Newcastle enjoyed a successful first season back in the Premier League following a 1-year hiatus, finishing in 10thfollowing a strong finish to their 2018 season.

It was however a turbulent season off the pitch as the much maligned Mike Ashley looked to sell the club to no avail following promotion, with performance suffering at times as a result of the distractions this brought.

Promotion saw a huge boost to Newcastle’s finances, with a loss of £41.3m turning into a sizeable profit of £18.6m, as Mike Ashley dialled back investment in a bid to make the club attractive to potential buyers.

Let’s delve into the numbers.

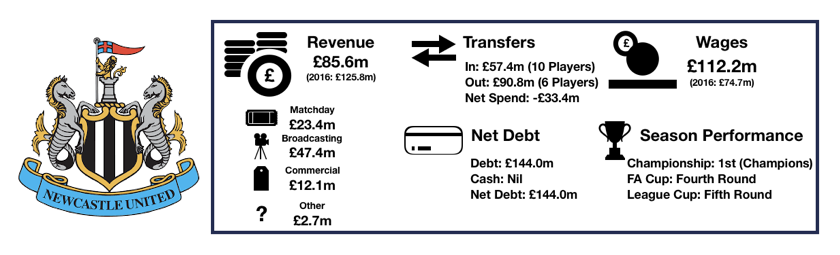

Revenue Analysis

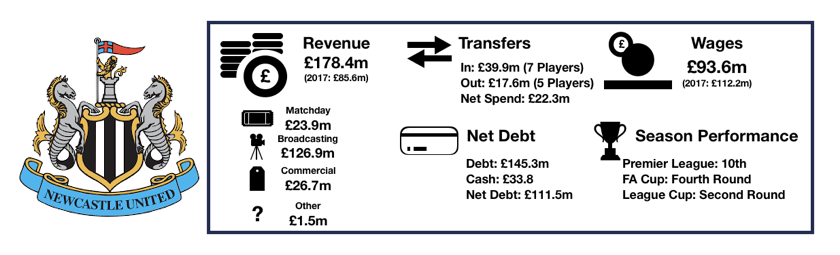

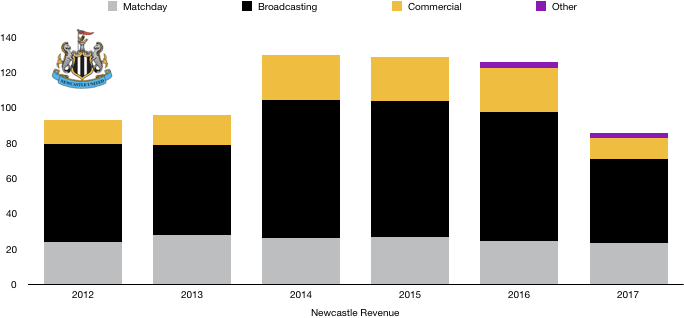

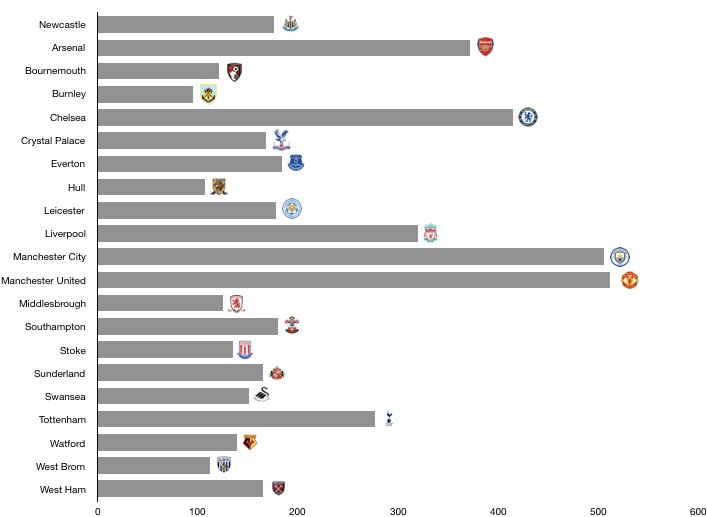

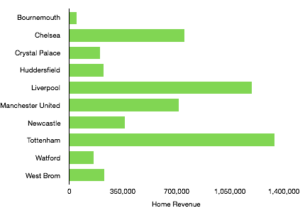

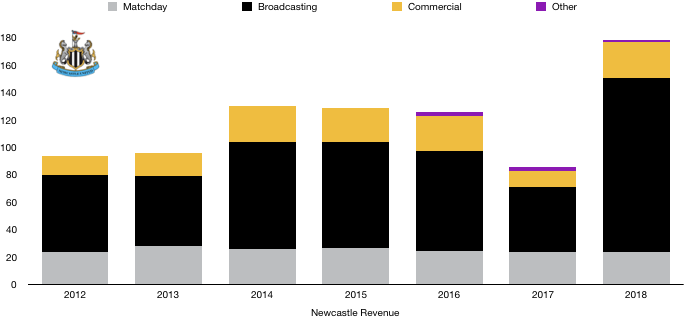

Newcastle saw revenue rocket following promotion, rising from £85.6m to £178.5m (109%), record levels for Newcastle.

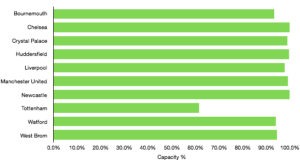

