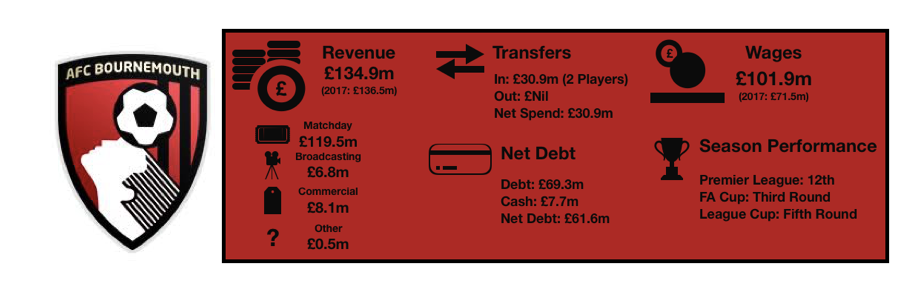

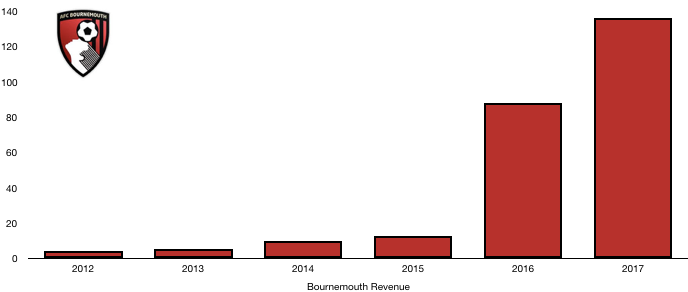

Bournemouth enjoyed their fourth consecutive season in the Premier League, and it was another successful one as they survived (with a few scares along the way), finishing 14th, a slight fall on the previous season (12th).

A run to the League Cup Quarter Finals gave the fans some hope of silverware, however an unimpressive FA Cup campaign finished in the Third Round, meaning the season ended in pretty unspectacular fashion.

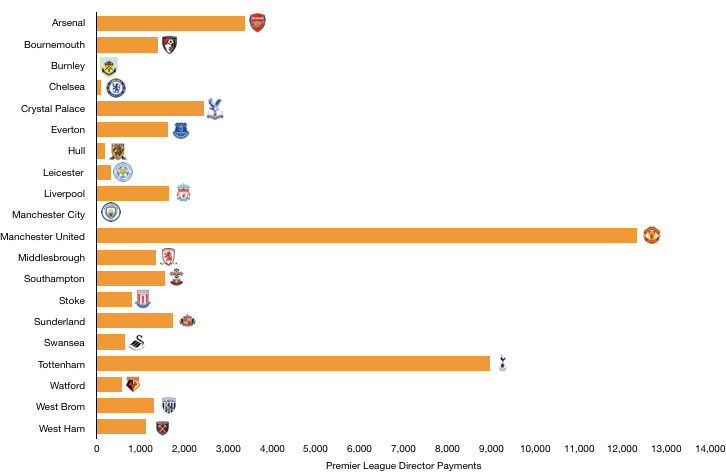

This article aims to predict how last season affected Bournemouth and their finances and what the future holds.

Let’s delve into the numbers.

