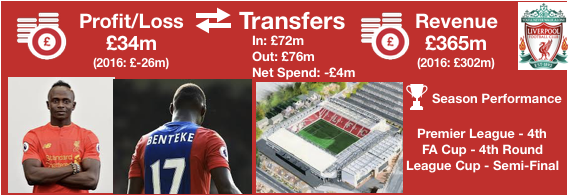

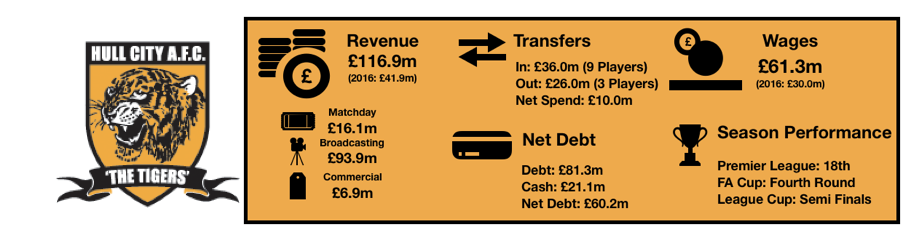

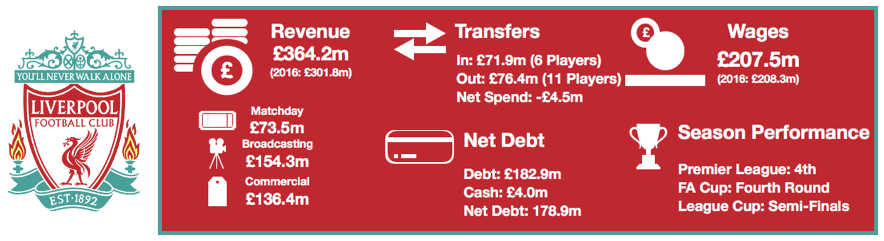

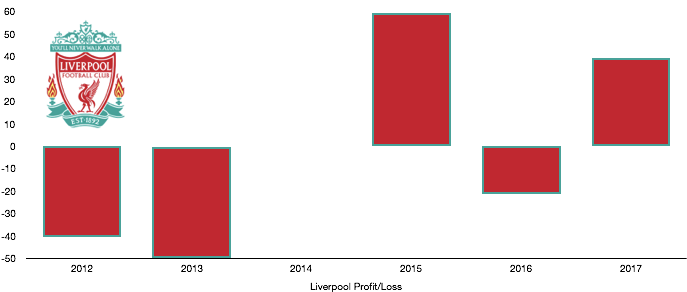

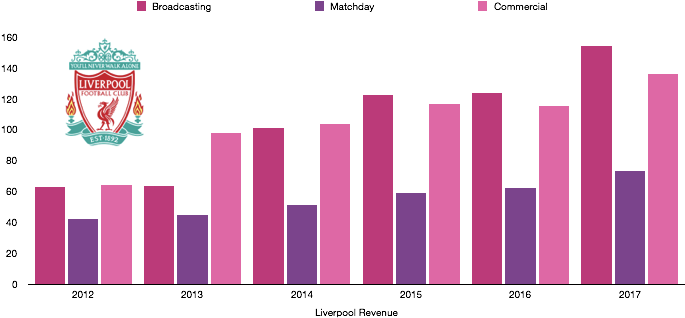

Liverpool FC released their financial results recently to great fanfare, record profits, growing revenue and a competitive wage structure were all reasons for Liverpool fans to get excited. Among all this excitement the composition of their revenue went under the radar.

Roughly half of their revenue was from TV money and prize money, which although shows success in a season, isn’t something that can be relied upon each year. Unless your Real Madrid or Barcelona, Champions League finals/trophies are a rare occurrence due to the strength of the competing rivals.

Roughly a fifth of Liverpool’s revenue came from matchday earnings which has remained fairly stable but is increasing as the capacity of Anfield increases.

This leaves around a third of Liverpool’s revenue being from commercial revenue. Commercial revenue is made up of sponsorship deals and merchandise sales. This is the area where Liverpool are below Europe’s top table and an area that has significant room for improvement.

