Arsenal experienced their first Wenger-less year in the 2018/19 season, with Unai Emery taking the reigns following a steady decline in performance in recent years.

The early signs were promising, and it would’ve been a successful season had the club not succumbed to a 4-1 loss to London rivals Chelsea in the Europa League final and secured a Champions League place for the coming season.

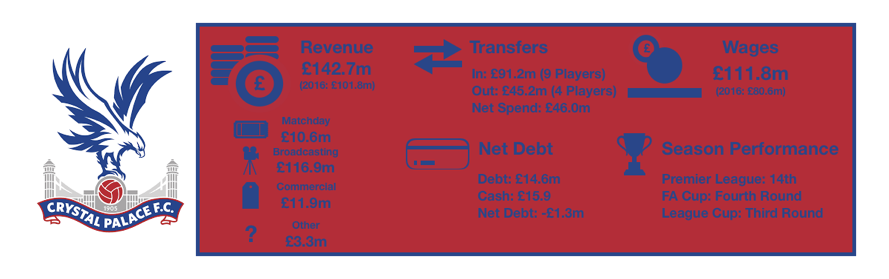

A slight improvement in the Premier League was welcomed, however defeat at home to Crystal Palace and a draw with Brighton in the last few weeks of the season robbed Arsenal of a Top 4 finish which was very much available with London rivals Chelsea and Tottenham stumbling into the Champions League.

This article aims to predict how last season affected Arsenal and their finances and what the future holds.

Let’s delve into the numbers.

