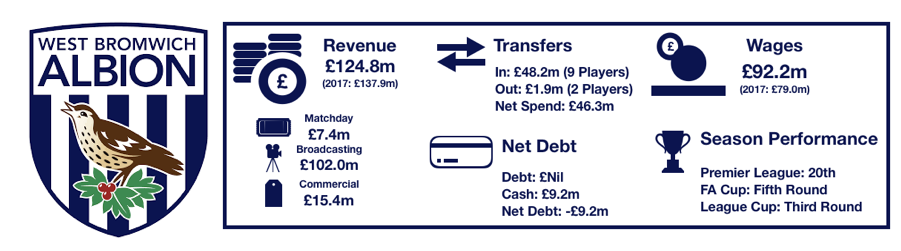

West Brom suffered relegation in 2018 after an 8 year stay in the Premier League following a rock-bottom finish in 2018. A turbulent season saw West Brom run through 4 managers (albeit one was just a caretaker for one game).

A poor season was capped off with early exits in both domestic competitions.

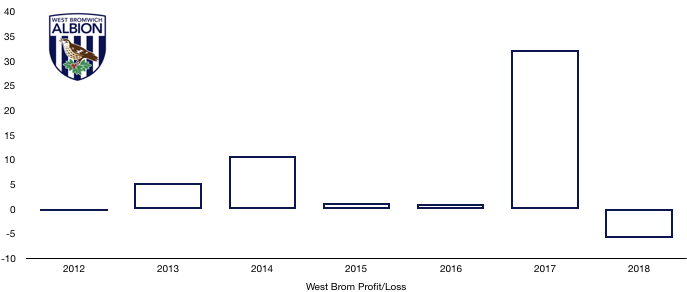

Relegation hurt West Brom off the pitch as well, with a profit of £32.3m swinging to a £5.9m loss.

Let’s delve into the numbers.

Revenue Analysis

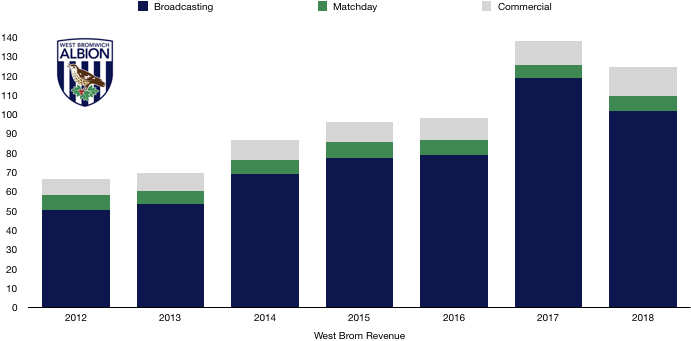

West Brom inevitably saw a drop in revenue after a difficult season. Revenue fell from £137.9m to £124.8m (9%), although this is just the start.

Matchday revenue surprisingly rose from £6.8m to £7.4m (9%) as fans supported their team throughout their battle with relegation. Average attendances rose from 23,876 to 24,520 (3%), meaning West Brom were running at a stadium fullness of 92%.

Broadcasting revenue was the reason for the fall in revenue, dropping from £118.7m to £102.0m (14%) after West Brom plummeted 10 places in the Premier League.

Commercial revenue rose as West Brom enjoyed and exploited their final season of their Premier League Status. Commercial income increased from £12.4m to £15.4m (24%).

Looking ahead, relegation will see a huge drop in revenue as Championship prize money hits. This will be a huge shock to the system for West Brom who have now grown accustomed to Premier League TV money.

Parachute payments will soften the blow, but revenue will still fall by at least a third. Matchday revenue is likely to remain robust, while both broadcasting and commercial revenue will be hit hard.

Costs Analysis

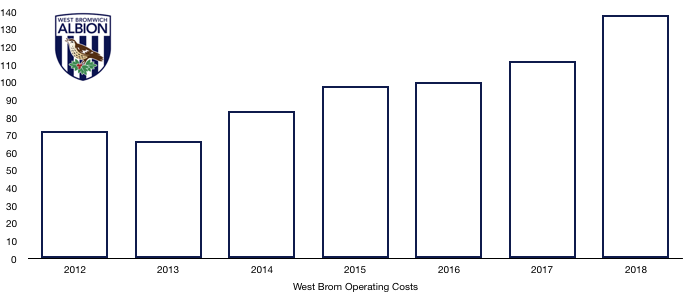

West Brom saw a large rise in costs, increasing from £112.2m to £138.2m (23%). With revenue falling, this large increase in costs resulted in their profitability plummeting.

Amortisation rose from £17.1m to £25.4m (49%) after heavy investment which obviously didn’t work but showed their desire to remain in the Premier League.

West Brom had no interest costs due to a lack of debt In the club (see debt analysis).

There was also no tax due to their loss making status, this is likely to persist into the near future.