Matchday revenue remained relatively stable, increasing from £23.4m to £23.9m (2%) as attendances rose slightly from 51,108 to 51,992 (2%).

Broadcasting revenue saw the largest increase, more than doubling from £47.4m to £126.4m (167%) as Newcastle saw the return of Premier League TV money following promotion. This increase would have been even larger had the Magpies not been so disappointing in the domestic cups.

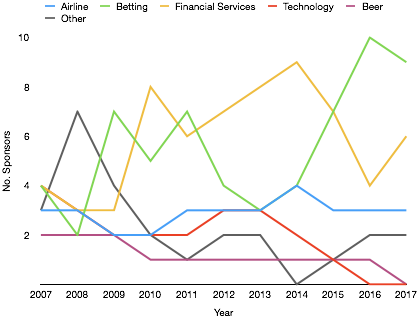

Commercial revenue more than doubled as well, increasing from £12.1m to record levels of £26.7m (121%). Relegation had seen a steep drop in their commercial income, but an immediate return saw it exceed previous levels as Newcastle continue to exploit their huge fan base to good effect.

Other revenue fell from £2.7m to £1.5m (44%).

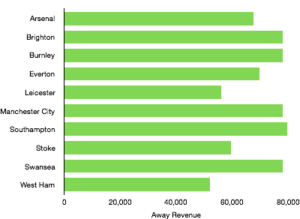

Looking ahead, Newcastle are likely to see a similar level of revenue next season. Matchday revenue will remain stable at £30m. Broadcasting revenue will fall slightly as Newcastle can only hope to finish 11that the best this season with two games to go. Commercial revenue is likely to increase further, which may offset the loss in broadcasting revenue.

