Charlton suffered another agonising season after once again losing in the play-offs, Condemning the Addicks to a third successive season in League One.

They will be hoping that they can achieve promotion at the third time of asking and return to the Championship, with the club close to another play-off place.

A profit of £1.2m was recorded last year due to player sales, their relegation last year and a lack of player sales has led to this turning into a loss of £10.1m in 2018.

Let’s delve into the numbers.

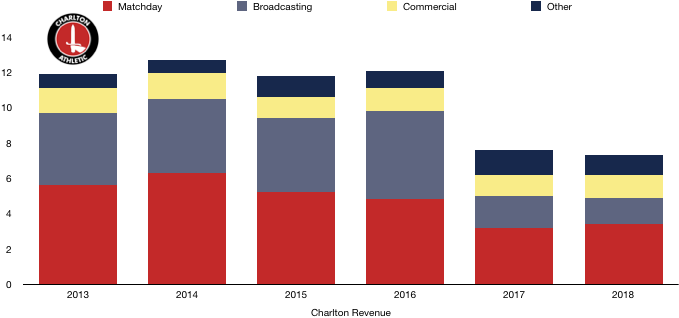

Revenue Analysis

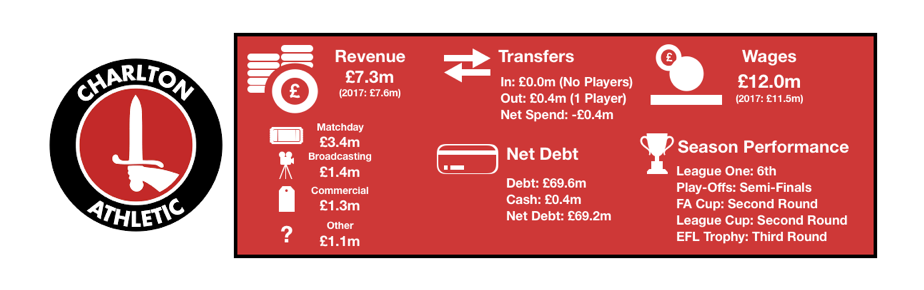

Charlton saw revenue fall from £7.6m to £7.3m (4%).

Matchday revenue increased in 2018, rising from £3.2m to £3.4m (6%) as another solid campaign in League One saw attendances rise from 11,162 to 11,846 (6%).

Broadcasting revenue decreased once again, falling from £1.8m to £1.5m (17%) despite finishing in the same position as last season due EFL parachute payments following relegation falling which was capped with poor domestic cup performances.

Commercial revenue increased from £1.2m to £1.3m (8%) as their YouTube venture began to pay dividends after hosting events at The Valley.

Other revenue fell from £1.4m to £1.1m (21%).

Looking ahead, Charlton are likely to see a similar level of revenue with the play-offs beckoning again for the South London side. Promotion is likely to see a slight boost this year (and a huge boost the following season). Commercial revenue should grow again slightly, while matchday revenue may also increase slightly. Broadcasting revenue is likely to remain relatively stable.

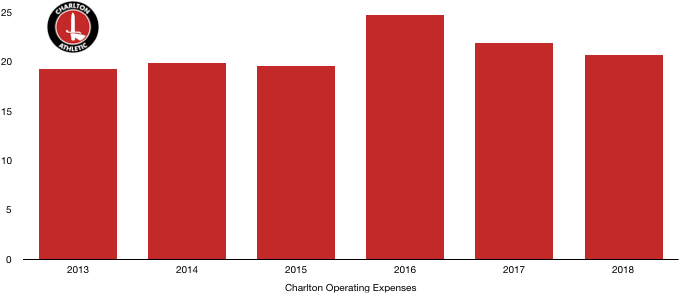

Costs Analysis

Charlton saw a small dip in costs, falling from £21.9m to £20.7m (5%). This fall was in line with the fall in revenue (4%), improving profitability slightly despite the sizeable loss (which was due to the lack of transfers).

Amortisation fell from £1.9m to £1.7m (11%) after a lack of player investment this season after signings players on free transfers only.