The Problem

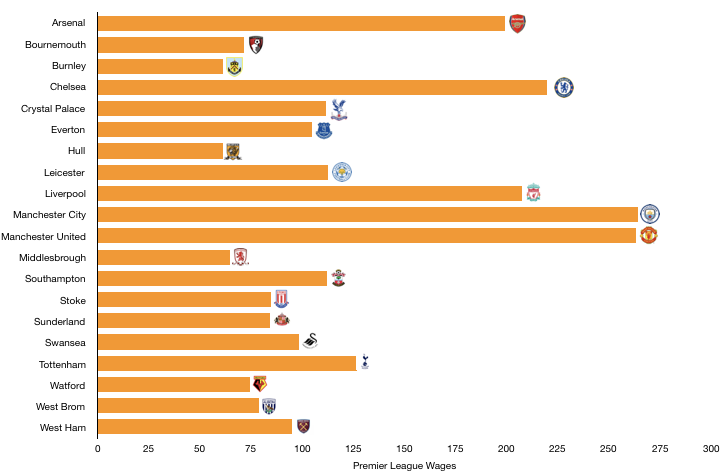

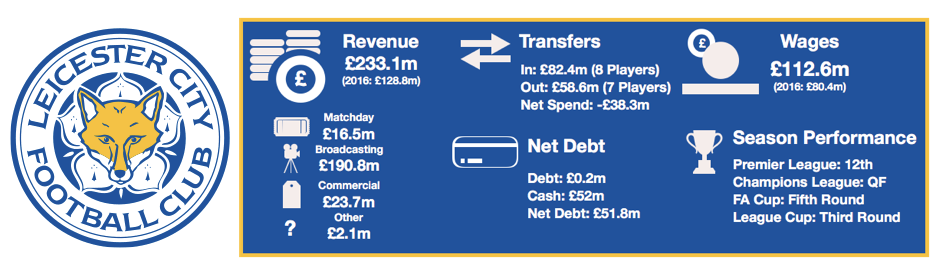

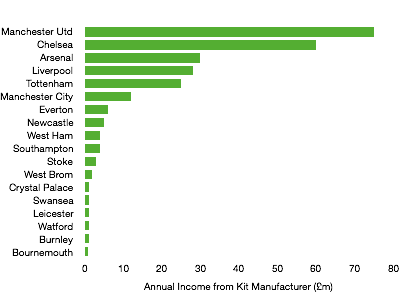

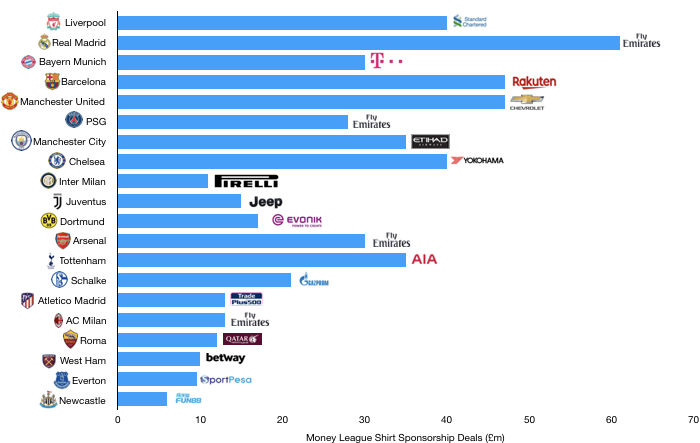

The graph above shows the potential Liverpool have to grow this area of revenue and boost income significantly to boost their financial muscle. Liverpool’s commercial revenue is the 8th highest in Europe according to Deloitte and is less than half the amount Real Madrid command. Although no one is saying Liverpool are as big a club as Real Madrid, the difference is much bigger than it should be.

