Manchester City completed an unprecedented domestic treble in 2018/19, winning the Premier League, FA Cup and League Cup in a sensation campaign for the club. In one of the most of the most remarkable title races of the Premier League era, Manchester City won the league by a solitary point against Liverpool after winning their final 14 games to end the season with 98 points.

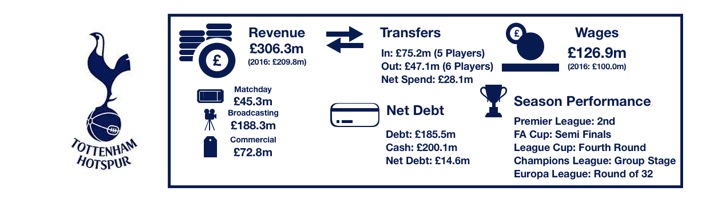

Despite their domestic successes, it was another disappointing Champions League season as Manchester City were once again knocked out at the quarter finals stage by eventual runners-up Tottenham in one the ties of the tournament.

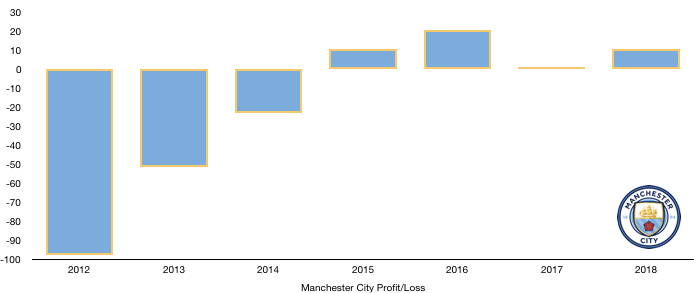

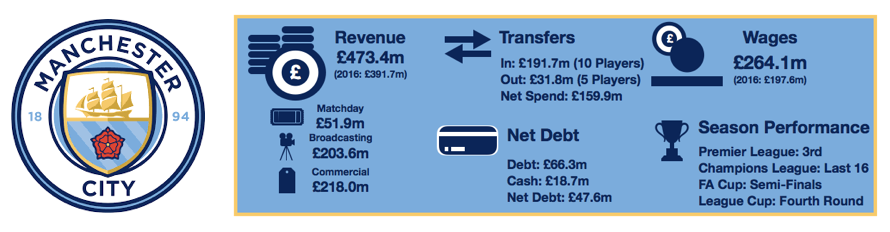

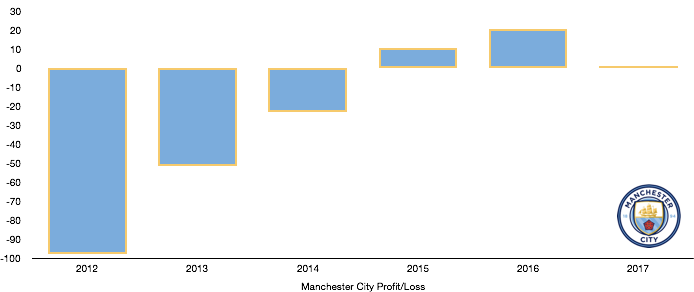

Off the pitch it was another financially successful year for Manchester City, recording a profit of £10m (also £10m in 2018), their fifth consecutive profitable year.

Let’s delve into the numbers.

Revenue Analysis

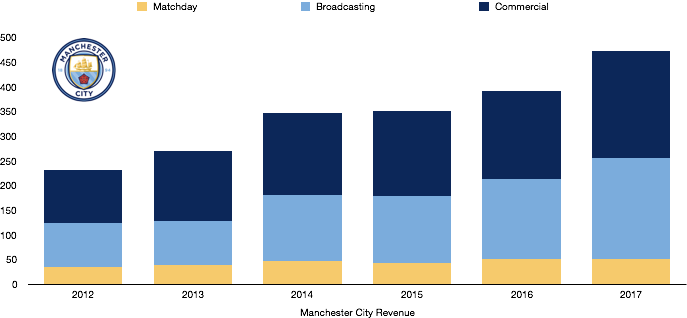

Manchester City recorded their highest ever revenue in 2019 as they continued their unrelenting revenue growth, increasing revenue from £501m to £535m (7%). This growth was largely owing to a new UEFA Champions League distribution cycle which saw all competing clubs receive more lucrative payments than in previous years.

