Chelsea had a mixed 2019, with many fans unsure what to make of what in the end, was a successful season. After missing out on the top four in 2018, Conte was sacked (a very expensive sacking) and Chelsea were condemned to the Europa League.

Maurizio Sarri took over from Conte at Stamford Bridge as fans gained renewed optimism following a strong start to the season that saw them neck and neck with title rivals Manchester City and Liverpool.

However, things soured, with Sarri-ball deemed ‘boring’ and Chelsea began to drop points, leaving Chelsea in a top four battle and calls for Sarri out. Sarri miraculously managed to turn things around following an eventful League Cup final loss where Kepa refused to be subbed off, with Chelsea going on to lift the Europa League and finish 3rd in the Premier League, a good season by anyone’s standards.

Despite this, Sarri sought pastures new and landed the Juventus job, leading to club legend Frank Lampard taking the reins ahead of the 2019/20 season, under the constraints of a transfer ban.

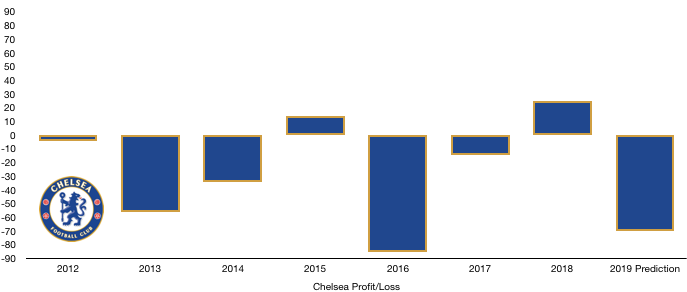

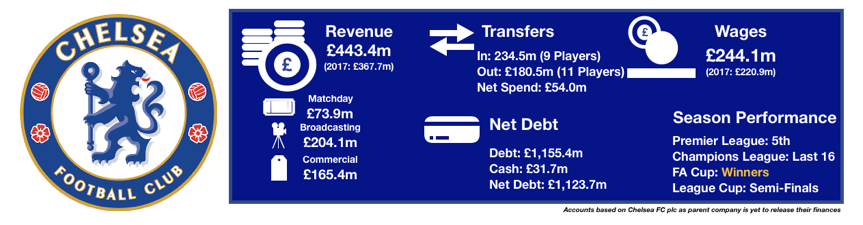

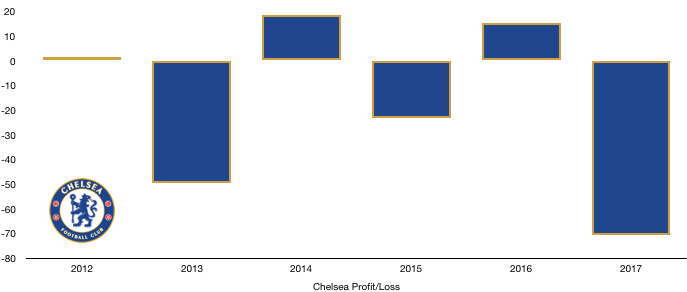

The failure to qualify for the Champions League in 2018 has had significant consequences for Chelsea’s finances, with Chelsea recording a huge loss of £110m, down to revenue not increasing significantly and costs sky-rocketing, which included a £27m payout to former boss Conte.

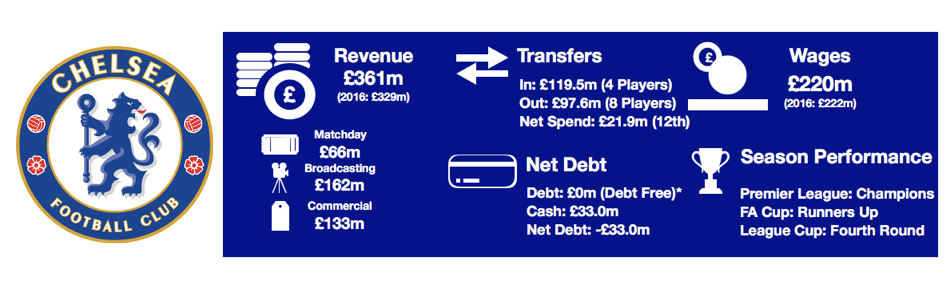

Let’s delve into the numbers.