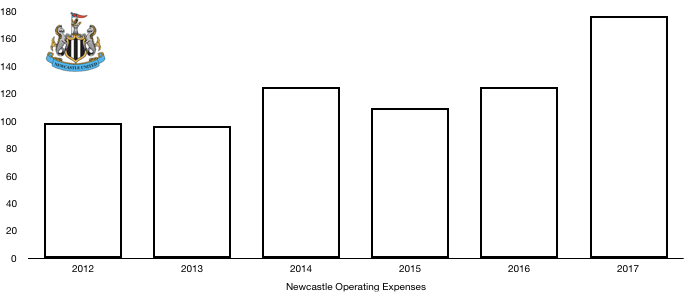

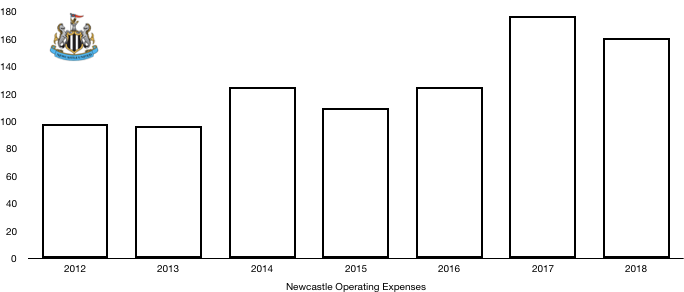

Costs Analysis

Newcastle surprisingly saw their costs FALL on a return to the Premier League, which is unheard of. Costs fell from £176.6m to £160.9m (9%). The fall in costs while revenue ballooned saw a huge improvement in their profitability.

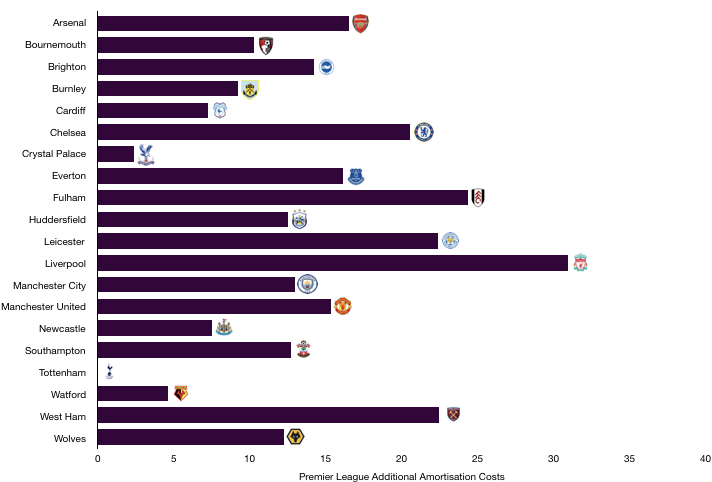

Amortisation rose from £35.8m to £41.3m (15%) as Newcastle invested in their playing squad, although the size of the investment was much smaller than fans would have hoped for.

Lease payments remained stable at £0.6m.

Newcastle have net interest income due to having little interest costs from their debt (which is interest-free) and this income fell slightly from £1.9m to £1.8m (5%).

Newcastle had a tax bill of £4.3m, an effective tax rate of 19%, equal to the corporate tax rate of 19%. This is slightly surprisingly given the ability to use previous losses to reduce taxes, which were quite large last year.

