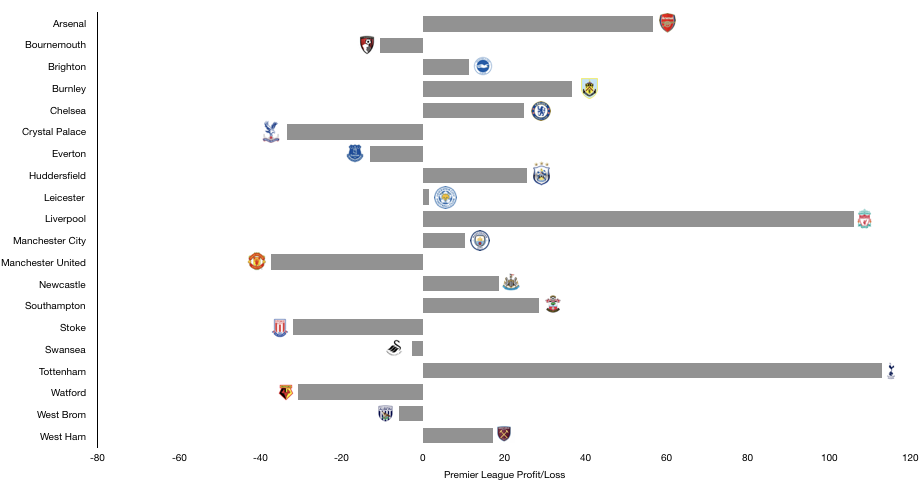

The 2017/18 Premier League season saw a cluster of clubs turn profitable, with 11 of the 20 clubs competing in the competition earning a profit.

The cumulative profits realised were a high £285m, an average of £14m per club. However, this doesn’t tell the story at all with huge variances among teams, from a record breaking £113m profit (Tottenham) to a loss of £37m (Manchester United).

The top 6 unsurprisingly led the way, accounting for £274m of the profits, 96% of the total Premier League profits. The rest account for £11m of profits, due to the huge variances in financial fortune among the rest of the pack.

There is no real correlation in terms of profit and league positions, other than at both extremes of the table, with 5 of the top 6 being profitable and all three relegated clubs turning in a loss.

