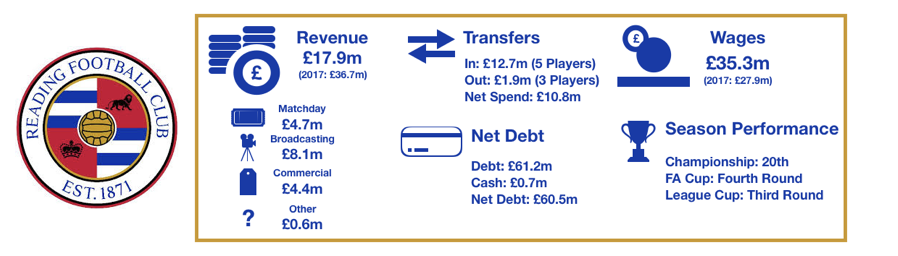

In the famous words of Drake, Reading went from 100 to zero real quick (not quite right is it?), going from the play-off final to 20th in one season, narrowly avoiding relegation.

After nearly gaining promotion last year, a poor season cost Manchester United legend Jaap Stam his job although things haven’t really improved since his departure.

A poor cup campaign further dampened spirits in a disappointing season.

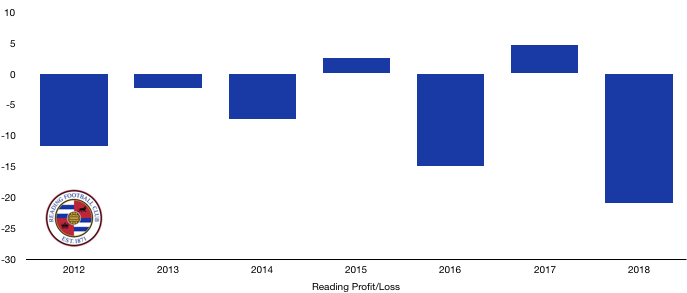

A demoralising season was just as poor off the pitch as a £4.7m profit in 2017 turned into a £21.0m loss in 2018 following the receipt of their final parachute payment last year.

Let’s delve into the numbers.

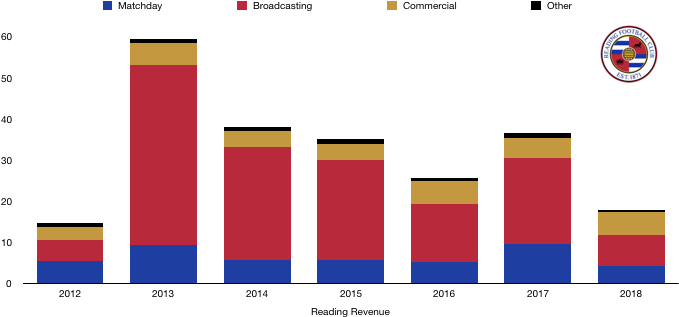

Revenue Analysis

Reading saw their revenue halved from £36.7m to £17.9m (51%) following a poor season that saw fans turn away from the club.

Matchday revenue more than halved from £9.7m to £4.2m (57%) as fans left in droves as their performances on the pitch plummeted. A fall in attendance only partly explains the fall in revenue as average attendance only fell from 17,481 to 15,181 (13%), meaning ticket prices must have fell or the ticketing strategy was a poor one.

Broadcasting revenue fell from £20.9m to £7.5m (64%) as Reading dropped 17 places in the Championship. This free-fall was compounded by the fact they no longer receive parachute payments for their relegation from the Premier League five years ago that helped prop up their finances.

This means that Reading are officially back to being a normal Championship side and are now on the same financial playing field as the majority.

Commercial revenue surprisingly increased from £4.8m to £5.6m (17%) as Reading managed to increase their income on the back of the memorable 2017 season. It remains to be seen whether this level of commercial revenue can be maintained after the season they just had (and are having this year).

Looking ahead, Reading will see a similar level of revenue this year, with the deciding factor being their final league position. At the time of writing, Reading are 19th, one places above last season’s 20th placed finish. Should they climb or fall, this will impact their broadcasting revenue, while relegation would have a long-term impact on their revenue and finances in general.

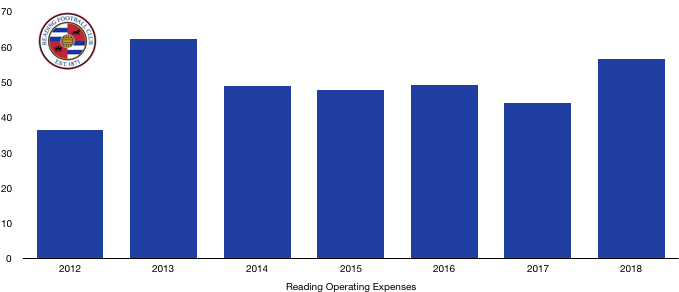

Costs Analysis

Reading saw a sizeable increase in costs despite falling revenue, hurting profitability considerably. Costs rose from £44.2m to £56.7m (28%).

Amortisation more than doubled, rising from £3.7m to £8.2m (122%) on the back of significant player investment, relative to recent levels. This investment has yet to pay any dividends with performances worsening rather than improving.

Reading incurred lease costs of £0.2m, an amount that will increase following the sale and lease back of the Madejski stadium (see debt analysis for more details).

Interest costs fell to almost zero, decreasing from £2.2m to £0.2m. This was mainly due to £1.2m of costs relating to arranging loans last season that weren’t present this year. General loan interest expenses fell as well.

Reading paid no tax this year having incurred a large loss, this is likely to be the case for the foreseeable future given their revenue and costs currently.

