Liverpool came off age last year under Klopp and returned as a European powerhouse, securing a top 4 place for the second consecutive year and coming within a goalkeeping performance and Salah arm of winning the Champions League. Domestic cup performance was the only blot on an otherwise promising season.

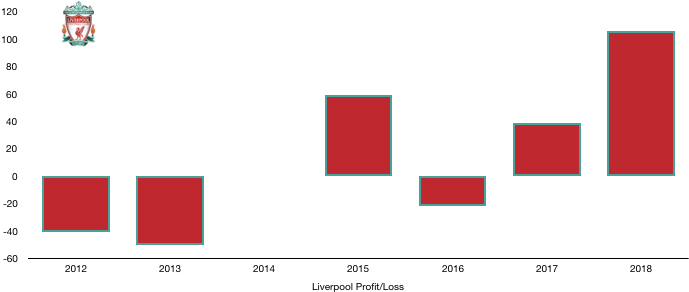

It has already been documented that the Reds have achieved recording-breaking level of profits, recording a profit of £125m (£106m after tax). This may seem amazing however the finances detail that the profit, although impressive, may not be all that it seems, with it predominately due to transfers.

Let’s delve into the numbers.

Revenue Analysis

Liverpool saw their revenue shoot up significantly on their return to the Champions League. Revenue rose from £364.5m to £455.1m (25%) with their success in the Champions League and consistent Premier League performance the main reason.

Broadcasting rose by the largest amount, increasing from £154.4m past the £200m barrier to £220.1m (43%). This huge boost was due to the £70m the club earned from their European exploits as they maintained their 4thplaced finish in the league and suffered early exits in the domestic cups.

Commercial rose a disappointing amount, increasing from £136.6m to £154.3m (13%) as the club hopefully have yet to see the full benefit of their Champions League exploits and general goodwill/popularity they have begun to generate.

Matchday revenue rose from £73.5m to £80.7m (10%) on the back of a greater number of home games from their Champions League participation.

Looking ahead, revenue is likely to increase as Liverpool enjoy (or try to) a title race for the ages that should see a boost in Premier League prize money. It will be a tough ask to equal or better their Champions League campaign of last year which will see a drop-in prize money here. However, any rise will depend largely on the success of the commercial team to monetise the increasing popularity of the club.

Costs Analysis

Liverpool saw a rapid rise in their costs this year, increasing from £357.8m to £447.8m (40%) as they looked to compete to a greater extent with their rivals. Interestingly despite the large profit recorded, profitability actually fell as their costs rose a greater rate than their revenue.

Amortisation rose by a third, increasing from £58.4m to £77.3m (32%) as player investment increased significantly due to a notable departure. It seems the investment is already paying off.

Liverpool also had stable lease costs of £2.6m in the year.

Net interest expense rose by 13% to £6.0m in the year as overdraft interest rose by £300k and notional interest on transfers rose in the back of increased transfer activity.

Liverpool also paid tax of £19.1m, an effective tax rate of 15% which is largely in line with the tax rate of 19% with a few adjustments.

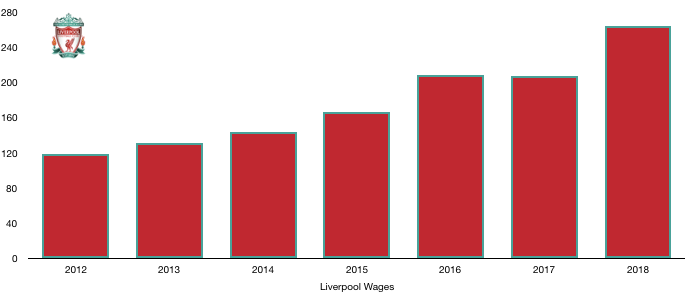

It has been well publicised that Liverpool wages have grown significantly, and they grew 27% to £263.6m from £208.3m in 2018. This was due to both new higher earners as well as a whole host of contract renewals. Liverpool also incurred an increase in bonuses due to a hugely successful campaign. The wage rise works out as an eye-watering extra £1,063k a week, making the club have one of the highest wage bills in Europe.

Liverpool also paid directors £2,276k, up from £1,649k due to a boost in performance.

Looking ahead, wages are likely to continue rising but at a slower rate unless a trophy comes home in which case bonuses may bump wages significantly. The club are likely to see a large rise in amortisation after a summer of significant investment.

