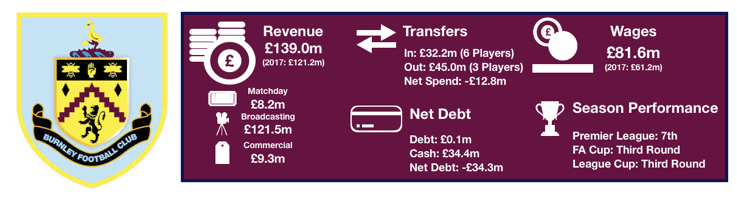

Burnley secured a third consecutive year in the Premier League in style by beating all expectations and achieving a 7th placed finish. This astonishing achievement meant Burnley qualified for the Europa League, with 2018/19 being their first season in Europe for over 50 years.

Their success in the Premier League came at the detriment of their domestic cup campaigns with poor performances in both.

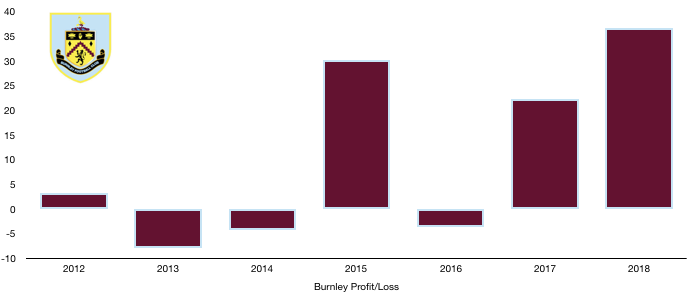

A great season was capped off with recording breaking profits, with profits rising from £22.2m to £36.6m (65%).

Let’s delve into the numbers.

Revenue Analysis

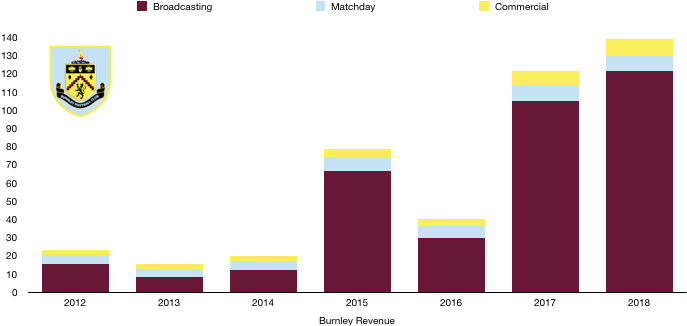

Burnley saw revenue reach record levels, rising from £121.2m to £139.0m (16%) after a great season.

Matchday revenue remained stable at £8.2m. Average attendance increased from 20,558 to 20,688 (0.6%), however Burnley are restricted by their stadium which only seats 21,401. This makes expanding Turf Moor a priority should Burnley wish to increase long term revenue.

Broadcasting revenue rose from £105.0m to £121.5m (16%) after Burnley finished 9 places higher than in 2017. The 7th placed finish was the main reason for their rise in revenue, meaning that with Burnley likely to finish much lower in the league this season, Broadcasting revenue will be hit.

Commercial revenue rose from £8.0m to £9.3m (16%) as Burnley saw their popularity grow after a great season and further consolidation of their Premier League status. This should increase going forward due to their European campaign and ongoing Premier League status.

Looking ahead, Burnley will most likely see a similar level of revenue despite a poor campaign.

The Europa League money should offset some (or all) of the lost Premier League revenue however due to Burnley failing to make the group stage, their Europa League windfall may be less than hoped and broadcasting revenue may fall.

Matchday revenue will rise slightly after more home games this season, while commercial revenue will increase with another season in the Premier League.

Costs Analysis

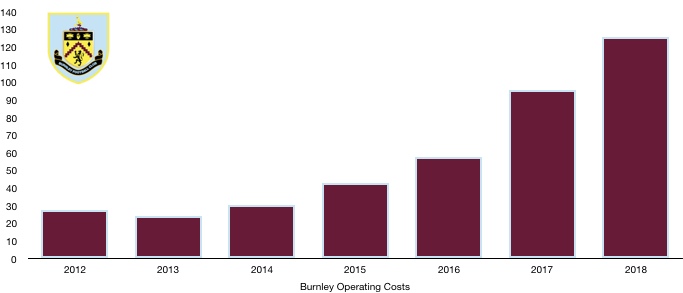

Burnley saw their costs continue to rise as they grow as a Premier League club. Operating expenses rose from £95.8m to £125.8m (31%). This rise of 31% was far greater than the 16% rise in revenue, hurting profitability.

Amortisation costs increased from £22.4m to £27.4m (24%) signifying player investment, although they had a negative net transfer spend. This was largely due to the sale of Keane who was brought cheaply so carried little amortisation charge, and since a large portion of this was reinvested, amortisation rose.

There are minimal interest costs for Burnley due to the absence of debt in the club (see debt analysis).

Burnley paid tax of £8.5m, an effective tax rate of 19%. This is equivalent to the UK Corporate tax rate of 19%.