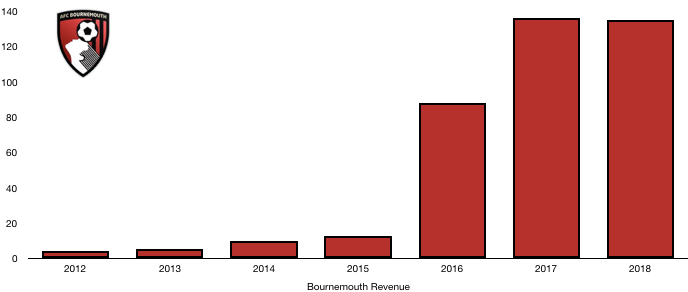

Revenue Prediction

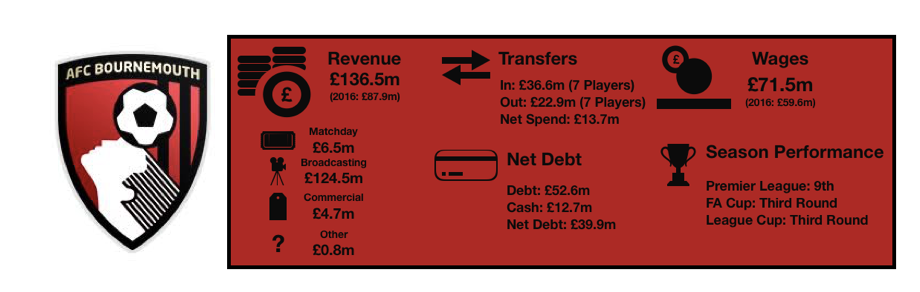

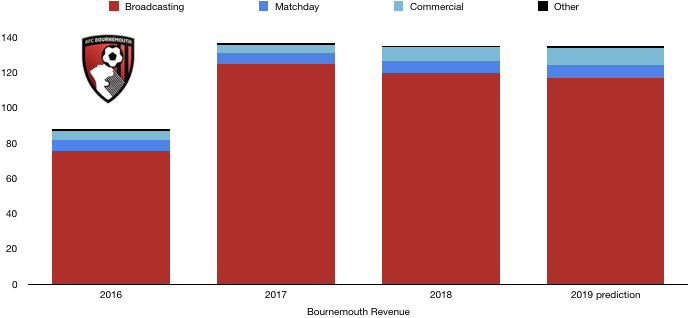

Matchday Revenue

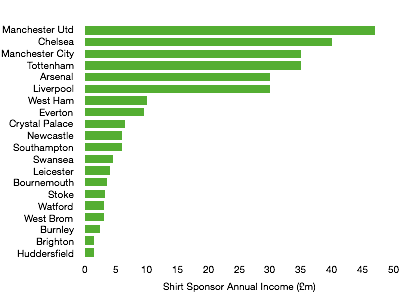

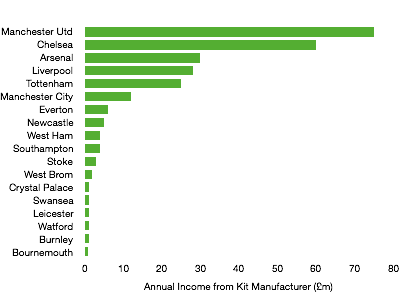

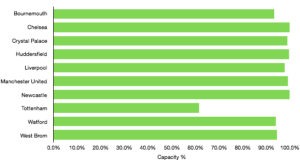

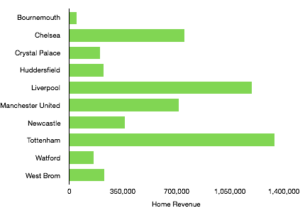

Bournemouth’s matchday revenue was the lowest among Premier League clubs in 2018 at £7m due to a stadium capacity of 11,329 which is ridiculously low for a Premier League club and shows how well the the south coast club are doing to survive fairly comfortably.

Average attendance fell slightly to 10,532, however Bournemouth did have 1 more home game this season due to their League Cup exploits so it is likely matchday revenue will remain at £7m.

Bournemouth have begun looking at boosting matchday revenue by building a new stadium, although this is proven difficult with plans on hold after the club were overly optimisticabout plans to move into a new stadium by 2020.

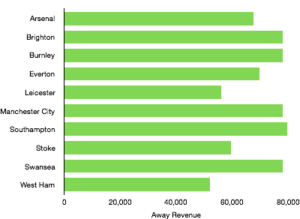

Broadcasting Revenue

Broadcasting revenue was £120m in 2017/18 after a solid mid table season was combined with poor domestic cup campaigns.

As with many mid table clubs, Bournemouth are heavily reliant on Premier League TV money and this makes up the majority of their revenue.

Premier League revenue was £111m in 2018, 82% of their total revenue and 93% of their broadcasting revenue.

In 2019, Bournemouth finished two places lower in the Premier League and were shown on live TV once fewer, costing the club around £3m as Premier League payments fell to £108m despite an increase in overall distributions.

Bournemouth will expect a similar amount of FA Cup prize money as they exited at the Third-Round stage again.

Whilst they did well to reach the League Cup Quarter Finals, the competition prize money is small and will make little difference financially to Bournemouth.

Based on the above, Broadcasting revenue is likely to fall by around £3m to £117m due mainly to the drop in Premier League payments.