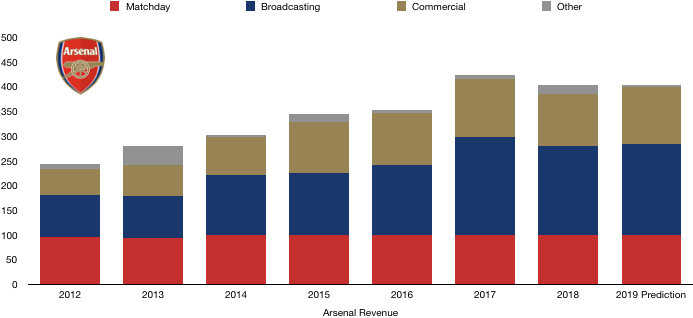

Revenue Prediction

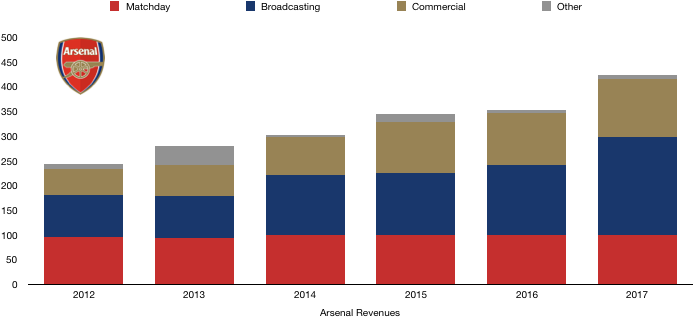

Matchday Revenue

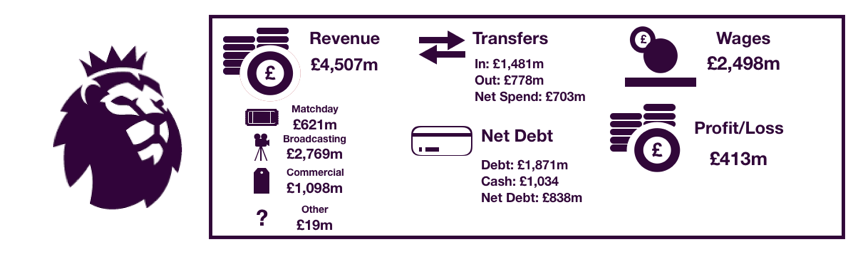

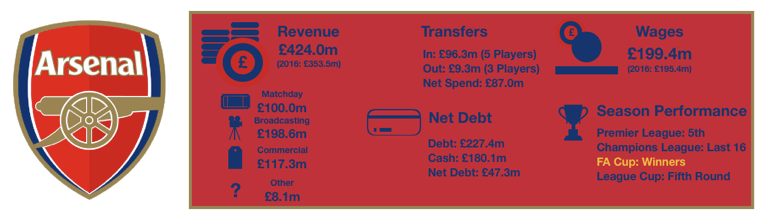

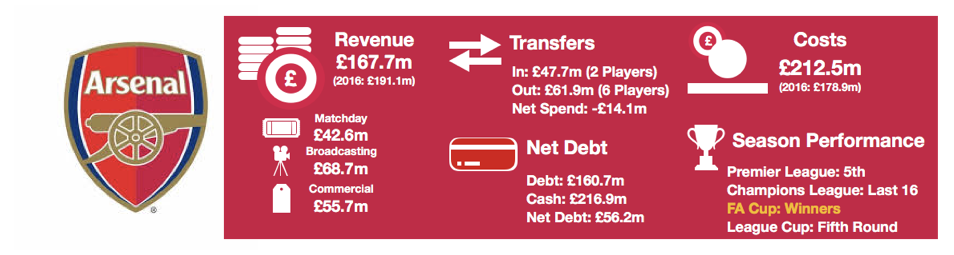

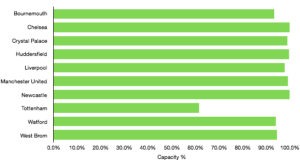

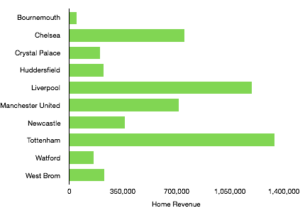

Arsenal’s matchday revenue was £99m in 2018, falling slightly from £100m in 2017 after a difficult season. Despite their Europa League run this season, Arsenal had the same number of competitive home games as in 2017/18 and therefore matchday revenue is unlikely to increase substantially.

However, Arsenal should see a slight increase due to reaching the Europa League final, with the competition (and ticket prices) being considerably more lucrative than the League Cup (in which Arsenal reached the final and had many home games in 2018).

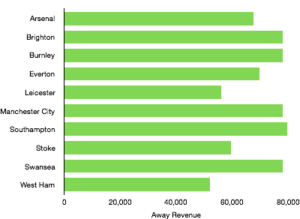

Premier League average attendances rose from 59,323 to 59,899 (1%) and therefore, we expect a slight increase of about 1% in matchday revenue to £100m.

Broadcasting Revenue

Broadcasting revenue was £180m in 2017/18 after a poor season with the only highlight being a League Cup final appearance.

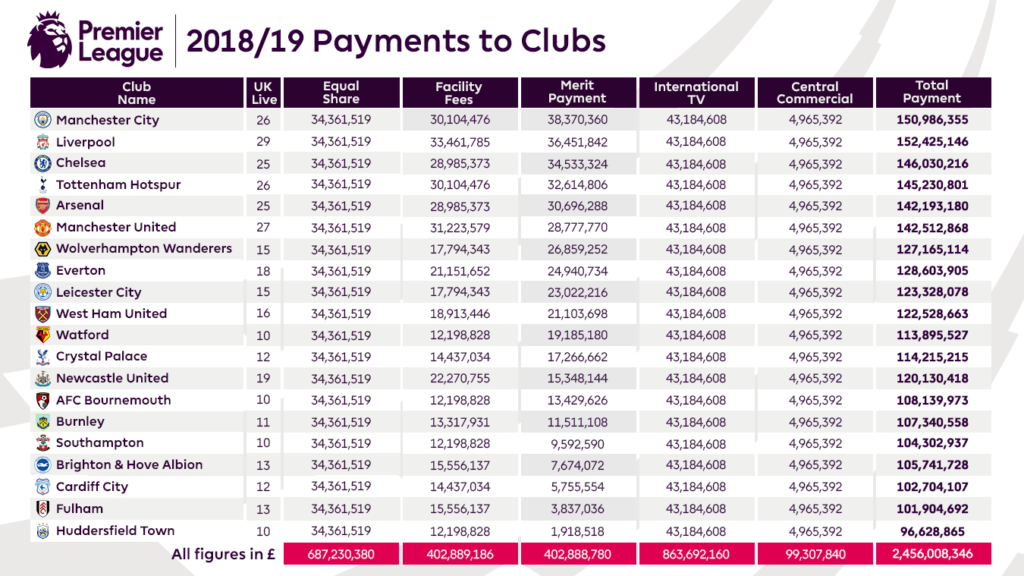

Despite finishing a position higher in the Premier League last season, Premier League prize money remained at £142m as despite distributions increasing, Arsenal featured on live TV three less games last season than in 2018.