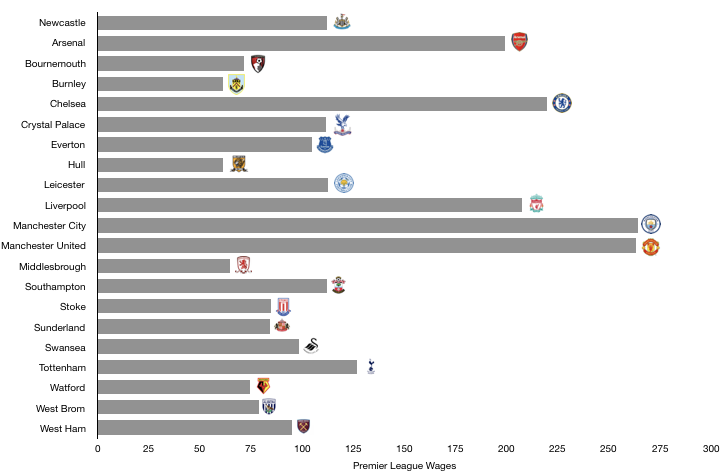

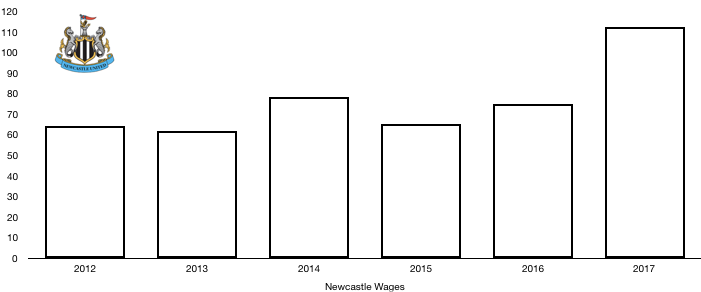

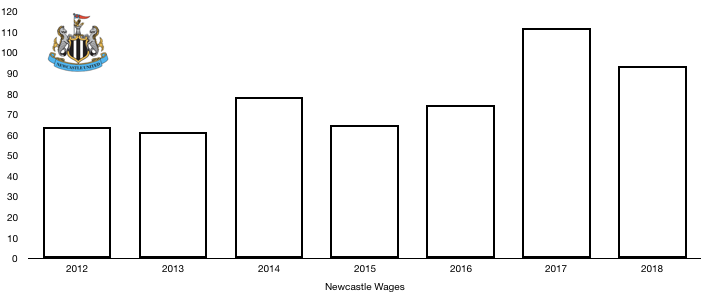

Wages were the main area to see a fall, decreasing from £112.2m to £93.6m (17%), unheard of after a team gains promotion. Wages would have fallen slightly due to bonuses paid out last year for promotion, however it is expected that incoming players will attract higher wages which didn’t happen in this case.

This wage saving works out a cool £358k a week less in wages, an amount that has boosted Newcastle’s finances considerably. This tight wage control by Mike Ashley was a ploy by the notorious owner to make the club more attractive to potential buyers, a strategy which is yet to pay dividends.

The fall in wages makes their 10thplaced finish even more spectacular given these constraints and the unwanted media attention /distractions the potential sale brings.

The one director on pay roll saw their remuneration double from £150k to £300k (100%) as they met all the targets expected of them.

Looking ahead, costs are likely to rise after new signings this season will see wages and amortisation both rise. It is unlikely this rise will be large with Mike Ashley still looking to sell the club and he is not interested in worsening the club’s financial health at this stage or plug any more money into Newcastle.