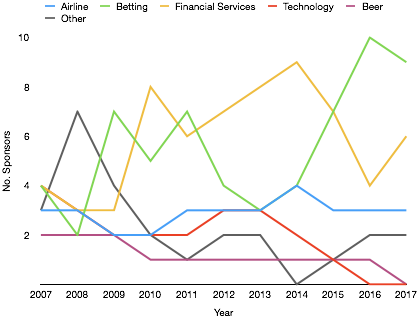

Commercial Revenue

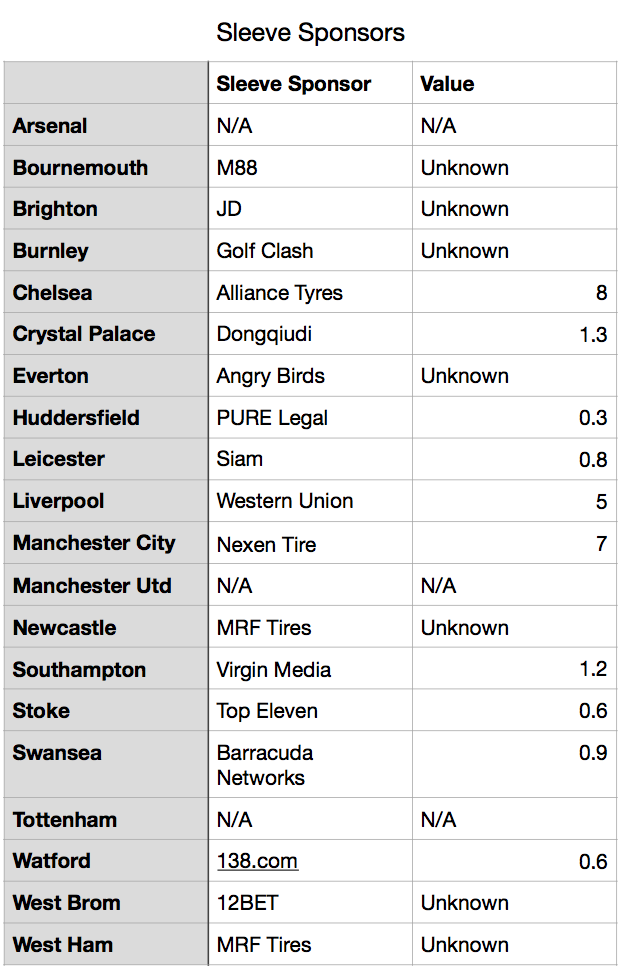

Bournemouth’s commercial revenue increased significantly in 2018, rising from £5m to £8m. Bournemouth can expect another jump in commercial revenue as they continue to consolidate as a Premier League club while the Premier League’s commercial appeal continues to grow.

Bournemouth are slightly limited by their shirt and kit sponsors being in the middle of contracts so will have to rely on growth in commercial partners. Based on this, Bournemouth should see an increase in commercial revenue by around 25% to £10m.

Other Revenue

Bournemouth’s other revenue amounted to £0.5m in 2018 and we expect it to remain at a similar level.

Total Revenue

Overall, Bournemouth’s revenue is likely to be at the same level as 2019 at £135m. Performance in the Premier League, FA Cup and League Cup was similar to 2018 and as such was never going to change significantly.

The fall in Premier League payments is likely to be offset by commercial revenue rises with strong growth of around 40% likely to see revenue actually increasing slightly although it is unlikely commercial growth will reach these levels.

