Crystal Palace started the 2018 season with a record breaking 7 losses that left their Premier League survival hanging in the balance and cost De Boer his first (and maybe last) job in England.

However, after a revival under Hodgson, Crystal Palace secured a sixth successive season in the Premier League after an astonishing 11th placed finish considering the start they had.

All of Palace’s energy went into securing their Premier League survival, coming at the expense of their cup campaigns which ended early.

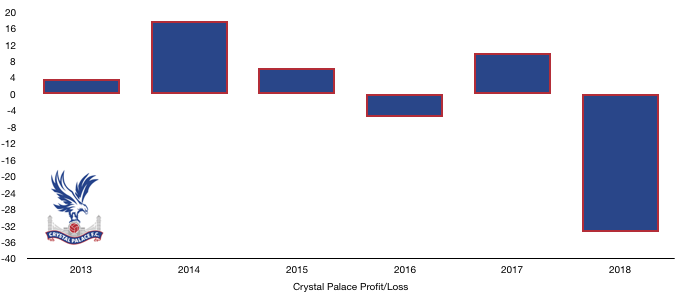

A stable season but a lack of player sales saw Crystal Palace turn a £10m profit in 2017 into the £33.4m loss.

Let’s delve into the numbers.

Revenue Analysis

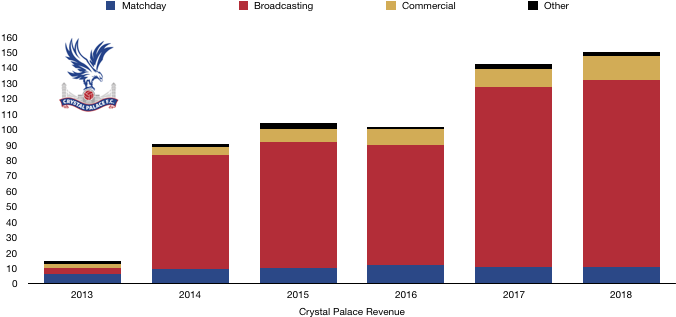

Crystal Palace saw a slight increase in revenue, rising from £142.7m to £150.3m (5%) after a season of stability.

Matchday revenue increased from £10.6m to £10.9m (3%) despite attendance falling slightly from 25,161 to 25,063 (0.3%).

Crystal Palace are pretty much at full capacity, with an expansion of Selhurst Park a priority, however delays are putting plans to increase capacity to 34,000 in doubt. Costs are rumoured to be around £100m, although, similar to all construction projects, this is likely to be exceeded heavily.

Crystal Palace are also currently in discussions to potentially increase ticket prices, citing a low price in comparison to their London rivals as the rationale. Any increase should boost revenue (but annoy fans).

Broadcasting revenue increased from £116.9 to £121.1m (4%) after finishing 3 places higher this season despite their poor start. This increase would have been even greater had they featured more heavily on TV, after having 2 less games broadcasted this season.

Commercial revenue rose from £11.9m to £15.2m (28%). Crystal Palace benefitted from a more lucrative shirt deal with ManBetX, while they also made progress on their commercial strategy to increase commercial partnerships and LED board revenue.

Other revenue fell from £3.3m to £3.0m (9%).

Looking ahead, Crystal Palace’s revenue will remain relatively stable yet again. With Crystal Palace unlikely to improve on last year’s 11th placed finish (and may not even match it), broadcasting revenue is likely to fall slightly.

Matchday revenue is basically capped (due to capacity constraints) at around £11m unless the club progress in the cups and have more home games.

Commercial revenue is likely to increase which will hopefully offset any revenue loss caused by a lower league finish.

Costs Analysis

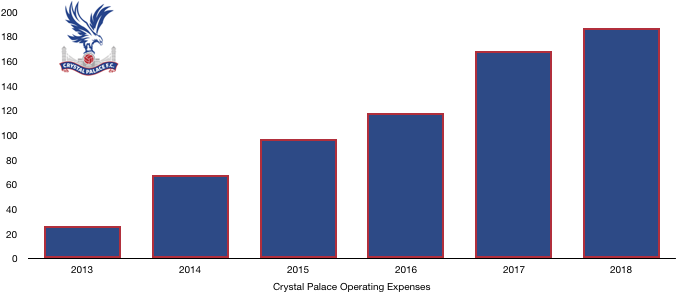

Crystal Palace knew their revenue was unlikely to rise much and controlled costs well. Operating expenses increased from £168.7m to £187.3m (11%). This rise did unfortunately hurt profitability, being larger than the rise in revenue (5%).

Amortisation increased significantly, rising from £32.7m to £46.0m (41%) after spending £44m in 2018 (see transfers analysis).

Interest costs increased from £1.0m to £1.1m (10%) as interest on loans grew slightly (see debt analysis).

Crystal Palace paid no tax due to their loss-making status. The large loss this year may be useful in offsetting any taxable profit in the coming years, reducing the tax bill at that time.

