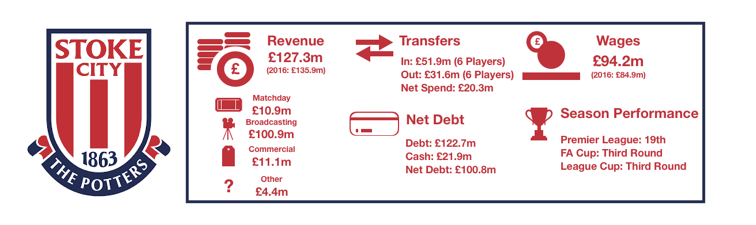

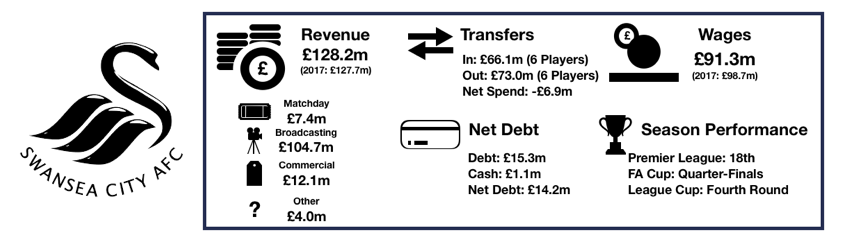

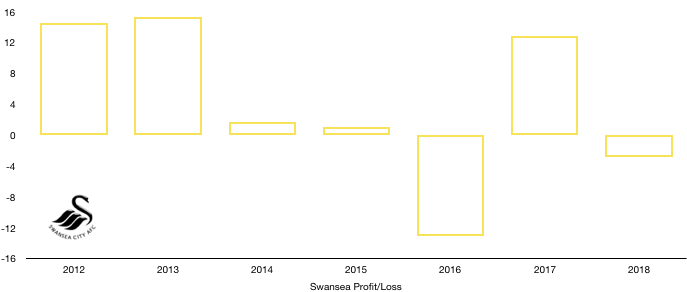

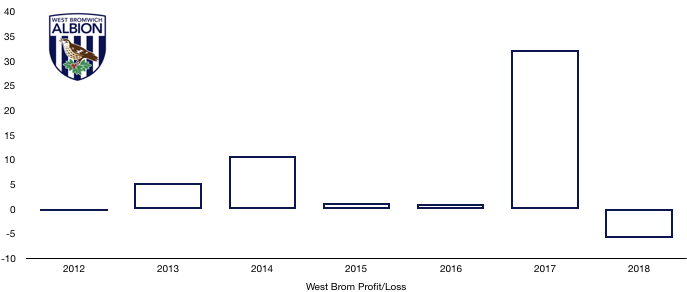

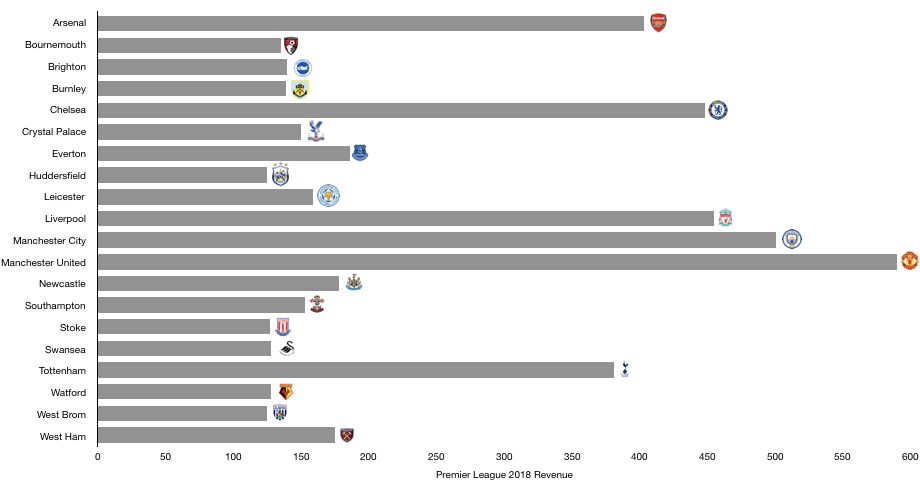

2018 was another thrilling season with Manchester City blowing away all competition to take the Premier League crown with ease. At the bottom of the table mainstays Swansea, Stoke and West Brom met their doom with relegation.

However, this article is about finances, and more specifically revenue and which clubs are bringing in the cash.

Revenue increased from an eye-watering £4.3bn to an even more outstanding £4.8bn, a more than half a billion rise in income and a 12% growth rate!

This is largely driven by the ever-increasing commercial appeal of the Premier League and improved performances in Europe by the top 6, further increasing the financial gap between the elite and the mid-table clubs.

