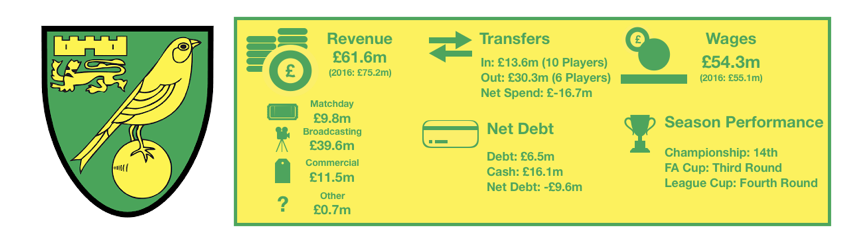

Revenue AnalysisNorwich City have had a disappointing spell in the Championship following relegation, condemning them to a 3rd consecutive season in the division. A brief relegation scare was overcome and a 14th placed achieved which still fell well short of expectations.

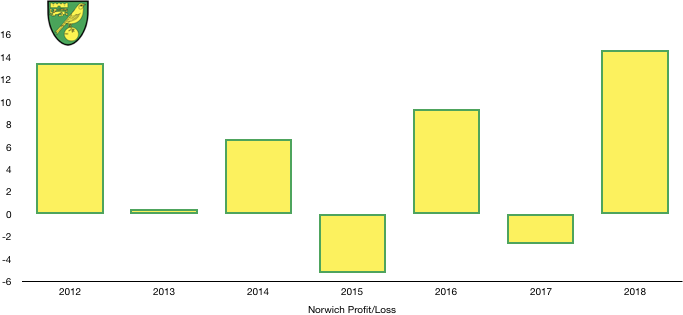

Despite a poor year on the pitch and falling revenue, Norwich managed to achieve a sizeable profit of £14.6m after making a significant profit on player sales. This is Norwich’s highest recorded profit in the last 6 years if not longer.

Let’s delve into the numbers.

Revenue Analysis

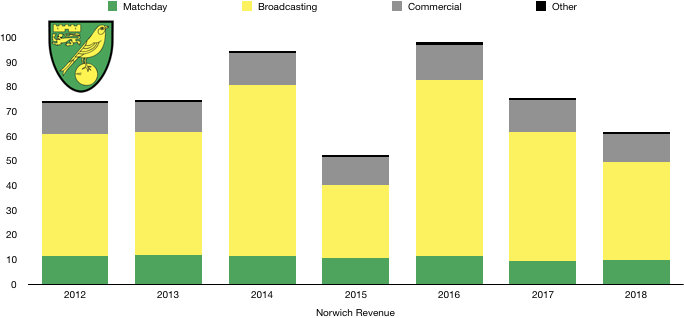

Norwich saw a steep drop in revenue this season after a poor campaign with revenue falling from £75.2m to £61.6m (18%).

Matchday revenue surprisingly rose, increasing from £9.2m to £9.8m (7%) despite average attendance falling after a disappointing season, meaning fans are paying more for tickets and/or spending more on match days.

Broadcasting revenue fell significantly from £52.5m to £39.6m (25%) after Norwich finished 14th, 6 places lower than the previous season. However, the main reason for the drop was a full in parachute payments following their relegation 2 years ago, this will fall further again next season.

Commercial revenue fell from £13.0m to £11.5m (12%) as fans spent less on merchandise and sponsors departed after a poor season. Norwich’s commercial team were unable to replace departing sponsors with as lucrative contracts.

Looking forward, Norwich have had quite the resurgence this season and are among the front runners for promotion currently. Promotion would bring with it great riches again compared with the last 2 seasons. However, the riches of promotion won’t be evident in next year’s revenue with the club still being in the Championship. Revenue is likely to fall as the fall in parachute payments is likely to be bigger than any gains in broadcasting revenue (from a higher league position) and commercial revenue.

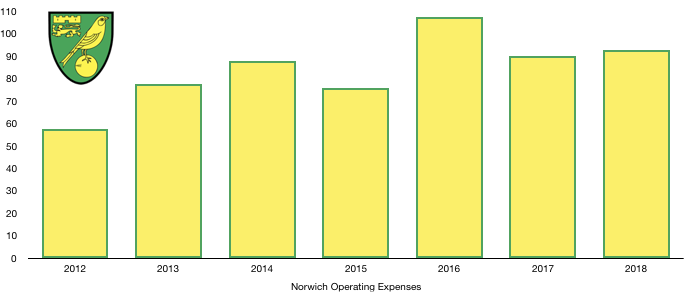

Costs Analysis

Norwich saw operating costs increase ever so slightly from £90.1m to £92.7m (3%). The combination of both revenue falling and costs rising has severely affected profitability and a profit only being recorded due to player sales.