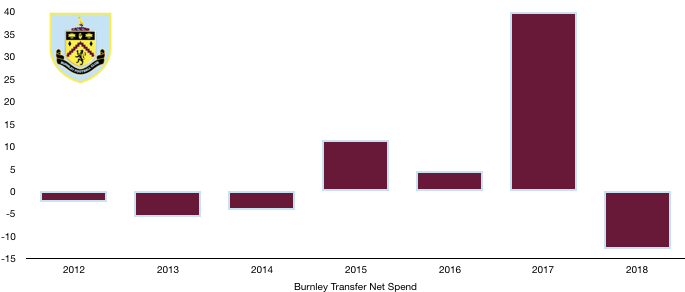

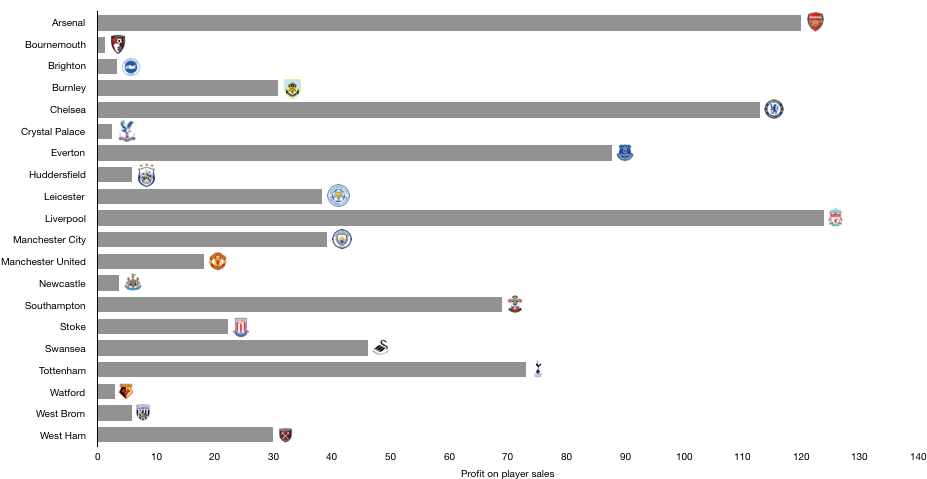

The vast majority of profits were due to clubs recording large profits on players sales after several high-profile players departed the Premier League. Such transfer windows are not common place and these clubs may see a steep fall in profits without these sales.

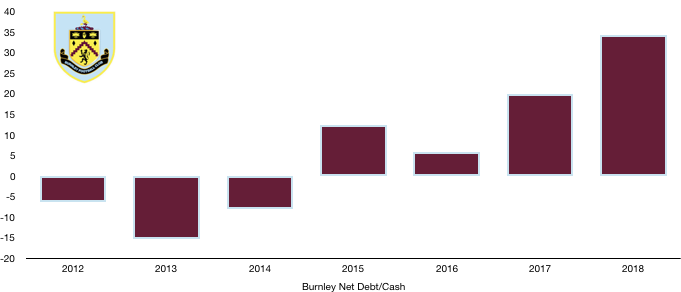

In 2018, profits outside the top 6 related predominately to an ability to keep costs down, while a couple of clubs also benefitted from relatively sizeable commercial and matchday revenue.

This article will look into the those who performed well and those who didn’t and the main reasons behind this, before finishing with a look at how things may look for the 2018/19 season.

Let’s delve into the numbers.

Top of The Profits

It was a good year for Tottenham (£113m), Liverpool (£106m) and Arsenal (£56m) who were the top three performing clubs from a profit (after tax) perspective, and all members of the illustrious top six.

Tottenham broke Liverpool’s short lived record profit figure for a football club following the release of their accounts after the sales of the likes Walker, Wimmer and Bentaleb helped Tottenham records a profit on player sales of £73m, 65% of their total profits.

Liverpool had Coutinho to thank for their huge profit after recording a huge profit on player sales of £124m, more than their after-tax profit but slightly less than their profit before tax (£125m).

Arsenal would have been loss making had it no been for their profit on player sales of £120m, due to a flurry of sales including Oxlade-Chamberlain, Walcott, Giroud, Coquelin and Szczesny plus many more.

Tottenham were further helped by revenue growth of £71m (23%) to a personal high of £381m, primarily due to their temporary move to Wembley and the commencement of their new Nike sponsorship deal.

Liverpool benefitted hugely from a run to the Champions League Final and a great Premier League campaign which saw revenue increase by £90m (25%) to £455m.

It was the opposite for Arsenal whose profits were entirely down to player sales with a loss being recorded without these sales as revenue fell by £21m (5%) after a season without Champions League football.

Tottenham had a lack of any real transfer activity this season and as such, profit on player sales will be small, however a run to the Champions League Final and the potential trophy itself will see profits remain relatively high, although lower than this year.

Liverpool also saw a huge dip in transfer departures of a high-profile nature, and as such profits will take a large hit. Another Champions League final and an improved Premier League campaign will offset some of this, however due to rising costs, profits are likely to be nowhere near 2018 levels.

Arsenal likewise saw minimal player sales and will be fortunate if they don’t record a loss, even if there is Europa League glory at this month.