Transfer Analysis

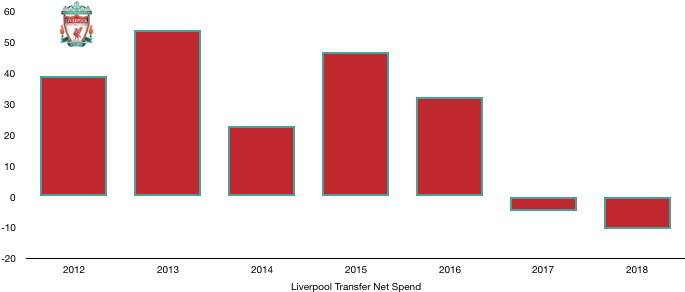

Liverpool were very active in the transfer window in 2018, spending and receiving over £150m in each direction.

Arriving at Anfield were Van Dijk (£70.9m), Salah (£37.8m), Oxlade-Chamberlain (£34.2m), Robertson (£8.1m) and Gallacher (£0.2m) for a combined £151.2m.

Departing Liverpool were Coutinho (£121.5m), Sakho (£25.4m), Origi (Loan – £5.9m), Lucas (£5.1m), Stewart (£4.1m), Wisdom (£2.1m) and Sturridge (Loan – £2.1m) for a combined £166.1m.

This meant that for the second successive season Liverpool had a net transfer inflow, this year of £14.9m. Despite this the club had a successful season and belatedly spent the cash built up this summer on the likes of Keita and Alisson.

The signings were all fantastic additions, even the Ox who was viewed by many as a poor signing initially. Van Dijk and Salah have been world class and repaid their large transfer fees already.

Now, Liverpool fans were rightfully worried when Coutinho was sold mid-season however the club performed admirably without him. Liverpool fans do not wish to thank Coutinho for much, but they do have this record-breaking profit due to his departure. Liverpool recorded a profit on player sales of £123.8m, pretty much the whole amount of their profit this year. This shows that the profit recorded is primarily due to transfers and not performance, however this isn’t something that should be looked at poorly due to the transfer fee being used to invest back into the club which should see revenue continue to rise as a result.

Liverpool are owed a huge £168.6m in transfers while they owe £151.6m which should give the club little to worry about despite the huge sums involved.

Liverpool may also owe another £38.6m in contingent transfer fees should certain clauses be met and may be owed £35.7m themselves if certain clauses are met elsewhere.

Liverpool also saw a net cash outflow of £49.2m despite a net transfer inflow as they gave clubs more favourable terms to pay for transfers than they negotiated themselves. Liverpool spent cash of £154.1m and only received cash of £104.9m.

Debt Analysis

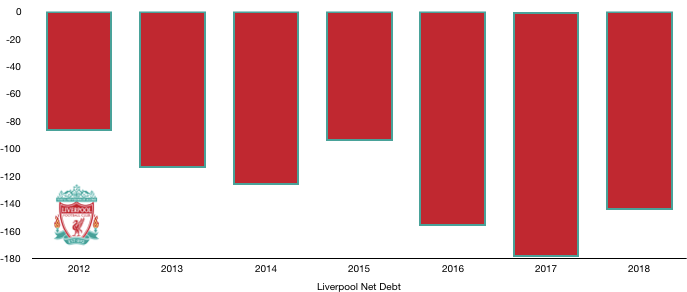

Liverpool had loaded up on debt a little due to the redevelopment of Anfield and took out loans in order to finance this expansion. Their cash levels are usually low as a result as they use all their capital in order to improve the stadium and their training facilities.

Cash levels were at their highest levels in recent times, rising from £4.1m to £10.3m (158%). This is largely due to transfer fees received and rising revenue that allowed them to repay loans to banks and their owners of £29.9m and invest a further £15.9m in facilities and the stadium.

Debt levels hence fell due to the repayments, falling from £181.6m to £151.1m (15%) as they repaid £17m to the bank and £12.9m to FSG. Liverpool’s loans have a fairly low rate of interest to both the bank (1.73%) and FSG (2.44%). Liverpool are due to repay the bank loan in 2020 which is just around the corner now and may hamper future transfer plans while the FSG loan has no repayment date.

Net debt hence fell from £177.5m to £140.8m (19%) as the club come towards the end of their bank loan which will release a significant financial burden on the club and allow greater investment once completed as Liverpool look to become less of a selling club and more of a powerhouse with promising signs already.

Thanks for reading – Share with a Liverpool fan!