Wigan secured an immediate bounce back to the Championship following an unexpected relegation last year by winning League One.

Promotion was the minimum expectation and Wigan met this challenge successfully to avoid financial ruin.

An FA Cup Quarter Final run was a further highlight to a good season that gave fans renewed optimism going into 2019.

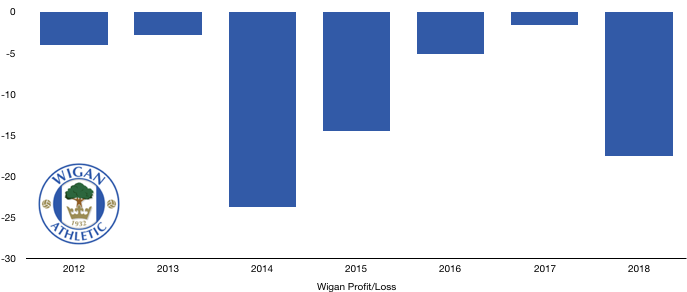

Relegation was however costly for Wigan, increasing their losses from a measly £1.6m to an eye-watering £27.6m (1,000%!).

Let’s delve into the numbers.

Revenue Analysis

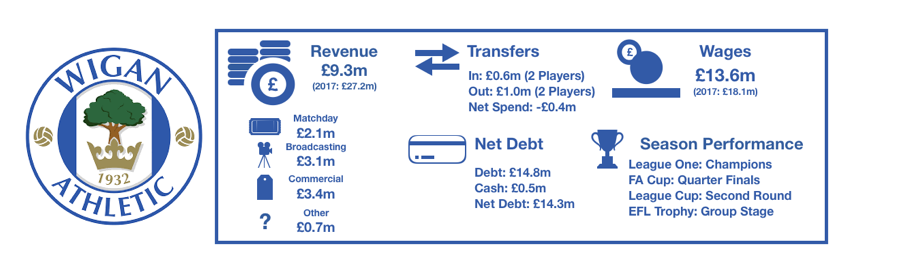

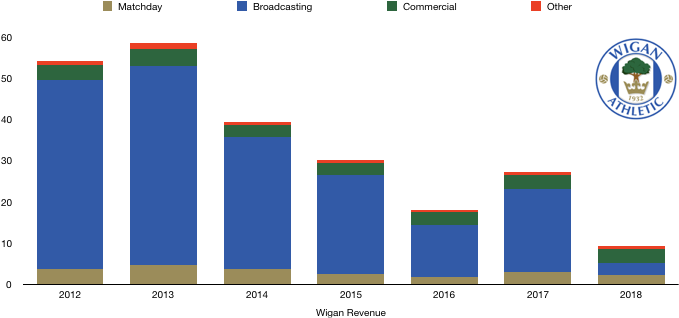

Wigan saw a huge drop in revenue as it fell from £27.2m to £9.3m (66%).

Matchday revenue dropped from £3.0m to £2.1m (30%) as Wigan suffered from lower attendances at games and also from cheaper tickets. This is despite having more home games as their FA Cup campaign yielded 6 home ties.

Broadcasting revenue fell off a cliff, free-falling from £20.2m to only £3.1m (85%). This drop was more pronounced then the majority of relegations from League One to Championship due to the fact that Wigan were receiving their final parachute payment during the 2016/17 season.

This meant that not only did broadcasting revenue from the Championship drop to League one levels, they also lost the buffer that their former Premier League status gave, talk about poor timing!

Even a solid FA Cup run couldn’t save their broadcasting income.

Commercial revenue surprisingly remained robust, even increasing slightly from £3.3m to £3.4m (3%) despite the loss of their Championship status. Their immediate return means that they are unlikely to see any drop in commercial revenue and now have a platform to build from.

Other revenue remained stable at £0.7m.

Looking ahead, Wigan can expect to see a rise in revenue which should at least double to around £7m due to promotion back to the Championship and could well approach £9-10m. Matchday revenue should return to around £3m while commercial revenue has potential to grow.

Revenue will still be substantially below their 2017 revenue due to no more parachute payments as mentioned above.

Costs Analysis

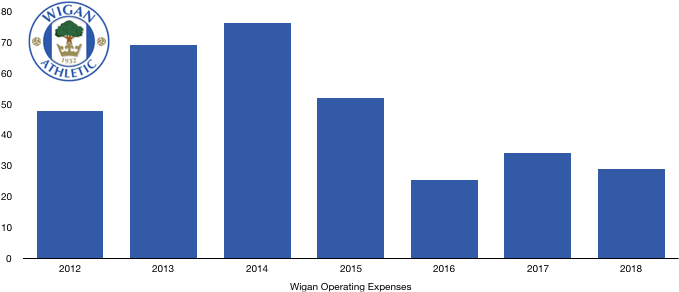

Wigan saw their costs thankfully decrease last year, falling from £33.9m to £28.9m (15%). This was still a much lower fall than the fall in revenue, hurting profitability hugely. Crazily, revenue is less than 3 times the size of their costs, an unsustainable position to be in for any business for any prolonged period of time.

Amortisation was almost halved in the year, decreasing from £4.4m to £2.4m (45%) as investment in the playing squad fell significantly following relegation which was a necessity.

Interestingly, Wigan disclosed their agent fees which fell from £0.9m to £0.5m (44%), a figure which still seems high considering Wigan spent only £0.6m in transfer fees and received £1.0m.