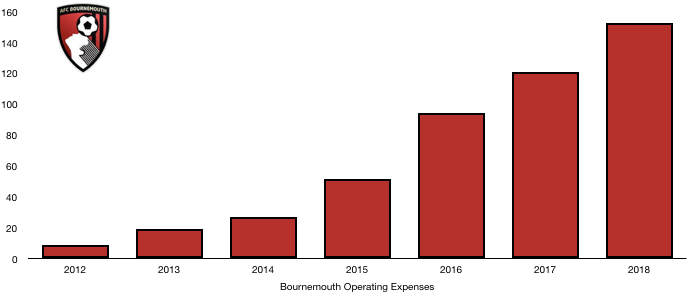

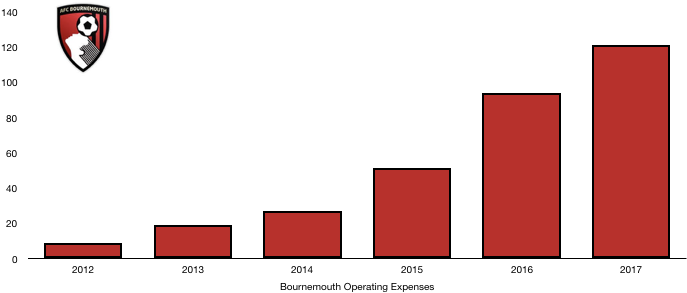

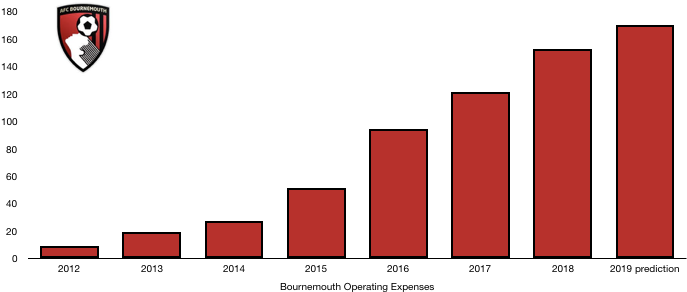

Costs Prediction

Amortisation

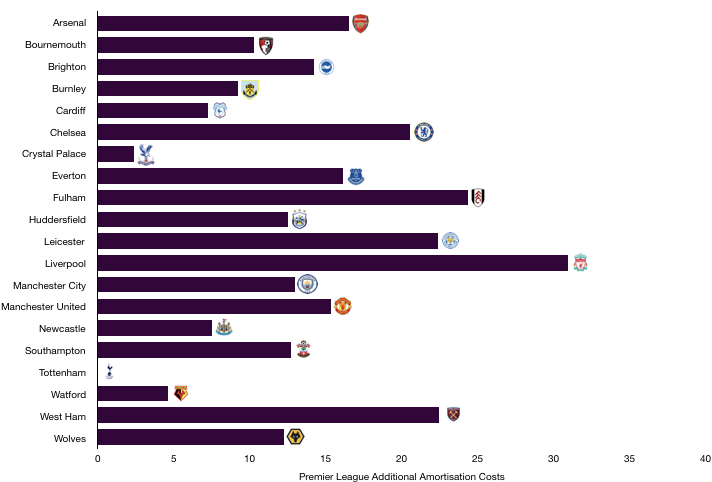

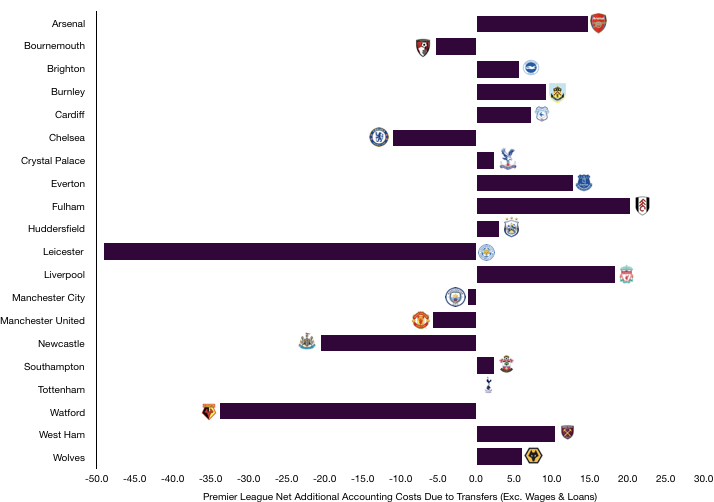

Amortisation is a large portion of total costs to a Premier League club and Bournemouth incurred amortisation of £27m in 2018. The signings of Lerma, Rico, Solanke, Mepham and Brooks undoubtedly add significantly to this figure, with the departures of Afobe, Grabban and Gradel offsetting some of this rise in amortisation.

Based on the transfer fees and contract lengths of the new signings and those sold, we expect amortisation to rise by around £9m to £36m for Bournemouth.