The average revenue of a Premier League club is a cool £240m. This average shoots up to a jaw-dropping £460m among the top 6, showing how uneven the revenue is across the league and the near-impossible challenge of competing with their ever-growing riches.

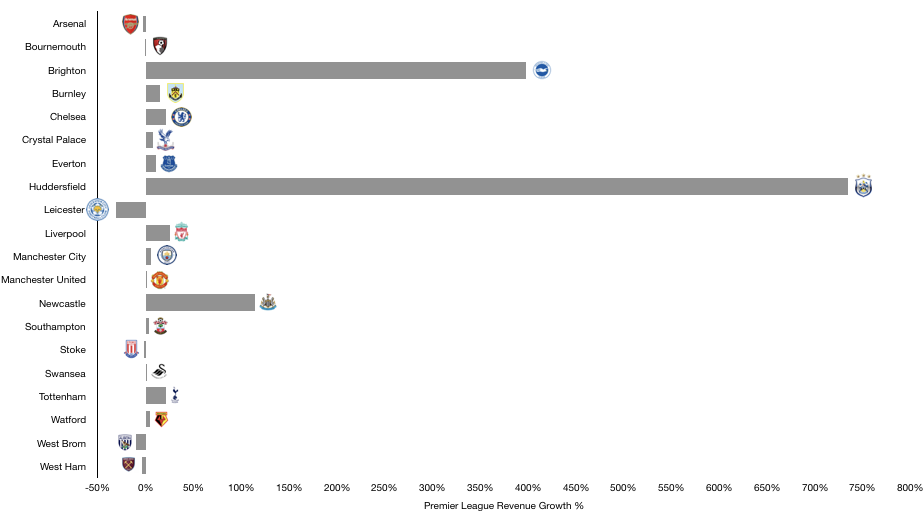

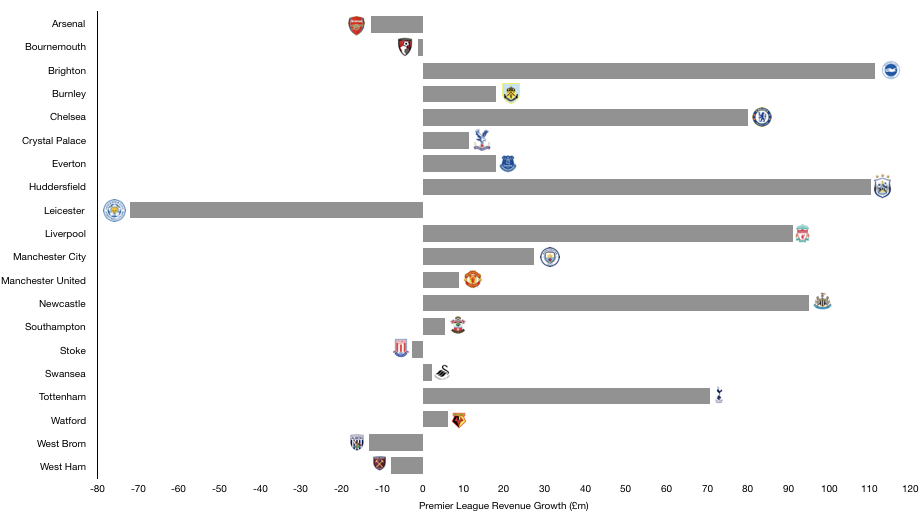

Revenue Growth

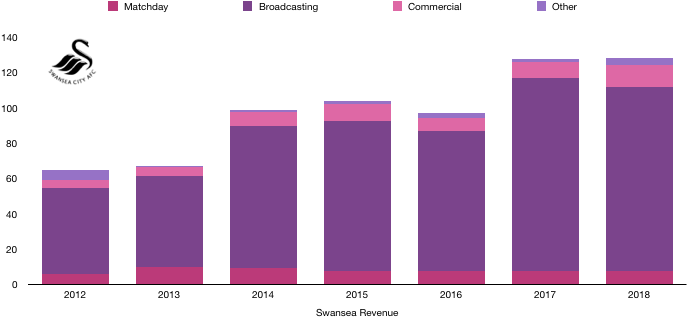

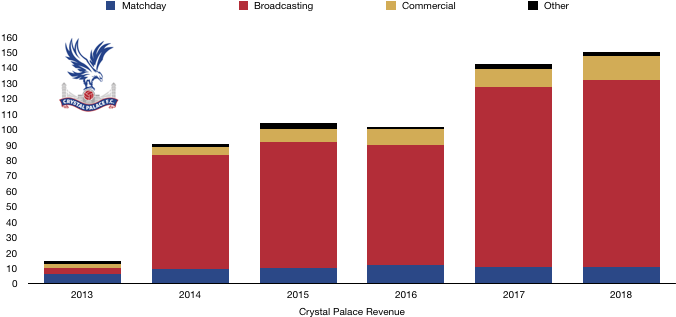

As mentioned above, revenue grew by 12% to £4.8bn, as matchday (7%), commercial (12%) and broadcasting (13%) all experienced good levels of growth as the Premier League continues to grow richer.

