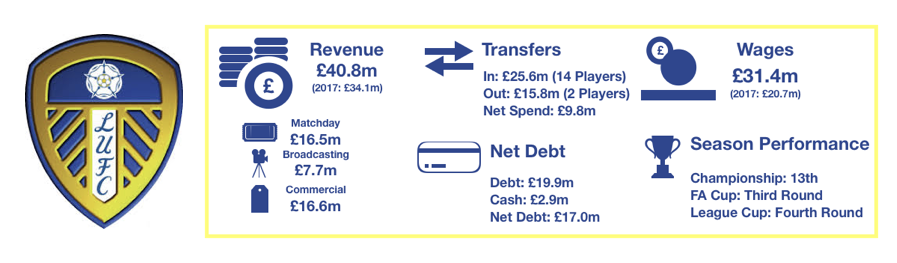

Leeds had a disappointing season in the first year since Radrizzani took over at Elland Road, finishing 13thin the Championship, condemning the club to a 9thsuccessive season away from the Premier League.

There was also disappointment in the domestic cups after early exits in both the FA Cup and League Cup.

However, optimism has been renewed due to their new ownership and the ambition he has shown to date, increasing investment in the club with much more expected to follow.

The investments made did worsen their finances, turning a profit of £1.0m to a loss of £4.3m, however with promotion in touching distance, it looks like a gamble that will pay off.

Let’s delve into the numbers.

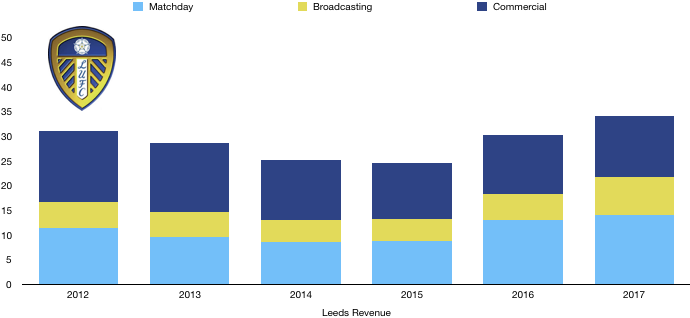

Revenue Analysis

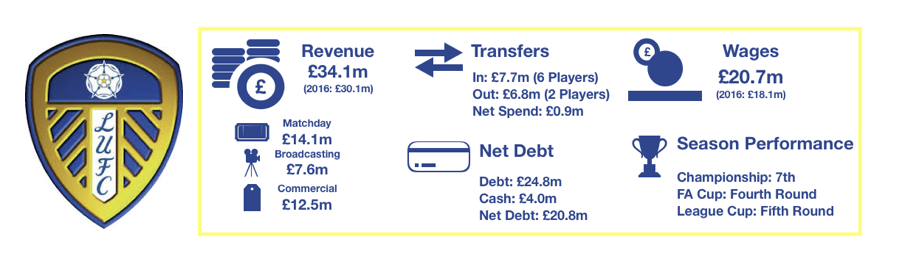

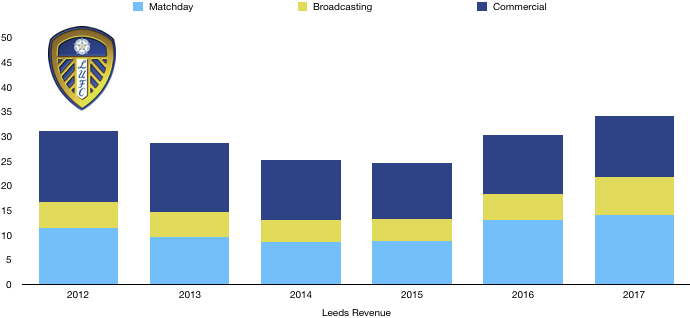

Leeds reached record levels of revenue in 2018, with revenue rising from £34.2m to £40.8m (19%).

Matchday revenue continued its upward trajectory, rising from £14.1m to £16.5m (17%) as an increase in fan sentiment saw attendances rise yet again from 27,699 to 31,521 (14%), approaching full capacity (37,980) as fans our hopeful once again of success.

It was also their second highest average attendance in their 8 year stay in the EFL.

Broadcasting revenue was relatively stable, increasing slightly from £7.6m to £7.7m (1%) despite falling 6 places in the Championship and a worse performance in the cups.

This is due to the club featuring on TV more regularly given the increased interest in the club.

Commercial revenue rose by a third, increasing from £12.5m to £16.6m (33%) as their new owner opened the doors to new, lucrative deals. This was a great season commercially as their popularity among their fans grew and in England as a whole as they close in on a Premier League return.

Looking ahead, revenue will rise after a wonderful league campaign so far. This should see revenue rise as prize money will increase and they have featured frequently on Sky Sports.