Matchday Revenue

Matchday revenue fell from £57m to £55m (3%) after a change in accounting treatment of ticket sales. In fact, on a like-for-like basis Manchester City state matchday revenue actual grew, although from now on matchday revenue will be recorded differently which saw the above drop occur.

Manchester City saw a slight improvement in average league attendances, which grew from 54,073 to 54,132 (1%) as they continue their attempts to increase game attendances which are a function of a number of season ticket holder no-shows (although Manchester City still receive their cash).

Commercial Revenue

Commercial revenue fell from £233m to £227m (2%) after a lack of commercial success in the year after years of growth. This was the first time commercial revenue has dropped under their current ownership and Manchester City will be hoping this is a minor blip.

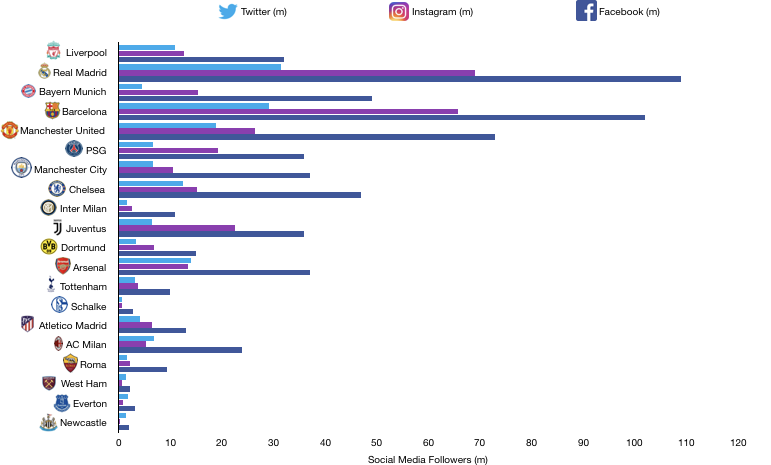

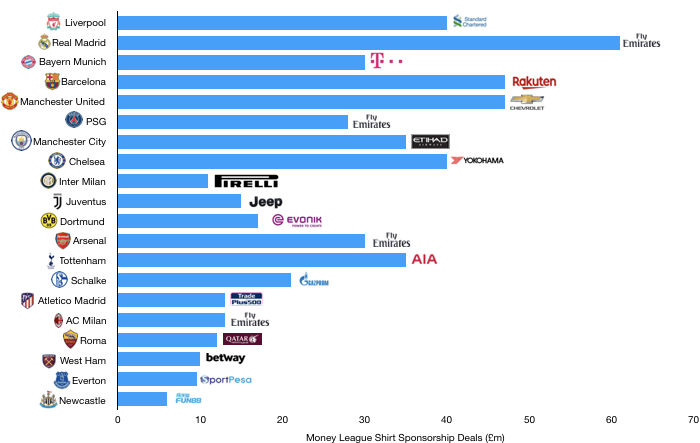

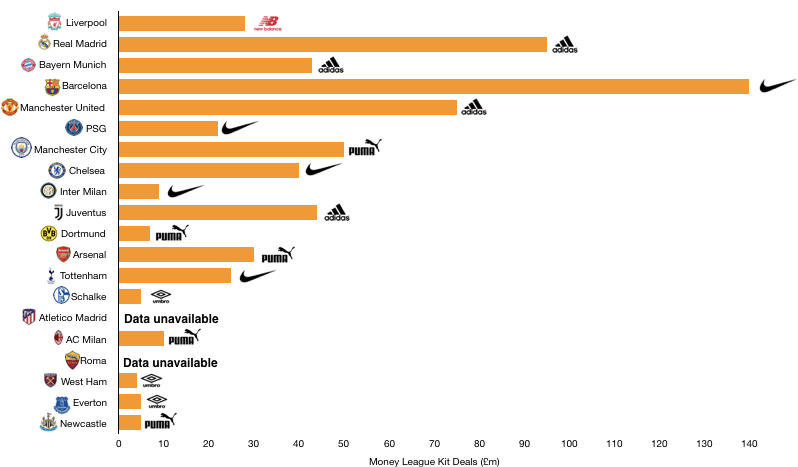

Manchester City now must look at new innovative ways to boost commercial revenue after reaching what appears to be a glass ceiling in 2019. New, lucrative commercial deals outside of what is received from Nike and Etihad will be necessary for growth to return and for the club to catch their Manchester rivals in commercial terms.

Broadcast Revenue

Broadcast revenue rose from £211m to £253m (20%) after a successful season on the pitch boosted revenue.

The increased distributions from the new UEFA Champions League broadcast cycle saw Manchester City’s UEFA prize money increase from £55m to £86m (57%) despite exiting at the exact same stage as last year.

Manchester City also saw a rise in FA Cup prize money after winning the competition, having only reached the Fifth Round in 2018.

The Premier League win also saw Manchester City bank £151m. Despite winning the league, Manchester City received less than runners-up Liverpool, who earned £152m after featuring on TV more frequently.

What does the future hold?

Looking ahead, Manchester City are relying on Champions League success on the pitch and commercial success off the pitch to have any significant revenue rise.

With the Premier League title looking unlikely at the mid-stage of the season, Manchester City may look to prioritise the Champions League in the second half of the season, giving them perhaps their best chance of reaching the latter stages in recent history.

Having seen a small dip commercially, this season, Manchester City will be hell bent on once again growing their commercial presence in the market.

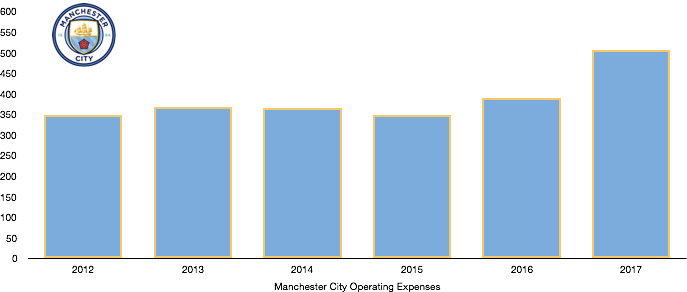

Expenses Analysis

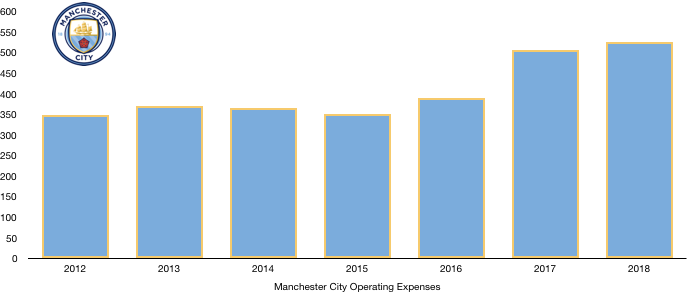

Manchester City saw overall costs rise from £526m to £560m (7%), in line with their revenue growth and therefore profitability remained relatively stable.

As always, the costs of competing in the Premier League and Europe continue to grow, with any increases in revenue (such as the increased UEFA distributions) being taken almost in its entirety by rising wages and other costs.