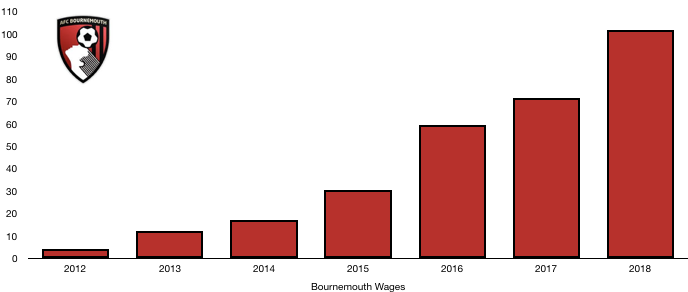

Wages and Other Costs

Other expenses such as stadium maintenance, lease costs etc. amounted to £24m in 2018. These costs rose by £1m from £23m in 2017 and we expect a similar rise this year to £25m.

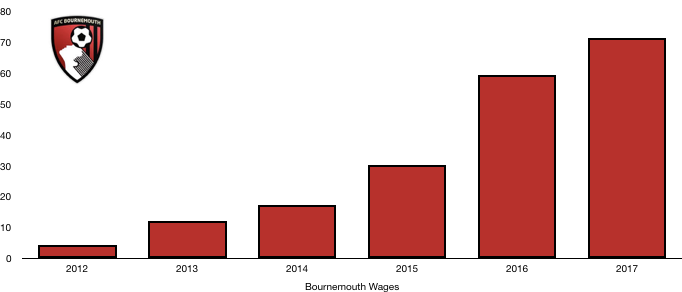

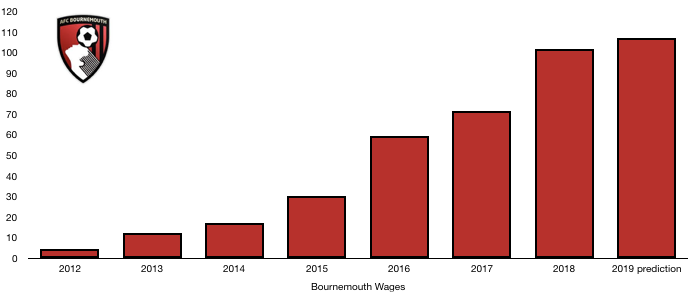

Wages are the most difficult area of finances to predict due to the opaque nature and privacy of these amounts. Bournemouth signed Lerma, Rico, Solanke, Mepham, Brooks and Clyne (on loan) as first team players in 2019 while only Afobe, Grabban and Gradel took anything meaningful of the wage bill.

New contracts were handed to Lewis Cook and Francis which will add to these wages

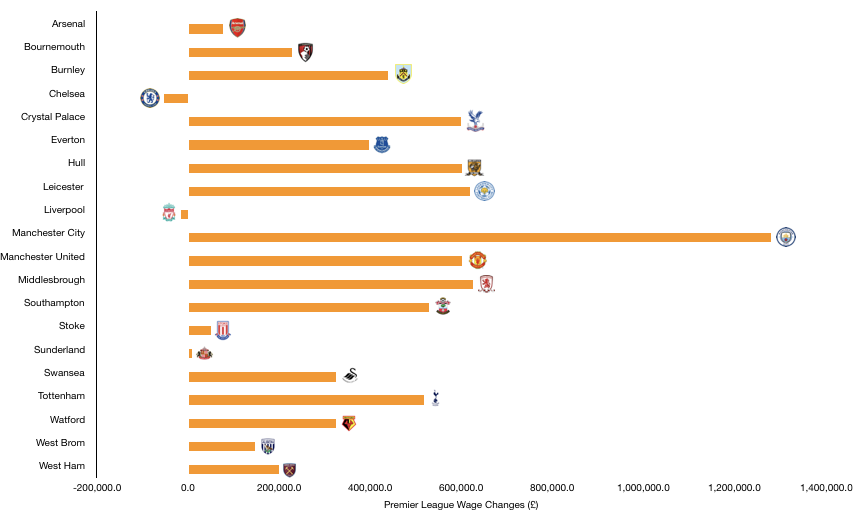

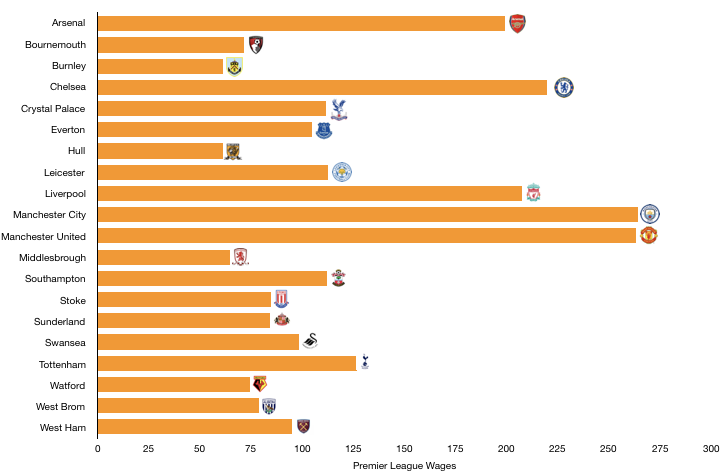

With these arrivals and we expect an additional £6m of wages to be incurred which will take total wages to around £108m from £102m. This could be larger based on survival bonuses players may have in their contracts.