Arsenal also fared far worse in the League Cup this year, only reaching the Quarter Finals compared to a final defeat in 2018. However, the prize money available in this competition is tiny and will have an immaterial impact on Arsenal’s finances.

Going a round further in the FA Cup will boost revenue by a few hundred thousand pounds for Arsenal which will more than negate the fall in revenue from the drop in League Cup performance.

Arsenal did manage to go a round further than last season in the Europa League, reaching the final in Baku and despite not achieving the result desired, will likely see a boost in revenue of around £4-6m from prize money of the competition which has become more lucrative in recent seasons.

With much of Arsenal’s other competition revenue remaining the same as in 2018, this should see Arsenal’s broadcasting revenue increase by around £5m to £185m.

Commercial Revenue

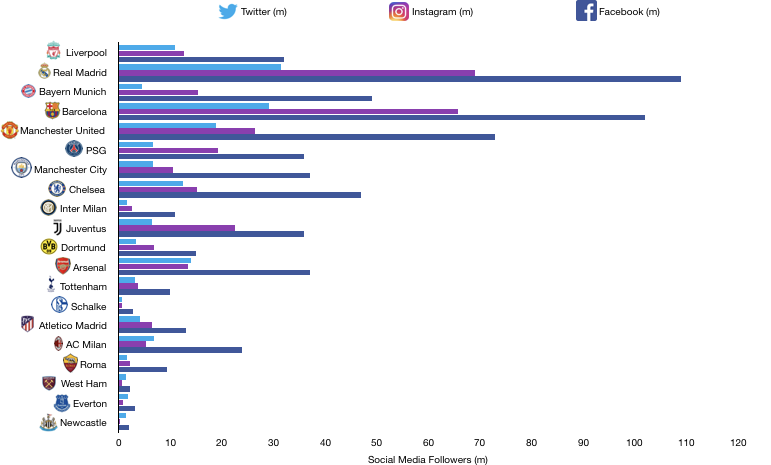

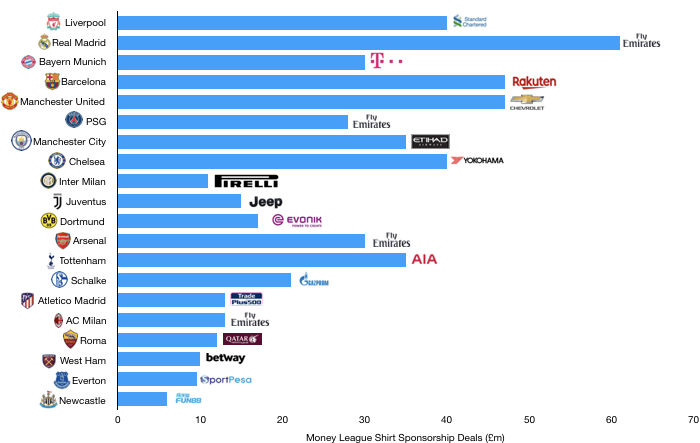

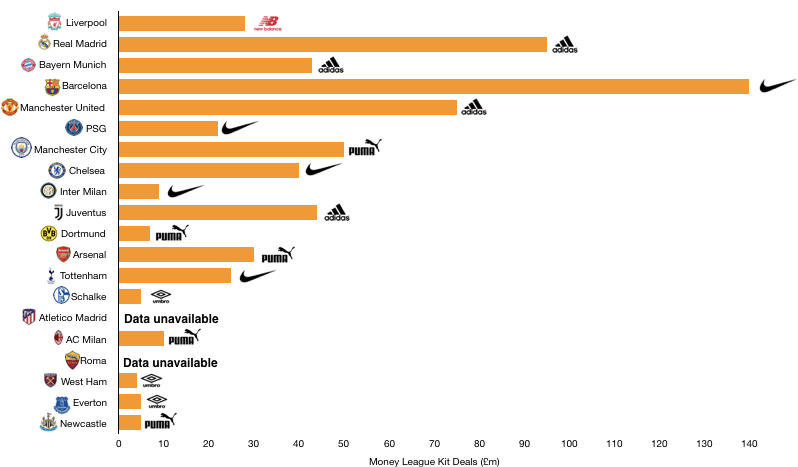

Commercial revenue saw a drop from £117m to £107m in 2017/18 in Wenger’s final season. We expect commercial revenue to bounce back in what seems to be a new drive at the Emirates to boost their relevance once more. The general popularity of the Premier League has seen all club’s commercial income rise and this should be no different for Arsenal.