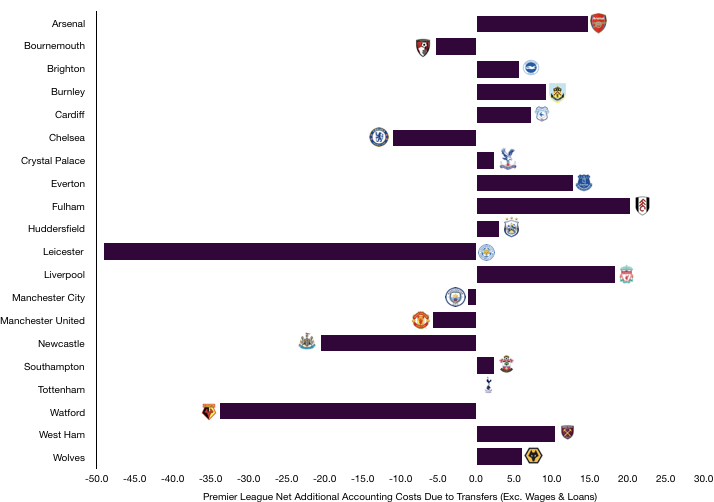

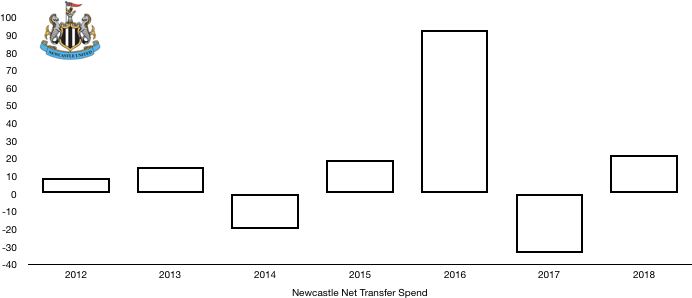

Transfers Analysis

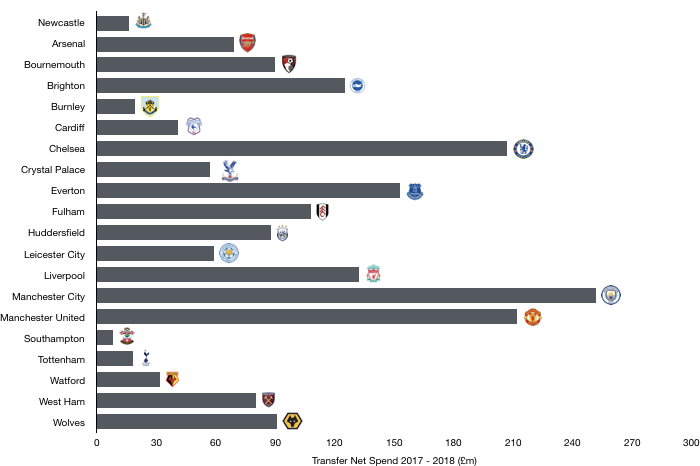

Newcastle were fairly busy in the transfer market throughout the season, signing 7 players and seeing 5 depart the Toon Army.

In came Murphy (£10.2m), Lejeune (£9.0m), Atsu (£6.8m), Joselu (£5.0m), Manquillo (£4.5m), Merino (Loan – £2.7m) and Duvbraka (Loan – £1.8m) for a combined £39.9m.

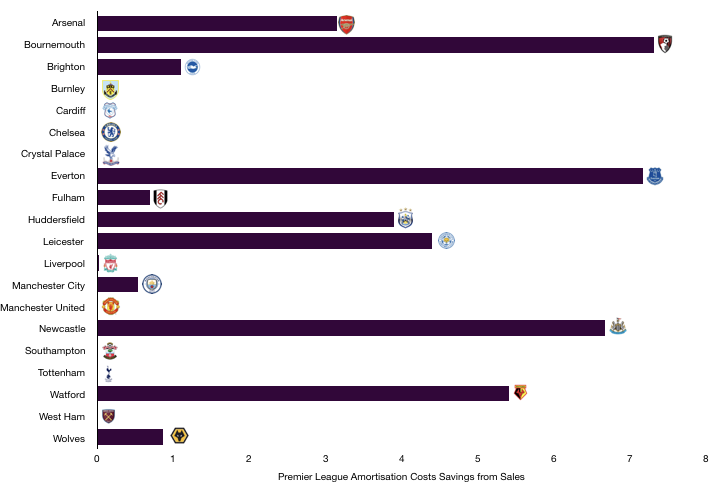

Departing Newcastle were Thauvin (£9.9m), Hanley (£3.4m), De Jong (£2.1m), Murphy (£2.1m) and Mbabu (£0.1m) for a combined £17.6m.

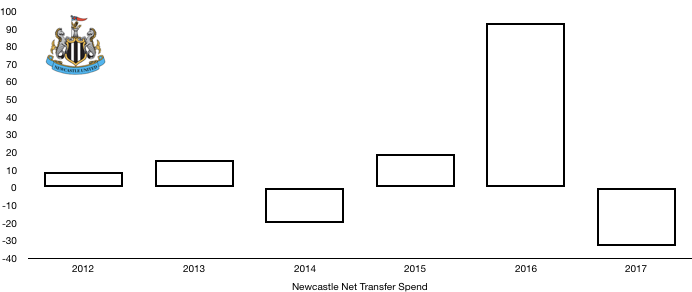

This led to a net transfer spend of £22.3m, up from a net transfer income of £33.4m last year. Despite this, this is a fairly low figure for a newly promoted club.

The big signings of Murphy, Atsu and Joselu failed to contribute consistently but all had key contributions at certain points of the season. Lejeune proved a good signing however injuries plagued a bright season. The loan signings of Duvbraka and Merino were inspired, although Merino was soon on his way to Dortmund.

Of the departures, Thauvin and Mbabu have flourished since their departures and their sales may be looked back on with a tinge of regret.