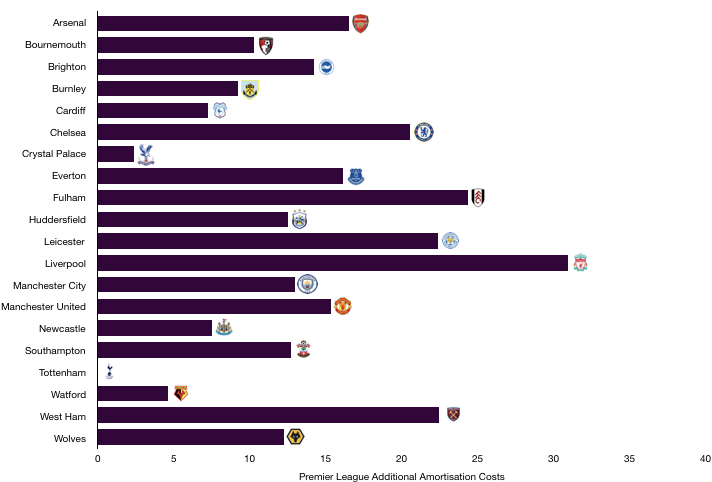

Amortisation

Amortisation costs fell from £134m to £127m (5%) owing to a relatively low level of investment compared to recent years.

The only notable incoming signing was Mahrez, while a host of fringe players were sold which inevitably led to a fall in amortisation.

Amortisation costs are likely to rise next year back to 2018 levels after a busier summer in 2019.

Net Interest Expense

Manchester City’s net interest expense remained stable at £2m, owing to the fact that debt levels remained the same.