Revenue Analysis

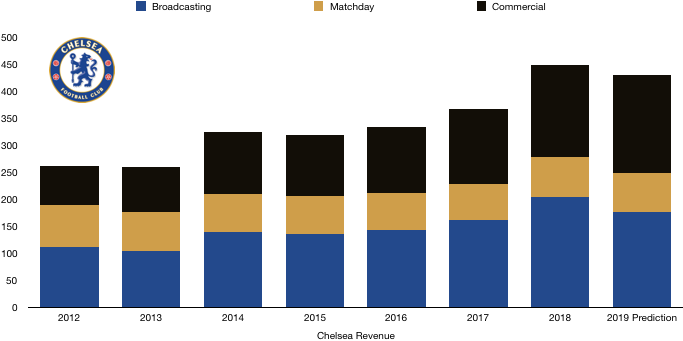

Chelsea were without Champions League football in 2019, having to settle for a Europa League trophy, not a bad alternative. Despite winning this trophy, Chelsea were unable to secure meaningful revenue growth due to the vast financial differences between Champions League qualification and the Europa League.

Chelsea saw their revenue increase slightly from £448m to £452m (1%), a new club record and their fourth successive year of revenue growth.

Matchday revenue

Matchday revenue dropped sharply from £74m to £67m (9%) as Chelsea competed in the less lucrative Europa League, meaning ticket were priced lower for these games than their Champions League equivalent.

Average league attendance fell from 41,282 to 40,437 (2%) despite domestic performance improving under Sarri, showing perhaps the disenchantment fans felt watching Sarri’s team.

With Lampard rejuvenating the team so far, attendances are likely to rise, while their return to the Champions League in 2019/20 means that matchday revenue should rise to around 2018 levels.

Broadcast revenue

Chelsea saw their broadcast revenue fall slightly from £204m to £200m (2%) after the club dropped from Europe’s top competition to the Europa League. Despite winning the Europa League, Chelsea would have been far better off financially by exiting the Champions League at the Round of 16 trophy-less. Roma received the least out of all Round of 16 participants and still received €57m, while Chelsea only received €46m for winning the Europa League.

Inter Milan (€48m), Napoli (€50m), Benfica (€50m), Shakhtar Donetsk (€47m) and Roma (€48m) all received more despite not qualifying from their Champions League groups.

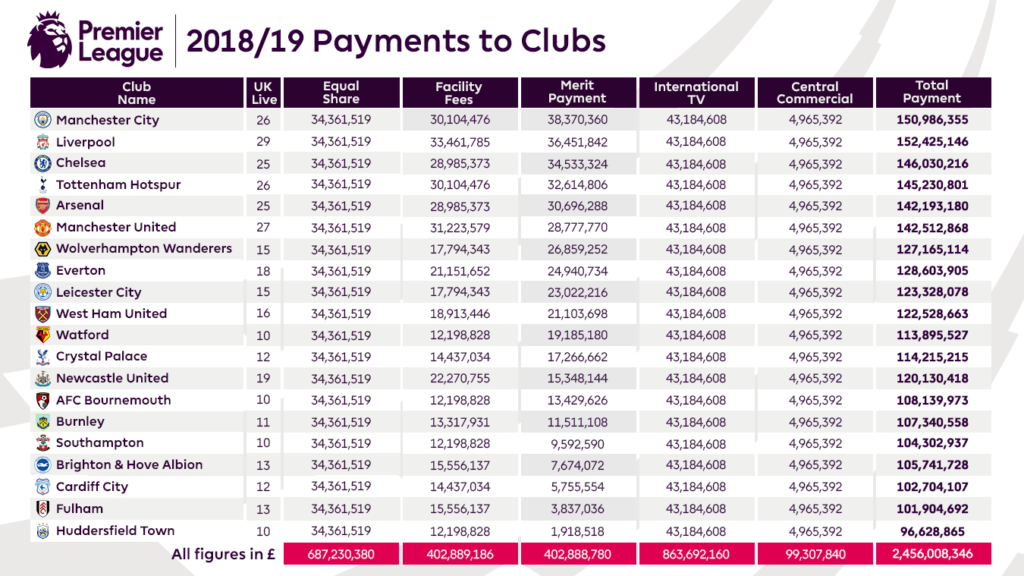

Chelsea saw their Premier League distributions increase from £142m to £146m (3%) after they moved up two places in the league table.

