Wolves had an outstanding 2018 after winning the Championship with ease following sizeable investment from their ambitious owners, Fosun.

Not only did they win the league, the style of play was that of a Premier League club and the side will go down as one of the best to grace the Championship.

Wolves’ heavy investment has led to a huge loss in the year that may cause Financial Fair Play issues in the near future as Wolves recorded a loss of £57.2m, more than double the £23.2m loss last year, which was already a sizeable amount.

Let’s delve into the numbers.

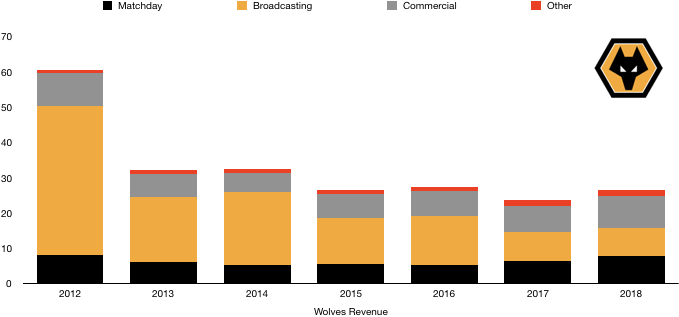

Revenue Analysis

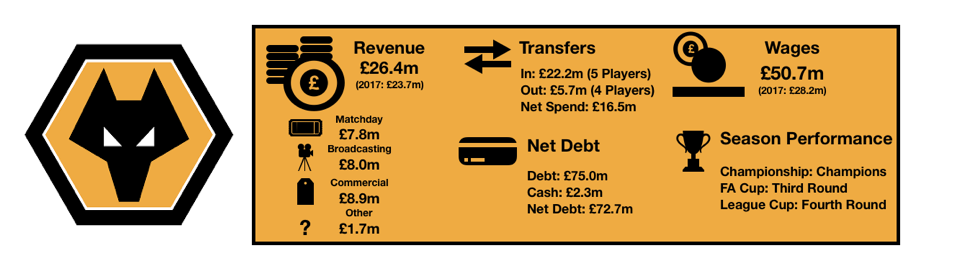

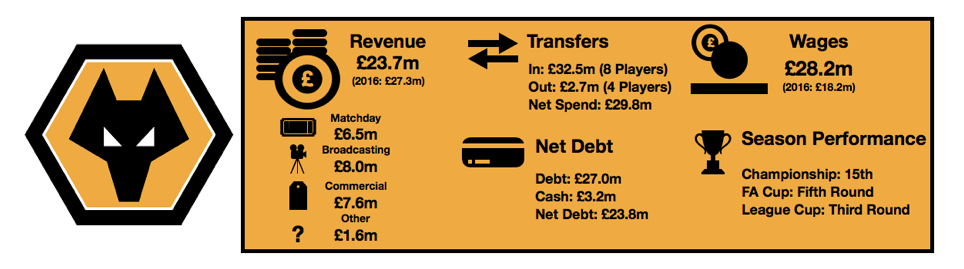

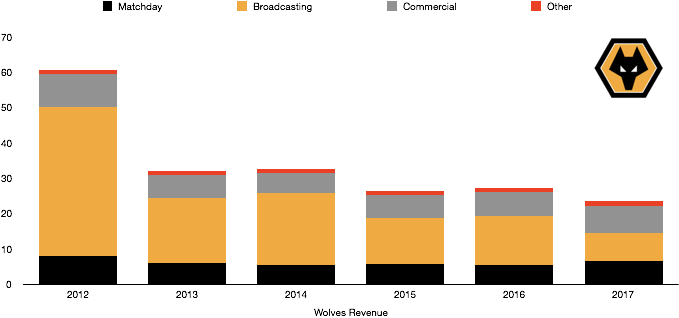

Wolves unsurprisingly saw a rise in revenue after a successful season, as revenue rose from £23.7m to £26.4m (11%).

Matchday revenue rose from £6.5m to £7.8m (20%) after a great season drove improvement in match attendances with season ticket sales increasing from 13,757 to 21,233 (54%), an incredible one-year increase. Match attendances were also up from 21,572 to 28,298 (31%).

Broadcasting revenue was surprisingly stable at £8.0m despite promotion and a fantastic season in general, however this is because last year was their last of parachute payments after relegation from the Premier League 4 years ago, making it a timely return.

Commercial revenue impressively rose from £7.6m to £8.9m (17%) as their new links through their owners paid dividends as that combined with a strong performance by their commercial team meant new, lucrative relationships were formed.

Other revenue rose from £1.6m to £1.7m (6%).