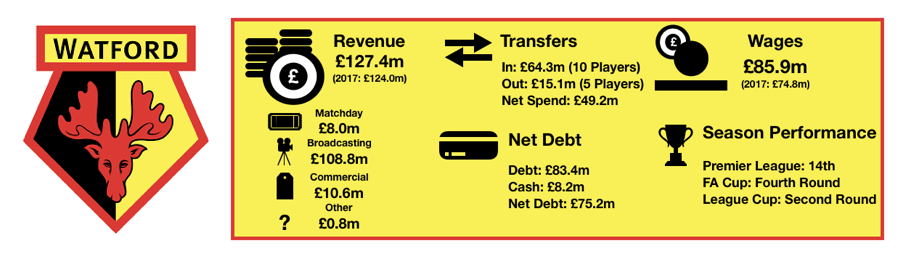

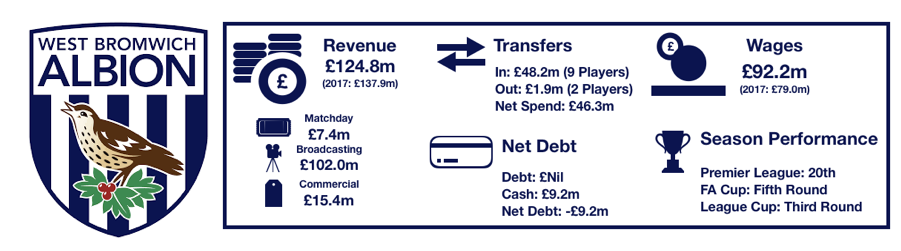

Interestingly, the growth isn’t uniform across clubs, with 7 of the 20 teams experiencing a decline in revenue, largely due to performances on the pitch rather than commercial reasons.

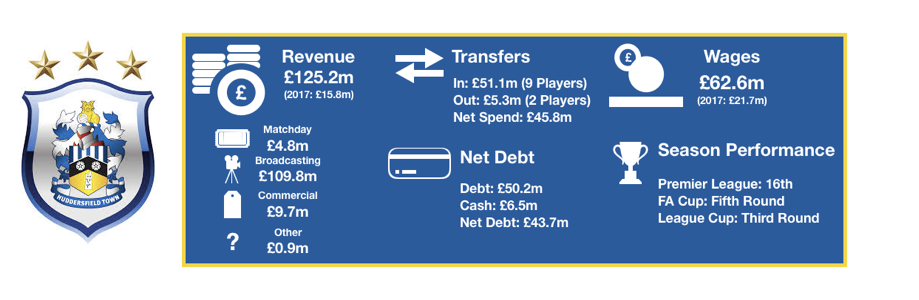

The biggest movers were of course the promoted clubs, with Huddersfield experiencing growth of 734% as revenue increased from £15m to £124m after they successfully survived their first season in the Premier League against the odds.

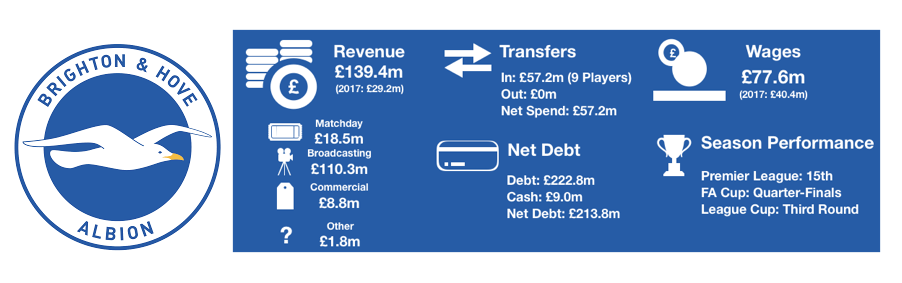

Brighton also saw revenue grow by 399% from £28m to £138m, also surviving on their return to the Premier League.