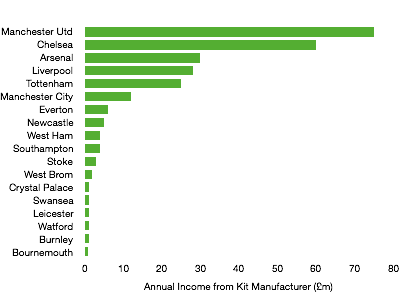

A new Adidas deal will significantly boost revenue in 2020, however before that comes into effect, we expect a rise in revenue to around £115m to be reasonable.

Other Revenue

Arsenal also had a significant amount of other revenue of £17m, compromising of transfer loan income (£2m) and property sales (£15m).

Arsenal only have one more property in their portfolio after the sale of a property next to Holloway Road Station in 2018 and there is no evidence this has been sold or the what the value of this property is. With the loans of the likes of Asano, Nelson, Ospina and Chambers, it is likely Arsenal obtained £3-5m on these loans.

Therefore, we predict that Arsenal’s other revenue will only be £5m, UNLESS they sale their remaining property which could bring in a significant chunk of extra income.

Total Revenue

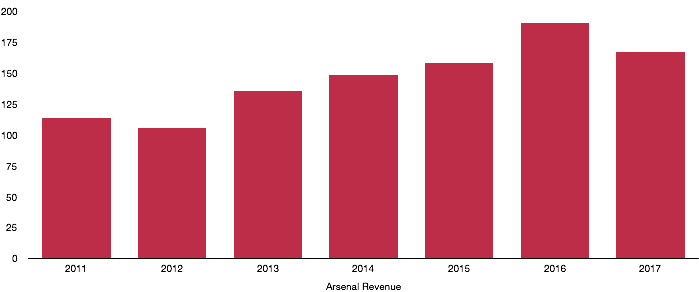

Overall, Arsenal’s revenue should be around £405m, a slight increase on 2018 (£403m) due mainly to potential rises in commercial revenue and their Europa League campaign. Revenue may increase by a larger extent if that final property held is sold.

All-in-all, revenue is likely to remain fairly similar to last year due to competition performance improving only slightly with the club remaining trophy-less and Top 4-less.