Broadcast revenue should rise significantly next year as Chelsea benefit from their Champions League qualification, and having reached the knockout phases of the Champions League, Chelsea are likely to see their UEFA prize money increase significantly on the €46m received in 2019, even if they fail to progress any further.

Commercial revenue

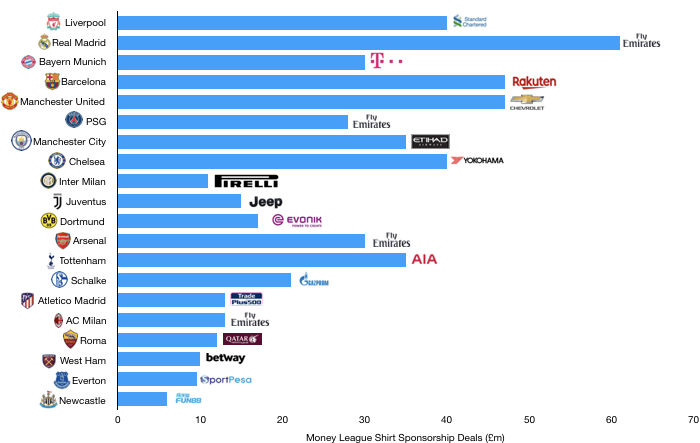

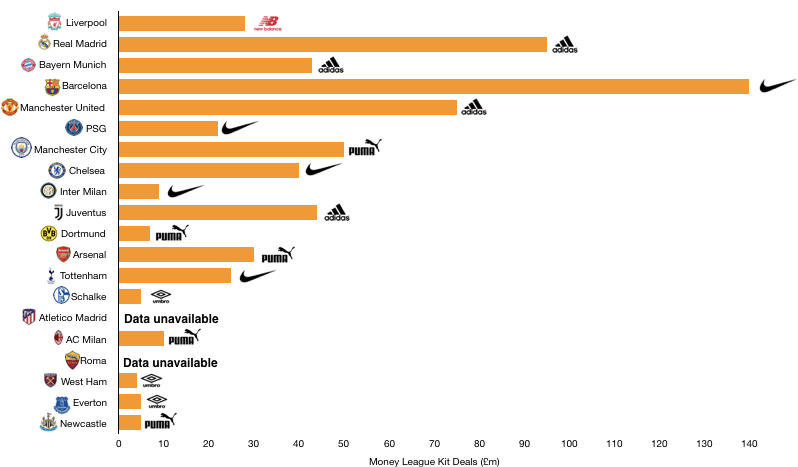

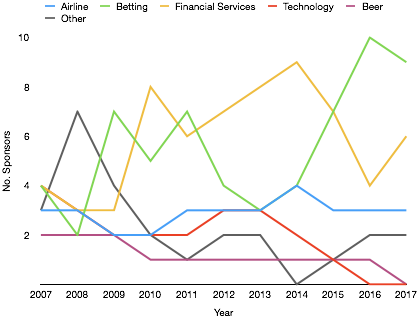

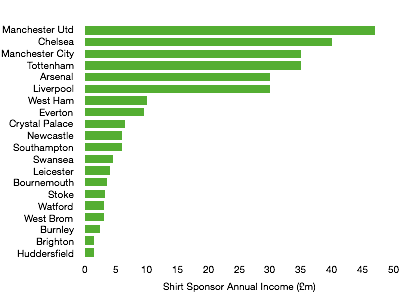

Commercial revenue increased from £170m to £185m (9%) as Chelsea saw good commercial growth after focussing on partnering with premium brands in the year.

