Southampton endured a difficult season in 2018, narrowly avoiding relegation with a 17thplaced finish after years of selling their best players nearly ended in disaster.

Pellegrino struggled to spend well during the season, with the previously excellent scouting team struggling to find any gems leading to departing players not adequately being replaced. A run to the FA Cup Semi-Final was a nice highlight for Southampton, with a trip to Wembley and survival meaning the season was actually not that bad.

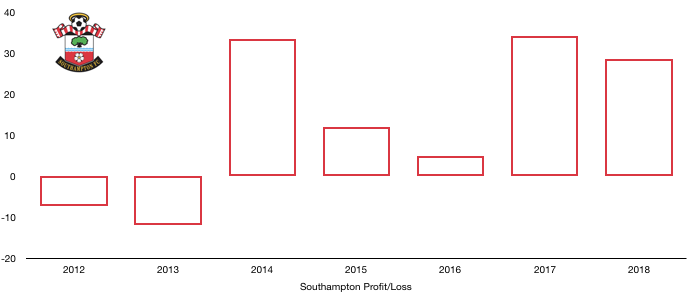

A poorer season than usual on the pitch saw profits fall from £34.1m to £28.6m (16%), with a profit being recorded only due to the sale of Virgil Van Dijk. Southampton would have had a loss of more than £30m without his sale.

Let’s delve into the numbers.

Revenue Analysis

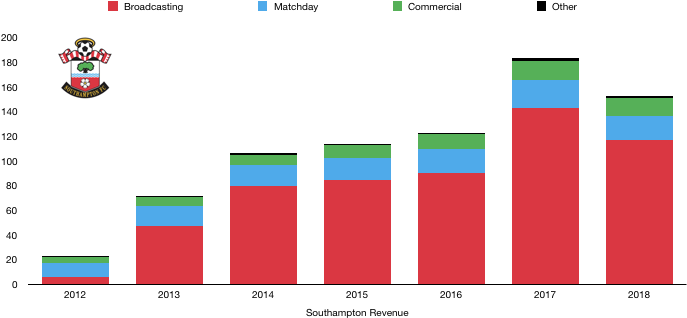

Southampton’s revenue suffered after a poor season, falling from £183.7m to £152.6m (17%) due primarily to a drop in league performance and the lack of Europa League football.

Matchday revenue fell from £22.4m to £19.2m (14%) as the number of home games fell and attendances at games suffered due to poor performances on the pitch and disgruntled fans. It was also unfortunate that their run to the FA Cup semi-final only yielded one home game (although much of the revenue is shared in FA Cup games).

Broadcasting revenue fell significantly, falling from £143.0m to £117.0m (18%) due to their drop in league position, lack of Europa League football and a much poorer League Cup campaign.

Southampton’s run to the FA Cup semi-final failed to offset these drops significantly. It is expected this level of broadcasting is more likely to be their level going forward, with another Europa League campaign in the near future unlikely as things stand.

Commercial revenue fell slightly from £15.5m to £14.9m (4%) which is not too bad considering a poor season, more or less maintaining all commercial deals. Southampton will be hoping to improve this and must be careful current sponsors are not scared away by the ongoing threat of relegation.

Other revenue pretty much halved from £2.8m to £1.5m (46%).

Looking ahead, Southampton are likely to see a similar level of revenue next year, regardless of whether they stay in the Premier League or not. Matchday revenue is likely to remain stable at around £20m, while broadcasting may increase or decrease slightly based on their final league position. Therefore, any growth in revenue will largely be dependant on their final Premier League position and a strong commercial campaign.

Costs Analysis

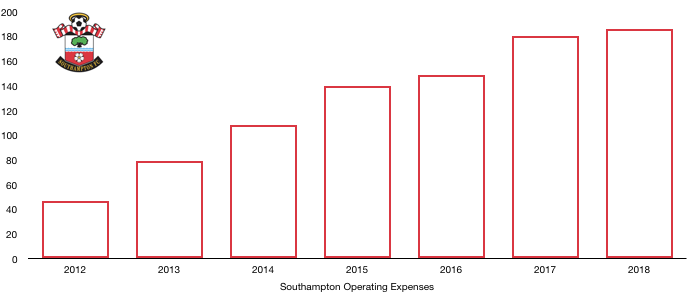

Southampton’s costs remained relatively stable, increasing from £180.6m to £186.2m (3%) as they prudently managed costs with the threat of relegation looming.

Amortisation grew by a third, rising from £27.4m to £36.7m (34%) as Southampton invested in the playing squad with around £55m of spending to replace outgoing players who were attracting lower levels of amortisation.

Interest charges however fell significantly, dropping from £3.9m to £2.3m (41%) after Southampton changed their debt profile (see debt analysis), reducing interest payments this year.

Southampton pretty much paid their full due of tax, paying tax of £6.3m, an effective tax rate of 18% which is broadly in line with the current UK corporate tax rate.

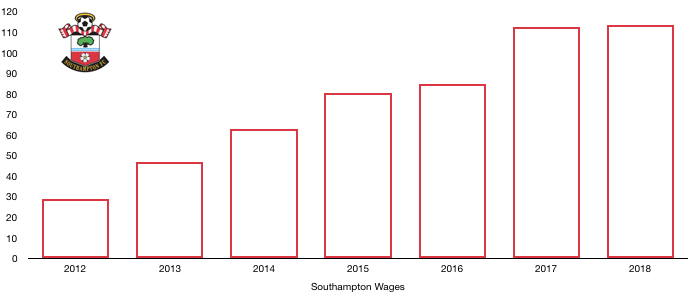

Wages remained relatively stable, increasing slightly from £112.5m to £113.3m (1%) as Southampton replaced outgoing players with those on similar (or lower) wages.

