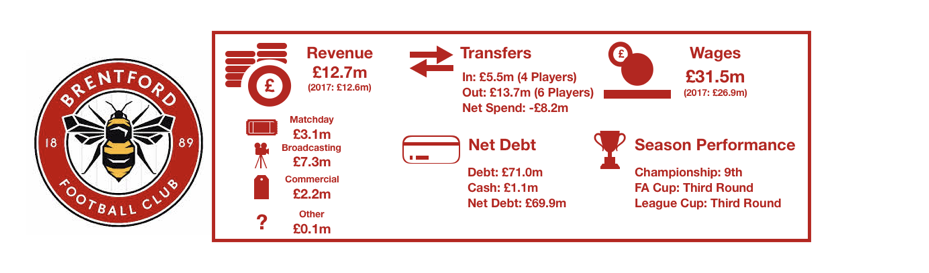

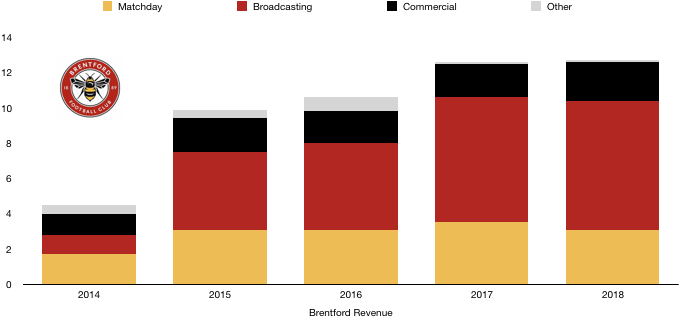

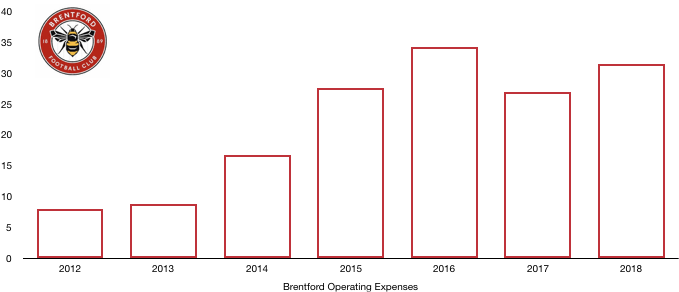

On the other end of the scale are Burton (£2m), Brentford (£3m), Barnsley (£4m) and Reading (£4m), who all have stadia with capacity below 24,000. Burton (6,200) and Barnsley (12,763) are significantly constrained by their stadium size. However, worryingly for Brentford and Reading, their stadiums exceed 20,000 and therefore shows a lack of fans at their games.

Matchday revenue accounts for 21% of revenue for Championship clubs and is a relatively stable income stream with attendances not varying much year on year. However, fan engagement is lessening with fewer fans attending games due to a lack of enjoyment and/or more games on TV.

Championship clubs going forward are going to struggle to attract fans and meaningful matchday takings due to many younger fans opting for Premier League top sides even where this isn’t their local team unless something is done to prevent this soon.

EFL Earnings

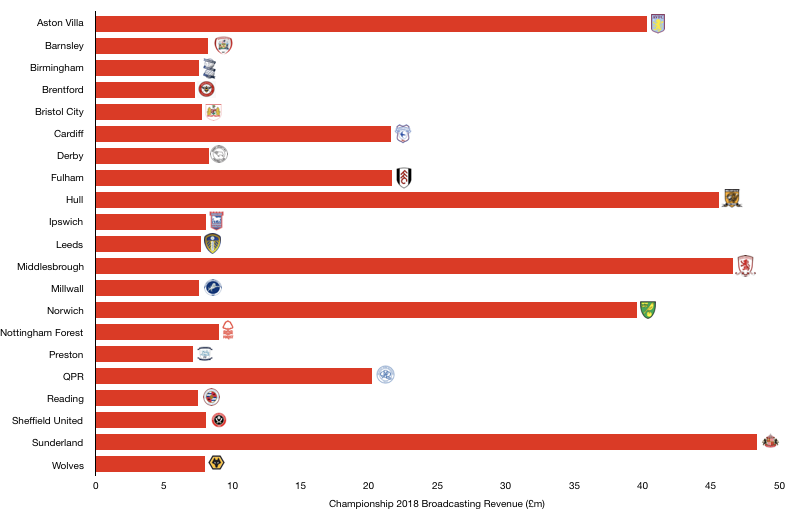

Broadcasting revenue makes up 57% of Championship club (falling to 49% without Premier League relegated clubs), making it their most importance form of revenue. Championship clubs gain this revenue from the EFL for Championship and League Cup performances and also receive cash from the FA Cup.

Not taking into accounted those relegated clubs, broadcasting revenue fell by 11% as parachute payments fell for those clubs relegated within the last 3 years, while Championship clubs faltered in the cups.

Unsurprisingly the three relegated clubs Hull (£46m), Middlesbrough (£47m) and Sunderland (£48m) had the highest levels of revenue due to significant parachute payments. Despite this, their revenue dropped by 51%, 54% and 49% respectively, showing the huge costs of relegation.