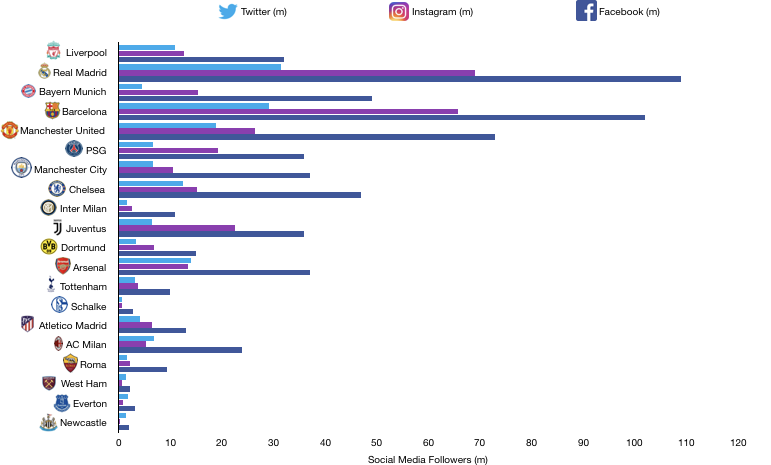

With their main shirt sponsorship deal due to expire at the end of the 2020/21 season, Chelsea will be hopeful of a further spike in commercial revenue. With no deal currently believed to be in place (possibly due to restrictions in their current contract with regards to negotiating a new deal), there may be worries that the club will struggle to find a more lucrative new deal than their current one.

What does the future hold?

Chelsea are likely to see significant revenue growth on their return to Champions League football, with a push past the £500m barrier possible if commercial revenue growth as its current rate or Chelsea progress to the latter rounds of the Champions League.

Chelsea will be hopeful of progressing further in the Champions League, which could lead to huge revenue growth in the coming year, however retaining their top four place in the Premier League is the most important objective.

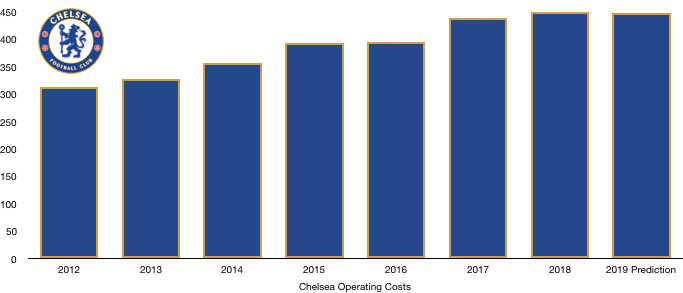

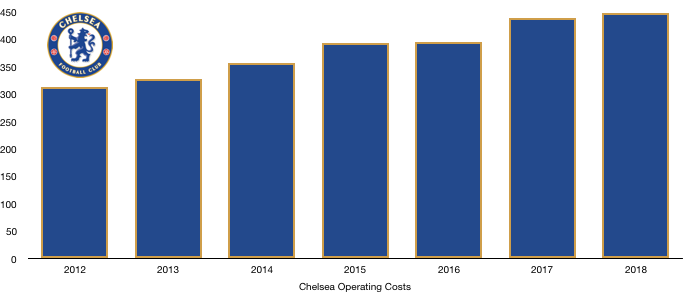

Expenses Analysis

Chelsea saw their costs sky rocket in 2019 as the costs of competing in the Premier League and Europe continue to rise. The sacking of Conte did not help matters, costing the club are large amount in severance pay.

