Hull endured a second successive season in the Championship following relegation from the Premier League in 2017.

It was an underwhelming season once again for the Tigers, who finished mid table in 13th, improving on the previous season’s 18thplaced finish.

A poor end to the season for Nigel Adkins’ side spelled the end of a late play-off push, something the club will be hoping to amend in the coming season under new boss Grant McCann.

Financially, Hull remain one of the few profitable Championship clubs due to the benefit of parachute payments following relegation and a number of player sales in the 2018 season. Despite the financial boost these gave, their reduction and the lack of player sales in 2019 have seen Hull’s profit after tax fall from £19m to £3m (84%), showing a significant downward trend in profits.

Let’s delve into the numbers.

Revenue Analysis

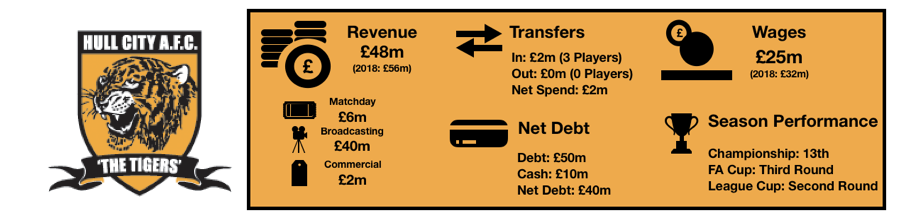

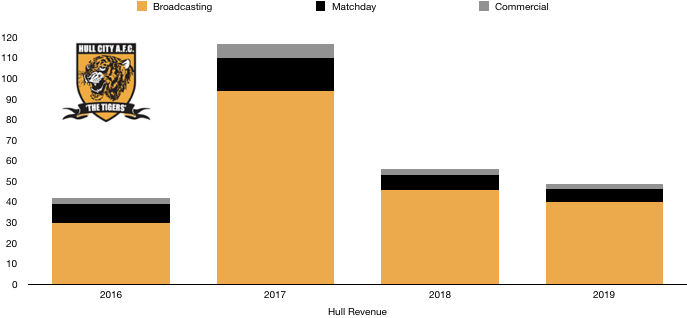

Despite an improved domestic campaign, Hull saw underlying revenue (excluding payments) fall from £12.3m to £11.2m (9%). When taking into account parachute payments the drop is far greater, falling from £55m to £48m (13%).

This was primarily due to a fall in match day revenue of £1m from £7.2m to £6.2m (14%) as average attendances fell from 15,622 to 12,165 (22%) as fan goodwill faded following a poor season. Hull also benefited in 2018 from a run to the FA Cup Fifth Round, featuring a lucrative trip to Stamford Bridge.

Broadcasting revenue increased, rising from £2.3m to £2.7m (17%) after Hull finished 5 places higher in the Championship last season. This is despite exiting the FA Cup at an earlier stage.

Parachute payments began to taper off following a prolonged stay in the Championship, falling from £43m to £37m (14%). These parachute payments will continue to decline over the next two seasons before ceasing, meaning Hull may have to prioritise a return to the Premier League or face worsening finances.

Hull suffered from a second successive season in the Championship commercially, with commercial revenue falling from £2.8m to £2.2m (21%). Should Hull fail once again to gain promotion (or challenge), commercial revenue may fall below £2m.

Looking ahead, revenue is very likely to fall in the 19/20 season due to another drop in parachute payments. Even if promotion is secured, in the short run (next year), Premier League income would lag a season behind the fall in parachute payments and therefore revenue is likely to deteriorate further.

Costs Analysis

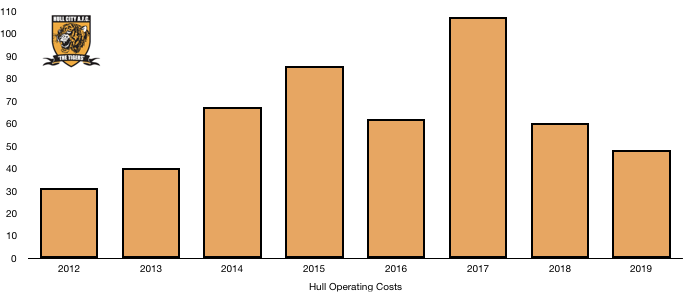

Hull have undergone cost control in order to safeguard their finances, with revenue falling year on year following relegation. Total costs fell from £60m to £49m (18%), a greater fall than revenue, improving underlying profitability.

Amortisation remained relatively stable, increasing from £12.3m to £13.0m (6%) after minimal player investment (just over £2m was spent in the season – see transfers analysis section).

Interest costs fell from £3.1m to £2.4m (23%) after a decrease in the debt owed by the club (see debt analysis section).