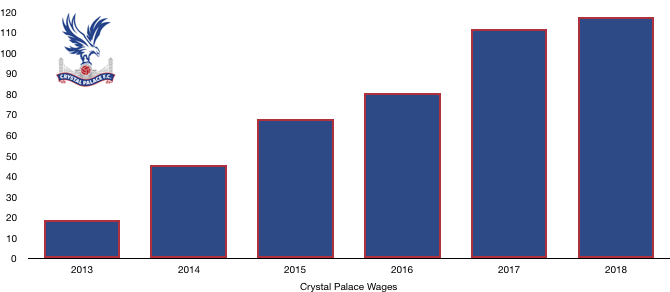

Wages increased slightly from £111.8m to £117.3m (5%). Despite new signings, wages remained relatively stable as the new signings were signed at modest wages while a few high earners (Mandanda, Ledley and Flamini) departed Selhurst Park.

This wage increase works out at an additional £106k a week, a tiny sum for Premier League clubs.

Director renumeration took a hit this season, dropping from £2.4m to £1.8m (25%) with Parrish’s pay falling from £2.2m to £1.6m (27%).

Looking ahead, Crystal Palace will see a slight increase in costs. Wages will rise slightly due to the signings of Meyer, Kouyate, Guatia and Sako, in particular Meyer whose wages are rumoured to be over £100k a week. The exit of the likes of Cabaye and Delaney should offset a lot of these wages.

Amortisation will increase ever so slightly due to the only signing or departure not on a free transfer being Kouyate this year.

Transfers Analysis

Crystal Palace saw an influx of players join the club, with 4 signings and only 1 departure (for a transfer fee).

In came Sakho (£25.4m), Sorloth (£8.1m), Riedwald (£8.1m) and Jach (£2.5m) for a combined £44.1m.

The only departure was Mandanda for £2.7m.

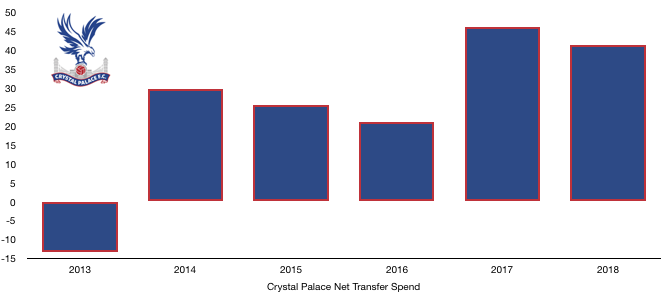

This saw a drop in their net transfer spend from £46.0m to £41.4m (10%), in what was a season of similar finances for the club.

Crystal Palace recorded a profit on player sales of a measly £2.4m. Last year, Crystal Palace recorded a profit on player sales of £34.7m mainly due to the sale of Bolasie. This difference of £32.3m is main reason for the £43.4m swing into the red this year.

Therefore, with a season of no player sales in 2019, Crystal Palace are likely to once again record a loss.

In cash terms, Crystal spent cash of £53.8m, recouping cash of £12.7m. This was a net cash outlay of £51.1m, a larger outlay then Palace are used to.

Crystal Palace are only owed a further £2.4m in transfer fees. However, Crystal Palace owe £49.0m in transfer fees (£40.4m due this year). This net creditor position of £46.6m shows why Crystal Palace reduced their spending this year, with such a large amount needing to be repaid soon.

On top of this, Crystal Palace are likely to face contingent transfer fees of £8.4m, while they could face an additional £4.8m, although the directors deem this to be less likely.

Debt Analysis

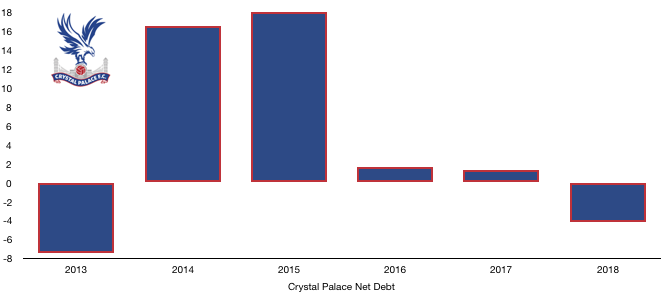

Crystal Palace kept their cash reserves robust, increasing it from £15.9m to £17.9m (13%) despite their losses.

New loans of £7.5m were used to fund these losses, pay their transfer fees and also allowed them to spend £2.1m on improving club facilities.

It is also worth noting that Crystal Palace took out a £29.3m short-term loan while they waited to receive their cash from the Premier League for the season, this has already been repaid (due to the extremely short-term nature of this loan, it has been excluded from the debt amount below).

Debt levels increased from £14.6m to £21.5m (47%) after new loans were provided by their owners. This was a nice boost for Crystal Palace that was needed to maintain a decent cash balance.

Crystal Palace hence saw a net cash balance turn into a net £3.6m debt position. This change is minor, and the club are incredibly prudently run.

An increase in spending in the last couple of years to maintain and consolidate their Premier League status was uncharacteristic of the club.

To understand their financial strategy, it is worth noting how close they were to going bust prior to Parrish’s takeover, and have since shown a greater level of financial responsibility while performing well in the Premier League.

Going forward, a new stadium is on the horizon which may further explain their prudence. Should they maintain their Premier League status after this, Crystal Palace are likely to push on and exciting times may be ahead.

Thanks for reading – Share with your football community!