Take the L

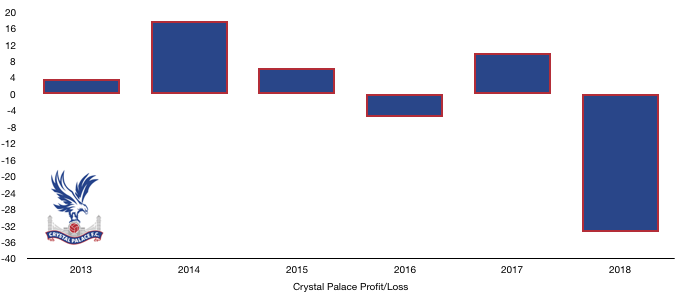

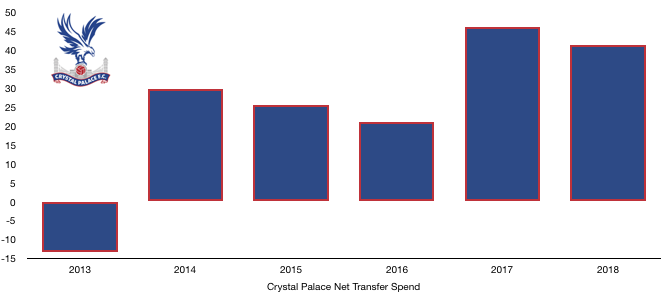

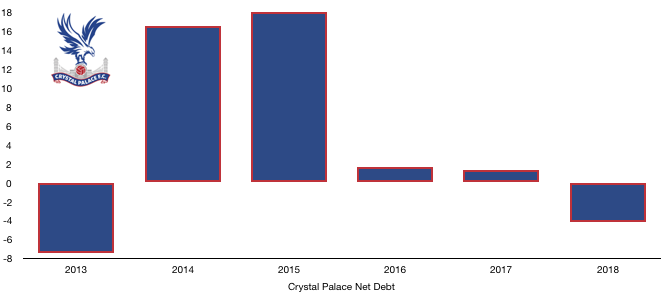

It was a bad year for Manchester United (£37m), Crystal Palace (£33m) and Stoke (£32m) who all recorded rather large losses that will not please their bosses.

Manchester United can partly be excused with loss solely down to US Tax and accounting hocus pocus with Manchester United recording a £26m profit before tax. This loss isn’t a real loss and reflects accounting adjustments rather than a cash loss.

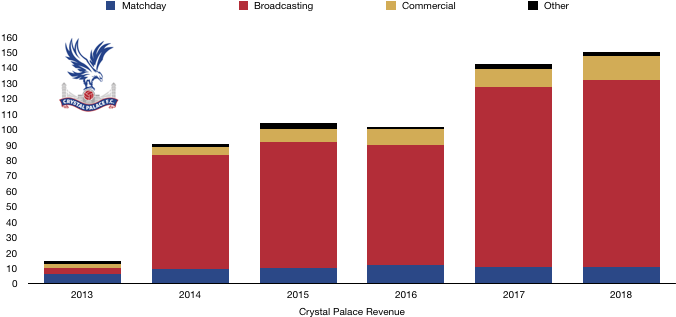

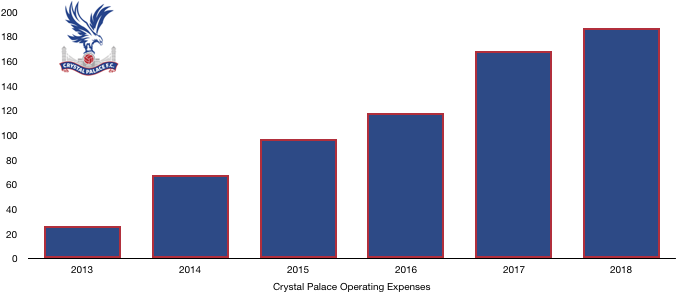

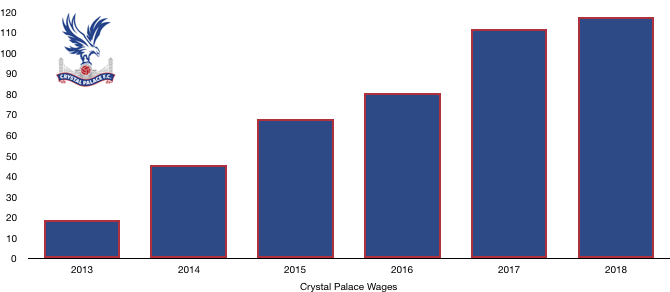

The same cannot be said for Crystal Palace, who made a £10m profit in 2017 due to player sales that were lacking in 2018. Despite revenue rising by 5% to £150m, Crystal Palace saw costs rise 11% to £187m as Crystal Palace struggled to stay competitive while keeping costs low.