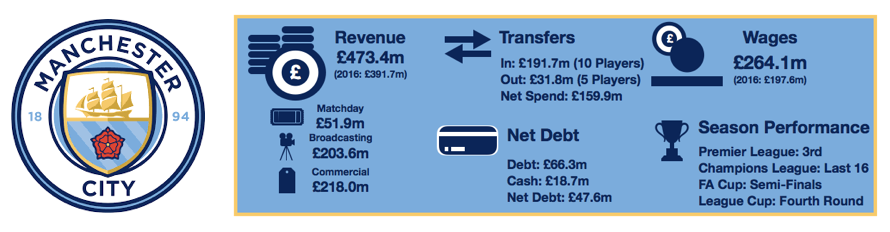

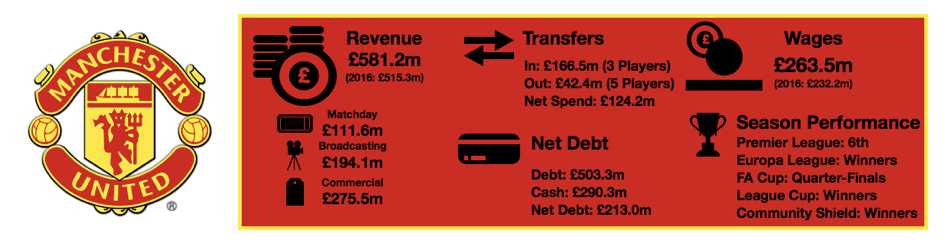

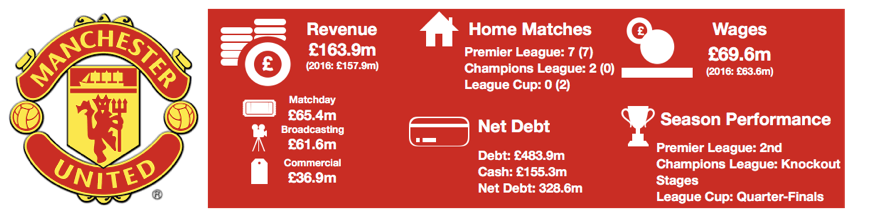

Liverpool lag their northern rivals in Manchester significantly too, by more than £100m in Manchester United’s case. This gap needs to shrink if Liverpool are serious about mixing with Europe’s finest.

Mr. Popular

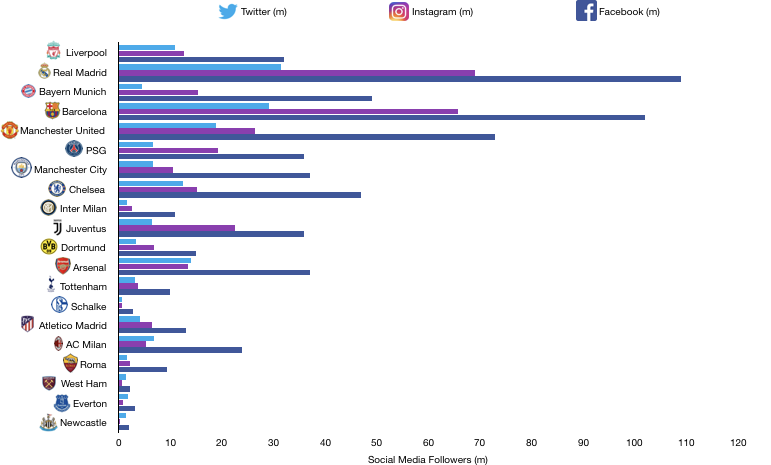

The reason Liverpool have so much potential and are currently under achieving when it comes to commercial revenue is the growth the club has experienced in popularity and appeal worldwide under Klopp.

Liverpool have struggled over the past couple of decades to ‘get with the times’ and match their rivals in digital popularity as football moved into the modern era. Manchester United perfectly exploited and channelled the new commercial era and as a result saw their finances explode with Liverpool playing catch up ever since.

However, Liverpool are catching up and are ahead of many in terms of social media followers. The club have the 6th highest number of twitter followers of the twenty teams to make up the Deloitte Money League. They also have 9th highest number of followers on Instagram which could be improved upon with more engagement and is an area for growth.

