Huddersfield enjoyed another memorable season, beating the odds to secure Premier League survival with a 16thplaced finish, just a season after an unexpected promotion.

Huddersfield were expected to finish rock bottom given their modest budget and the surprise they were promoted in the first place, but they made all their fans proud in their first season in the Premier League.

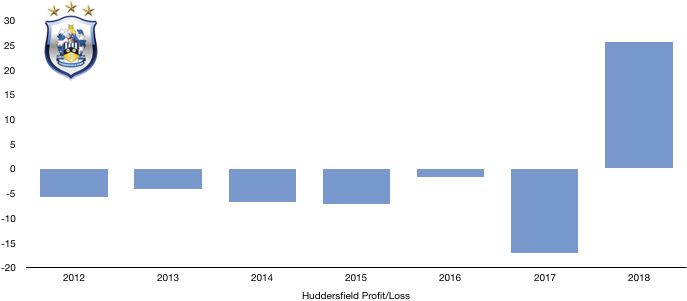

An inaugural Premier League campaign turned a £17.1m loss in 2017 into a record-breaking £25.7m profit for the club, showing the riches the Premier League brings.

Let’s delve into the numbers.

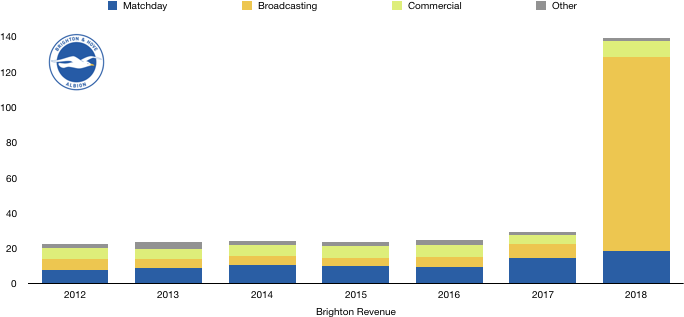

Revenue Analysis

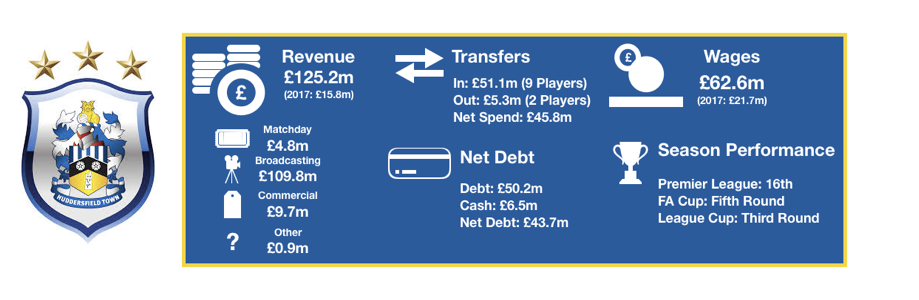

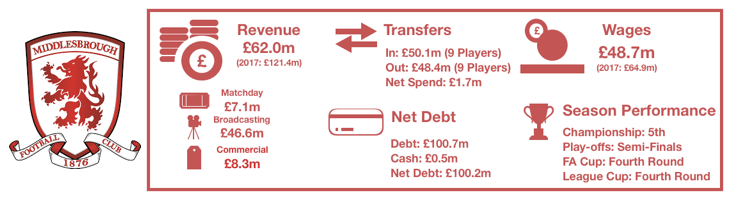

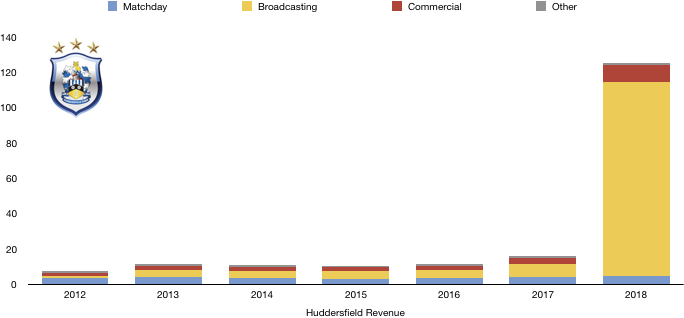

Revenue shot into the stratosphere for Huddersfield, rocketing from £15.8m to £125.2m (692%) as they benefitted for the riches available in the Premier League.

Matchday revenue increased from £4.0m to £4.8m (20%) as fans flocked to the John Smith’s Stadium and ticket prices rose slightly.

Broadcasting revenue increased 12-fold, rising from £7.5m to an eye-watering £109.8m (1,364%!) as Huddersfield saw first-hand the riches the Premier League brings and why clubs fight tooth and nail to get to the top flight and to stay there.

Huddersfield also performed slightly better in the cups which added to their prize money pot.