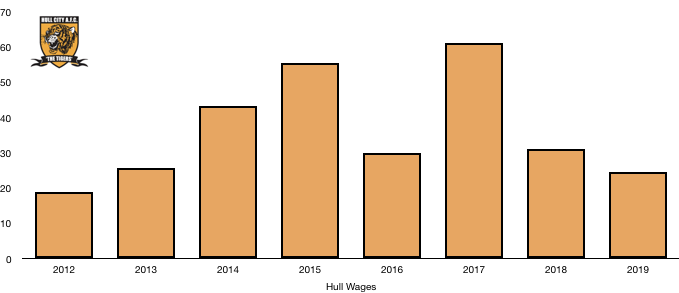

In a bid to remain profitable, Hull adopted strict wage controls to reduce their wage bill. Wages fell from £31m to £25m (19%), greater than the fall in revenue (13%), essentially improving underlying profitability despite the figures not showing such.

A host of high-earners such as Meyler, Larsson and Hernandez were released, freeing up wages for new signings while also reducing the overall wage bill.

Hull were also taxed £424k, an effective tax rate of 14%, below the actual tax rate of 19%.

Looking ahead, Hull were fairly inactive in the 2019 summer transfer window and as such wages and amortisation (two of the largest costs) are likely to remain fairly stable, with a slight increase being expected to overall costs.

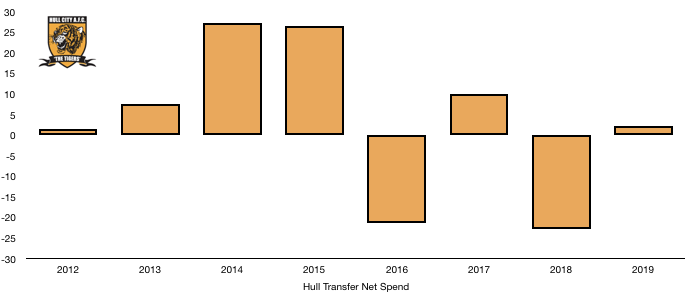

Transfers Analysis

Hull saw a significant pool of players depart on free transfers in 2018/19 with little in the way of transfer fees with no departures (for fees) and only 3 signings (for fees).

In came Burke (£1.5m), De Wijs (£0.4m) and Milinkovic (£0.3m) for a combined £2.2m.

The signings all performed as expected with none really disappointing in their first season with the onus now being on them to kick on.

The lack of player sales compared to the exodus following relegation helped stabilise the team on the pitch and it showed. However, without such sales, Hull saw their profit on player sales fall from £31m to £5m (83%). (Despite no player sales in 2018/19, contingent transfer fees would’ve have been activated hence the £5m profit).

In cash terms, Hull spent £1.9m on new players and received £4.6m, a net cash inflow of £2.7m.

Hull are also owed £5.5m in transfer fees, although this is significantly down on last year’s £20m (which has boosted cash reserves – see debt analysis).

However, Hull do themselves owe £2.5m in transfer fees in the next year, which is more than covered by the amounts owed to them so shouldn’t be a financial worry.

In terms of contingent fees, Hull could be liable to make payments of £6.6m depending on palter appearances etc. Fortunately, Hull could also be due £7.3m should players previously sold meet certain clauses.

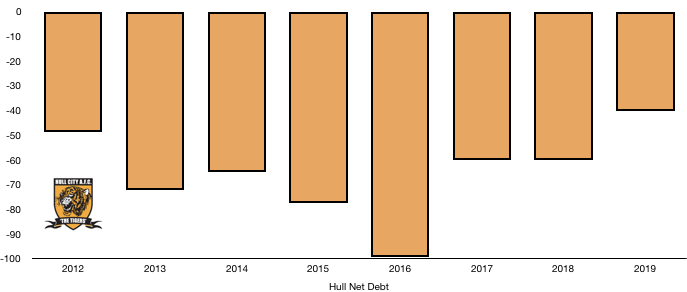

Debt Analysis

Hull are fairly cash-rich compared to their peers, with cash reserves increasing from £3m to £10m (233%) in their second Championship season. This was due to their ability to reduce costs by more than the fall in revenue and also due to the net transfer income they received.

This allowed Hull to repay £13m in loans, ensuring the club are more sustainable going forward.

As mentioned above, Hull have begun attempting to reduce the debt owed by the club to their owner, Mr Allam. Debt fell from £63m to £50m (21%) after the repayment mentioned above, which also reduced interest costs.

Hence net debt has fallen from £60m to £40m (33%).

Going forward, Hull will need to be careful to manage the balance between their ambitions and finances to ensure compliance with Financial Fair Play in a period where many EFL clubs are at risk of falling foul of the measures.

Hull have prudently managed their finances since relegation, recording profits in both periods, although this will become increasingly difficult as parachute payments fall and unless the club make any significant player sales. However, due to profits of £22m over the past two years, Hull should be fairly secure from any FFP troubles for the next couple of seasons at least, plenty of time to attempt to secure promotion back to the Premier League.

Thanks for reading – Please Share!