The club only has the 10th highest number of Facebook ‘likes’ and should look at these platforms as areas that could grow significantly. In all these areas they aren’t far of moving further up the social media chain as the club engage to a greater extent with the fans and their success on the pitch attracts more digital fans.

The importance of this nowadays cannot be underestimated, a club’s social media pull gives companies a great way to advertise directly to their target market being football fans or geographical location. A greater number of followers makes it much easier to negotiate lucrative sponsorship deals, especially the smaller club partners who can make up a considerable amount of a club’s commercial revenue.

Kitted Out

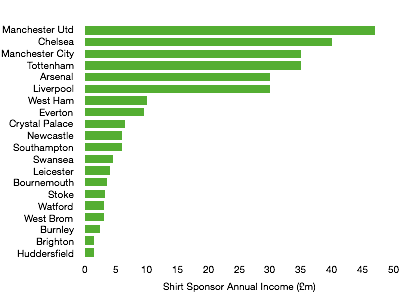

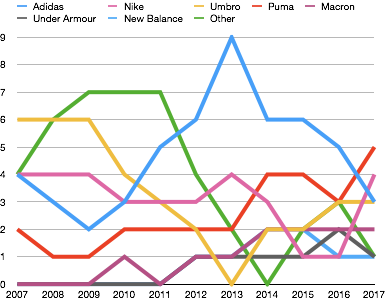

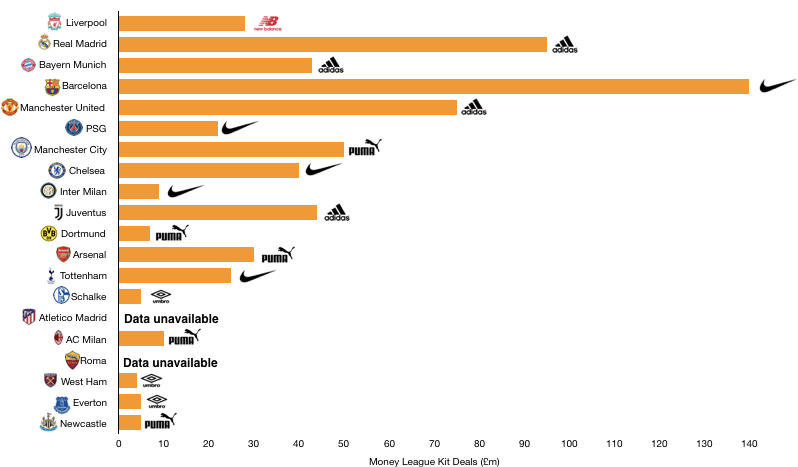

Liverpool currently earn roughly £28m from their kit manufacturer New Balance annually. This is almost a third of the amount Manchester United attract in their £75m deal with Adidas and 5 times less than Barcelona’s high of £140m from Nike.

Liverpool are (and should be) entertaining offers from the likes of Adidas and Nike as they look to match, if not exceed the amount earned by Manchester United when their deal with New Balance runs out at the end of next season.

Liverpool should be able to increase their kit deal significantly as Manchester United negotiated their deal a few years ago so by now, this should be well within the grasp of Liverpool considering the growth in popularity the club has sustained of late.

Their current deal is also below the likes of Chelsea and Manchester City, clubs of a similar stature social media wise however Liverpool also have a larger fan base outside of this and would therefore hope to command at least in excess of the £50m Manchester City recently negotiated with Puma.

Getting More Shirty

Liverpool have stayed loyal to their shirt sponsors historically, seemingly married to Carlsberg until they parted ways a few years ago and Standard Chartered took their place. Liverpool chose wisely and have recently renegotiated their deal on £40m a year for four years, up from £30m. This was a shrewd move and Liverpool are doing well in terms of their shirt sponsor and there is not much room to improve in this area.

The club should focus on maintaining a good working relationship with Standard Chartered and negotiate at the appropriate time to improve the terms, maybe by incentivising additional performance related bonuses that will reward the club on the back of successes on the pitch.

Opportunity Knocks

Liverpool have many additional areas that could enhance commercial revenue with some controversial and others just sensible.