Attendance looks likely to rise again with average attendance to date of around 33,000, so matchday revenue will also rise.

Commercial revenue should continue to increase due to the growing popularity and the aggressive commercial strategy the club have begun to implement.

Promotion will not initially boost revenue considerably, instead, should they get over the line, revenue will boom to over £100m following their first Premier League campaign.

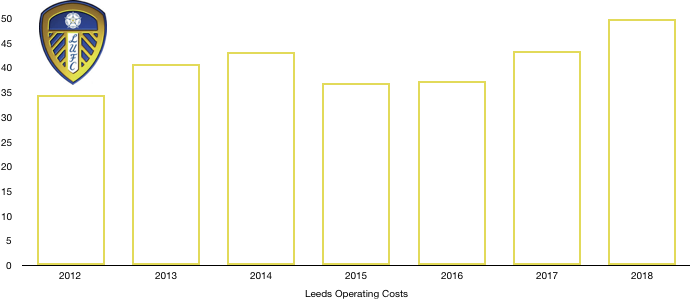

Costs Analysis

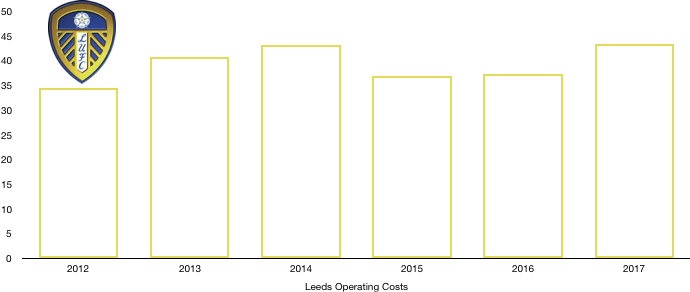

Leeds saw a significant increase in costs, with operating expenses rising from £43.3m to £61.4m (42%) after a surge in investment.

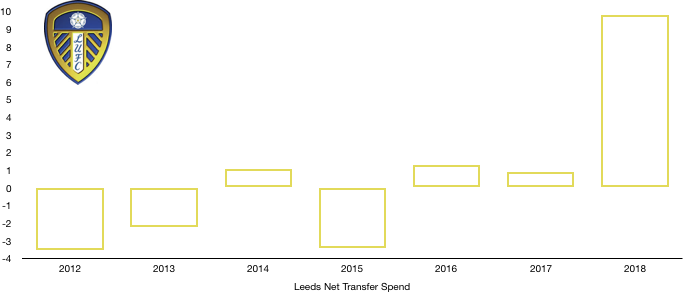

Amortisation grew from £5.4m to £8.1m (50%) after an increase in player investment after their net transfer spend grew by nearly 1,000% (see transfer analysis)!

The rise in amortisation signifies Leeds growing ambition and it is expected this will only rise going forward.

Lease costs remained relatively stable, rising from £2.1m to £2.2m (5%).

Interest costs rose from £1.5m to £1.7m (13%) due to an increase in lease interest costs.

Leeds also had £2.6m of interest income last year due to a change in the value of their loans which wasn’t present this year, contributing to their loss.

Leeds paid no tax this year due to making a loss, this may help when they return to a profit in the next couple of years, with the loss in 2018 being able to partly offset any tax bill the club face.

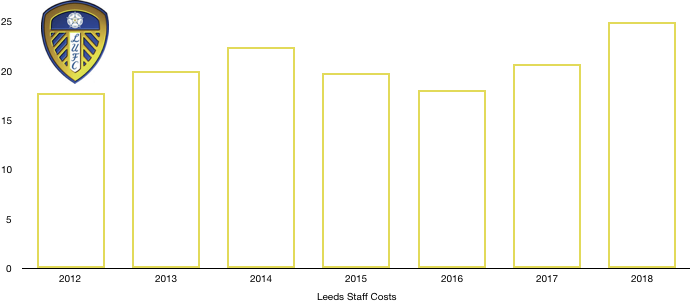

Leeds saw a huge rise in their wage bill as it increased from £20.7m to £31.4m (52%). The club signed a host of players with some new high earners, while new contracts were given to key players.

Should Leeds achieve promotion is has been disclosed they will owe players and staff £18.1m in bonuses, a sizeable sum that will increase their losses. However, from a Financial Fair Play perspective, these amounts will be ignored in any investigation (although Leeds are well within the limits so we wouldn’t expect an investigation by the EFL at present).

The extra wages equalled a sizeable extra £206k a week, a large sum for any Championship club.

Directors were paid £212k this year, however no such disclosure on remuneration were made last year.

Looking ahead, costs are likely to rise significantly after another year of spending that will see amortisation and wages rise. The extra promotion bonuses will also increase costs significantly, should they reach the promised land.