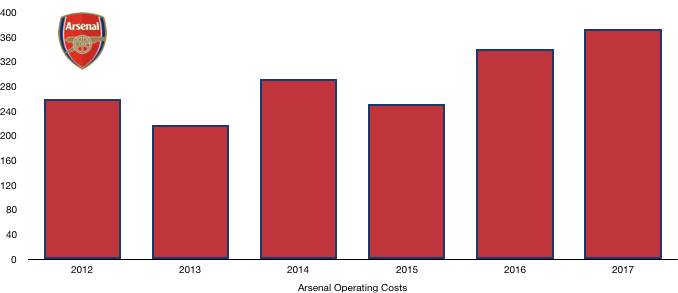

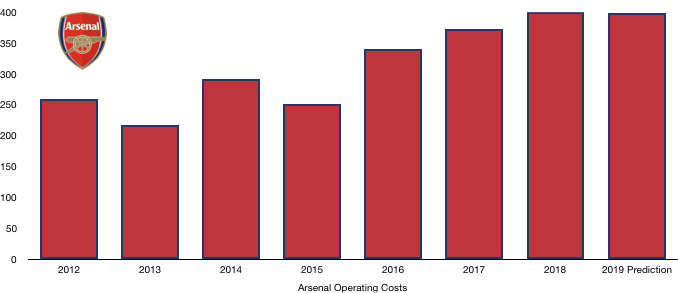

Cost Predictions

Amortisation

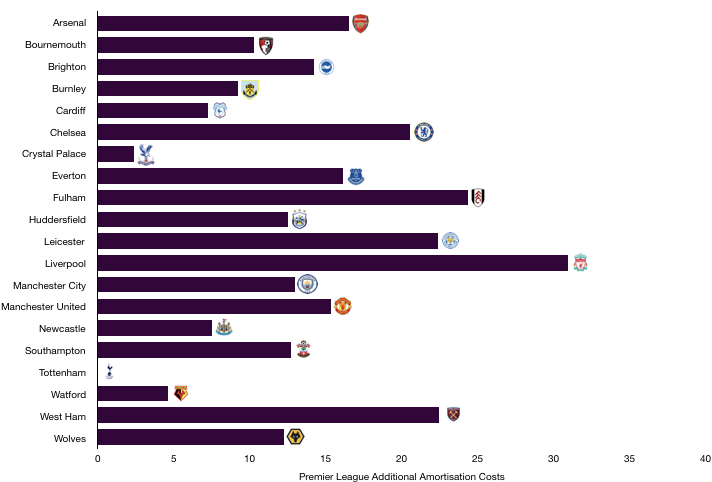

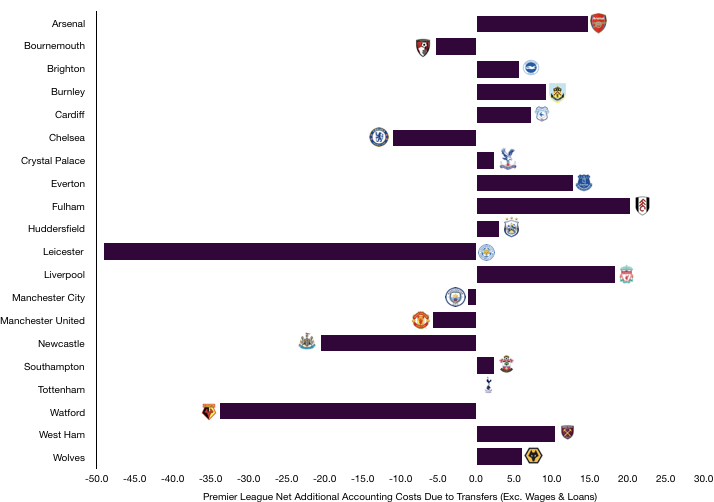

Amortisation is a large portion of total costs to a Premier League club and Arsenal incurred amortisation of £86m in 2018. The signings of Torreira, Leno, Sokratis and Guendouzi will add a fair bit to these costs while the departure of Perez will reduce this slightly.

Based on the transfer fees and contract lengths of the new signings, we expect amortisation to rise by around £15m to £100m for Arsenal.

Exceptional Costs

As mentioned, Arsenal sold one of their two remaining properties in 2018 which brought the cost of that property into their expenses last year of £9m. With the sale of the one remaining property unknown, property costs have been excluded in our 2019 prediction.

The departure of Wenger and some of his staff and then the costs of bringing in Emery, Arsenal incurred exceptional costs of £17m at the end of last season. These costs are obviously not expected again and have been excluded.

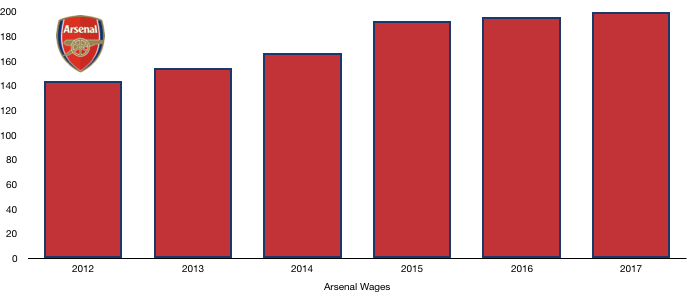

Wages and Other Costs

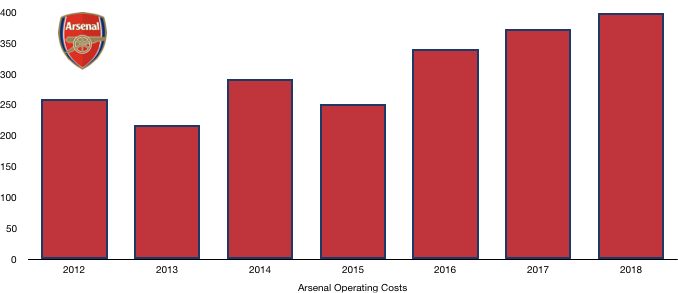

Other expenses such as stadium maintenance, lease costs etc. amounted to £88m in 2018. We expect these have increased to around £95m in 2019 based on recent trends.