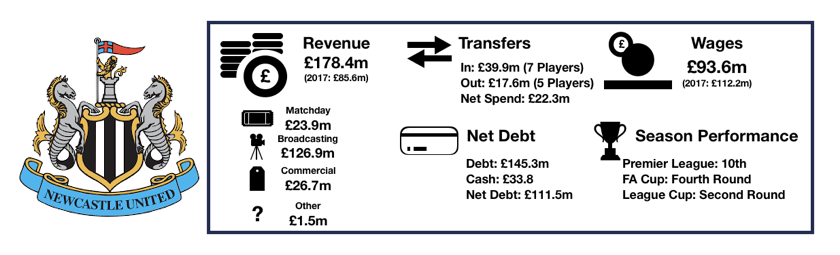

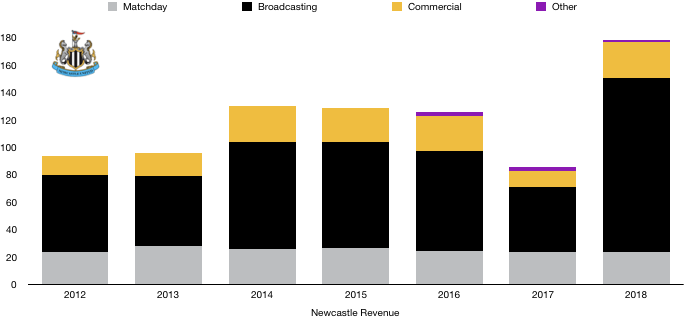

Newcastle experienced only a doubling in revenue due to only being relegated the season prior, with revenue growing from £83m to an impressive £177m (114%) as they completed a clean sweep of survivals by the three promoted clubs.

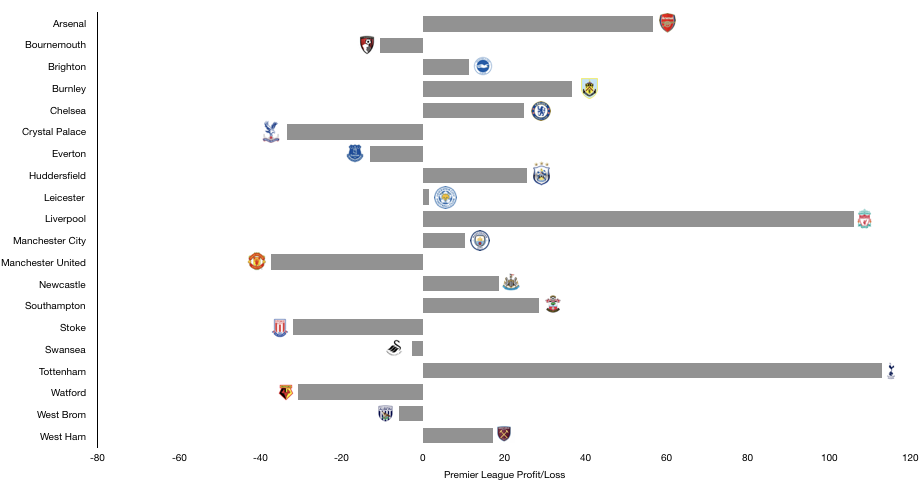

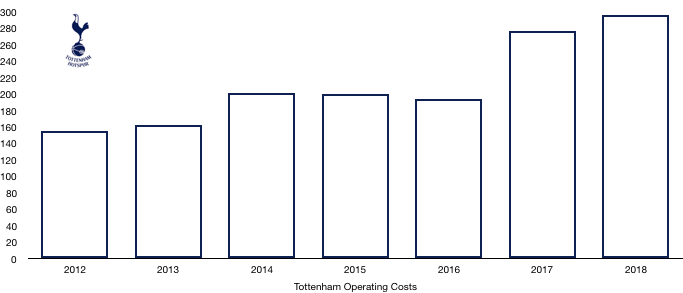

Outside of this, the major movers were Liverpool (25%) and Tottenham (23%), whose performances in Europe and domestically saw a huge uptake in their revenues and led to huge profits too. Tottenham also benefitted from a season at Wembley which saw matchday revenue grow by 57% while Liverpool’s run to the Champions League Final helped them net an extra 43% in broadcasting revenue.

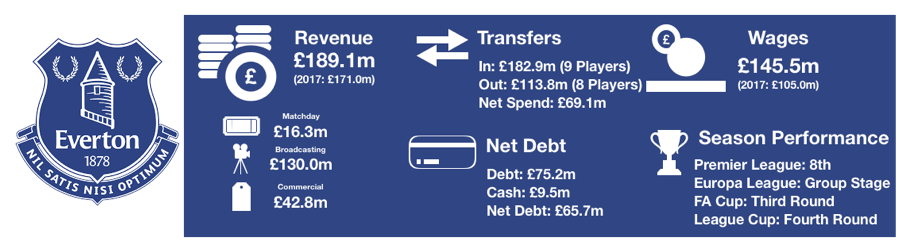

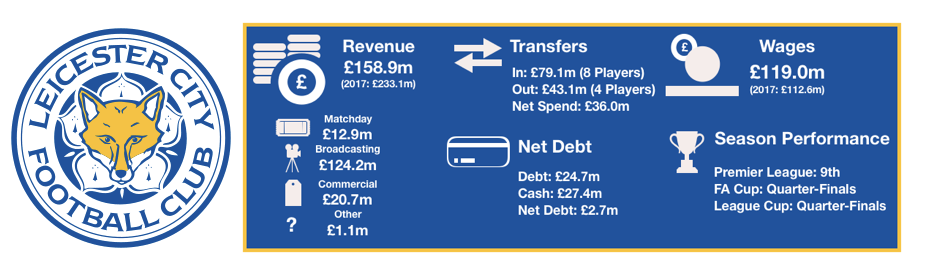

On the other end of the scale, Leicester saw the biggest decline in revenue, suffering from a European hangover after their one-time Champions League campaign ended with revenue falling from £231m to £158m (32%).