A huge part of Wigan’s costs and hence loss was due to an accounting impairment on the goodwill in the club that was created when they were brought. Wigan being relegated obviously saw their value plummet and hence the goodwill was devalued due to this (technical accounting sits behind this explanation). The good thing however is that due to the nature of this cost (being just an accounting costs and not a real one), it will not be taken into account in any Financial Fair Play investigation.

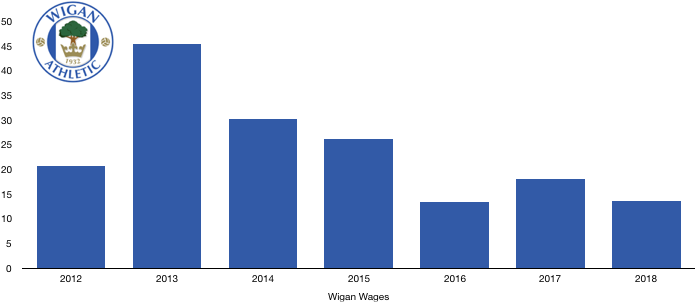

Wigan saw wages fall from £18.1m to £13.6m (25%) as relegation wage drops came into effect and some high-earners and fringe players left as Wigan attempted to create some sort of wage control to brace for their season in League One.

The wage drop was equivalent to a saving of £87k per week, a sizeable amount for a club the size of Wigan.

Wigan also had interest on new loans of £1.0m in the year, having previously had loans that were interest-free.

Wigan also paid no tax due to their loss in the year.

Looking ahead, Wigan can expect a fall in costs due to the unlikelihood of another sizeable impairment of goodwill. Wages are likely to increase slightly however not substantially as Wigan look to be more prudent following promotion.

Transfers Analysis

It was a quiet transfer season for Wigan, with two signings and two departures for low transfer fees.

In came Walker (£0.3m) and Vaughan (£0.3m) for a combined £0.6m.

Out went Bogle (£0.7m) and Woolery (£0.3m) for a combined £1.0m.

This led to a small net income of £0.4m, the 6thconsecutive year of having net transfer income as the club are forced to budget and partly rely on transfer income to stay afloat.

The new signings were important in securing the league title and the departures were not particularly missed despite their quality.

Wigan also recorded a profit on player sales of £1.0m, which is almost all the fees received in the year despite Bogle being purchased the year before for £0.8m. It is likely that the fees on transfermarkt.com are slightly wrong.

In cash terms, Wigan spent cash of £2.8m and received a mini windfall of £5.9m, a net cash income of £3.1m as they received a large amount from previous transfers (most likely Wildschut) which helped the club following the loss this year.

Wigan are also owed a further £0.5m (all due this year) and owe £0.3m (all due this year), meaning they are net due £0.2m which isn’t much and shouldn’t help or hinder any future transfer plans.

There are potential contingent transfer fees payable of £3.6m should certain transfer clauses be met, although it is unlikely a large part of this is ever paid.

Debt Analysis

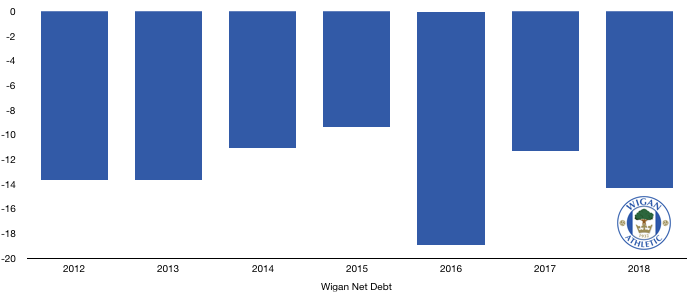

Wigan needed all the cash they could get their hands-on meaning cash reserves halved from an already low £1.0m to £0.5m (50%). Wigan used cash received from transfers (£3.1m) and new loans (£2.3m) to subsidise their costly relegation.

Relegation also threatened investment in club facilities, as investment fell to £0.3m from £0.6m (50%) as club improvements became low priority in the face of poor finances.

Debt increased due to the new loans mentioned above, increasing from £12.3m to £14.8m (20%). Wigan received new bank loans of £1.7m and also new owner loans of £0.9m, while a small amount was repaid to Whelan before the sale of the club.

Following a sale of Wigan to International Entertainment Corporation (IEC) by Whelan, Whelan is to be repaid all of his loans by IEC which are approximately £11m.

It remains to be seen whether IEC will include this £11m or so as an amount owed to them by Wigan or if they are just going to pay it off as part of the acquisition consideration.

Wigan hence saw net debt increase from £11.3m to £14.3m (27%). Wigan seem financially secure following their sale by Whelan who could no longer cope with the pressures, both financially and sporting.

It now remains to be seen what the level of ambition is of IEC and their plans for Wigan who are in need of investment in their playing squad should they harbour ambitions of remaining a Championship club, let alone returning to the Premier League.

Wigan’s return to the Championship should enable their finances to begin improving although we expect them to remain loss-making for the time being until a return to the Premier League is secured, costs are cut significantly, or a big player is sold.

Lastly, from an FFP standpoint, Wigan should be okay due to the nature of some of their costs which is likely to be excluded when examining whether any rules have been broken.

Thanks for reading – Share with a Wigan fan!