Southampton should be commended for not going for broke to retain their Premier League status and still maintaining strong wage controls, meaning even if relegation does eventually come, Southampton should have the resources and financial prudence to bounce back without their financial health unravelling.

Directors of Southampton saw their pay drop by a third, falling from £1,562k to £1,047k (33%) after a disappointing season.

Looking ahead, Southampton are likely to see a rise in costs with wages and amortisation likely to rise following the reinvestment of the Van Dijk cash. This will damage profitability further with revenue likely to remain relatively stable.

Transfers Analysis

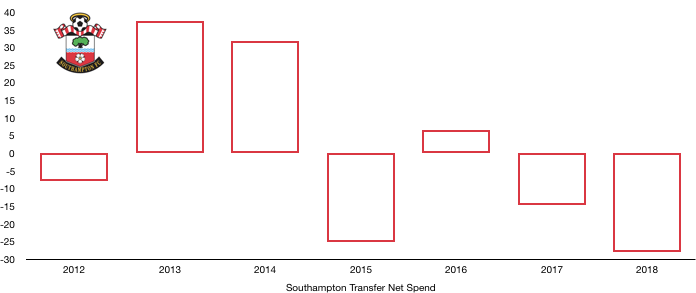

Southampton had a high-profile transfer period after a 6 month transfer saga ended in Virgil Van Dijk heading to Anfield for a world-record transfer fee for a defender. The saga not only saw Southampton suffer due to the loss of a star player, but the uncertainty affected their league form and meant they couldn’t reinvest the cash as quickly as they would have probably liked in hindsight.

In came Carrillo (£19.8m), Lemina (£15.5m), Hoedt (£14.4m) and Bednarek (£5.4m) for a combined £55.1m.

Out went Van Dijk (£70.9m) and Rodriguez (£12.3m) for a combined £85.3m.

This led to a negative net spend of £28.0m, the second successive year Southampton have been in such a position.

Southampton failed to spend well, with the signings of Carrillo and Hoedt not going to plan while Bednarek is young and the jury is still out on whether he will be a success. Lemina however has shown promise and looks a good signing.

The sale of Van Dijk may not have helped the Saints on the pitch, but it did off the pitch as Southampton recorded a profit on player sales of £68.9m, meaning without the sale of Van Dijk (and to a lesser extent Rodriguez), Southampton would have recorded a loss of just over £40m.

This means that with costs sets to rise and revenue to remain at a similar level this year, Southampton are likely to record a large loss due to the lack of big sales this year.

In cash terms, Southampton spent £65.9m and received £79.9m, a net cash flow in of £14.0m which helped boost the club’s cash reserves substantially. This is likely to be reversed next year once the Van Dijk cash is spent.

More worryingly, Southampton are owed £35.0m in transfers (of which £30.4m is due this year). However, Southampton owe other clubs £74.0m in transfers (of which £40.9m is due this year), a net debt position on transfers of £39.0m which may affect future transfer plans, with some of the Van Dijk cash probably earmarked to pay these transfer fees.

Southampton also have potential transfer fees payable of £19.2m if certain transfer clauses are met.

Debt Analysis

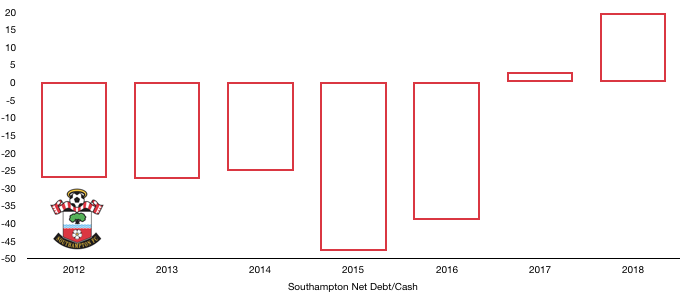

As Virgil Van Dijk left, in came the money for Southampton as cash levels rose. Cash reserves shot up from £40.6m to £57.1m (41%).

The balance owes a lot to the sale (and timing) of Van Dijk as the club are yet to spend a large amount of it. Southampton also received new loans of £20.5m which boosted cash substantially.

Debt levels remained relatively stable, dropping slightly from £37.8m to £37.3m (1%) despite new loans, as Southampton move some debt (capitalised) to equity and used it repay some bank debt, meaning the amount moved to equity will now not be repaid. This saw £23.1m of debt taken off the books and new shareholder loans enter with 4.25% of interest from their new owners. This replaced bank loans with interest of 0.5% which should see interest costs rise next year.

Therefore, Southampton saw their net cash position balloon from £2.9m to £19.8m (583%), meaning the club are in great financial health. Survival is still of paramount importance due to their profitability already falling and the need to at least maintain current revenue levels and sell players to remain in profits and at good cash levels.

The new owners have yet to really invest heavily in Southampton and it remains to be seen what their level of ambition is, although the sacking of Hughes shows they’re not content to be in a relegation battle. A net spend this summer is a positive sign (although largely due to the sale of VVD), and fans will be hoping this is a sign of things to come.

Thanks for reading – Share below with a Southampton fan!