Commercial revenue nearly tripled, increasing from £3.4m to £9.7m (185%) as the club exploited their new Premier League status to good effect and will be hoping they can maintain this despite relegation.

Other revenue was stable at £0.9m.

Looking ahead, Huddersfield are relegated however their revenue next season should remain fairly stable. Finishing 3 or 4 places lower than last season will hit the club by around £6-10m, however commercial revenue may offset much of this drop.

The real drop will be felt next year when they play in the Championship and are likely to see revenue drop by at least a third as they will receive around £8m from the Championship in revenue and then further parachute payments.

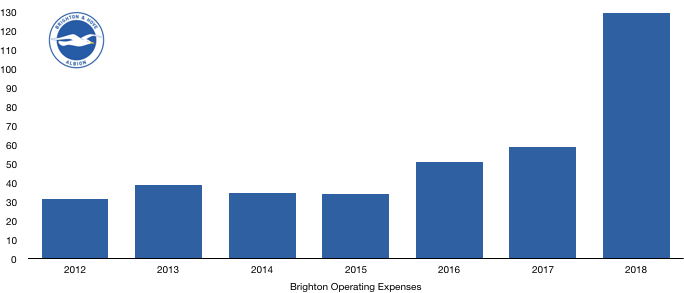

Costs Analysis

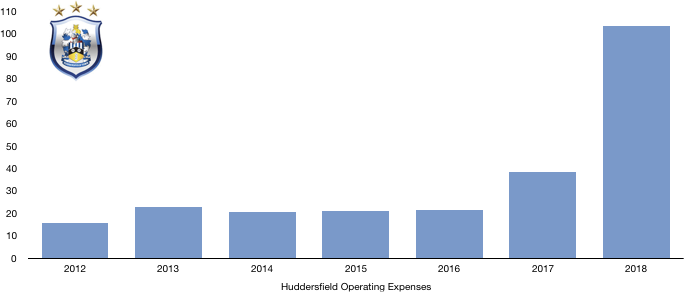

Huddersfield saw their costs more than double from £38.5m to £103.6m (169%) as they invested relatively heavily to make themselves Premier League ready. However, this rise in costs paled in comparison to the huge increase in revenue, boosting profitability significantly.

The increase in costs is even more pronounced when considering that they had exceptional one-off costs of £11.9m related to gaining promotion last season.

Amortisation costs increased from a measly £2.7m to £17.1m (533%) as the club, who are used to relatively quiet transfer windows, experienced the largest transfer season in their history.

Huddersfield also had an impairment charge on existing players values of £1.5m.

Interest charges increased from a minimal amount to £0.5m due to interest on transfer fees paid by instalments.

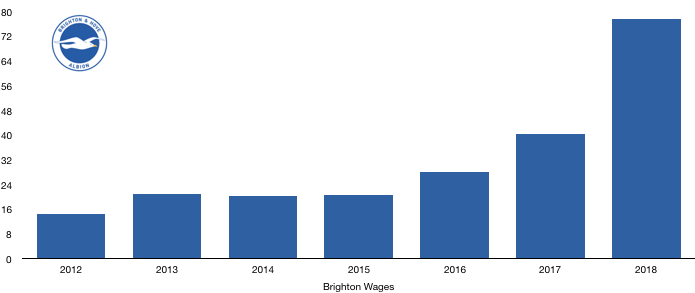

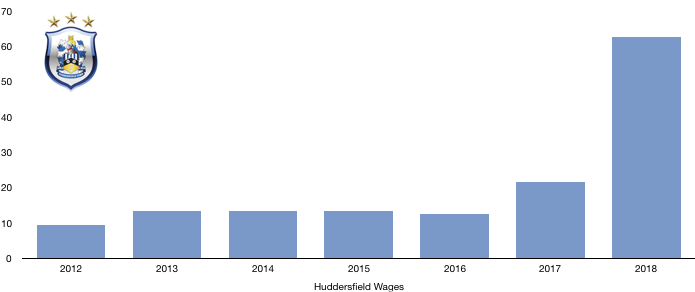

Huddersfield’s wages nearly tripled, rising from £21.7m to £62.6m (188%) as the club paid their new players at Premier League rates while existing players were rewarded with lucrative new deals.

Huddersfield are likely to have also rewarded players in spades for securing survival.

This wage increase works out at a huge extra £787k per week, an astronomical amount. However, to put this into perspective, this is still the lowest wage bill in the Premier League, showcasing the amazing feat they achieved in surviving.

Directors were rewarded as their wages increased from £291k to £664k (128%).

Looking ahead, Huddersfield will see a further increase in costs next season as the club spent relatively heavily again then they are used to. Huddersfield will be hoping that wages do then drop significantly next season as wage drop clauses come into effect and high-earners leave following relegation.