Looking ahead, Wolves are going to see an astronomic rise in revenue next season on their Premier League return. Revenue is likely to quadruple if not more as their solid mid-table season to date means broadcasting revenue is likely to be in excess of £100m while their solid campaign means that both matchday revenue and commercial revenue are likely to rise.

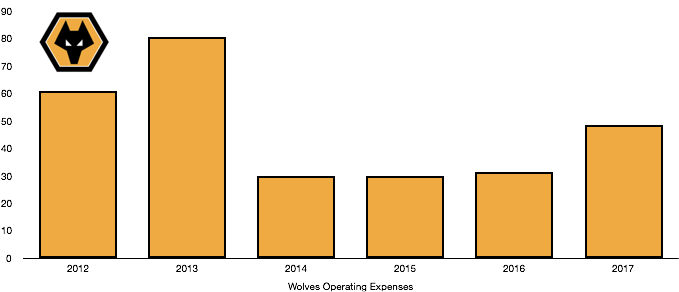

Costs Analysis

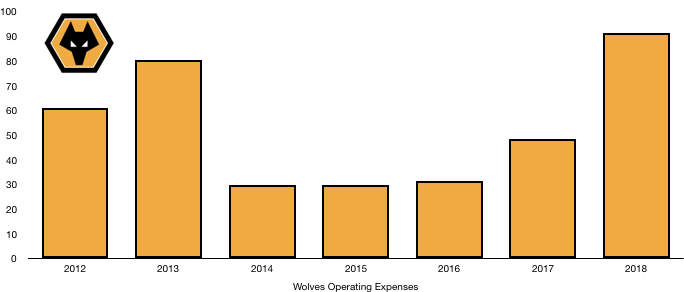

This is where Wolves’ finances get interesting. Extraordinarily, Wolves costs rocketed to £91.2m from £48.5m (88%) as Fosun invested heavily into the club but caused Financial Fair Play issues to rear its head.

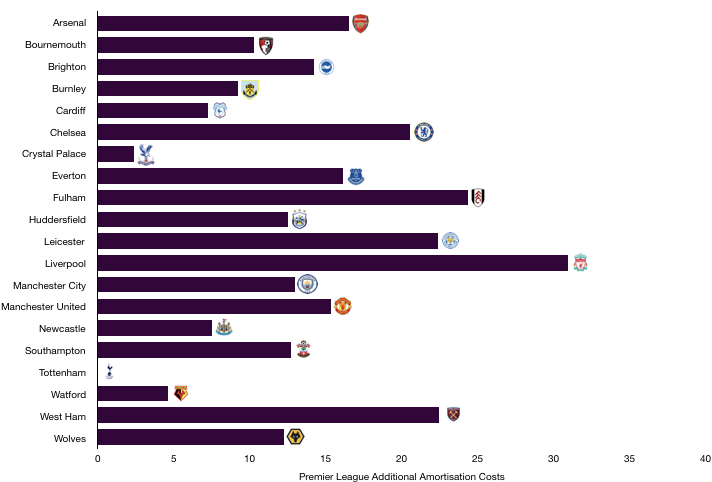

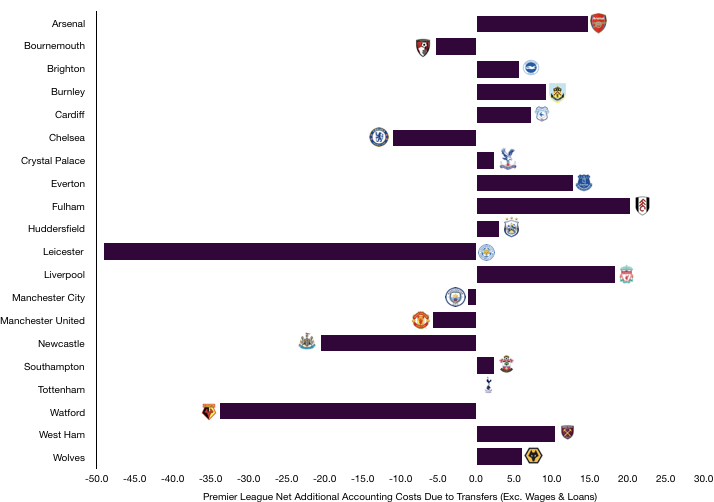

Amortisation more than doubled from £7.6m to £16.1m (118%) after huge levels of player investment relative to the size of the club previously. We expect that this will continue to increase as the club invest more and more into establishing Wolves as a Premier League mainstay.

Wolves saw interest costs fall slightly from £0.6m to £0.4m (33%), however these amounts were minimal to begin with.