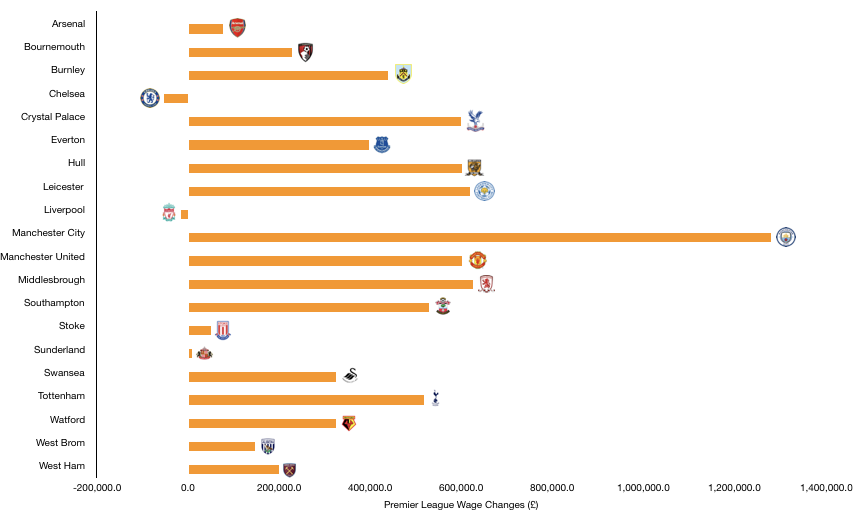

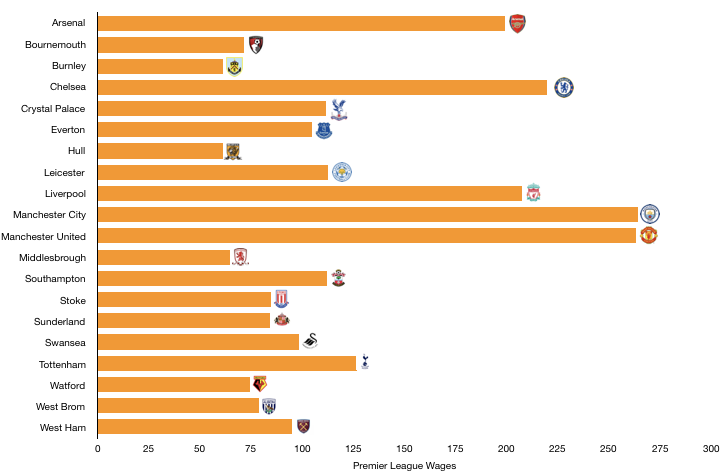

Wages are the most difficult area of finances to predict due to the opaque nature and privacy of these amounts. Arsenal brought in Torreira, Leno, Sokratis, Guendouzi and Liechtensteiner as first team players in 2019 while high earners such as Cazorla and Mertesacker departed the Emirates.

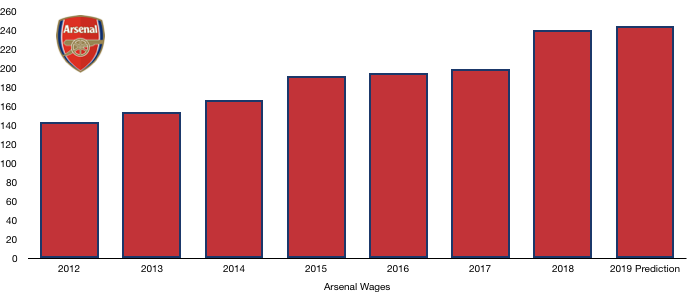

Therefore, despite these arrivals we do not expect wages to increase significantly and as such we predict wages are likely to increase from £240m to around £245m.

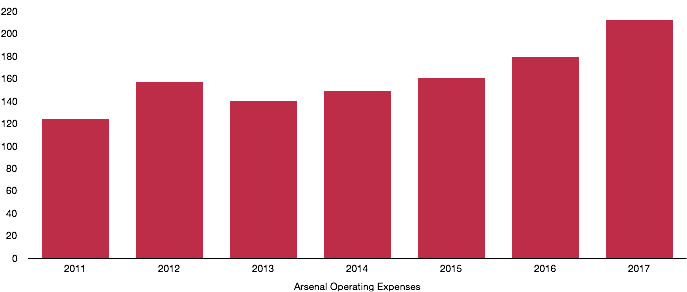

Total costs

Overall costs are hence due to increase to around £450m subject to the effects of salary bonuses and property sales. Furthermore, contract renewals (which were few) may be more significant than first thought.

Lastly, should there be any exceptional costs (which in nature cannot be predicted) costs may increase to a larger extent.