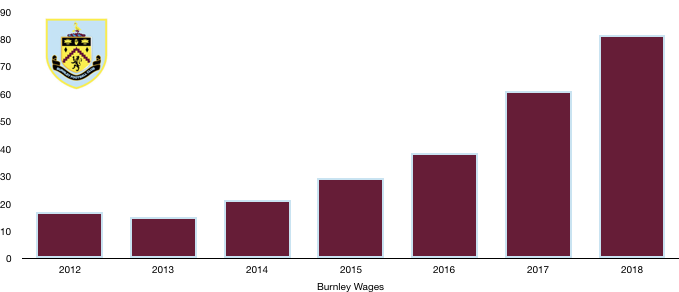

Wages once again rose but remained well below £100m, increasing from £61.2m to £81.6m (33%) after the addition of higher-earners and also the reward of new, lucrative contracts for their key players.

This wage bill is still closer to the bottom of the wage charts in the Premier League, but is slowly becoming more competitive, making their achievements in 2018 even more astonishing.

Burnley did not disclose any director renumeration in 2018.

Looking ahead, costs will continue to rise with the times. Burnley signed new players which will increase both amortisation and wages, although wages may fall if Burnley are relegated (due to relegation wage drops), although this looks extremely unlikely after a strong run of form.

Transfers Analysis

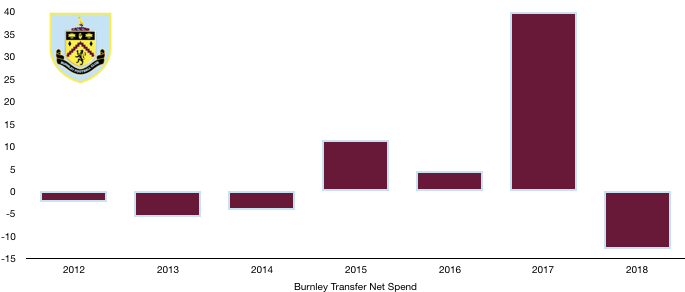

Burnley had a busy transfer season in 2018, signing 6 players and selling 3.

In came Wood (£14.8m), Cork (£8.2m), Wells (£4.9m), Walters (£2.1m), Lennon (£1.5m) and Bardsley (£0.8m) for a combined £32.2m.

Leaving Turf Moor were Keane (£25.7m), Gray (£18.4m) and Darikwa (£1.0m) for a combined £45.0m.

Therefore, Burnley achieved a 7th placed Premier League finish despite a negative net spend of £12.8m.

Wood, Cork and Lennon proved great signings at relatively low fees and fitted well with the playing style of the club, slotting in seamlessly. Wells, Walters and Bardsley also proved good back up options.

Burnley recorded a profit on player sales of £30.7m due to the sales of Keane and Gray, this makes up the majority of the profit Burnley made, although they would still have been profitable without these sales, something most clubs cannot put their hands up too.

However, there was a lack of player sales however this season, meaning Burnley will see a steep fall in their profits this year.

In cash terms, Burnley spent £41.4m and recouped cash of £14.6m, a sizeable net outlay of £26.8m despite recording a net transfer income of £12.8m after negotiating to be paid in instalments.

Due to this, Burnley are owed £27.9m in transfer fees, although they do owe £22.5m themselves (£13.3m due this year), a net debtor position of £5.4m, a good position to be in.

This should also help with future transfer plans as they do not need to fund any previous transfers.

Burnley could potentially have to pay a further £13.0m in transfer related fees if certain clauses are met, although it is unlikely this will all become payable.

Debt Analysis

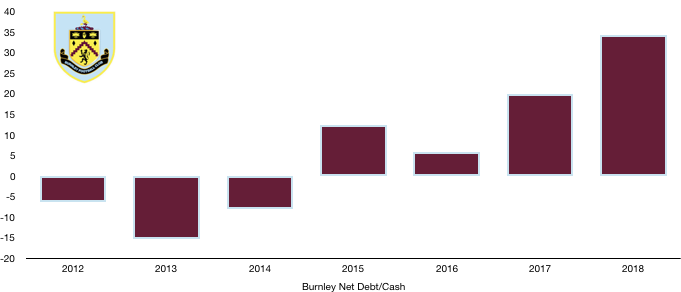

There is not much to say about Burnley from a debt perspective.

Cash levels grew even more robust, rising from £20.1m to £34.4m (71%). This was largely due to the profits recorded from rising revenues which helped fund their transfer outlay (although they are due to receive more transfer fees later) and also allowed Burnley to spend a sizeable £6.1m on club infrastructure, a much-needed investment as they continue to grow as a Premier League club.

Debt levels halved! From £0.2m to £0.1m …

Hence net cash increased from £19.9m to £34.3m (72%).

Burnley are, and have been an essentially debt-free club for years. Burnley are a model club for how to sustainably run a football club, being patient to reach their goals and not ever overstretching themselves.

Sometimes this can be criticised as too prudent, an argument that has some merits. Burnley should be careful not to be too prudent and risk an unneeded relegation (although I would expect them to bounce right back) which makes this season likely to be the wake-up call they need.

With their robust finances, now seems a great time to begin expanding their stadium and investing a bit heavier (but smart and sensibly) in the squad.

Thanks for reading! Share with your network.