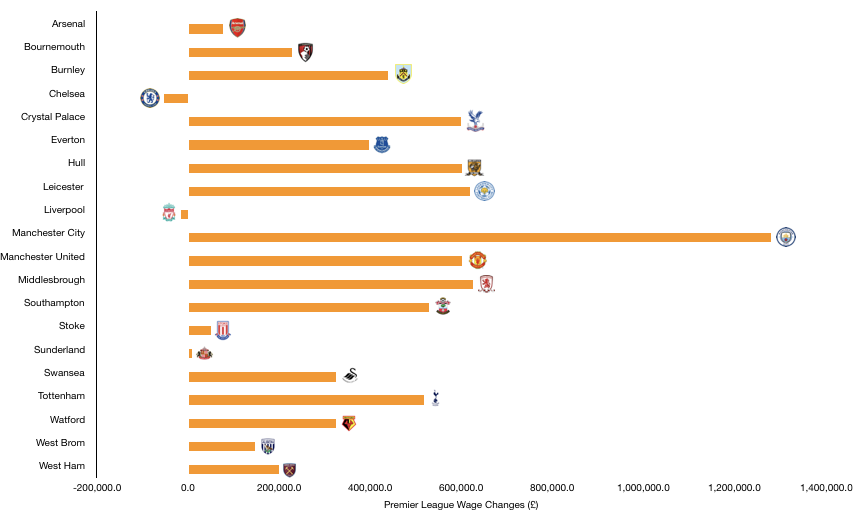

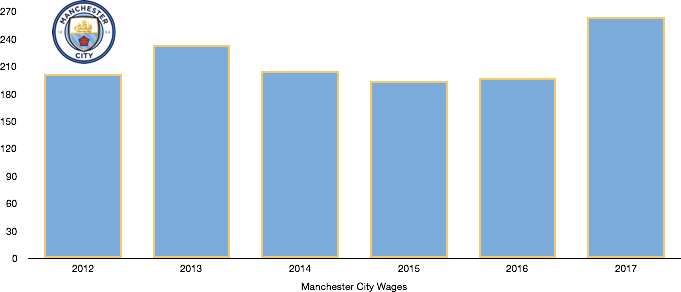

Wages and Staff Costs

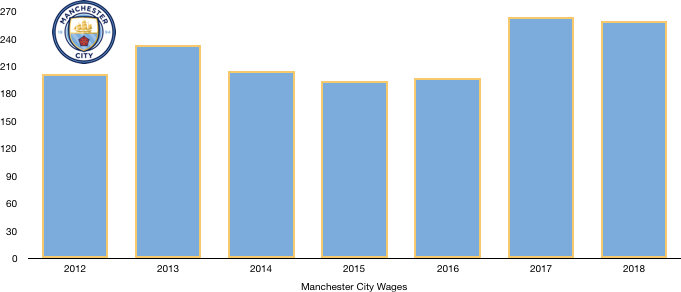

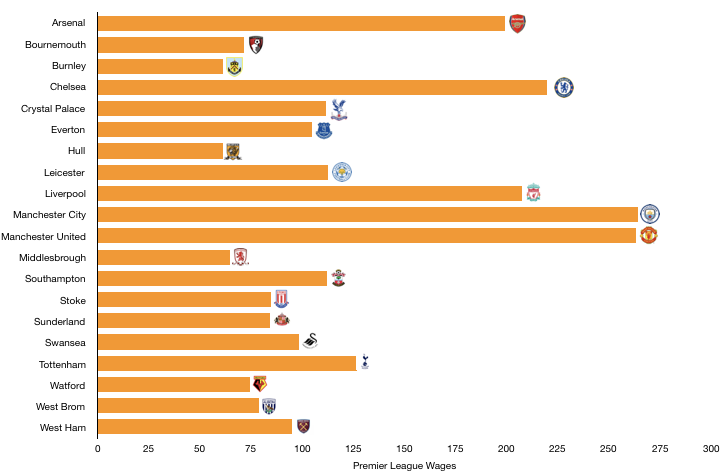

Wages rose from £260m to £315m (22%), despite only one notable arrival in Mahrez and a number of fringe departures.

This was due to a host of new, lucrative contracts for their star players with Fernandinho, Aguero, Sterling, Foden, Jesus and Laporte all signing new deals during the campaign to reward them after two sensational seasons where the club amassed 198 points in the Premier League.