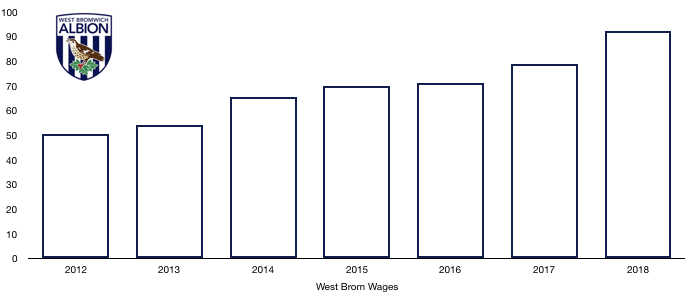

Wages rose from £79.0 to £92.2m (17%) after an influx of new signings in the summer, while there was probably sizeable severance pay paid in the year, although no amounts have been disclosed.

These extra wages worked out at a sizeable extra £254k a week, an amount that will need to be completely reversed in the Championship.

Director remuneration of £90k has been disclosed, halve of the £180k paid last year as directors were penalised for relegation. This amount seems relatively low, so there is likely to be additional directors whose pay was not disclosed.

Looking ahead, Relegation will mean it is now vital West Brom reduce costs. Relegation wage drops will come into effect, reducing wages significantly while high-earners have departed. Amortisation is likely to fall after a negative net transfer spend in 2018/19.

General costs will fall due to the lower standards required in the Championship however this will not be huge.

Revenue is likely to fall by a greater extent than costs, meaning profitability will drop even further and losses will grow.

Transfers Analysis

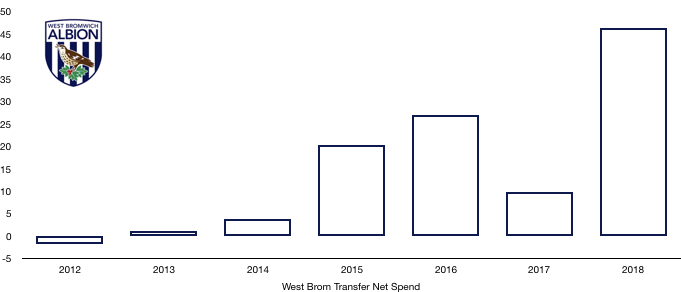

West Brom had a busy transfer window in an attempt to remain in the Premier League with 8 signings and a couple of departures at the Hawthorns.

In came Burke (£13.7m), Rodriguez (£12.3m), Gibbs (£6.8m), Zhang (£6.5m), Hegazi (£4.5m), Sturridge (Loan – £2.1m), Barry (£1.0m) and Gabr (Loan – £0.5m) for a combined £48.2m.

Out went Gardener (£1.6m) and Zhang (Loan £0.3m) for a combined £1.9m.

This saw a huge increase in their net transfer spend from £9.8m to £46.3m (372%), showing their ambition to remain in the Premier League.

However, the signings proved to be poor. Burke never settled and Zhang only lasted half a season. Gibbs and Rodriguez are good players, but injuries halted their progress. Barry proved a level headed presence while Hegazi was a hit signing initially before tapering off.

West Brom recorded a profit on player sales of £5.8m, an amount that does include the sale of Evans on top of the sale of Gardener.

In cash terms, West Brom paid transfer fees of £41.7m and only recouped £6.0m in the year, a net cash outlay of a hefty £35.7m.

West Brom are also owed a further £15.2m in transfer fees (£5.1m due this year), however they owe clubs a chunkier £27.6m (£17.0m due this year), a net £12.4m creditor position.

This may affect future transfer plans for the club should they not bounce straight back to the Premier League.

West Brom also have contingent transfer fees of £8.7m which are payable if certain clauses are met, although it is unlikely all these fees will ever become payable.

Debt Analysis

This is going to be a pretty short section.

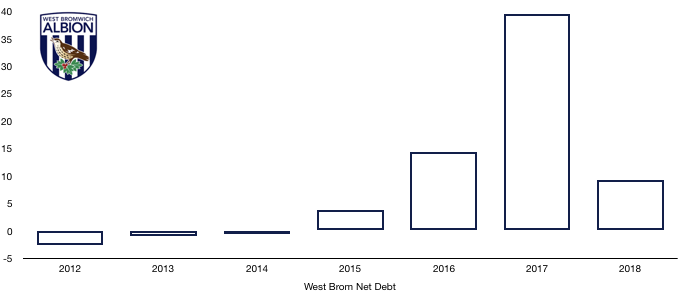

Cash reserves plummeted from a healthy £39.5m to £9.2m (72%) after significant transfer spending in the year and the small loss incurred this year.

On top of this, West Brom also spent £1.7m on improving club infrastructure.

West Brom have no debt, being completely funded by their success and misfortunes on the pitch.

Hence, West Brom saw a huge dip in their net cash position from £39.5m to £9.2m (72%).

West Brom are in a good place financially to bounce back to the Premier League, being a model Premier League club throughout their stay. It does however show that a few bad decisions can unravel even the most sensible of clubs with a poor strategy and signings causing their demise.

Their finances provide a great foundation to return sooner rather than later with no need to go for broke to return, making the decision to sack Moore even more perplexing, although it may be a function of their owner being unwilling to provide the funding a prolonged Championship stay would require.

West Brom are however in need of investment and a solid long term strategy to return to the Premier League and stay there.

Should promotion not be achieved in the next couple of years, growing losses would cause Financial Fair Play issues which would constrain their ability to compete and increasingly make a return more difficult.

Thanks for reading – Share with your community!