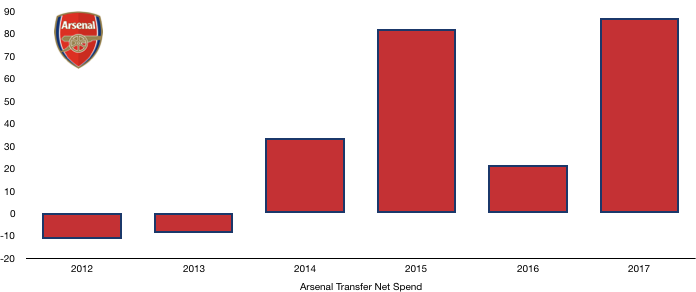

Transfers Analysis

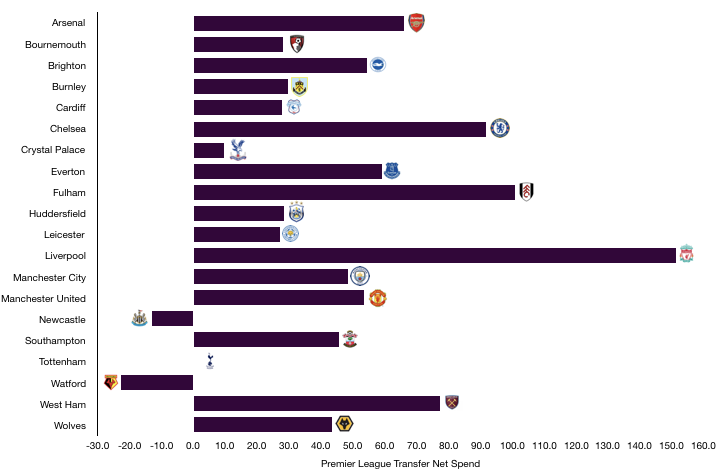

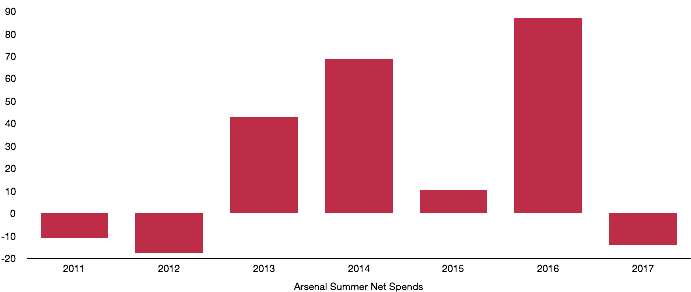

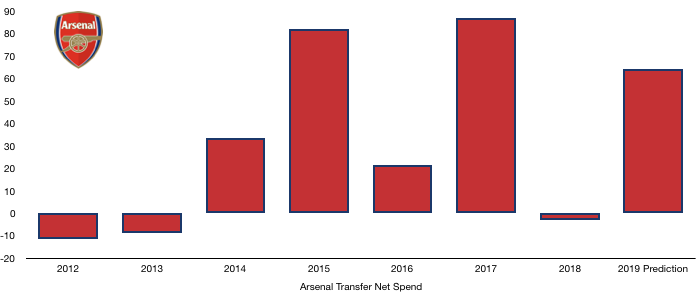

Arsenal brought in Torreira (£26m), Leno (£23m), Sokratis (£14m), Guendouzi (£7m) and Liechtensteiner (Free) as first team players in 2019 for a combined £72m.

Departing were Perez (£4m), Campbell (£1m) and Akpom (£1m) for a combined £6m.

This led Arsenal to a net transfer spend of £66m, much changed from the net transfer income of £3m in 2018.