Lease costs on facilities fell from £159k to £138k (13%).

Interest costs increased from £0.7m to £0.8m (14%) after an increase in loans from their owners (see debt analysis).

Charlton paid no tax after making a loss in the 2017/18 season which is usually the case for Charlton at the moment.

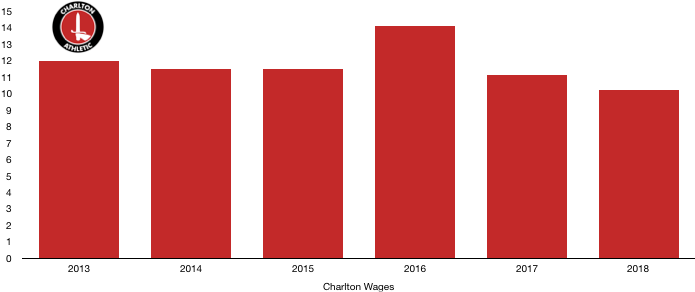

Wages rose fell from £11.1m to £10.2m (8%) as players left The Valley and Charlton had to cut costs after another season in League One.

The salary saving works out at measly £17k a week in wages, which is still a decent saving for a League one side.

No director remuneration was disclosed, with it being in the wage figure above.

Looking ahead, Charlton are likely to see a similar level of costs next year, although wages may cause costs to rise should they gain promotion as bonuses will be rewarded. Another season in League One however would require costs to be cut further to avoid larger losses and Financial Fair Play issues.

Transfers Analysis

Charlton had a quiet transfer season with the club constrained on spending due to their League One status.

The Addicks made no signings other than free transfers while they had one departure, with Holmes leaving for £0.4m.

This led to a negative net transfer spend of £0.4m, the third year in a row this has happened.

Charlton recorded a profit on player sales of £4.0m after receiving contingent transfer fees from the prior sales of the likes of Gomez, Lookman and Gudmundsson who all met appearance bonuses that increased Charlton’s income.

The profit also includes the sale of Konsa, which happened at the end of the season but before the end of June.

In 2017, Charlton recorded a profit on player sales of £16.2m after the sale of Lookman, an amount that was the sole reason for their profit last year, the lack of sales in 2018 hence so losses grow considerably.

Charlton benefit significantly from their academy and did well to negotiate contingent fees that can give the club a timely boost as they look to return to the Championship.

However, Charlton do owe other clubs £1.5m for transfers (all due this year) and are only owed £0.8m, a net creditor position of £0.7m which is affecting their ability to buy any players currently with finances tight.

Charlton could also be owed a further £7.7m in transfer fees if certain conditions are met, and with the likes of Gomez and Lookman beginning to make names for themselves, these fees are likely to be received at some point, although the sooner the better.

In comparison, Charlton could owe other clubs £1.9m in contingent transfer fees should certain conditions be met, although this is less likely to become payable than the figure above.

Debt Analysis

Charlton saw cash levels drop significantly, falling from £2.1m to £0.4m (81%) after the huge loss made.

There was also a sizeable £2.2m spend on training facilities at Sparrows Lane, showing a commitment to continue to grow despite their hardship of late.

This is vital for a club that prides itself on its ability to bring through youth, who will see this development as another reason to begin their young careers at The Valley.

To fund all of this, debt levels rose from £65.0m to £69.6m (7%) as the owners plunged more money into the club to keep them ticking over and hopefully aid their promotion push.

The loans from owners of £61.9m carry an interest rate of 2% while their director loans of £8.0m are interest free.

Net Debt hence increased from £62.8m to £69.2m (10%).

Charlton are likely to require further irrespective of whether promotion is achieved. If they are promoted, investment will be needed to bring them up to standard and stay in the division, while if promotion is not gained, further funding will be required to keep their finances in a decent position.

The prolonged stay is affecting their finances considerably and will make it increasingly difficult to return to the Championship due to a deterioration in their finances.

A Championship return soon is vital for the long term financial health of the club with Charlton not being a club built to survive in League One. A return to the Championship will allow them to better benefit commercially from their London status and grow financially.

Thanks for reading – Share with a Charlton fan!