Crystal Palace finally released their financial results after HMRC threatened to strike off the club following the late filing of these results.

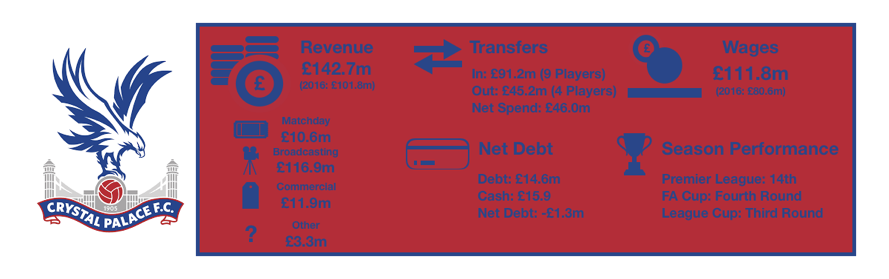

Crystal Palace once again secured Premier League survival and a fifth consecutive season in the top flight after looking doomed at various stages of the season under Alan Pardew and even at times under Sam Allardyce before the latter steered them clear of the jaws of relegation, achieving a 14thplaced finish, 1 place higher than last year.

Crystal Palace enjoyed their 2016 FA Cup run, going within touching distance of winning the trophy, no such excitement was forthcoming this season as they suffered early exits from both cup competitions, but the main aim of Premier League survival was achieved.

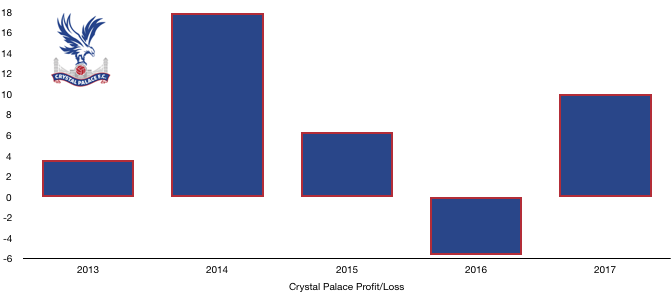

In achieving survival, Crystal Palace returned to profitability after a loss of £5.6m last year, achieving a profit of £10.0m.

Let’s delve into the numbers.

Revenue Analysis

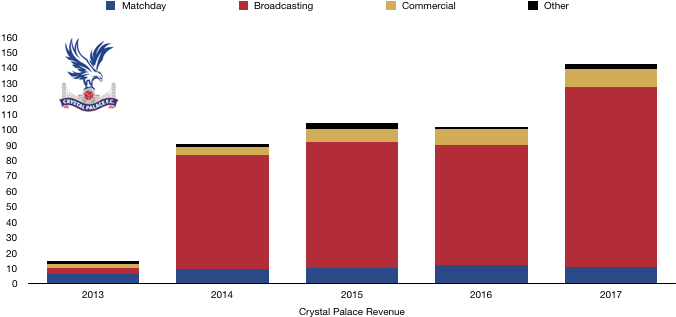

Crystal Palace saw their revenue soar to record levels after a slight dip last year, increasing from £101.8m to £142.7m (40.2%)

Despite this rise, matchday revenue dropped, falling from £11.9m to £10.6m (10.9%) mostly due to having less home games due to their significantly poorer domestic cup campaigns compared to the previous year. Premier League matchday income remained relatively stable.

Broadcasting revenue rose significantly, increasing from £78.0m to £116.9m (49.9%) as the new Premier League TV deal kicked in, while their battle with relegation yielded entertainment at the end of the season and they were rewarded with four more televised games than the previous season, helping achieve this big boost in revenue. This would have been even higher if they had matched last season’s domestic cup performance.

Commercial revenue also rose, offsetting the fall in matchday revenue by increasing from £10.2m to £11.9m (16.7%). This represents a good year commercially for the club as the look to exploit their consolidated Premier League status.

Crystal Palace will likely see revenue rise to new records again after a higher league finish however this may be dampened by less televised games, while another poor domestic campaign won’t add any revenue of note. With matchday revenue to remain relatively stable, a good commercial season may be necessary to continue their forward momentum.

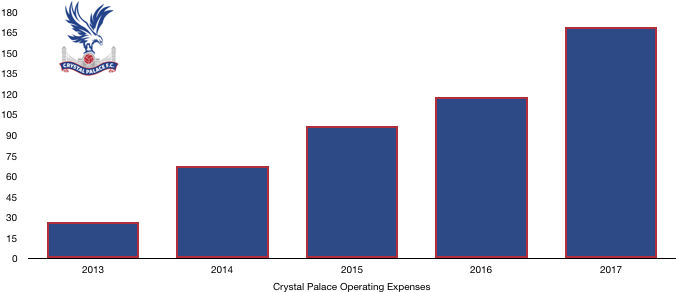

Expense Analysis

Crystal Palace’s expenses rose at a higher rate than revenue, increasing from £118.3m to £168.7m (42.6%).

Amortisation costs rose significant from £20.4m to £32.7m (60.3%) after huge player investment, with the majority coming in the January Transfer Window as they bid to avoid relegation, knowing the investment was worth the risk to attempt to maintain their Premier League status.