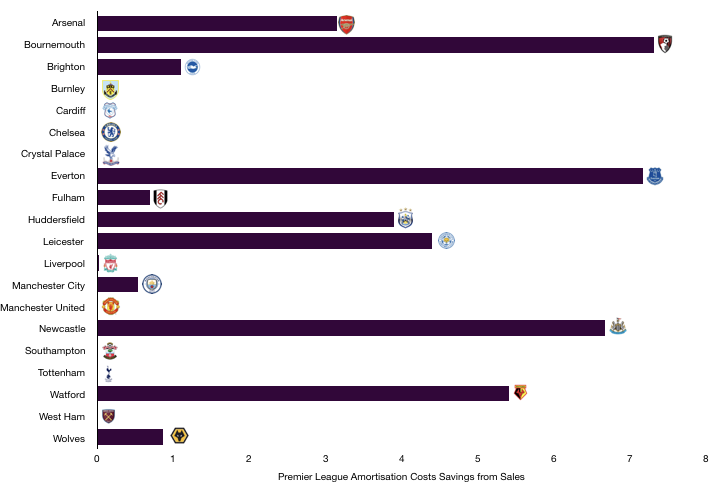

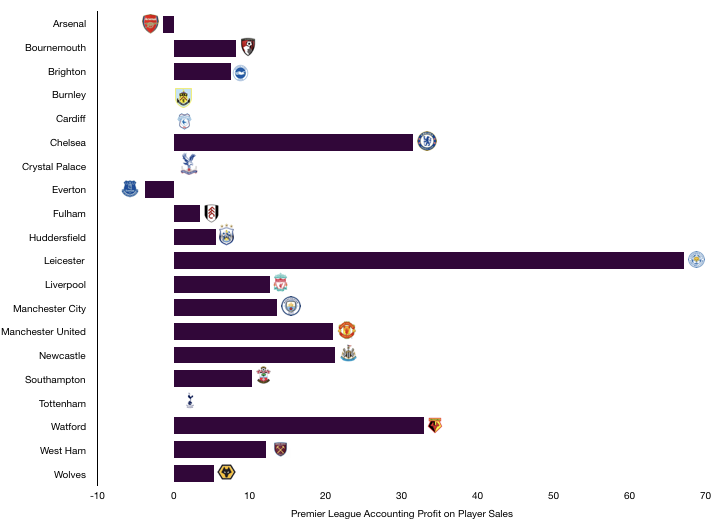

However, in 2018, Arsenal saw a host of departures (£141m) which led to a massive profit on player sales of £115m due to the sales of the likes of the Ox, Walcott, Giroud, Szczesny etc.

With the lack of player sales in 2019, Arsenal will be lucky to record a profit on sales of £5m, a drop of more than £110m, which will see profitability take a huge hit.

Cash will also take a hit after spending in 2018/19, with the club already owing clubs a net £50m in transfers (Arsenal owe around £100m and are owed about £50m), plus the £72m spent this season, showing why Arsenal are so desperate to agree deals in instalments this season (Hi Zaha and Pepe).

Arsenal need not worry however with cash reserves of £231m in the bank.

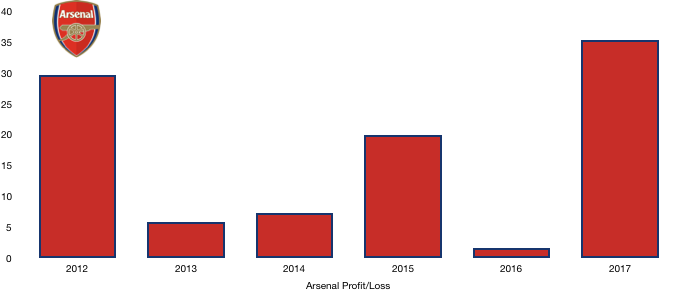

Profit/Loss Prediction

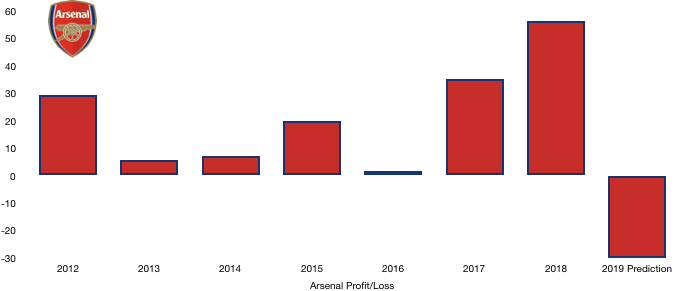

Arsenal made a pre-tax profit of £70m (post tax: £57m) in 2018 largely due to player sales that were not evident in 2019. As mentioned, player sales are likely to fall by around £110m and with revenue and costs predicted to remain at similar levels, a loss of between £30-40m is likely.

A return to the Champions League is hence vital to the club’s long-term finances. However, the new Adidas deal will see a significant bump in revenue which should help the club to return to profitability in 2020, subject to how they perform in the upcoming season and player sales.

I hope you enjoyed this article! Share with a Gunner and look out for when the actual finances are released to see how we fared!