Incredibly, wages rose from £28.2m to £50.7m (80%) as the club invested in their playing squad and brought in some marquee signings that needed marquee wages to sign. What is amazing about their wages is that it is nearly double their revenue of £26.4m which is unheard of levels of financial risk. Had the club failed to secure promotion, Wolves would have found themselves in deep water without more investment from Fosun.

It also questions how Financial Fair Play could allow such a situation without punishment due to the huge gamble the club made in attempting to secure promotion and the potentially unfair advantage this bought.

The wage rise is the equivalent of an eye-watering £433k extra a week, even more crazy considering they were a Championship club at the time.

A large portion of the wage rise will be due to promotion-related bonuses, possibly to the tune of £25m (maximum). This amount is likely to be excluded from any loss calculations made in relation Financial Fair Play due to the cost only being realised due to promotion. This may help Wolves when arguing their case, if it comes to that.

Directors saw their pay apparently cut from £494k to £110k (78%).

Looking ahead, Wolves will see costs rise even further as the money keeps flowing. This may also increase more than expected should the club receive any Financial Fair Play penalties if they are deemed to have broken the rules (which seems likely). Losses should however fall next year as revenue growth outpaces costs growth significantly.

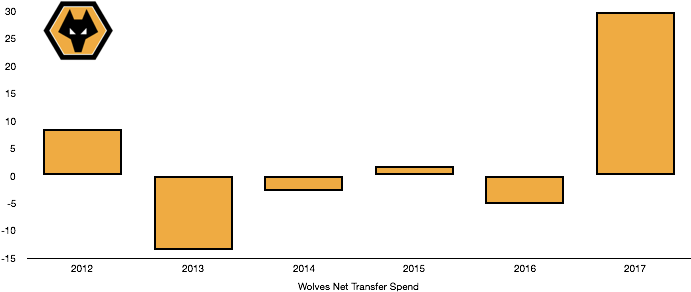

Transfer Analysis

Wolves’ relationship with Jorge Mendes made for an exciting transfer season for the club as exotic names entered the Molineux.

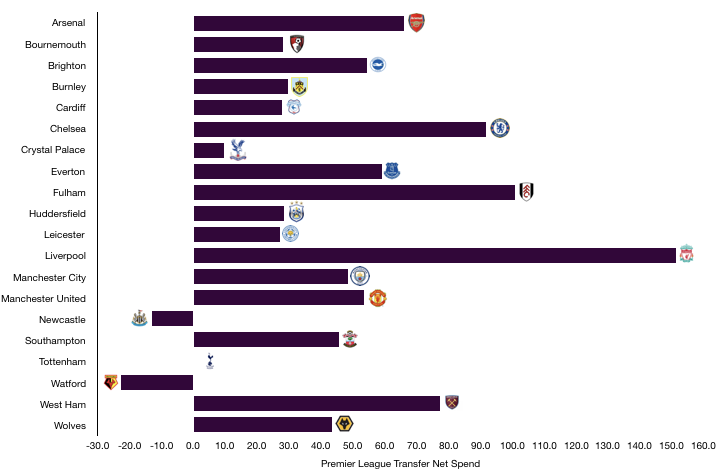

In came Neves (£16.1m), Miranda (£2.7m), Mir (£1.8m), Douglas (£1.0m) and Stevenson (£0.5m) for a combined £22.2m.

Leaving Wolves were Dicko (£3.4m), Edwards (£1.0m), Evans (£0.8m) and Saville (£0.5m) for a combined fee of £5.7m.

This meant Wolves had a net spend of £22.2m, down 45% on last year as Wolves focussed more on getting the right player than spending senselessly.

This tactic worked as the additions really improved the squad and the signing of Neves was inspired as he made his own goal of the season competition while dictating the play of the club.