Amortisation

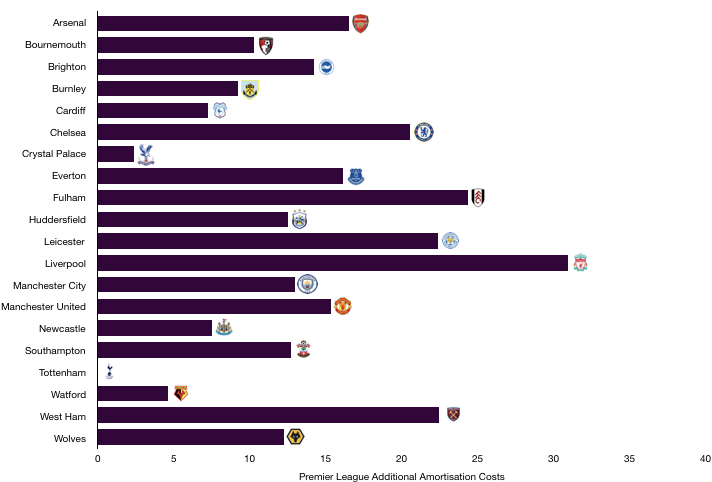

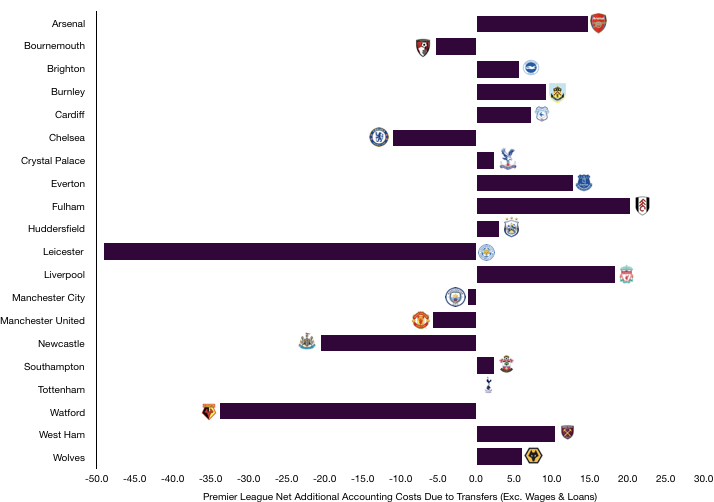

Chelsea’s amortisation costs increased from £127m to £170m (34%) after substantial player investment in 2018/19 in a season that saw Chelsea spend nearly £200m on transfers (see transfer analysis) ahead of their transfer ban.

With Chelsea banned from signing players in the 2019 summer transfer window, amortisation is unlikely to increase in the coming season, unless there is significant spending in January 2020.

Conte’s severance package

Chelsea sacked Conte at the end of the 2017/18 season after failure to qualify for the Champions League. Conte had signed an improved two year contract until the end of the 2018/19 season in 2017, a move that has proved costly for the Blues.

Chelsea had to pay off the last year of Conte’s contact and those of some of his key staff which has cost them £27m, making it the latest in a long list of large severance packages paid by Roman Abramovich under his Chelsea ownership.

