Fulham ended their 4-year stay in the Championship via the dramatic play-offs having narrowly missed out on automatic promotion in 3rd place.

Fulham didn’t let the disappointment of finishing outside the top two that affect them, comfortably winning the play-offs and securing their return to the Premier League.

The increased investment needed to get to the Premier League came at a cost, more than doubling their losses from £21.3m to £45.2m (112%), which may bring Financial Fair Play into play (more below).

Let’s delve into the numbers.

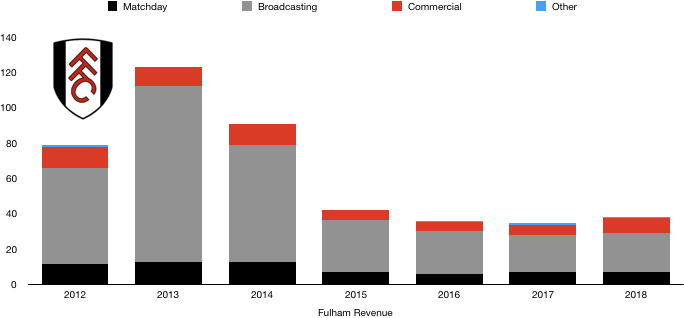

Revenue Analysis

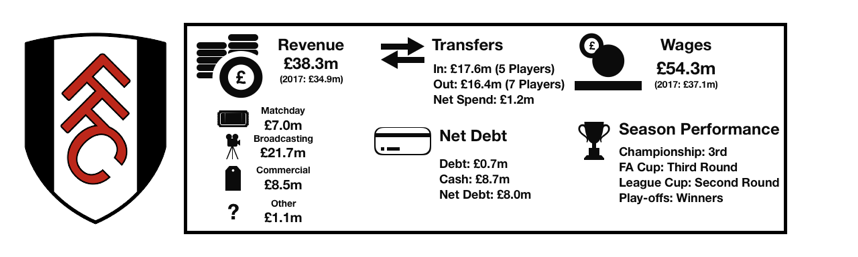

Fulham’s revenue grew slightly, increasing from £34.9m to £38.3m (10%) on the back of promotion.

Matchday revenue increased from £6.6m to £7.0m (6%) as their average attendance increased from 18,498 to 19,896 (8%) with fans flocking to Craven Cottage to see their team promoted. Matchday revenue also benefitted from the additional matches the play-offs yielded.

Broadcasting £21.0m to £21.7m (3%) as Fulham finished 3 places higher than last season and also gained considerably from the play-off final. These gains were offset by a fall in parachute payments, making a return to the Premier League timely.

Commercial revenue increased from £6.0m to £8.5m (42%) as Fulham began exploiting their new Premier League status and will look to build on this and take advantage of the London premium they receive commercially from sponsors.

Other revenue fell from £1.3m to £1.1m (15%).

Looking ahead, Fulham can expect a huge increase in revenue as it shoots to well in excess of £100m from promotion.

Fulham should expect revenue of at least £130m as broadcasting revenue will be around £110m, while matchday revenue and commercial revenue combined is likely to be in excess of £20m, depending on fan attendance and the success of the club’s commercial strategy.

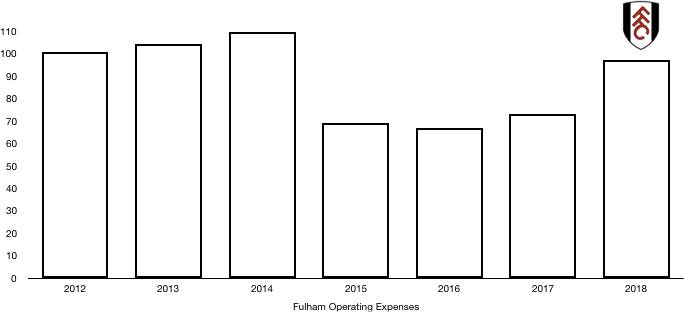

Costs Analysis

Fulham saw costs increase by a third, rising from £73.1m to £97.4m (33%) on the back of increased investment in the club to reach their promotion goal.

Amortisation shot up from £13.7m to £19.0m (39%) due to an increase in player spending (although the majority was recouped). This figure will probably double given the sizeable spend last summer.

Fulham have no interest expense due to the funds provided being interest-free or through share issues (see debt analysis).

Fulham also have no tax charge due to their loss-making status. These losses will be useful in reducing any tax bill this season as the majority of any taxable profit next year can be offset with losses from the last two seasons (or longer if they had not previously been used).

Wages were the biggest mover, rising from £37.1m to £54.3m (46%) as new signings were paid handsomely while existing players earned lucrative new deals.