Crystal Palace saw net interest expense boom after an increase in debt from their owners saw their net interest increase from £0.2m to £1.1m. This interest has since been waivered by the owners.

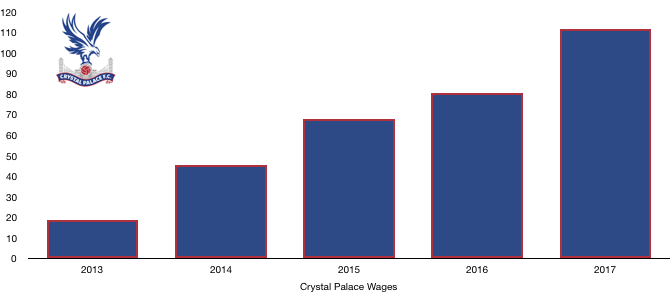

Crystal Palace unsurprisingly saw a sharp rise in wages, increasing from £80.6m to £111.8m (38.7%) after the significant transfer activity in the winter saw expensive players join Crystal Palace’s battle against relegation.

These extra wage costs work out at an eye-watering extra £600k a week – showing the cost of survival.

Crystal Palace paid their only director, believed to be Steve Parrish, was paid a handsome £2,446,000, tripling from his pay of £787,000 last year after achieving their objectives for another season with his gambles paying off – First sacking Alan Pardew, then hiring Big Sam, before giving him a sizeable transfer kitty that lifted them clear of relegation.

Crystal Palace paid tax of £1.8m last year, an effective tax rate of 15.3% after utilising some of last year’s losses.

Transfers Analysis

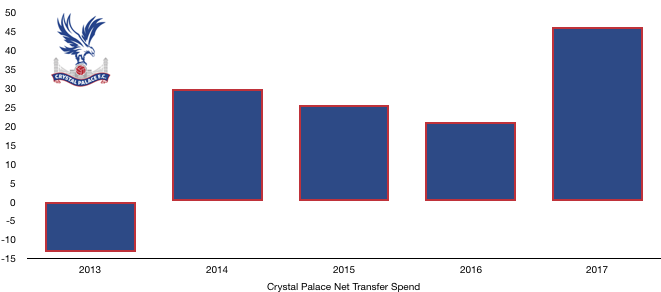

As already mentioned, Crystal Palace invested significantly in players in the summer transfer window and especially in the winter transfer window as they realised the danger of relegation was real, bringing in 4 players in January and 9 players in total, while only 4 departed Selhurst Park.

In came Christian Benteke (£28.1m), Townsend (£14.0m), Milivojevic (£13.6m), Schlupp (£12.4m), Tomkins (£10.5m), Van Aanholt (£9.5m) and Jonathan Benteke (£0.1m) while Sakho (£2.1m) and Remy (£0.9m) join on loan, coming in at a combined £91.2m.

Out went Bolasie (£26.0m), Gayle (£10.8m), McCarthy (£4.2m) and Jedinak (£4.1m) for a combined £45.2m.

This led to a significant net transfer spend of £46.0m, a huge increase from last year’s £4.9m net transfer spend. This investment in transfers was hugely successful as the £37.6m spent in January ensured Premier League survival that will be worth at least double that investment in the short term, proving success favours the brave and Crystal Palace were certainly that.

Crystal Palace also achieved an accounting profit on player sales of £34.7m due to the sizeable sales of Bolasie and Gayle.

Crystal Palace had a large cash outlay after their transfer activity with a net cash outlay of £29.4m as they spent £63.4m and received £34.0m. This is compared to a net cash outlay of £22.1m last year, a 33% increase.

Worryingly for future transfer windows, Crystal Palace owe a significant £45.9m on transfer fees from their recent activities while they are only owed £11.4m and as such, may face restraints on transfer activity over the next couple of years.

Crystal Palace also have a potential £2.6m extra payable in respect of contingent transfer fees.

Assets/Liabilities Analysis

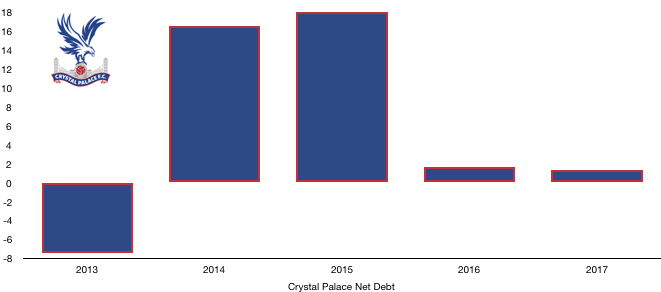

Crystal Palace had the cash reserves to fund their transfer activity in January and decided to use it with cash levels nearly doubled from £8.1m to £15.9m (96.3%) as the profit made in the year helped supplement the increased spending levels while their owners pumped in another £7.5m to ensure that cash levels were high enough.

Debt levels hence rose after the new loans from their owners, more than doubling from £6.4m to £14.6m (128.1%). The majority of the debt is from their owners with a £7.5m infusion this season.

Despite this, Crystal Palace continued to continue in a net cash position falling slightly from £1.7m to £1.3m (23.5%). This will come in handy due with their upcoming Selhurst Park redevelopment that will require significant funding, whether from bank debt or owner debt or a combination.

Thanks for reading – share with a Crystal Palace fan!