What does the future hold?

Manchester City are likely to see costs rise again after more new signings and new contracts for existing stars.

The rise in costs isn’t likely to be huge, with Manchester City’s costs expected to remain below the £600m mark.

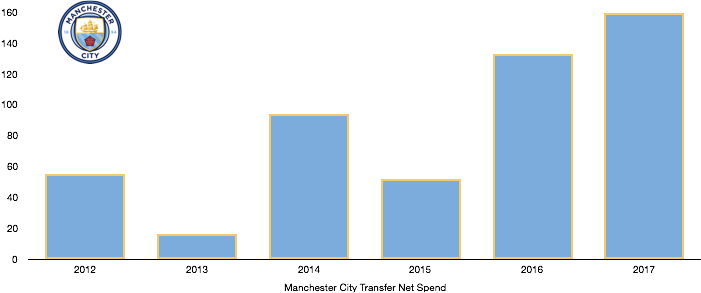

Transfers Analysis

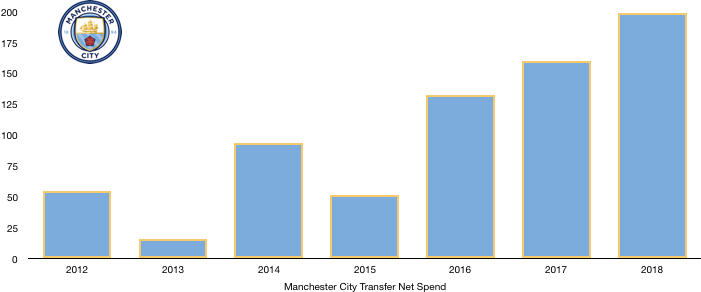

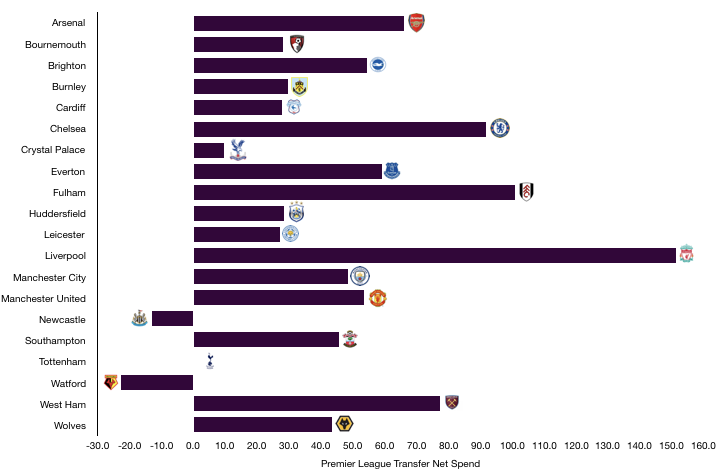

Manchester City had two relatively quiet and inexpensive transfer windows during the 2018/19 season.