The same can be said for Stoke that will be unhappier with relegation than the loss (which will grow even larger following relegation). Revenue fell due to a poor campaign by 9% to £127m while costs rose 33% to £180m, a double whammy their financial health didn’t enjoy.

This year, we are likely to see one of the largest losses in Premier League history with Fulham relegated after a £100m+ spend which will see huge impairment losses as players leave for a fraction of the transfer fees spent.

Cardiff and Huddersfield are unlikely to see huge losses due to relatively low costs despite relegation.

Crystal Palace are likely to keep their place near the bottom of the profits table with another loss following another year of low player sales.

No Sales, No profits

Premier League clubs sold a whole host of talent in 2018, some to other Premier League clubs but also a large portion of players went abroad.

Premier League clubs recorded profits on these sales of an eye-watering £836m, an average of £42m per club although the amounts vary greatly from club to club.

Leading the way were Liverpool (£124m), Arsenal (£120m), Everton (£88m) and Tottenham (£73m) after the high-profile sales of Coutinho, Oxlade-Chamberlain, Lukaku and Walker respectively.

These sales helped Liverpool and Tottenham boost profits, Arsenal to turn a loss into a profit and helped Everton reduce a loss significantly.

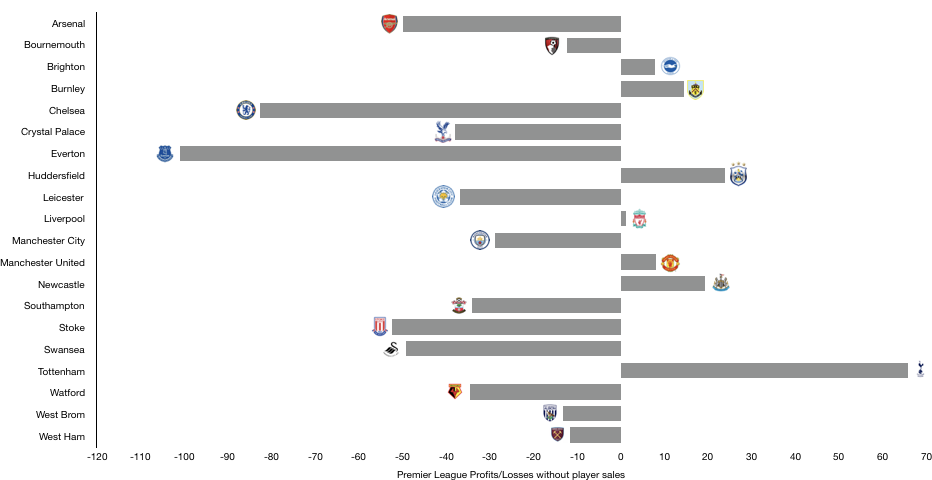

The Premier League profit table looks a whole lot different without player sales. Although important to clubs, relying on player sales is not a true test of profitability as they large sales are not made every year, nor would fans want them to be (unless adequately replaced).

To work out the profits without player sales, we take the profit before tax and deduct the profits on player sales and we will ignore taxes for this analysis.

Interestingly, without player sales, Premier League clubs make a huge loss of £403m. It is worth noting here however that had clubs not sold players, they also wouldn’t have brought many. When players are brought, they experience an amortisation charge in each year of their contract.

Had these additional amortisation costs not been included, clubs would have still turned a profit on the assumption that the total fees spent of £1,833m on average contract length of 4 years, the amortisation this year would have been £458m, essentially meaning a profit of around £50m would have been recorded without transfers, around a fifth of the profits actually recorded.

Tottenham would have been way out in front even without transfers, recording a profit of £66m after another successful season was boosted by Wembley and Nike, while their costs remain way below the level of their rivals.