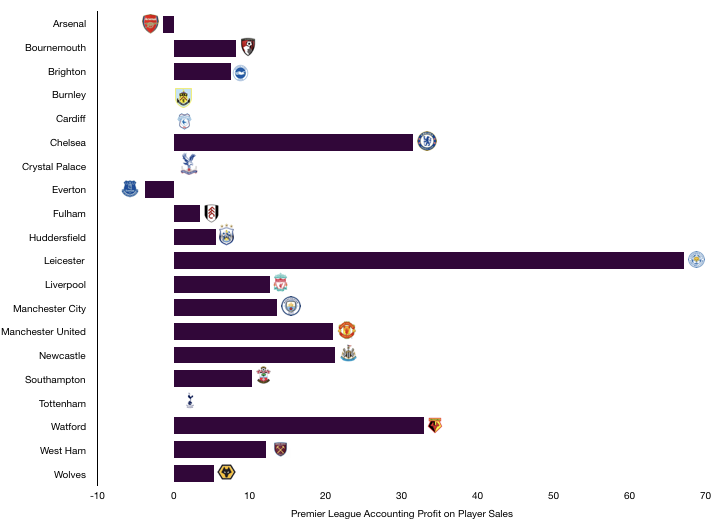

Newcastle recorded a profit on player sales of £3.6m, showing that Newcastle would have made a profit even without player sales, an outstanding and fairly rare achievement.

In cash terms, Newcastle spent cash of £46.2m and recouped cash of £30.5m, a net cash outlay of £15.7m, paid for entirely with their profits.

Newcastle are owed a sizeable £43.9m (£20m due this year) in transfer fees from previous transfer windows and only owe other clubs £28.8m (£22.8m due this year), a net debtor position of £15.1m.

This puts Newcastle in a strong position to push and this £15m almost entirely funds the signing of Almiron in January.

Newcastle could potentially owe £7.0m in contingent transfer fees should certain clauses be met.

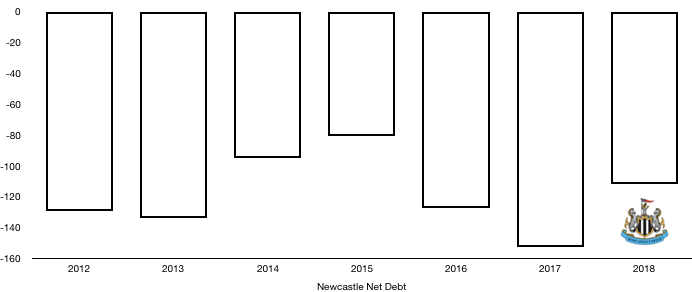

Debt Analysis

Newcastle’s fine season saw their cash reserves boom. An overdraft of £8.3m turned into a £33.8m cash balance following a hugely profitable year after promotion.

Their profits helped fund their transfer outlay and also allowed a measly £0.7m investment in infrastructure, further showing the lack of investment Mike Ashley is willing to sanction.

The little investment in the past year is likely to continue until the club is sold to new owners who are excited by Newcastle’s potential.

Debt levels fell slightly, falling from £152.3m to £145.3m (5%) due to the elimination of their bank overdraft, with actual debt staying the same.

Mike Ashley refuses to invest further into the club, wanting to show the club as self-sufficient to attract potential suitors, while also wanting to keep his pockets flush.

Net debt hence fell from £152.3m to £111.5m (27%). This shows Newcastle as incredibly financially stable compared to years gone by.

Fans are not happy with the level of investment at the moment and have every right to be, however fans should take comfort in the financial health of the club and the opportunities available once a new, more ambitious owner is found.

This new owner is needed sooner rather than later with not only fans becoming impatient, but just as importantly at the moment their manager Rafael Benitez, whose departure would put club in danger.

Following early flirtations with relegation, a bit of investment in January helped the club stride clear of the drop zone and shows what can be achieved if they invest more (and smartly).

Thanks for reading – share with a friend!