Arsenal suffered a dip of 9% to fall back below £400m in revenue (£386m) on the back of a less than successful season in Wenger’s final year as boss.

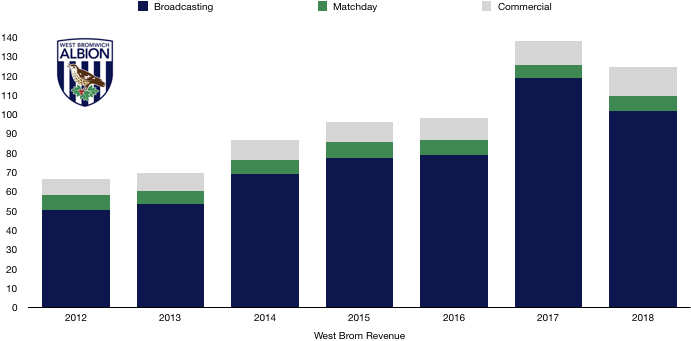

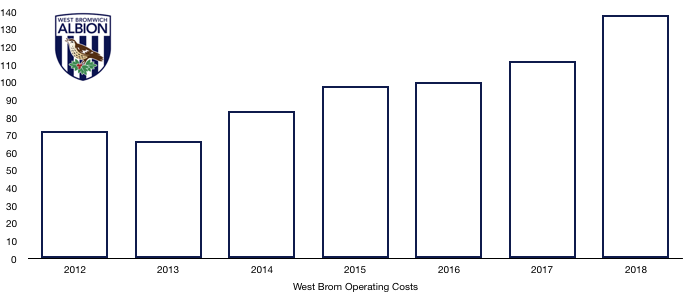

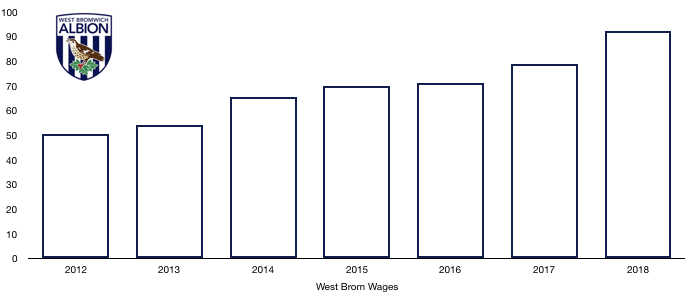

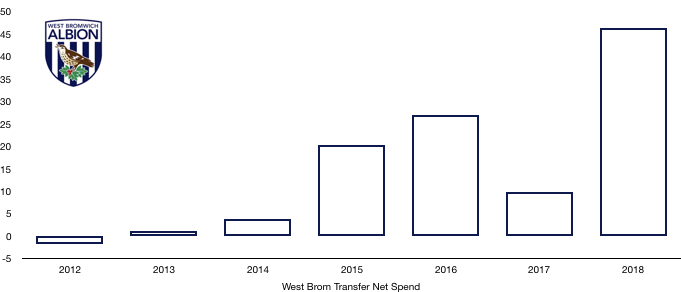

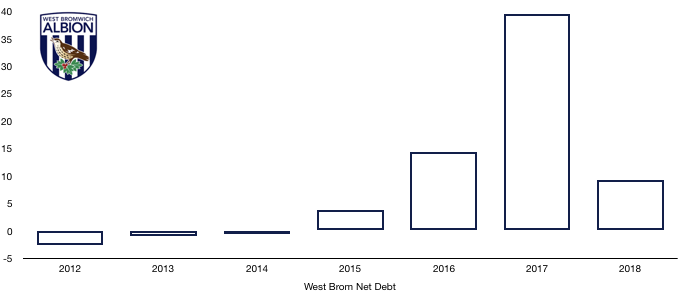

West Brom’s relegation saw their revenue drop by 9% to £125m as they fell from mid table to rock-bottom.