Huddersfield experienced the financial joys of promotion which accounted for the majority of their profits which would have still been £24m without transfers.

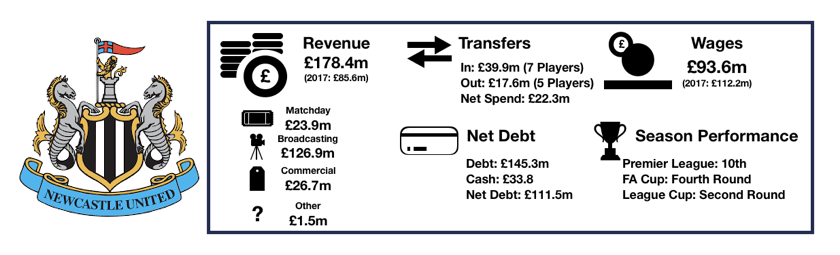

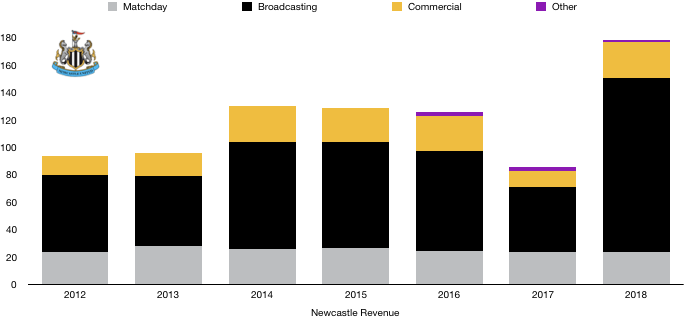

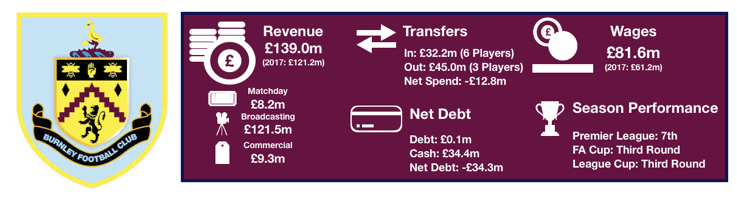

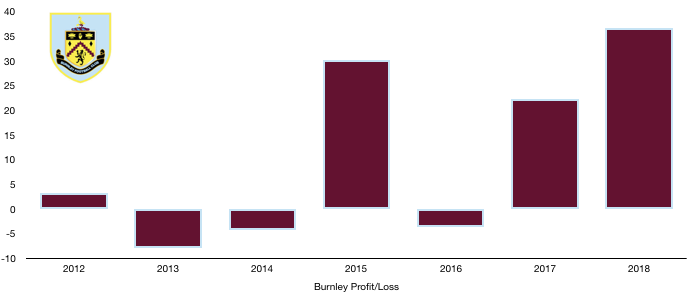

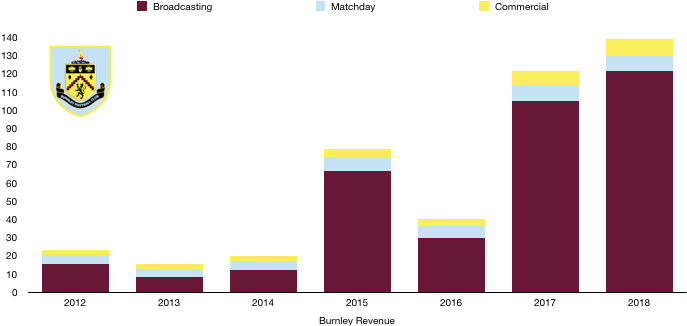

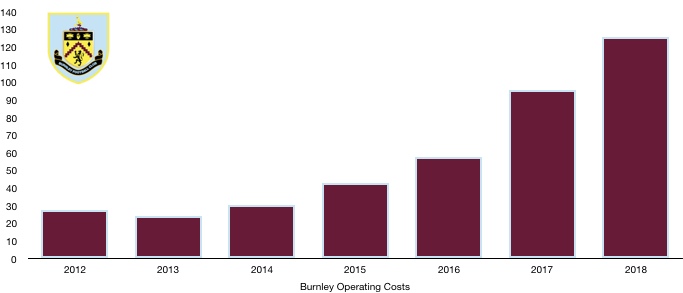

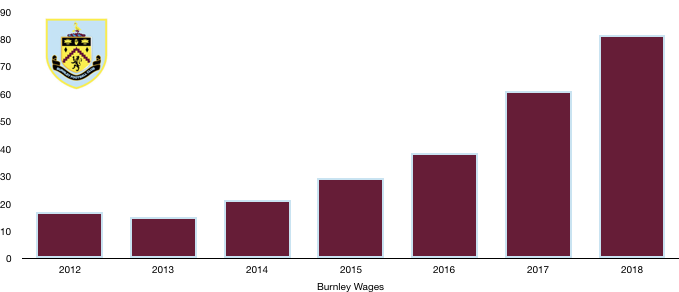

Brighton (£8m), Burnley (£14m), Liverpool (£1m), Manchester (£8m – due to not taking into account the taxes) and Newcastle (£19m) were the only other clubs to record a profit without player sales.

The largest loss would have been Everton, whose losses amounted to £101 without the sale of Lukaku and others.

Chelsea also benefitted hugely from players sales, recording a loss of £83m without them.