Total Costs

Based on these additional costs, we expect wages to increase by around £17m from £153m to £170m.

This means that before taking into account transfers, Bournemouth will be losing around £35m, an unsustainable financial position that will need to be addressed by either selling players, further funds from their owners or by boosting revenue.

Transfers Analysis

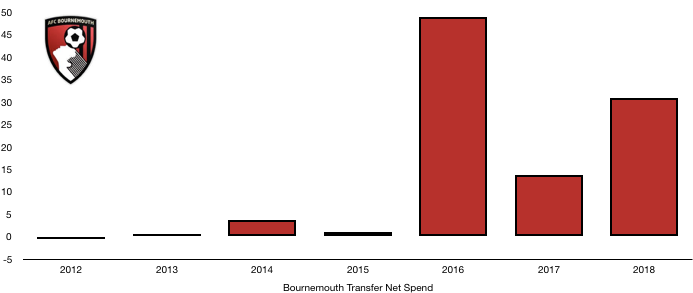

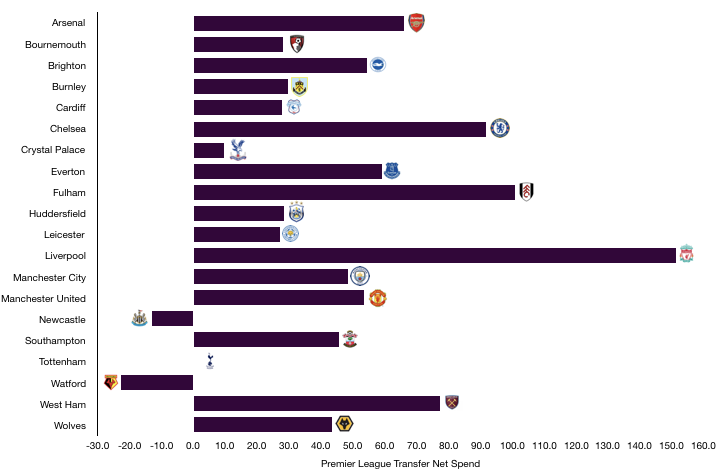

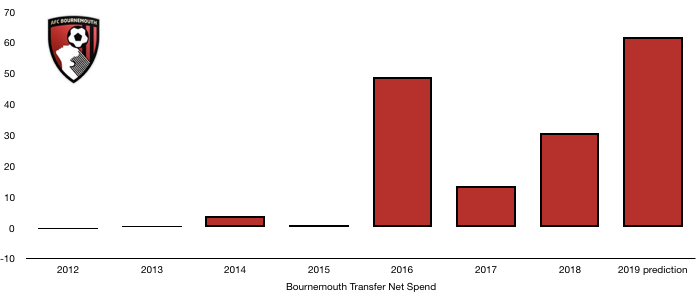

As mentioned, Bournemouth signed Lerma (£25m), Solanke (£19m), Rico (£14m), Mepham (£12m) and Brooks (£10m) for a combined £80m.

Departing the Vitality Stadium were Afobe (£10m), Grabban (£6m) and Gradel (£2m) for £18m.

This led to net transfer spend doubling to £62m, showcasing the ever increasing ambition of the club as they strive to move up the table.

