Millwall returned to the Championship after a season in League One and nearly succeeded in making it a brief return for all the right reasons, surprising most in narrowly missing out on the Play-offs with an 8thplaced finish.

Millwall had a great season all round, going 17 games unbeaten during the season and renewing hope around the club with The Den proving a fortress in its 25thyear of existence.

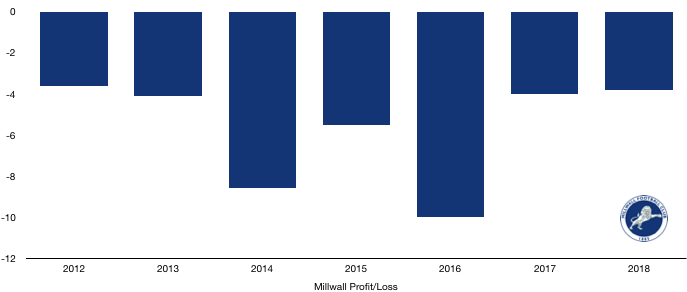

Despite this, Millwall continued to be loss-making however the level of losses fell to £3.8m, their lowest levels since 2012. The low level of loss means that at least Millwall remain well within the Financial Fair Play regulations with a cumulative loss of £17.8m, significantly less than the allowable £39m loss.

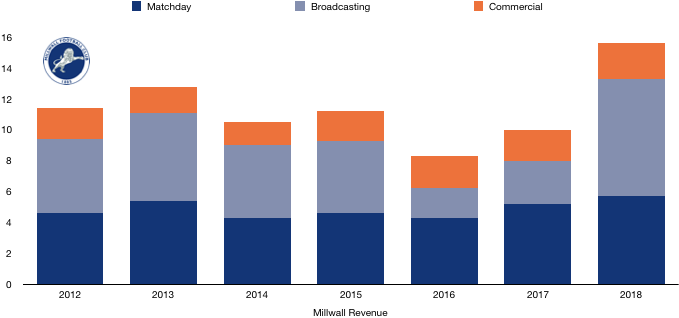

Revenue Analysis

Millwall saw record revenue after returning to the Championship with revenue rising from £10.0m to £15.6m (56%) with the main contributing factor unsurprisingly being promotion back to the Championship.

Matchday revenue grew from £5.2m to £5.7m (9.6%) as fans, happy with performances, spent more on matchdays and average attendance grew on the back of their performances.

Broadcasting revenue more than doubled, increasing from £2.8m to £7.6m (171.4%) as the return to Championship saw prize money explode which was further boosted by an increase last season in distributions by the football league to all Championship clubs.

Commercial income rose slightly from £2.0m to £2.3m (15%) as the club attracted more sponsorships and fans increased spending on merchandise on their return to the Championship.

This season hasn’t gone as planned for Millwall as they find themselves in and around the relegation zone at the mid-way point of the season. This means an improvement on their 8thplaced finish last season seems ambitious which will see broadcasting revenue suffer. Matchday income is likely to see a small dip on the back of disappointed fans spending less. Relegation would not see a huge change in revenue this season, however next season would see a huge drop in revenue on the back of a drop in prize money.

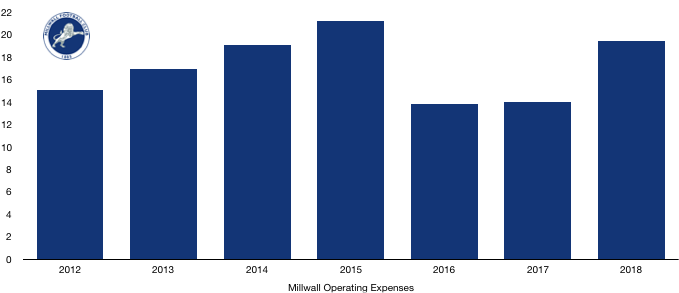

Expense Analysis

With a return to the Championship, Millwall needed to spend in order to compete at a higher level and reward their existing stars in order to keep everyone happy.

This saw expenses rise from £14.0m to £19.4m (38.6%), increasing at a slower rate than revenue which nicely improves Millwall’s profitability. Expenses are still lower than 2015 levels where Millwall’s finances were close to unravelling which will be of comfort to their owners who are looking to make the club more financially sustainable and self-sufficient.

Amortisation tripled from a measly £0.2m to £0.6m (200%) as the club increased player investment after no transfer fees paid in the previous season.

Lease rentals also grew significantly, rising from £0.2m to £0.5m (150%) as Millwall move to a leasing model after selling their training facilities and leasing them back recently while there is also some costs related to current negotiations around the areas surrounding The Den.

Wages rose significantly, increasing from £9.4m to £13.4m (42.6%) due to new signings (mainly on frees) and promotion wage rises to existing stars. Interestingly, wages are also still below 2015 levels as Millwall exercise tighter financial controls.

The £4m rise in wages is equal to a reasonable £77k extra per week in wages.

Directors saw wages rise slightly to a total of £287k compared to £259k last year.

Millwall are not tax paying having made losses for a long time and will also not pay much tax for foreseeable future even if they make a profit due to the build-up of £79m in tax losses meaning profits up to £79m will be covered by losses in the future (some complicated tax loss rules mean that not all profits each year will be covered).

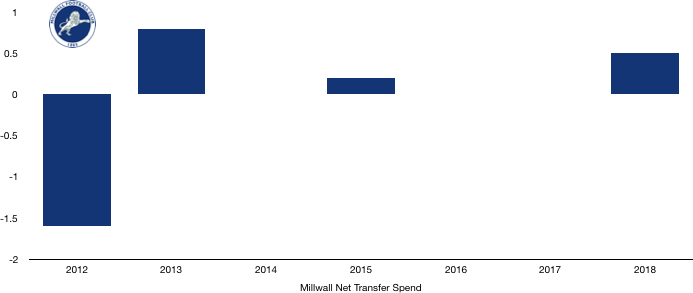

Transfer Analysis

Millwall’s recent financial history has meant they have predominately relied upon loans and free signings to improve the squad. This did not really change this year with only one cash signing and no departures for transfer fees.

With no departures, joining The Den was George Saville from Wolves for £0.5m, proving a shrewd signing by the club alongside their frees and loans, including club legend Tim Cahill.

Despite no outgoings, Millwall are still owed £99k in transfer fees over the next year. Millwall owe no transfer fees currently.

More worryingly but still a minor issue, Millwall have a potentially contingent transfer fee payable of £0.8m, up £0.5m, most likely due to the signing of Saville.

Millwall have no contingent transfer fees that could be received.

Assets/Liabilities Analysis

Millwall have recently seen net debt rise as losses mount and the club require financial boosts from their owners.

Cash levels fell slightly, falling from £0.4m to £0.3m (25%). Cash levels have remained relatively low and stable for Millwall as they require all their capital in order to operate currently.

There were no transfer fees received to boost cash levels and the loss was offset by a cash injection from Millwall’s owners .

The after mentioned cash injection of £4.1m increased debt from £86.9m to £90.9m (4.6%) as the owners continue to service the club’s losses in the hope things turn around and they begin to become profitable.

It is however promising that the rate of owner funding is falling as the club look to become more self-sufficient as the losses fall, however this may unravel if Millwall suffer relegation.

All of Millwall’s debt is owner debt and is interest free with no imminent repayment date meaning the club are not under any immediate financial pressure.

This leaves Millwall with net debt levels of £90.3m, up from £86.5m.

Thanks for reading – Share with a Millwall fan!