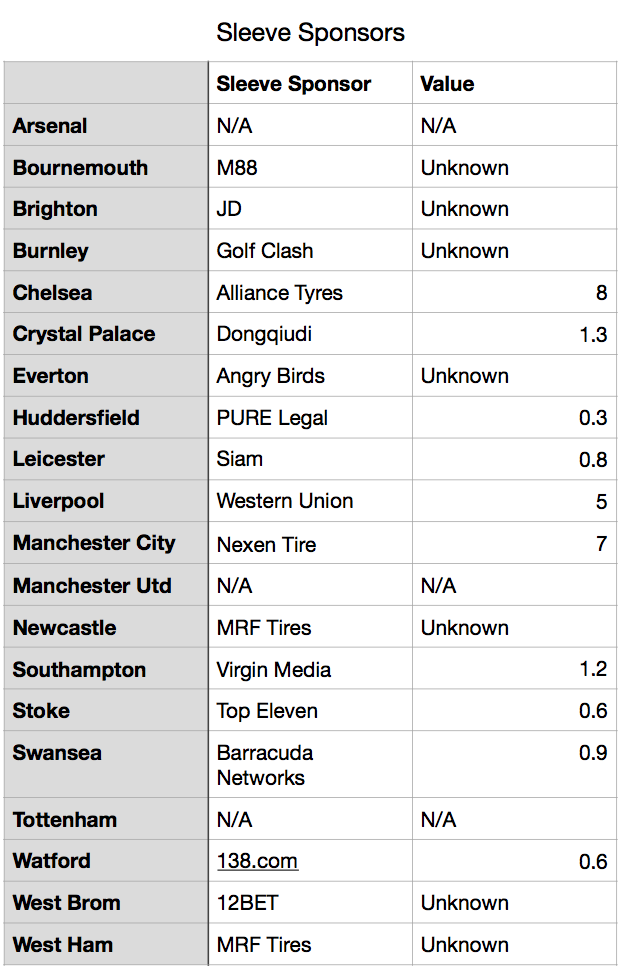

Sleeves

Liverpool currently have a 5-year deal with Western Union as their sleeve sponsor, mainly in line with their rivals. Arsenal are currently leading the way with an £8m-a-year deal, something Liverpool should consider exceeding considerably when their current deal expires in 3 years, something for the future.

Training kits

Liverpool’s training kit is sponsored by BetVictor and their current deal expires at the end of the season, making it an opportunity to bring in a more lucrative deal. For comparison, Barcelona have reportedly the highest training kit deal (with Beko) at around £16m a year, which offers a sizeable boost in revenue should Liverpool get anyway near that figure, either by improved terms of a new sponsor.

Naming Rights

Stadium naming rights are a controversial topic in England among fans with many opposed to the idea of ruining club traditions all for the sake of a few quid. However, recent studies have shown it is no longer a few quid with valuations in excess of £10m being placed on Anfield and other famous stadiums. A boost of even £10m in commercial revenue would by over 5%.

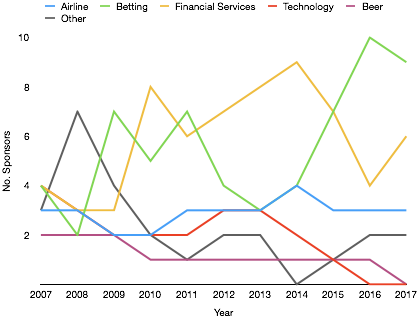

Club Partners

Liverpool could attempt to go a different way and go for volume with sponsors. Club partners can add small multi-million-pound deals here and there however if this was scaled up, could run to the tens of millions. The main drawback here is the time it may take and the devaluing of their main sponsor who may not be best pleased to see all these deals that take the shine of their large deals.

Go Strange

What if Liverpool find the newest trend like the sleeve sponsor? This is an option for the creative. How about shorts sponsors? Press conference sponsors? These are all options and many more. The club could also develop a new medium to share their content that substantially boost their social media following and attracts more lucrative deals.

Thanks for reading – share with a Liverpool fan!