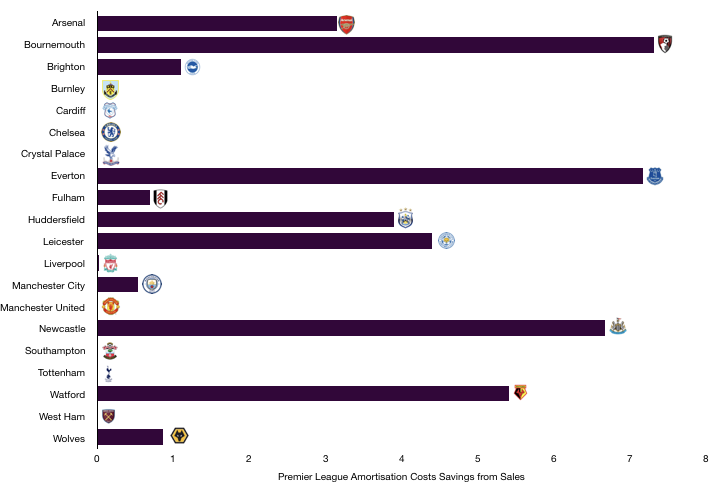

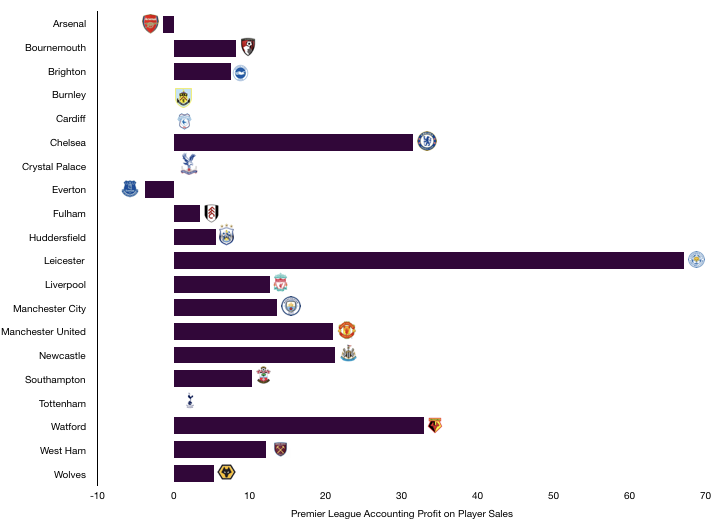

In 2018, Bournemouth made a profit on player sales of £1m due to low sale activities, this year there were more sales and despite none being earth shattering, profit on players sales should be around £6m, an increase of £5m that will boost profits (or reduce losses).

In terms of transfers fees owed, clubs owe Bournemouth £11m as of 2018 with £6m due in 2019 which will come in handy.

However, Bournemouth owe clubs transfer fees of £38m, of which £27m was due this year, which may affect transfer plans going forward unless revenue begins to rise.

Looking ahead, the sale of Mings and Mousset will boost profit on player sales considerably which should help Bournemouth record a profit in 2020.

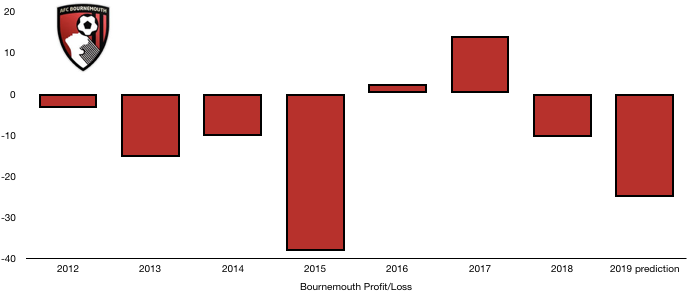

Profit/Loss Prediction

Bournemouth made a loss of £11m last year and are likely to record an even bigger one this season. With revenue flatlining but costs likely to rise by around £15-17m, even a rise in transfer sales means losses are likely to increase to around £25m. This is partly due as well to the lack of exceptional income after Bournemouth settled an FFP fine for £3m less than expected in 2018 which won’t be the case in 2019.

These increasing losses may be a theme of 2019 for most mid-table Premier League clubs with the costs of competing in the top flight rising considerably. Clubs look like only recording profits currently based on player sales rather than underlying financial stability.

Bournemouth’s reliance on Premier League revenue is more than most due to the relative size of the club, commercially and stadium-wise. The situation is improving commercially due to the playing style of the club and their continued Premier League presence, while a new stadium would boost matchday revenue considerably with attendance restricted by their current size.

As mentioned, the sale of Mings and Mousset will boost profits considerably and help fund further investment. However, the owner may have to pump additional cash into the club to keep them ticking over and growing.

I hope you enjoyed this article! Share with a Bournemouth fan and look out for when the actual finances are released to see how we fared!