Amortisation rose significantly, increasing from £16.5m to £24.0m (45%) as Norwich invested in new players to replace the youth products sold (who wouldn’t have attracted any amortisation charges as they came through the academy) leading to a surge in amortisation.

Net interest payable stayed stable at £0.5m.

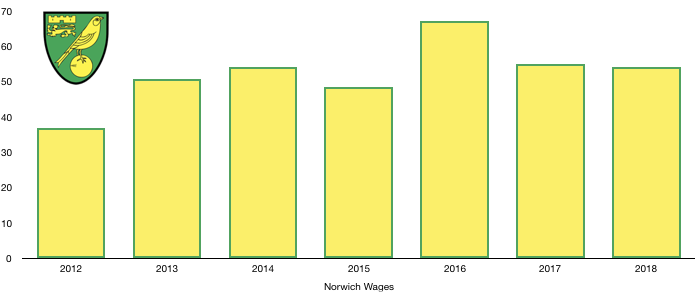

Wages stayed relatively flat, decreasing from £55.1m to £54.3m (1%) as despite the new signings their wages were relatively similar to those departing. The decrease in wages of around £800k is equal to approximately £15k a week saving on wages which is minimal.

Directors saw a huge drop in pay, receiving £108k compared to £1.1m last year, although £717k of this wage was due to compensation for the loss of office.

Norwich paid a high £3.8m in taxes, giving them an effective tax rate of 20.5%, higher than the actual corporation tax rate of 19%.

Looking forward we would expect a slight decrease in costs next season after little transfer activity over the last year meaning wages are likely to fall while the lack of incoming transfers will lead to amortisation to decline as well.

Transfers Analysis

There was a flurry of activity in the transfer market for Norwich with 10 arrivals and 6 departures.

Entering Carrow Road were Hanley (£3.4m), Franke (£2.7m), Hernandez (£2.3m), Stepermann (£1.5m), Srbeny (£1.4m), Husband (£1.0m), Vrancic (£0.7m), Raggett (£0.2m), Abrahams (£0.2m) and McClean (£0.2m) for a combined £13.6m.

Leaving Norwich were Pritchard (£11.1m), Jacob Murphy (£10.2m), Howson (£5.1m), Jerome (£1.5m), Dorrans (£1.4m), Rudd (£1.0m) for a combined £30.3m.

This gave Norwich a net surplus of £16.7m, a second consecutive year where there was a net inflow since relegation as the club managed their finances however this didn’t lead to a sustained promotion push (until this season).

Norwich’s signings struggled to make an impact and the replace the talented players lost with Pritchard, Murphy, Howson and Dorrans in particular missed.

The silver lining is those outgoings led to a profitable season as the club recorded a profit on player sales of £48m. Despite these accounts being based on the 17/18 season, it seems the sale of Maddison and/or Josh Murphy who were sold in the summer.

Norwich are in a healthy position in terms of future transfer fees payable. Norwich are owed a total of £42.4m, of which £19.8m is owed in the next year. Norwich in contrast only owe £13.8m in transfers, of which £8.7m is due this year.

However, Norwich could potentially owe a further £22.5m in contingent transfer fees if certain clauses are met.

In terms of cash, Norwich received cash of £24.8m for transfers and spent cash of £20.1m as the club pay down previous transfer fees still.

Debt Analysis

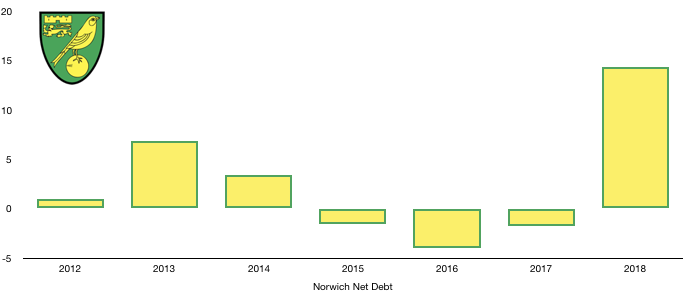

Norwich are traditionally a club of little debt which bodes well for their future.

After some big transfers Norwich saw cash levels soar from last year, rising from £1.4m to £16.1m (1,050%). This was in addition to a £2.3m investment in the training ground and academy after what their owners called “years of under-investment”. This was financed by a new loan from the owner of £4.8m, showcasing some much-needed ambition.

Looking forward with the level of transfer fees receivable detailed above, cash levels should increase further which will be more than helpful if the club secure promotion back to the Premier League this season.

Debt levels hence rose due to the new loan, increasing from £3.2m to £6.5m (103%). This level of debt is minimal compared to their peers.

Norwich are run so sustainably that they are currently in a net cash position, unheard of for a Championship club which should be commended especially due to the recent relegation. Norwich find themselves in a net cash position of £9.6m after a net debt position of £1.8m. It remains to be seen what promotion may do to this balance as the squad will require significant investment to stay up.

Thanks for reading – Share with a Norwich fan!