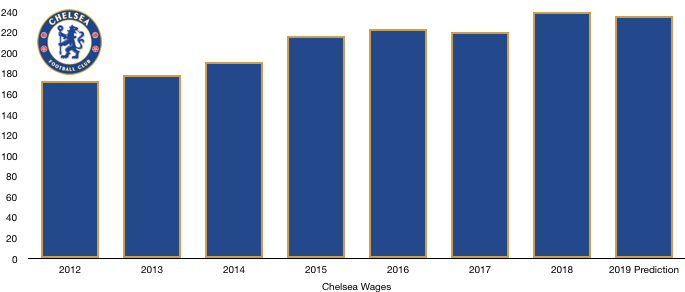

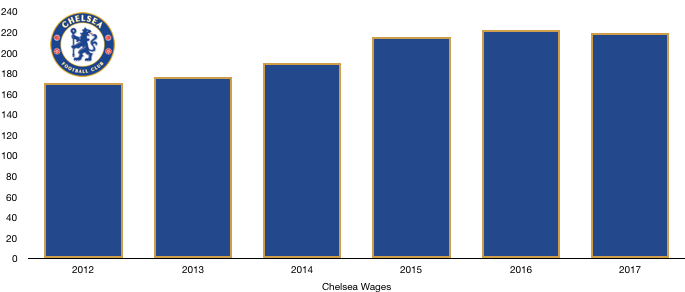

Wages

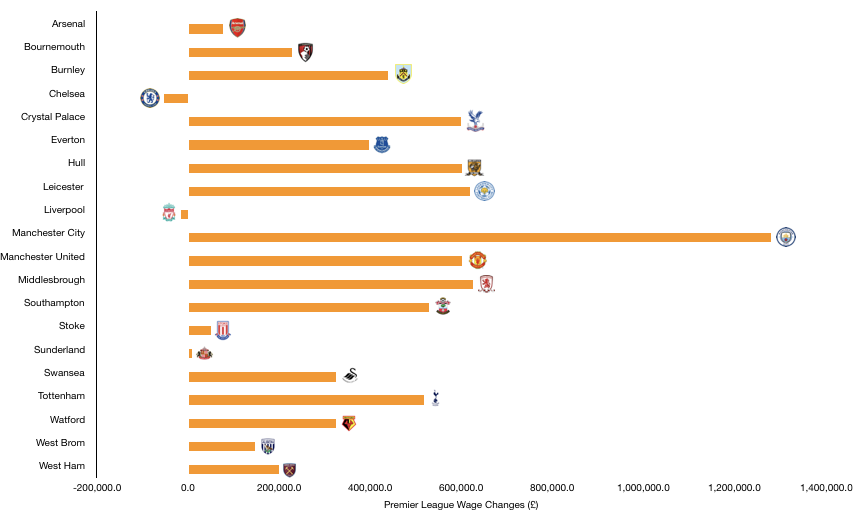

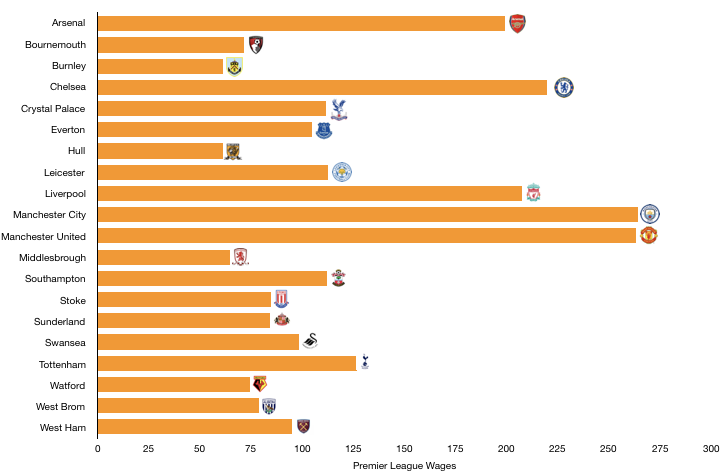

Chelsea saw their staff costs rise from £246m to £288m (17%) on the back of significant incoming signings, including new contracts for Giroud, Pedro and Christensen.

These extra wages work out a huge £810k a week, an eye-watering sum that shows the increasing costs of doing business at the top end of European football.

What does the future hold?

Chelsea are likely to see costs remain at similar levels as this year, perhaps even decreasing. Sarri’s contact may also include a severance payout, however it is likely to be significantly smaller than Conte’s and hence Chelsea will naturally see a reduction in costs in this area. A less busy summer is likely to see wages stagnate, especially with the departure of their highest earner in Hazard.

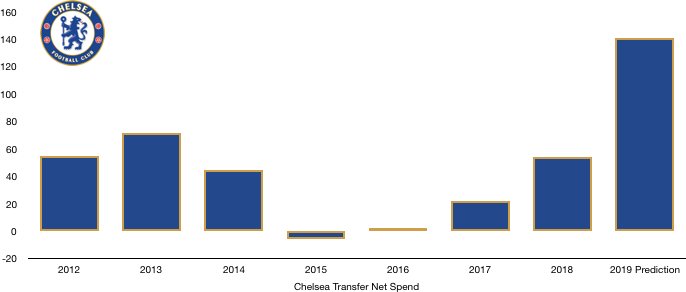

Transfers Analysis

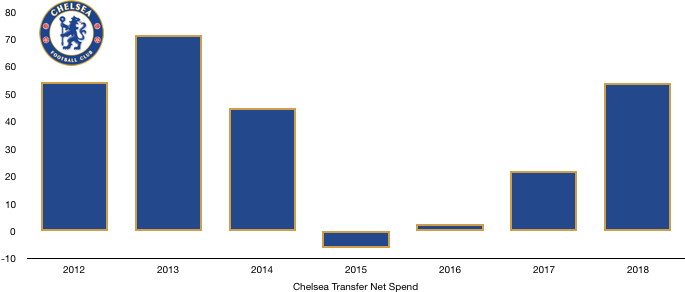

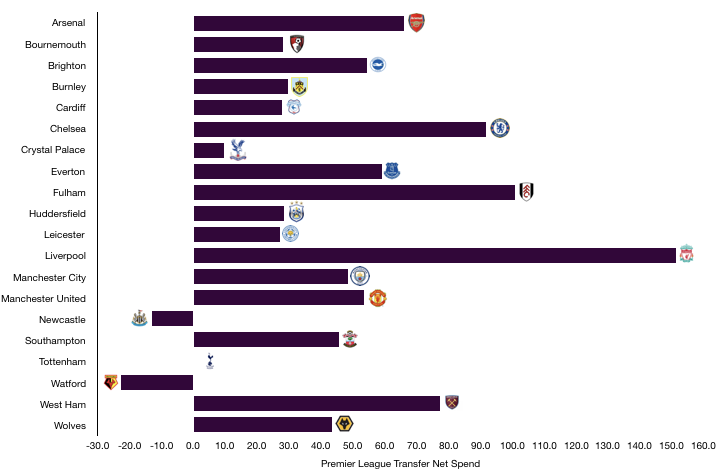

Chelsea had a busy 2018/19 transfer season, spending close to £200m on players.