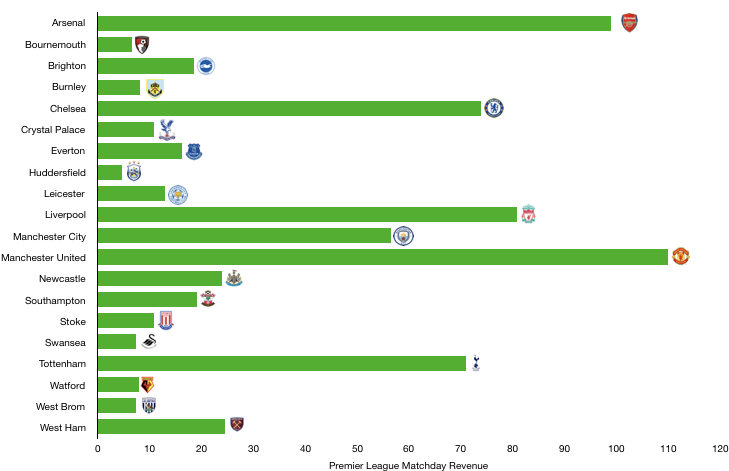

Matchday Money

Matchday revenue is gradually becoming a smaller portion of top clubs’ revenue as they see commercial and broadcasting revenue sky rocket on the back of lucrative commercial sponsors and growing prize money.

Matchday revenue in the Premier League increased from £629m to £671m (7%) with the majority experiencing a small level of growth as ticket prices remained fairly static.

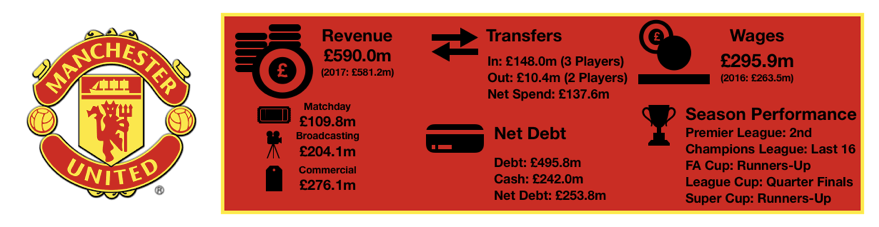

Manchester United brought in the most matchday income by a distance as the Theatre of Dreams continues to be the largest club stadium (Wembley being occupied by Spurs an exception), helping United bring home £110m, the only club in triple digits.

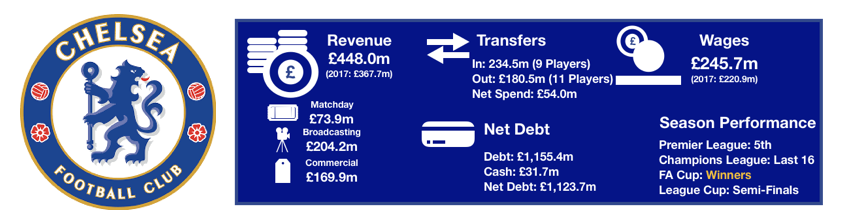

They are followed by Arsenal (£99m), Liverpool (£81m), Chelsea (£74m) and Tottenham (£71m) as fans flooded in to see their top teams play and compete for honours.

Manchester City lag their rivals in this area, bringing in only £57m due to a smaller stadium and the notorious empty seats rival fans taunt City about.

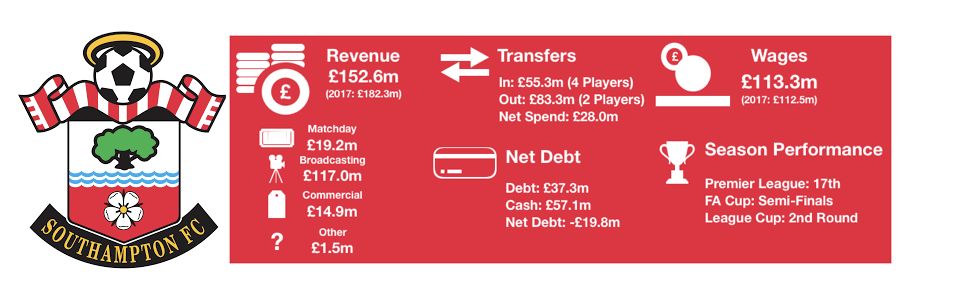

Outside the Top 6, Newcastle (£24m), Brighton (£19m), Southampton (£19m) and Everton (£16m) are the only clubs to have revenue from matchdays in excess of £15m, showing the gulf between the top 6 and the rest.

On the other end of the scale, Huddersfield take home a lowly £5m in matchday taking due to their 24,000-seater stadium and well-priced tickets which do no exclude anyone, something that should be commended.

