Sheffield United returned to the Championship in the 2017/18 season with great success. Despite a poor start, the Blades form spectacularly picked up and a promotion charge was in the offing. Unfortunately a playoff place was narrowly missed, with Sheffield United being in the race until the penultimate game of the season. A successful league campaign was accompanied by a decent FA Cup run to the Fifth Round.

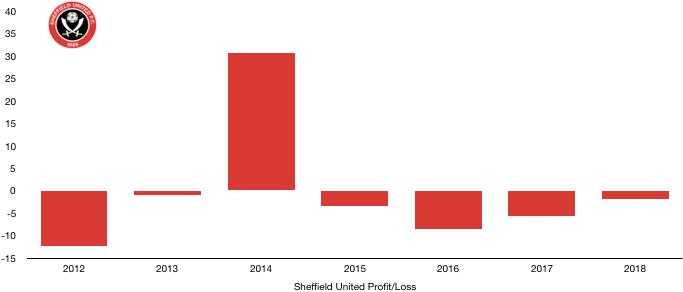

Off the pitch, financial losses fell as the club headed towards profitability with their loss levels decreasing from £5.7m to £1.9m. However, this was primarily a function of the sale of young starlet David Brooks at the end of the season.

Let’s delve into the numbers.

Revenue Analysis

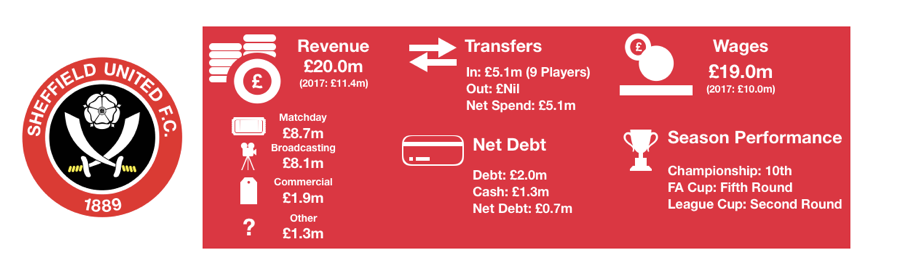

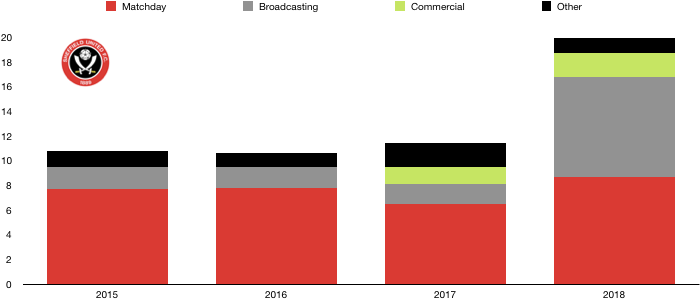

Sheffield United saw revenue rise from £11.4m to £20.0m (75%), with a return to the Championship being the obvious major factor.

Matchday revenue rose by a third, increasing from £6.5m to £8.7m (34%) as the Blades sold over 20,000 season tickets on the back of promotion. Sheffield United benefit from having a relatively large stadium, average attendance of 26,854 was the 6thhighest in Championship and higher than 6 Premier League clubs. The return to the Championship not only boosted attendance at matches, the feel-good factor and higher quality opponents also yielded higher ticket prices and increased spending by fans on matchdays.

Broadcasting revenue exploded, rising from £1.6m to £8.1m (406%) due to a huge uplift in TV money from promotion. This is due to an increase in televised games and the higher prize money available for Championship clubs in comparison to League One.

Commercial income rose slightly, increasing from £1.7m to £1.9m (12%) after new deals with Teletext Holidays (Shirt sponsor), Disba Structures (Training sponsor), Heineken and Ladbrokes. Sheffield United will be hoping to further exploit their return to the Championship and relevancy with high commercial income going forward.

Other revenue fell from £1.9m to £1.6m (19%).

Looking ahead, we expect Sheffield United to see a rise, albeit smaller in revenue. Commercial revenue should increase on the back of new sponsors. Matchday revenue may increase slightly but will remain relatively stable. Broadcasting revenue could increase significantly due to Sheffield United’s promising season to date where automatic promotion and even 1stplace is huge possibility.

Costs Analysis

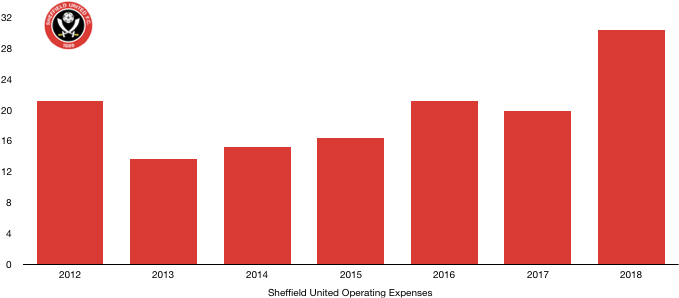

Operating costs rose significantly, increasing from £19.8m to £30.3m (53%). This increase however was much less than the 75% growth in revenue and hence profitability has risen this year.