In came Kepa (£72m – a world record for a goalkeeper), Pulisic (£58m), Jorginho (£51m) and Higuain (Loan – £7m) for a combined £188m.

Departing Stamford Bridge were Courtois (£32m), Fabregas (£8m), Zouma (Loan – £7m), Morata (Loan – £6m), Bakayoko (Loan – £5m), Batshuayi (Loan – £3m), Pasalic (Loan – £2m), Omeruo (Loan – £0.7m), Aina (Loan – £0.5m) and Miazga (Loan – £0.3m) for a combined £65m.

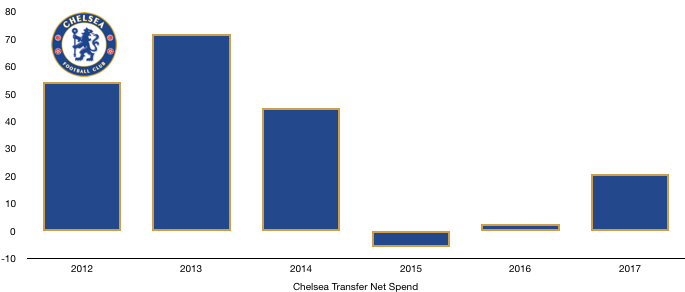

This led Chelsea to a net transfer spend of £123m, up from £54m in 2018, a 128% rise. This showed huge backing for Sarri, spending substantially to replace Courtois, whilst also backing their former manager in signing one of his Napoli favourites in Jorginho.

It is worth noting that Pulisic was signed in anticipation of the Hazard sale at the end of the season and their impending transfer ban so skews their spending significantly.

Kepa has proven a good signing despite a few troubles while the quality of Jorginho cannot be denied, fans are still adapting to his playing style and main qualities. Neither Fabregas nor Courtois were particularly missed.