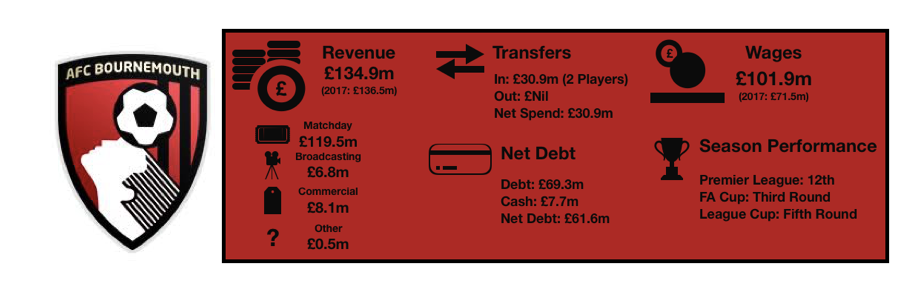

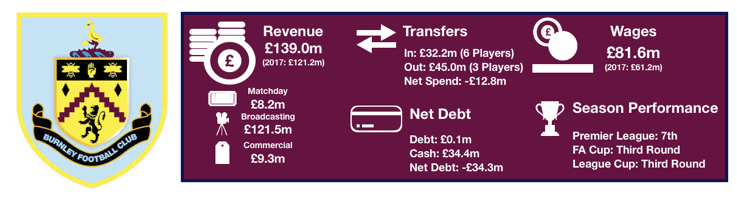

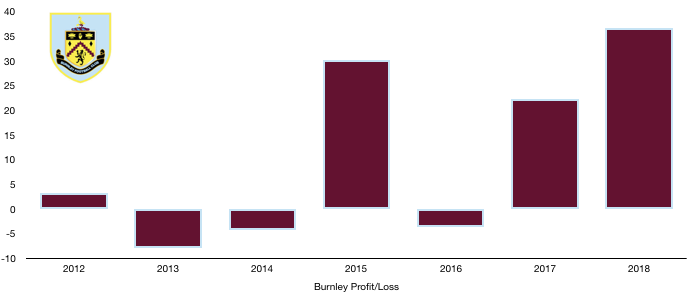

Bournemouth (£7m), Swansea (£7m), West Brom (£7m), Burnley (£8m) and Watford (£8m) all had matchday revenue below £10m. Any growth is constrained by stadium size and price elasticities; therefore, it is unlikely these numbers will exceed £10m anytime soon.

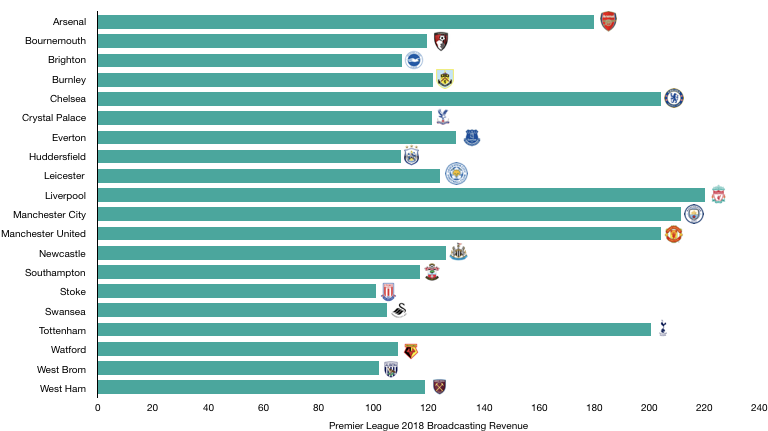

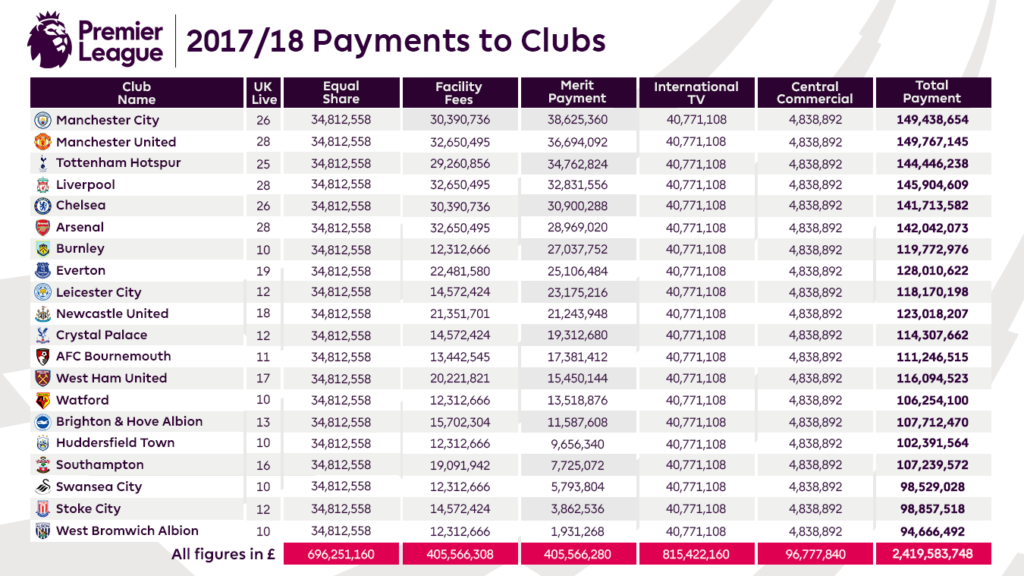

TV Money

Broadcasting revenue makes up the majority of Premier League clubs’ revenue, accounting for 59% of revenue and this only increases when excluding the top 6, with the Premier League prize the major source to the lower clubs that treasure survival as everything.

