Preston enjoyed their third consecutive season in the Championship in what was their most successful to date in that period. Preston narrowly missed out on the play-offs, finishing in seventh place, an agonising 2 points from a chance at promotion. However, the club thrilled fans with what was an unlikely promotion push (following a poor February/March) after a strong finish to the season that filled the club with hope heading into the 2018/19 season.

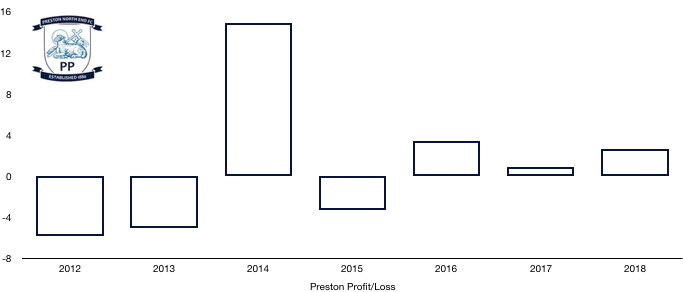

Off the pitch was equally as promising with a third consecutive of profits which increased from £0.9m to £2.6m (189%) as the club consolidated their Championship status. It is worth noting that despite another year of profit, this wouldn’t have been possible without a big departure…

Let’s delve into the numbers.

Revenue Analysis

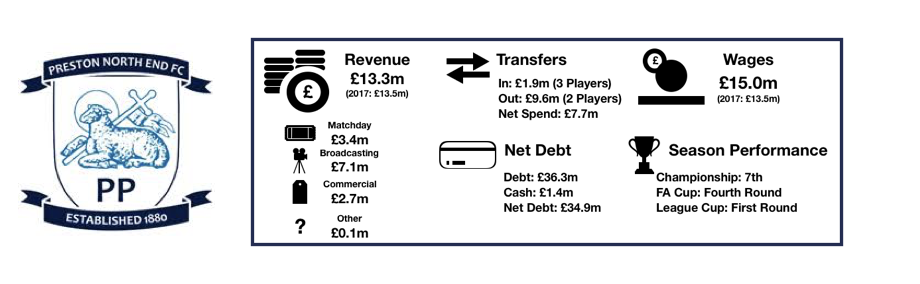

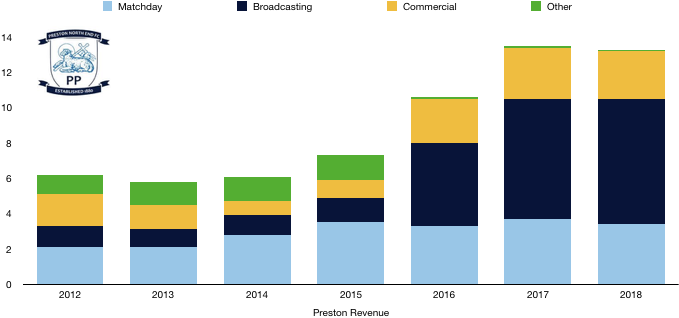

Despite a great season, Preston saw an ever so slight dip in revenue, falling from £13.5m to £13.3m (1%), although this amount is broadly in line with last season.

Matchday revenue interestingly fell from £3.7m to £3.4m (8%) despite season ticket sales increasing from 7,605 to 8,298 (9%), showcasing a near perfectly correlated negative relationship between the two, suggesting a poor ticketing strategy but potentially greater support.

Broadcasting revenue unsurprisingly increased, rising from £6.8m to £7.1m (4%) after finishing 4 places higher in the league, although Preston did perform worse in the League Cup (although they went one round further in the FA Cup).

Commercial revenue disappointingly fell slightly, falling from £2.9m to £2.7m (7%) as the club failed to capitalise on the feel-good factor around the club and the ever-growing popularity of the Championship and football in general.

Other revenue remained stable at £0.1m.

Looking ahead, Preston are likely to see much more of the same with a slight dip in revenue following a poorer season to date (although Championship prize money is rising which will negate this). A late promotion push, much like last season, may see their outlook change completely. The club also need to perform better in the commercial department and will be hoping to attract more lucrative sponsors in the near future while they will hope that the increased season ticket sales begin to pay dividends.

Costs Analysis

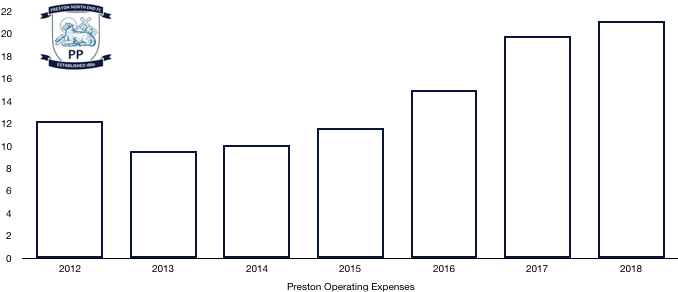

Preston saw a rise in costs despite falling revenue as costs increased from £19.8m to £21.1m (7%), adversely affecting profitability in the process.

Amortisation rose from £1.4m to £2.0m (43%) after an increase in transfer spending which the club aren’t usually accustomed too (although completely funded by player sales). Although amortisation rises usually signals an increase in player investment, this would be misleading here as Preston only reinvested a small sum of the fee received for Hugill this season (more on the reason why below). However, due to this amount being greater than usual and Hugill not attracting much amortisation (due to being bought for £27k!) this meant a rise in amortisation.