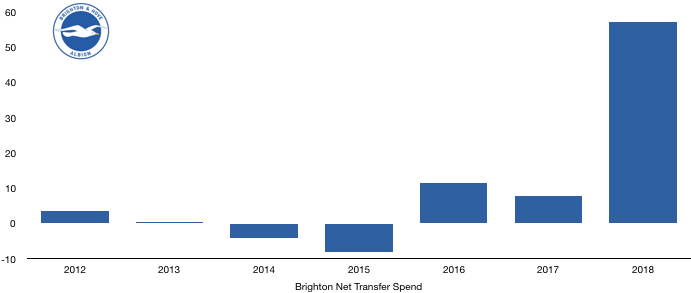

Transfers Analysis

Huddersfield had the biggest transfer year in their history, spending £51.1m to bring in 9 players.

In came Mounie (£11.7m), Pritchard (£11.1m), Ince (£8.2m), Mooy (£8.2m), Malone (£3.5m), Depoitre (£3.4m), Zanka (£2.4m), Sabiri (£1.4m) and Kachunga (£1.2m) for a combined £51.1m.

Out went Wells (£4.9m) and Dempsey (£0.4m) for combined £5.3m.

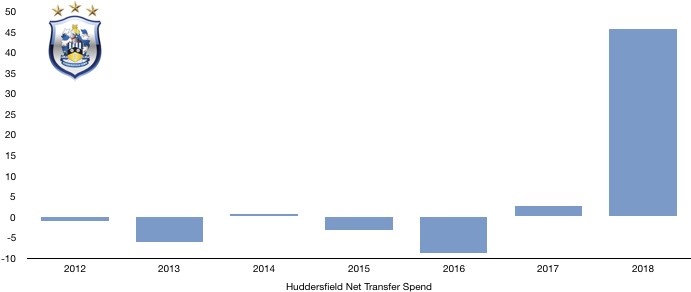

This meant their net transfer spend increased from a measly £2.7m to a huge £45.8m (1,596%), only their third net transfer spend in the last 7 years.

The signings all did their bit to secure survival with Mooy proving one of the signings of the season while Mounie offered some goal threat and Pritchard boosted the club just when they needed it following his winter move.

Huddersfield also secured a profit on player sales of £5.9m, although this amount also includes the sale of Ince to Stoke.

In cash terms, Huddersfield spent actual cash of £39.0m while they only received £2.5m, a net cash outlay of £36.5m.

They are however owed a further £7.4m (of which £4.5m is due this year) but owe £14.6m (of which £11.5m is due this year), meaning they owe £7.2m net, an amount that should not affect future transfer plans.

Huddersfield also have contingent transfer fees payable if certain clauses are met. A potential £4.6m is payable to players while they could also be forced to fork out an additional £2.1m to agents.

Debt Analysis

Huddersfield’s finances were significantly boosted by the Premier League and this was reflected in their cash balance more than doubling.

Cash reserves increased from £3.0m to £6.5m (117%) due to the profits made on promotion. £5.1m was used on a new training ground at PPG Canalside and stadium enhancements, with a further £0.7m on other improvements. This £5.8m infrastructure investment was up from only £1.1m last year, showing the long-term outlook Huddersfield have sensibly chosen.

In the process of counting all their new cash, Huddersfield actually repaid some loans owed to their owner.

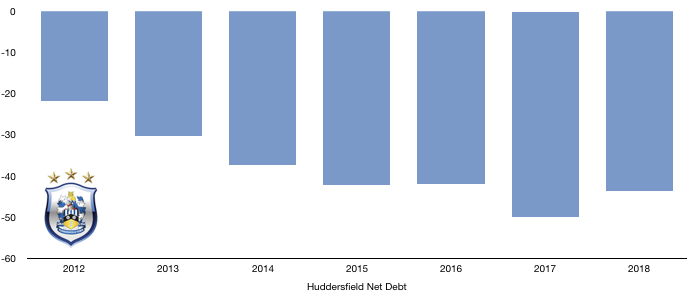

Debt levels fell from £53.1m to £50.2m (5%) as the owner rewarded himself with a job well done this year, repaying himself £2.9m.

This repayment may soon be back with the club following another heavy transfer window that may require funding, while relegation is unlikely to see him repay himself again anytime soon.

Net debt hence fell from £50.1m to £43.7m (13%) after the increase in cash and decrease in debt.

Huddersfield are still in a good place financially despite relegation this season due to the prudence they showed in their two year stay. This means that the club should be okay if their stay in the Championship is prolonged, although a quick return would be welcome, and they are well positioned financially to do this.

A return within the next two seasons would mean their financial approach wouldn’t have to change too much as parachute payments should assist their transition to the Championship.

Any longer and further investment will be needed to avoid a much longer stay in the Championship becoming their reality.

Thanks for reading – Share with a Huddersfield fan!