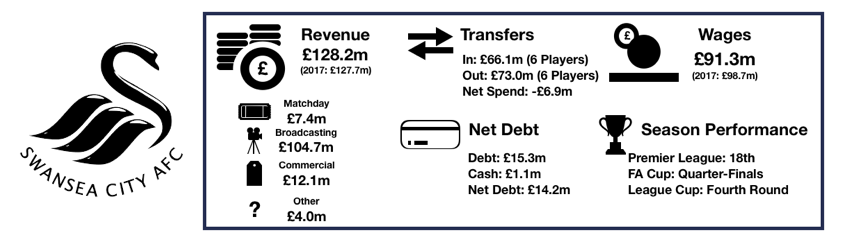

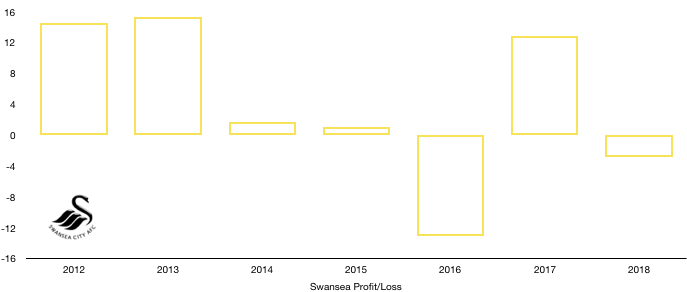

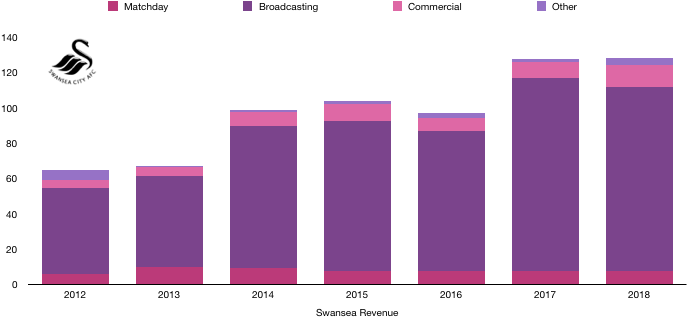

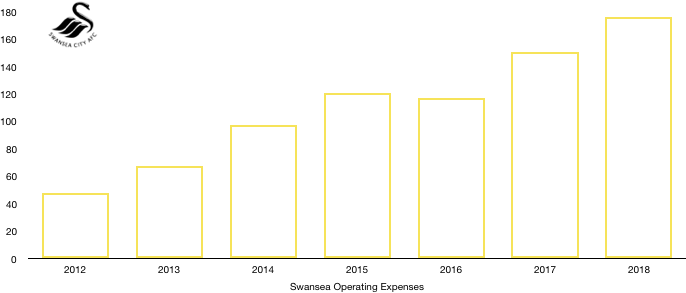

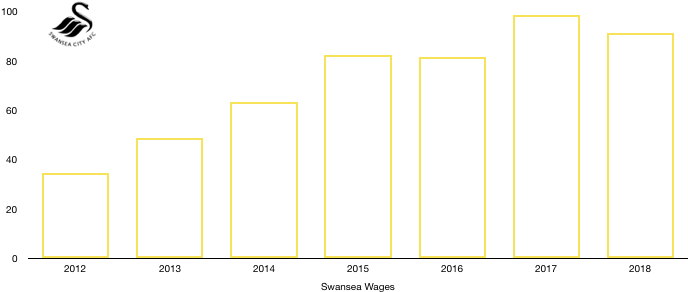

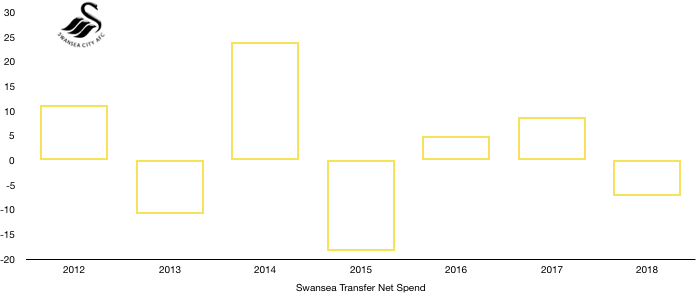

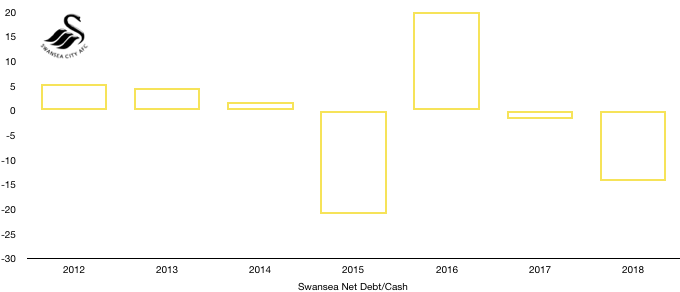

Arsenal (£50m), Crystal Palace (£38m), Leicester (£37m), Manchester City (£29m), Stoke (£52m), Swansea (£49m) and Watford (£35m) all recorded huge losses without players sales.

Summer ‘19

This year, there has been lack of high-profile player sales in the Premier League which will mean profits will be lower unless revenue rises significantly, or costs are lowered. Costs are unlikely to be on the decline with wages continuing to grow. Revenue from the Premier League will be similar to this year due to the League being in the final year of a 3-year cycle.

However, European performances have been huge this year and have concluded in an All English final in both the Champions League and Europa League, the first time this has happened. This should enhance profits of the top six and hence the Premier League as a whole.

On top of this, commercial revenue will continue to rise as the popularity of football and the ability to monetise this appears to have no bounds.

Outside of this, Burnley will have high profits once again after playing in the Europa League.

Watford and Leicester saw the high profile exits of Richarlison and Mahrez which should see large profits realised by both clubs.

As seen in the previous section, the likes of Arsenal, Crystal Palace, Stoke and Swansea all recorded huge losses without players sales and are likely to see large losses this season without them. Stoke and Swansea’s relegations mean that their losses will be large regardless of any sales.

It’s an interesting time for Premier League clubs who are all looking to become profitable and sustainable to a mixed degree of success due to the delicate balance of achieving your goals and spending prudently. The key is to spend smarter not more, something most clubs are yet to master.

Thanks for reading – Share with your fellow football fans!