Preston had no interest costs in the year (and a small amount of interest income of £25k).

Preston paid tax of a measly £9k due to benefitting from previous losses which were used to offset the profit of this year for tax purposes.

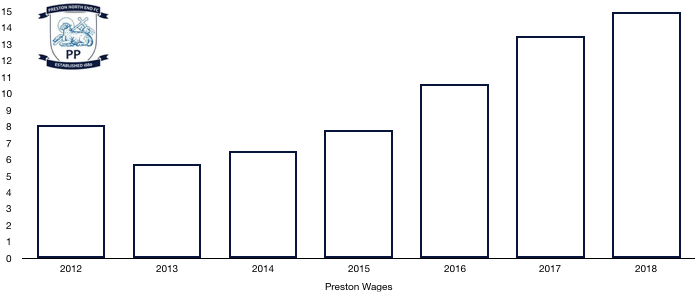

Wages made up the majority of Preston’s costs and increased from £13.5m to £15.0m (11%) as the club began paying higher salaries and players benefited from bonuses in their contract for a good season.

The rise in wages works out at an extra £29k a week, a not insignificant amount for Preston.

Preston’s directors didn’t see a wage rise of any sort unfortunately for them as their wages remained at £156k.

Looking ahead, Preston will likely see similar levels of costs next season with no major changes within the playing squad. Wages are likely to rise a little after Preston replaced Cunningham with three players. Amortisation will hence rise due to a similar situation as mentioned above.

Transfer Analysis

Preston were active in the market following the huge blow of losing Hugill in January in the midst of a play-off push. Things didn’t quite go to plan for the forward at West Ham, however his importance to Preston at the time was invaluable.

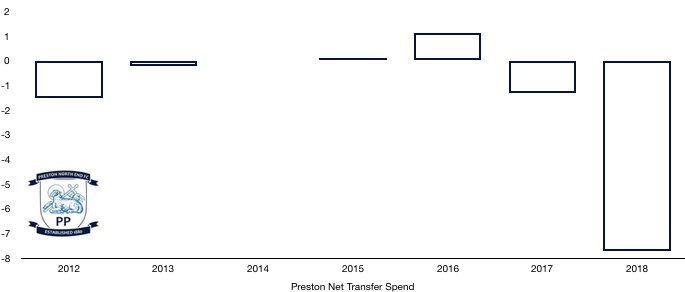

Entering Deepdale were Rudd (£1.0m), Moult (£0.5m) and Bodin (£0.4m) for a combined £1.9m.

Departing Deepdale were Hugill (£9.2m) and May (£0.4m) for a total of £9.6m.

This led to Preston having a negative net spend of £7.7m, the second successive year of negative spending but improving results.

The loss of Hugill affected their play-off push and may have been a costly error despite his struggles elsewhere.

His sale did however help Preston record a profit this year as his sale meant a profit on his sale of £9.7m was recorded in their financial accounts, meaning the club would have made a loss of £7.0m if he wasn’t sold (and May contributed slightly as well).

The transfer activity this year brought in £3.4m in cash to the club’s coffers with the remaining to be paid in instalments. Preston did however spend cash of £4.5m surprisingly as past transfer had to be paid for, meaning a net £1.1m cash outlay, explaining why not all of the Hugill transfer fee has yet been spent.

Preston are however owed a further £7.7m in transfer fees over the next year or two and in contrast only owe around £1.8m in transfer fees, a net £5.9m position which is a good position to be in.

The club don’t have any contingent transfer fees they expect to be payable or receivable in the future.

Debt Analysis

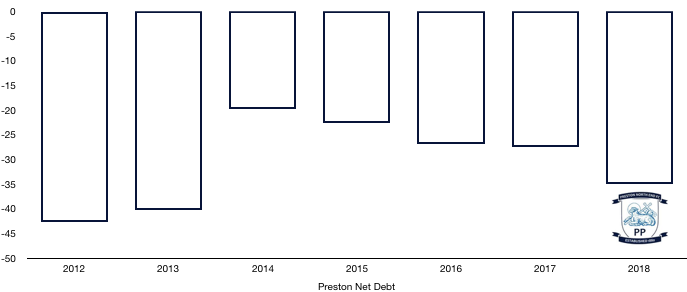

Preston saw cash levels more than halve from £3.2m to £1.4m (56%) as they reinvested the Hugill cash received in new players and also spent £2.2m on their facilities, which was also in part funded by new loans of £5.7m.

Debt increased from £30.7m to £36.3m (18%) on the back of this new loan, the fourth consecutive year debt has risen since it was halved in 2014.

All loans are owed to their owners and as such, they are not a liquidity risk as the owner will be repaid when he sales the club or decides to remove some cash (which they won’t do unless the club are financially able). The loans also carry zero interest.

This has led to a sizeable increase in net debt, increasing from £30.7m to £36.3m (27%) as cash fell and debt rose.

Preston have no reason to worry financially, the club are fairly stable and are also run prudently and within their means. The club do however need to be wary of increasing costs, as with revenue not increasing, profitability is being eroded which may lead to losses going forward as would have been the case this year without the sale of Hugill.

Thanks for reading – Share with a Preston Fan!