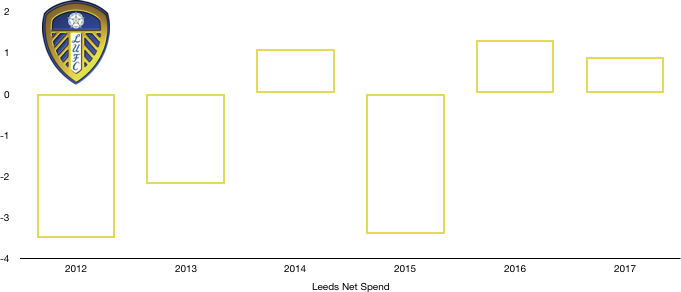

Transfers Analysis

What a busy transfer for Leeds! A remarkable 14 players entered Elland Road while only 2 departed.

In came (here we go) Forshaw (£4.6m), Jansson (£3.6m), Saiz (£3.2m), Roberts (£2.6m), Alioski (£2.3m), Klich (£1.5m), Sacko (£1.5m), De Bock (£1.5m), Grot (£1.4m), Cibicki (£1.4m), Ekuban (£0.5m), Ideguchi (£0.5m), Halme (£0.5m) and Wiedwald (£0.5m) for a combined £25.6m.

Out went Wood (£14.8m) and Bridcutt (£1.0m) for a combined £15.8m.

This meant their net transfer spend increased from £0.9m to £9.8m (989%), a meteoric rise in spending and a show of ambition.

However, the signings were quantity over quality with the players proving to be an incredibly mixed bag. The likes of Forshaw, Jansson and Saiz have been great while other have flattered to deceive but there is still time for them to come good.

Leeds may have been better off not spreading their £25m so thinly and focussing on signing a few great players.

The departure of Wood was clearly felt as they missed his ability towards the back end of the season.

Leeds recorded a profit on player sales of £18.1m (although this does also include the sale of Viera at the end of the season) largely due to the sale of Wood. This figure helped make sure their losses weren’t far greater.

The lack of sales this year (also considering the sale of Viera has already been taken into account), Leeds losses are likely to be much greater this season.

In cash terms, Leeds spent cash of £19.5m while receiving cash of £16.9m, a net cash outlay of £2.6m, which is a fairly minor outlay considering the ambitions of their new owners.

Leeds are also owed a further £11.5 in transfer fees (£5.9m due this year) and owe £12.4m (£5.7m due this year), a net owing position of a measly £0.7m which is hardly going to affect future transfer plans.

There is also the potential for Leeds to owe other clubs and agents £7.1m in contingent transfer fees should certain transfer clauses be met (largely related to promotion and appearances), although it is unlikely the full amount here will ever become payable.

Debt Analysis

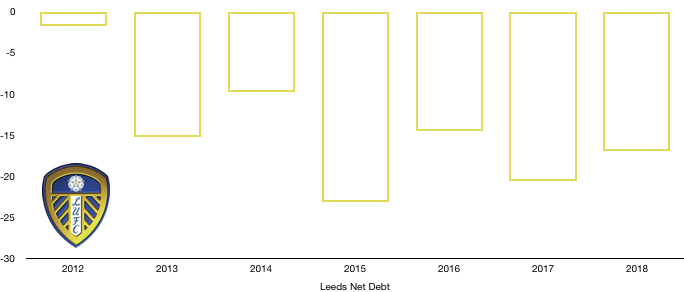

Leeds saw their cash levels depleted following their losses, with cash reserves falling from £4.0m to £2.9m (28%).

Their new owners provided new funds of £13.6m (£11m in shares and £2.6m in loans). These funds were used to take care of their losses and pay transfer fees. It also allowed them to invest £3.3m in the club’s infrastructure as they look to also invest in their future as well as present.

The £11m provided by Radrizzani in shares was also used to repay existing loans in the club.

Debt levels surprisingly fell, falling from £24.6m to £19.9m (19%) as Radrizzani repaid debts owed to their old owners of around £11m and replaced these with shares of £11.0m, meaning that Leeds now owe their owners less money.

On a separate note, Leeds disclosed they are seeking legal advice on the recoverability of a £2.0m debtor, it was not disclosed what this amount relates to, but they will be hoping to recover this amount.

Net debt hence dropped from £20.6m to £17.0m (17%). There is no doubt this amount is likely to increase as Radrizzani begins pumping more money into the club. Promotion (if achieved) is likely to require significant investment (i.e. Wolves and Fulham) however it is how this is spent that will be important.

No matter how this season ends, promotion is vital in the next season or two to make any of these investments worth it. Also, if promotion is not achieved soon, Financial Fair Play limits will be tested, and the club may be forced to tone down investment and implement strict costs controls to avoid penalties.

Leeds are finally close to a return to the big time and will be hoping this season is the one. Financially they are in a good place and a return to the Premier League this season will only boost their finances in this new era.

Thanks for reading – Share with a fan!