In came Mahrez (£61m), Palaversa (£6m), Sandler (£2m), Itakura (£1m) and Arzani (£1m) for a combined £71m.

Departing Manchester City were Diaz (£15m), Gunn (£10m), Maffeo (£8m), Denayer (£6m), Hart (£4m), Celina (£3m) and Kayode (£3m) for a combined £49m.

This led to a net transfer spend of £22m, down from a huge £199m in 2017/18, highlighting that Guardiola was already happy with his squad and for good reason.

Mahrez added to an already exceptional group, however struggled at times to stamp himself on the team and frequently found himself as a substitute. The players sold were all fringe players and Manchester City missed none of them while also managing their wage bill well. The one disappointment may be the departure of youngster Brahim Diaz, who many feel has a bright future at Real Madrid.

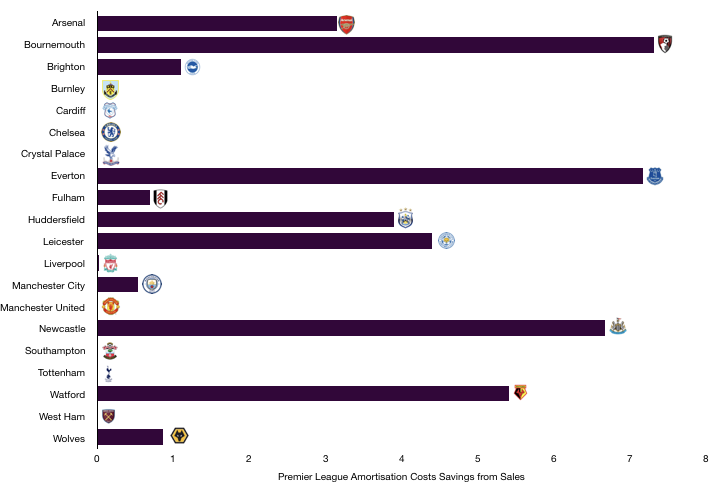

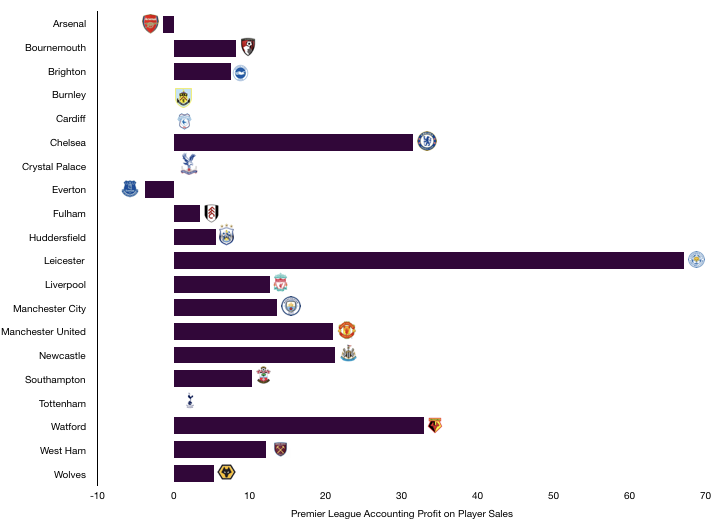

The sale of fringe players helped Manchester City record a profit on player sales of £39m, the same level as last season. As with last year, this means Manchester City would not have recorded a profit without player sales, a position Manchester City and all clubs strive to achieve.

Transfer debts

In debt terms, Manchester City are owed £54m in transfer fees, of which £49m is due during the 2019/20 season.

However, Manchester City owe a bigger sum of £86m, of which £73m is due during the 2019/20 season.