Amortisation fell despite player investment, falling from £2.6m to £2.2m (15%). Amortisation falling usually signifies a lack of investment, however in this case it seems that it more greatly signifies the lack of investment in prior years which has now caught up to the club due to spending far too long in League One and the financial constraints that came with that.

Sheffield United had a net interest expense of £148k, up from £36k.

Sheffield United paid no tax in the year due to their loss-making status.

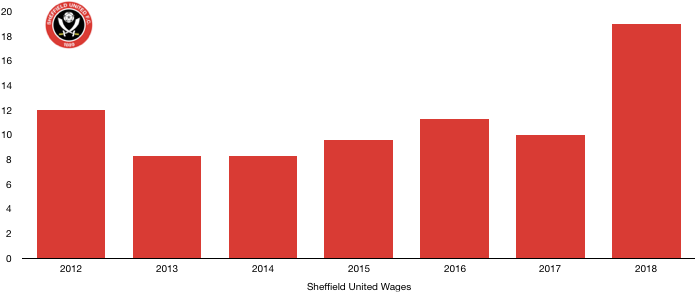

Wages nearly doubled, increasing from £10.0m to £19.0m (90%) after promotion saw brand new (more expensive) players, promotion bonuses and wage rises. This increase is unlikely to be repeated next year (unless the Blades are promoted) as there will be no large bonuses and wage rises handed to existing players.

This wage increase works out a relatively high extra £173k a week.

Directors at Sheffield United were interestingly only paid a measly £13k compared to £196k last year despite promotion. Directors may have been paid in another group company or were awarded stock options as this amount is unlikely to be that low.

Looking ahead, we would expect costs to rise next year as the Blades continue to invest in their playing squad with the ambition of a return to the Premier League.

Transfers Analysis

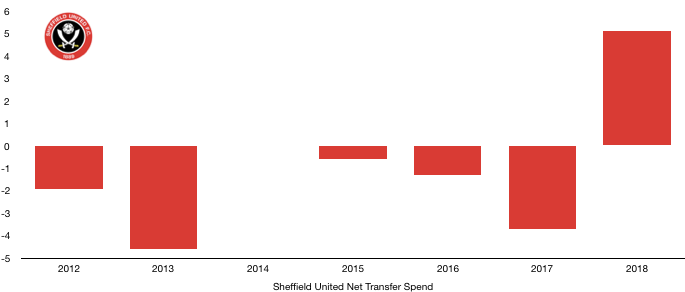

Sheffield United had a busy year of incomings to Bramall Lane with no outgoings (with a transfer fee) on their return to the Championship, they did however sell Brooks in the summer which has made its way into the finances of last year.

In came Stearman (£0.8m), Lee Evans (£0.8m), Leonard (£0.7m), Baldock (£0.7m), Ched Evans (£0.5m), Lundstram (£0.4m), Holmes (£0.4m), Heneghan (£0.4m) and Thomas (£0.3m) for a combined £5.1m.

This combined with no outgoings led to a net spend of £5.1m, the first time in years the club have seen a net outlay on transfers with no net spends since they were relegated to League One.

Sheffield United recorded a profit on player sales of £8.4m after the sale of David Brooks at the season end. Without this sale, Sheffield United were facing a large loss and partly explains the need for the club to sell.

In terms of transfer fees owed and owing, Sheffield United owe £0.9m in transfer fees and are owed £2.0m which means the club have little to worry about on this front.

Slightly more worrying is contingent transfers fees may become due of £6.2m although the board gave confirmed these costs are not expected to be realised.

Debt Analysis

Since relegation to League One, Sheffield United have battled to get their finances back in order. The owners have been more stringent and run a steady ship which even meant a write down a few years ago in debt owed to himself.

In terms of cash, as with most Championship/League One clubs, Sheffield United have little cash to spare so are unlikely to ever have large cash balances. Cash did fall, decreasing from £2.55m to £1.3m (48%) on the back of the loss in the year and higher transfer spending than usual.

Debt remained relatively stable, increasing slightly from £1.9m to £2.0m (5%) as the club look to run more sustainably this debt is relatively small.

This means the club have a net debt of £0.7m, which is essentially breaking even. This minimal amount shows the financial responsibility within Sheffield United has changed and the club is much more financially astute. This bodes well for the future and builds a solid platform with which to build a strong promotion challenge on the back of.

Thanks for reading – share with a Blade!