Promotion related bonuses would also have been paid. These costs and any other that were only payable due to promotion won’t be considered when the EFL commence any Financial Fair Play investigations into the large losses Fulham have made in the last 3 years.

The wage increase works out at an extra £331k a week, a huge increase for a Championship team, showcasing the huge financial risks teams are willing to take to try and achieve promotion.

Directors were also rewarded for promotion as their renumeration increased from £1.0m to £1.2m (20%).

Looking ahead, Fulham will only see costs rise further, probably doubling to around £100m. After a record-breaking summer in the transfer window for a promoted club, amortisation and wages will rocket.

With relegation looming, relegation wage drop clauses are likely to come into effect and may dampen any of these increases slightly. Relegation will be extremely costly to Fulham who will need a quick return to avoid extreme costs controls being required.

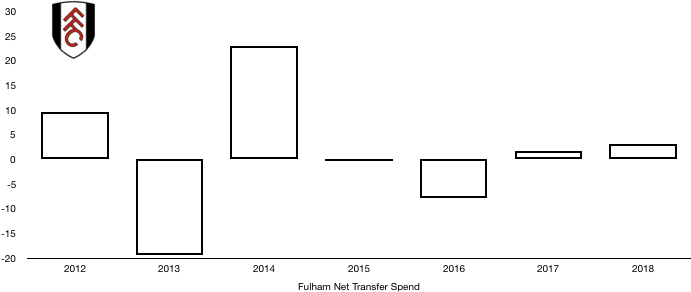

Transfers Analysis

Fulham were relatively busy in the transfer window as 5 players entered Craven Cottage and 7 departed.

In came Fonte (£6.2m), Kamara (£5.4m), Christie (£3.1m), Cisse (£2.3m) and Djalo (£0.7m) for a combined £17.6m.

Leaving Fulham were Aluko (£6.8m), Malone (£3.5m), Sanchez (£3.2m), Vigen (£1.4m), Stearman (£0.8m), Madl (£0.7m) and Burgess (£0.1m).

This meant Fulham’s net transfer spend actually fell from £1.6m to £1.2m (25%) as they recouped the majority of their spending in 2018.

The signings were important to their promotion campaign, although it was really the existing talents that took them a step further than they achieved in 2017 by leading them to play-off glory.

In cash terms, Fulham spent cash of £21.7m and recouped cash of £18.1m, a net £3.6m outlay which needed funding (see debt analysis).

Fulham are also owed a further £12.4m, although they owe £18.8m (all of which is due this year). This means Fulham owe £6.4m net this year to other clubs, something that didn’t seem to affect their spending last summer.

There are also potential contingent fees owed to clubs/players if certain clauses are met of £4.7m.

Debt Analysis

Fulham had a heavy loss to deal with this year that depleted their cash reserves, however Shahid Khan was there to fund it all.

Cash levels actually increased, rising from £3.9m to £8.7m (123%) despite the huge loss. New funds of £40m were pumped into the club to pay for these losses and also funded their transfer spend and a £5.7m spend on enhancing their infrastructure as Fulham planned to redevelop the Riverside Stand.

It is such a shame that relegation now seems inevitable given the spending by the club with not only a present mind set but also with a long-term outlook shown by the investments made.

Debt level surprisingly fell from £65.7m to £0.7m (99%) however this was just due to accounting hocus pocus and change in debt to equity. The existing loans of £65.7m were converted into shares and the new £40m funds were given through an issue of shares.

This means the club now do not owe Khan anymore money, with the only way he will recoup these funds is through an increase in value of the club, something relegation will unfortunately not help with. This may help when any Financial Fair Play issues are investigated as the club don’t actually owe much money.

Shahid Khan has shown huge ambition with the level of funds provided, however it seems the strategy was incorrect. The summer signings were not what was hoped for and the decision to sack Jokanovic showed a vision gone awry.

Hence a net debt position of £61.8m turned into a net cash position of £8.0m.

Further funding is likely to be required due to relegation after a £100m+ transfer window. The ongoing financial health of the club will take a huge hit in the Championship with a quick return vital. Fulham have put themselves in a position of financial vulnerability given their huge investment which was meant to secure their Premier League status for next season at the minimum. A financial rethink is needed, and a solid strategy implemented to avoid financial ruin.

Fulham must also deal with any Financial Fair Play issues that come their way, after making a loss in excess of £60m over 3 years, way above the limits allowed. Costs related to promotion will be excluded, while the conversion of their debt to equity may help them significantly when discussing the issue with the EFL (as they owe a minimal amount to anyone).

Thanks for reading – Share with a Fulham fan!