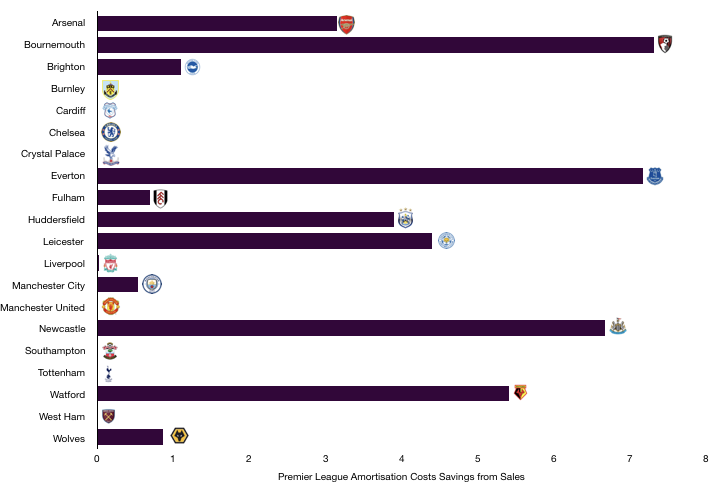

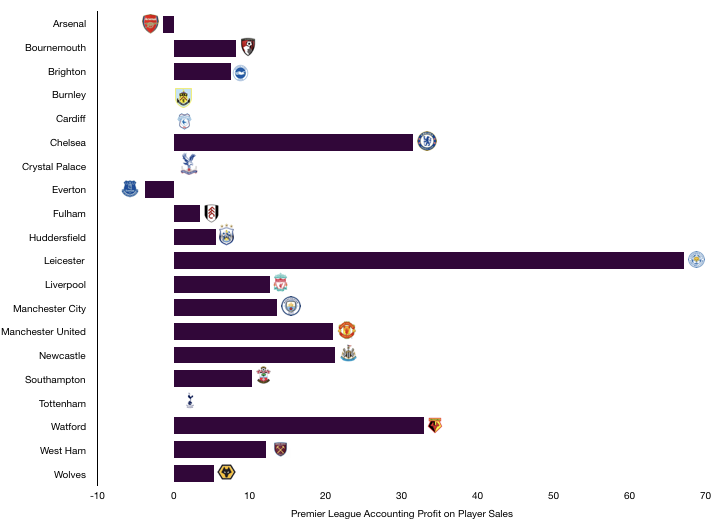

Wolves’ loss was not bigger only because of player sales on which Wolves made a profit of £8.1m (some of the summer sales slipped through to be included this year).

Wolves paid cash of £25.1m to buy players last season and only received £7.3m in cash for player sales, a net position of £17.8m which required funding from Fosun.

Wolves are also owed a further £5.0m in transfer fees, however, Wolves owe £23.0m in transfer fees, of which £17.5m is due this year which is a sizeable cash burden to Wolves. This didn’t however seem to curb spending last summer on their Premier League return.

Wolves may also have a further £9.0m in contingent transfer fees to pay should certain clauses be met.

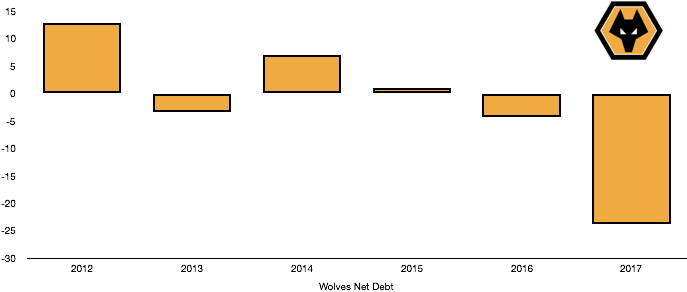

Debt Analysis

Fosun’s Wolves are running up their debts to their owners this year after he began investing huge funds into the club who previously had little debt.

Cash levels fell slightly from £3.2m to £2.3m (28%) as the club spent heavily and Fosun funded the club with £48m in new loans which was used to pay for transfer fees (£25.1m), facility improvements (£2.8m) and the increased costs Wolves experienced last year.

This loan led to debt levels increasing from £27.0m to a huge £75.0m (178%) which is all owed to Fosun and attracts no interest charges. Fosun has big plans for the club and looks like they are just getting started with the investment into Wolves which is a good sign to the club. With performances matching what you would expect from their investment so far, Fosun will be happy to continue his investment as it will improve the value of Wolves which is how they will get recoup their investment when Wolves are eventually sold at a huge profit on the reported £45m paid for the club.

Net debt hence increased from £23.8m to £72.7m (205%) after the huge investment by Fosun.

Wolves fans need not worry about their financial situation as long as the owner stays interested, which so far seems the case. The only issue Wolves may have is their compliance with Financial Fair Play.

Championship clubs are meant to only record maximum loss of £13m loss a year. This means over a 3-year rolling period a maximum loss of £39m is usually allowed. Wolves have recorded a cumulative loss of £74.6m over that period, nearly double the limit which is likely to be deemed unacceptable despite Fosun pumping £48m of his own money into the club.

It is now up to the EFL to decide whether to penalise Wolves in what seems to be financial foul play, however the huge investment by Fosun may circumvent the rules if the EFL have given consent for this investment. However, other Championship clubs may lobby for sanctions to avoid a similar situation occurring again which may force the EFL’s hands regardless.

Thanks for reading – Share with a Wolves fan!