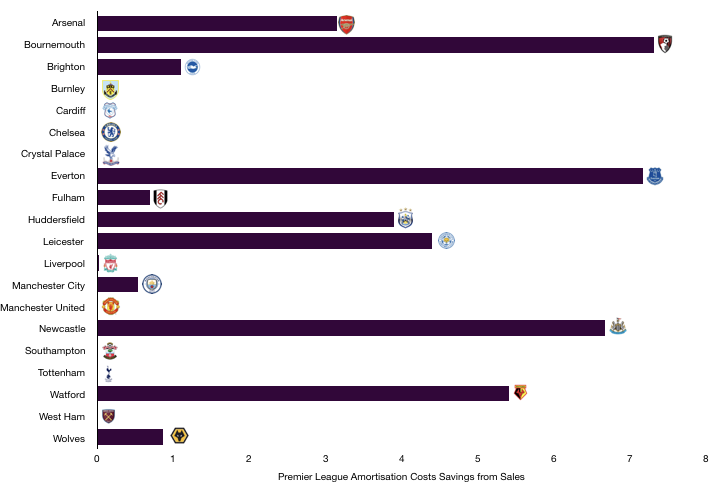

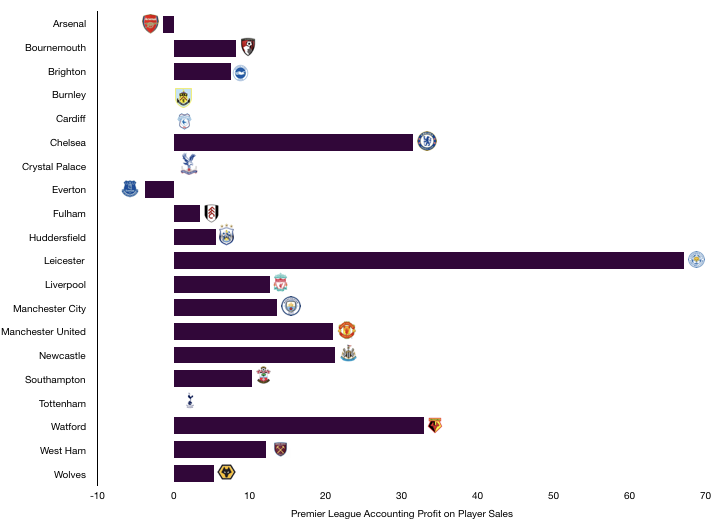

With sales in the year much lower than in 2018, Chelsea recorded a profit on player sales of £60m, significantly down on the £113m recorded in 2018, explaining a large part of their huge loss in 2019.

With the record sale of Hazard to be accounted for in their 2020 accounts, Chelsea are likely to see a huge rise in their profit on player sales, and hence a large improvement on their profitability this year.

Transfer debts

In debt terms, Chelsea are owed a huge £156m in transfer fees, of which £124m is due in 2020. Whilst that sounds fantastic, Chelsea also owe £154m in transfer fees (of which £116m is due in 2020) and therefore are essentially break even. This means that future transfer plans shouldn’t be affected significantly by past transfer windows.

Chelsea may also have to pay another £10m in contingent transfer fees should certain clauses be met, something that will not worry their executives much.

Cash

In cash terms, Chelsea spent a huge £282m in cash on player transfers in 2019, only recouping £120m, a substantial £162m outlay.

Such a large outlay required further funding from their Russian owner (see debt analysis).

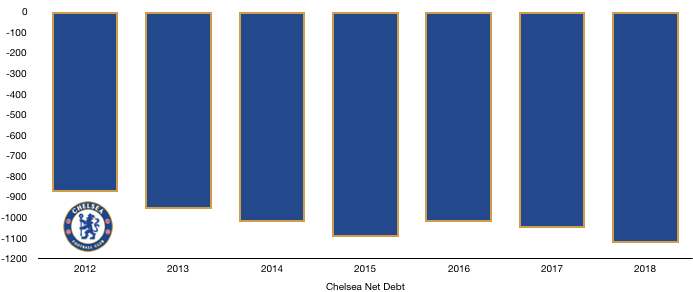

Net Debt Analysis

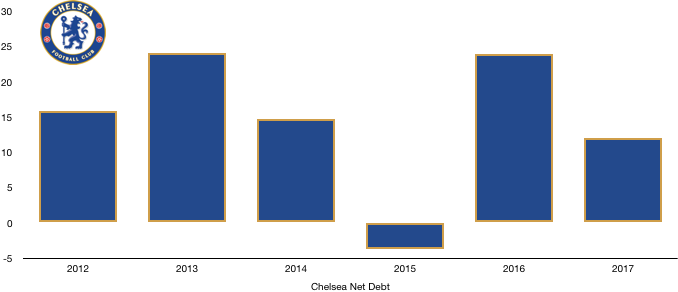

Chelsea Usually maintain a cash reserve of around £30m and this was consistent with their 2019 balance which increased from £32m to £37m (16%). The huge cash outlay on transfers and the large loss recorded were funded by a net cash inject from Roman Abramovich of £266m, showing that he still has an interest in the club despite his visa issues and newspaper reports.

This £266m injection took the amount owed by Chelsea to Roman Abramovich to nearly £1.4bn (£19m of the cash was input as a capital contribution and hence is excluded from debt), showing the huge sums the Russian has invested into the club over the years.

The cash injection of £266m was the largest by Roman Abramovich in many years, showing a renewed ambition of the owner and the difficult financial year Chelsea endured without Champions League football.

Net debt hence increased from £1,155m to £1,383m (20%) as their reliance on Roman Abramovich once again ramped up after debt levels had remained at around £1.1bn for the last few years.

Chelsea remain unconcerned by UEFA Financial Fair Play issues knowing that the losses incurred are highly likely to be reversed next year after the sale of Hazard and their return to the Champions League, making any sanctions unlikely at this stage.

Should Chelsea fail to retain their Champions League status in 2020, Chelsea may find themselves in a spot of both with UEFA in the future.

Thanks for reading – Share with a Chelsea fan!