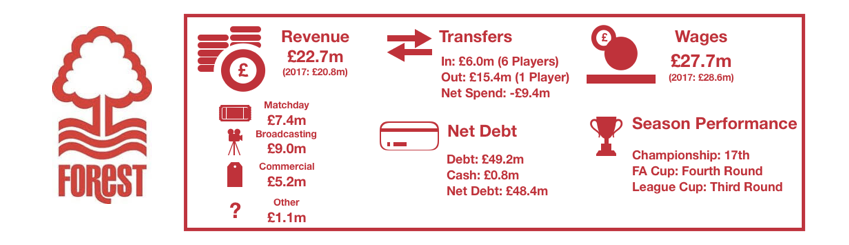

More positively, Barnsley (£8m), Bristol City (£8m), Millwall (£8m), Nottingham Forest (£9m) and Sheffield United (£8m) all experienced double digit growth in revenue, with Sheffield United seeing a 406% growth in revenue following promotion!

Burton would have also experienced significant growth in broadcasting revenue, however they have combined both broadcasting and commercial revenue together (£11m) so cannot be analysed.

Aston Villa (£40m), Norwich (£40m), QPR (£20m) and Reading (£8m) all experienced big falls in broadcasting revenue after their parachute payments were reduced once again, with both QPR and Reading at the end of their cycle.

The average broadcasting revenue among clubs not receiving parachute payments is around £8m compared to the £100m minimum available in the Premier League, showing why clubs and their owners go for broke to reach these riches.

However, a new EFL deal was agreed in 2018 for £595m for five years, a 35% increase. This will increase broadcasting revenue for Championship clubs going forward and slightly narrow the wide chasm between the Championship and Premier League.

Commercial Pittance

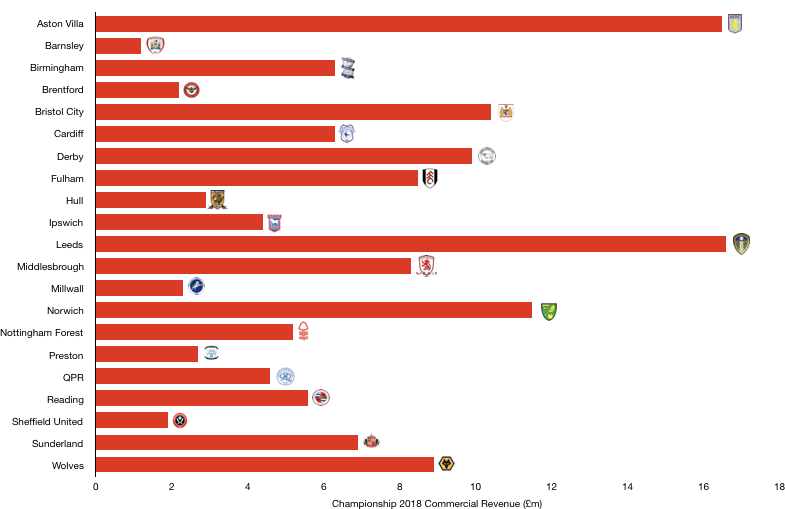

Commercial revenue makes up a fifth of Championship club’s revenue and is the main area for growth that the clubs can directly affect.

Many Championship clubs have huge followings due to the history behind their clubs. This history and fan base of these clubs could be better utilised and exposed to boost commercial revenue by many of these clubs.

Commercial revenue did in fact fall by 2% to £143m, a total less than the individual commercial revenue earned by Chelsea, Liverpool, Manchester City and Manchester United each.

The biggest earners commercially are Aston Villa (£17m), Leeds (£17m), Norwich (£12m) and surprisingly Bristol City (£10m) after their League Cup exploits. These 4 all earned more commercially than Bournemouth, Brighton, Burnley, Huddersfield, Stoke and Watford, showing the huge commercial appeal they have considering their league status.

Aston Villa will only grow further following promotion and will be hoping to get back towards their all-time high commercial revenue of £31m in 2014 and 2016.

On the other hand, many clubs in the Championship struggle to drum up commercial interest. Barnsley (£1m), Brentford (£2m), Hull (£3m), Millwall (£2m), Preston (£3m) and Sheffield United (£2m), all take well below the levels Championship clubs should be, especially considering some of the history and fan base of many of these clubs.

Of the clubs promoted that season, Wolves (£9m), Fulham (£9m) and Cardiff (£6m) should all see sharp rises in commercial revenue into the double figures, although Cardiff and Fulham’s relegations may put pay to that.

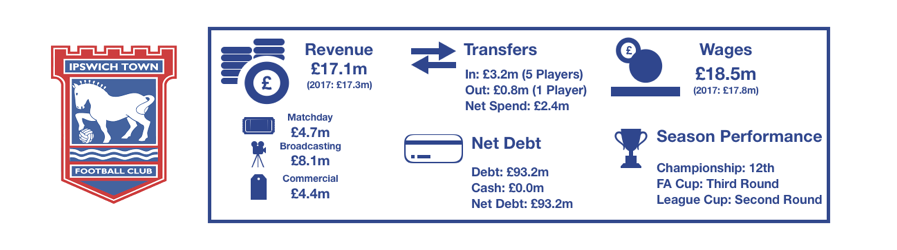

The declines of Ipswich (£4m) and Sunderland (£7m) will see their commercial revenue continue to plummet.

All in all, this is the biggest area of opportunities for Championship clubs. As more and more games are shown on TV and the quality continues to improve, sponsors are going to show further interest in the right clubs so long as they can capitalise.

I hope you enjoyed this article – Share with a fan!