This is a net £32m that is owed to other clubs in transfer fees, of which £24m is due this season. This figure is relatively minor for a club of Manchester City’s size and will cause no financial issues.

Interestingly, Manchester City may end up owing an eye-watering £200m in signing-on clauses, contingent transfer fees and contract clauses if certain conditions are met. It is unlikely all of this will ever become payable.

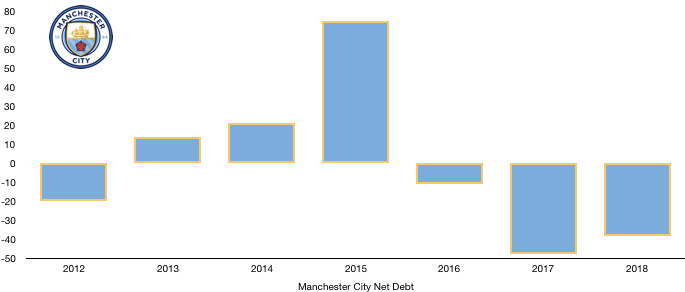

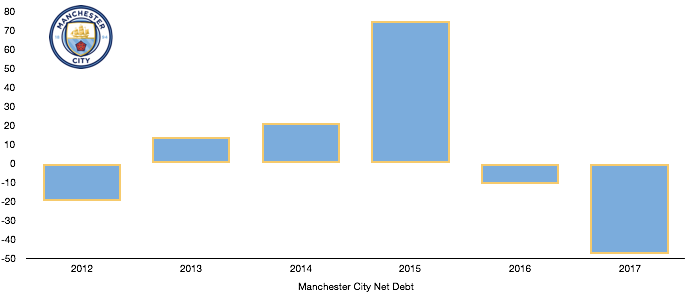

Net Debt Analysis

Manchester City have been in a net debt position for the last three years however that all changed this year after a surge in their cash reserves.

Cash more than quadrupled from £28m to £130m (366%). The exact reason were not disclosed in the accounts however amounts owed to Manchester City fell from £279m to £198m, meaning that the drop of £81m would’ve been paid in cash to the club, a likely large reason for this cash balance. This combined with the timings of other financial figures will be the reason for this surge.

Manchester City do not traditionally maintain such large cash balances so it will be interesting to see what the balance will be used for. Usually, such cash balances are only present when a large stadium or training project is in the works.

Debt levels remained at £66m, meaning Manchester City’s net debt of £38m transformed into a net cash position of £64m, a very financially healthy position to be in.

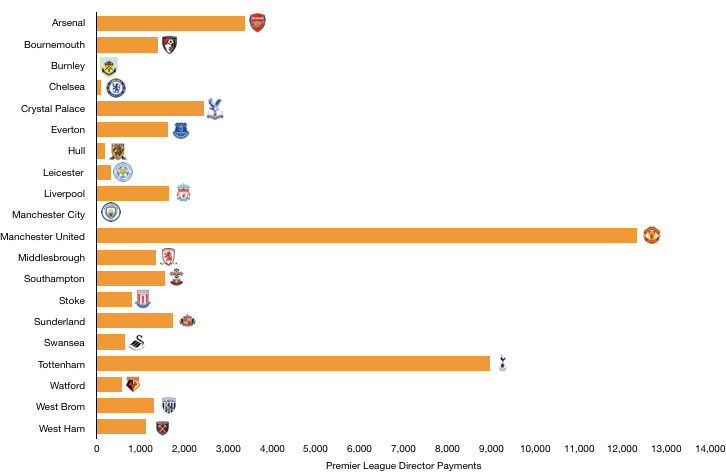

Manchester City are in a golden era in their history with huge success on and off the pitch which shows no sign of relenting. The challenge of Liverpool has challenged them on the pitch while the financial successes of Manchester United off it are still the benchmark, showing there is still some way for the club to go.

Manchester are however as well placed as any Premier League team to be the most dominant club in England over the next decade.

Thanks for reading – Share with a Manchester City fan!