Broadcasting revenue increased from £2.5bn to £2.8bn (13%) as improved performance in Europe and a slight increase in Premier League distributions the major cause for this.

Liverpool were kings of broadcasting revenue and nearly Kings of Europe as their run to the Champions League final and 4th placed finish boosting their broadcasting revenue to £220m.

They were closely followed by Manchester City (£211m), Chelsea (£204m), Manchester United (£204m) and Tottenham (£201m), with Arsenal lagging their rivals at £180m after a disappointing campaign.

Among the rest of the league they all vary between Everton at £130m and West Brom at £102m, primarily due to Premier League prize money based on final league performances, with the majority failing to enjoy lengthy cup runs (which do not boost revenue considerably anyway).

Europe is the big differentiator here, with a £90-118m gap down predominately to the lack of European adventures among those outside the top 6, showcased by Leicester seeing their broadcasting revenue drop from £191m to £124m!

The promoted clubs saw their broadcasting revenue rocket, with rises of £102m, 102m and £79m for Brighton, Huddersfield and Newcastle respectively, showcasing the riches available in the Premier League.

Liverpool are likely to once again lead in this category after going one step further and secure their sixth European title and will be closely followed by treble winning Manchester City and Europa League winners Chelsea, who incidentally are the top three in the Premier League this season.

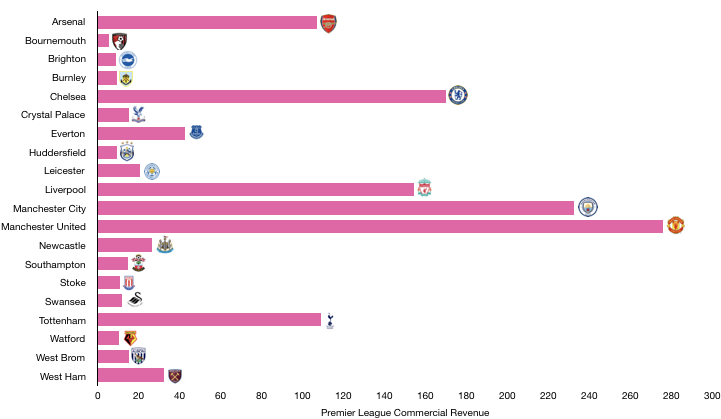

Commercial Cash

Commercial revenue continues to grow in importance for clubs as they looked to find other ways to pad their pockets. Commercial revenue grew by 12% to £1.3bn as companies continue to see value in the Premier League as a global stage for their brands.

Manchester United is a league of their own in this regard, taking home an impressive £276m from corporate partners as the biggest brand in English football continues to pull in the commercial cash despite falling on harder times on the pitch as of late.

They are being chased heavily by their Manchester rivals who have seen a commercial drive prove successful, taking their commercial revenue to £233m.

Their top 6 rivals lag significantly here with Chelsea (£170m), Liverpool (£154m), Tottenham (£109m) and Arsenal (£107m) all having room for improvement. Liverpool seem best placed to challenge the Manchester clubs after a return to prominence was capped off with the Champions League trophy in 2019 which will surely boost their profile and commercial revenue to new heights.

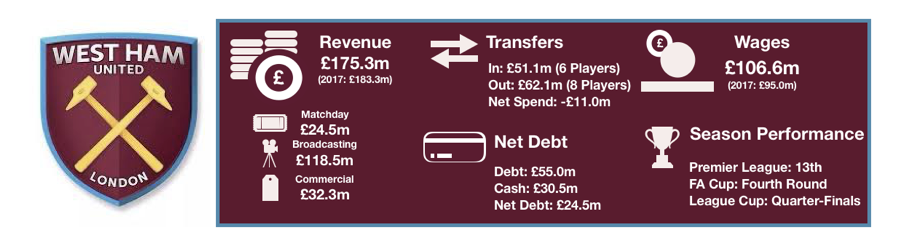

Everton (£43m), West Ham (£25m) and Newcastle (£24m) are the next biggest in a commercial sense due to their history, however they still lag the top 6 by huge amounts that make the ability to compete near on impossible.

Meanwhile, the three ‘Bs’, Bournemouth (£8m), Brighton (£9m) and Burnley (£9m) are the only clubs in single digits, however we would expect these teams to join their rivals by pushing past £10m in 2019.

Manchester United are likely to maintain a narrow lead of Manchester City in commercial terms next season, however the gap will close further.

Liverpool and Chelsea are likely to push close to the £200m barrier, while Tottenham are likely to increase their lead over their North London rivals after another good season.

Everton are likely to fall just short of the £50m mark while Leicester (£21m) are likely to overtake both Newcastle and West Ham as their profile continues to grow.

I hope you enjoyed this article – Share with a mate!