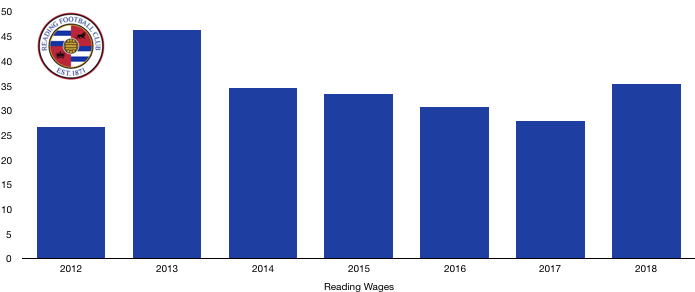

Wages rose from £37.9m to £35.3m (27%) after the signing of new higher-earners, while new contracts were rewarded to the players who performed so well in 2017.

There would also have been severance payments to Jaap Stam and his staff, although these haven’t been disclosed.

The wage increase works out at a sizeable extra £142k a week, a figure that is going to have to be reversed following a couple of poor seasons that have stretched their finances.

Directors were rewarded for their 2017 performance in 2018, as their renumeration increased from £0.7m to £1.4m, despite a poor season. It remains to be seen whether this will fall back to 2017 levels given the poor season the club are having.

Looking ahead, costs are likely to remain at a similar level, although they really do need to begin controlling their costs too avoid financial fair play issues as their losses mount. A second successive poor season is likely to be the catalyst to a cost reduction strategy, with high-earners likely to depart, while transfer spending will also fall.

Transfers Analysis

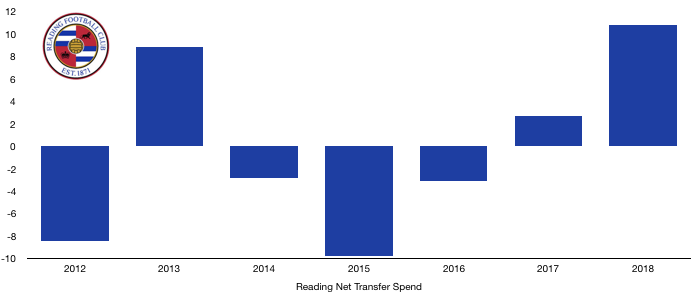

Reading had a busy season in the transfer market as they signed 5 players and sold 3, spending the largest amount they have done in over 6 years.

In came Aluko (£6.8m), Mannone (£2.1m), Barrow (£1.5m), Bacuna (£1.4m) and Edwards (£1.0m) for a combined £12.7m.

Departing the Madejski stadium were Beerens (£0.9m), Samuel (£0.5m) and Hurtado (£0.5m) for a combined £1.9m.

Reading’s net transfer spend hence increased from £2.7m to £10.8m (300%) as they recorded their largest net spend in recent memory.

The signings were meant to push the club on having narrowly missed out on promotion, however they did the opposite with none of the players (bar Barrow) impressing.

Reading did at least manage to record a profit on player sales of £1.4m. They also hold sell-on clauses on 9 players being McCarthy, Novakovitch, Fosu, Cooper, Norwood, Beerens, Samuel and Al Habsi that may bring some money into the club soon.

In cash terms, Reading spent a heavy cash load of £19.2m as they had to pay for transfers from previous seasons. In contrast, Reading only received £2.0m of cash in 2018, a net cash outlay of £17.2m.

It doesn’t get any better financially as Reading still owe £6.9m (all of which is owed this year) and are only owed £0.5m. This £6.4m owed needs to be funded and will further constrain any future transfer plans.

Reading may also potentially owe players, clubs and agents a further £12.9m in contingent transfer fees should certain clauses be met, although it is unlikely all of this will ever become payable.

Debt Analysis

A poor season for Reading ended in the need for cash to fund their spending (which was meant to be funded by a return to the Premier League).

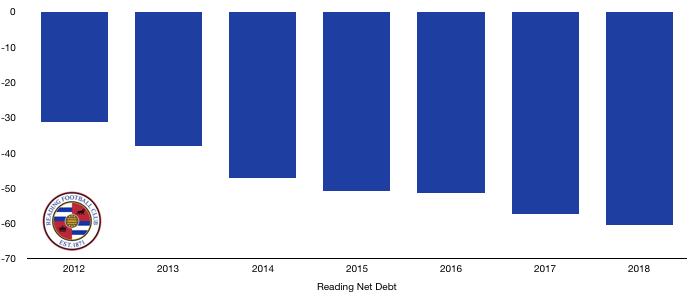

Cash levels remained low, falling from £1.1m to £0.7m (36%) as their losses were funded via three main sources: new shares issued by their owners (£15.8m), new loans from their owners (£3.2m) and the sale and leaseback of the Madejski stadium (£26.5m). These funds were used to pay for transfers, fund their losses and invest in their infrastructure (£1.1m).

The sale and leaseback of the Madejski stadium for £26.5m to their owners is a short-term measure to provide funding. What it does is at least give their owners something in return for their investment. The lease is £750k a year until 2043. The value of the stadium hasn’t been disclosed so it is uncertain whether this was a fair deal for Reading or not. It is likely that following the lease ending in 2043, the Madejski stadium will return to the ownership of the football club.

Debt levels increased from £58.4m to £61.2m (5%) after the owners lent a further £3.2m to the club. The owners also gave Reading funds of £15.8m by issuing new shares, Reading will not have to repay their owners this money. Looking ahead, unless costs are cut it is likely further funding will be necessary.

Net debt hence increased from £57.3m to £60.5m (6%). The increase is not big but masks the fact that they received £15.8m in share issues and also had to sell and lease back their stadium.

With their parachute payments running out and a return to the Premier League looking remote currently, Reading’s financial health will only deteriorate further unless significant financial changes are made or there is a surprise upturn in performances on the pitch.

Thanks for reading – Share with a Reading fan!