Fulham enjoyed a spectacular Wembley Play-off victory in 2018 to achieve promotion back to the Premier League for the first time since 2014 ahead of the 2018/19 season.

The season began with much hope after an ambitious summer transfer spend that saw Fulham become the first promoted side to spend over £100m in the season after promotion.

Although they didn’t lack ambition, it was not reflected in performances on the pitch with Fulham condemned to relegation following a 19th placed Premier League finish.

Despite relegation, one season in the Premier League will see their 2019 finances rocket with a huge rise in revenue expected.

Let’s get into the numbers.

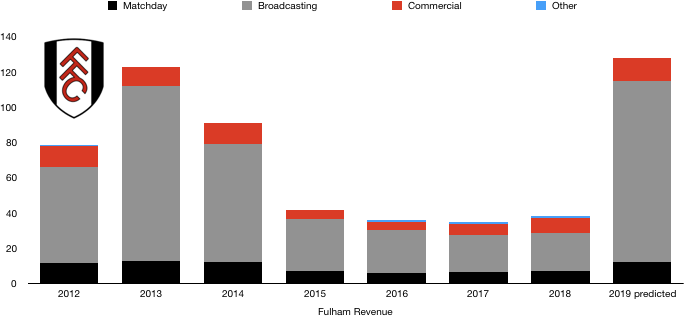

Revenue Prediction

Matchday Revenue

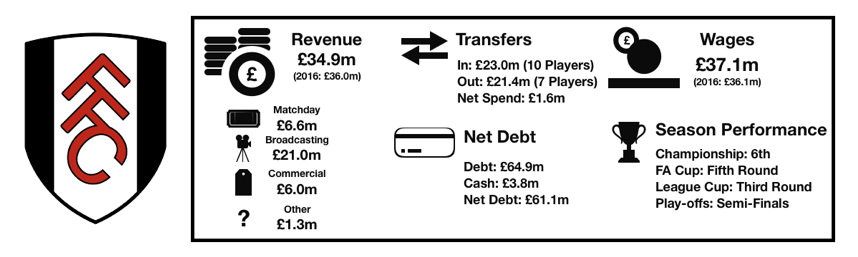

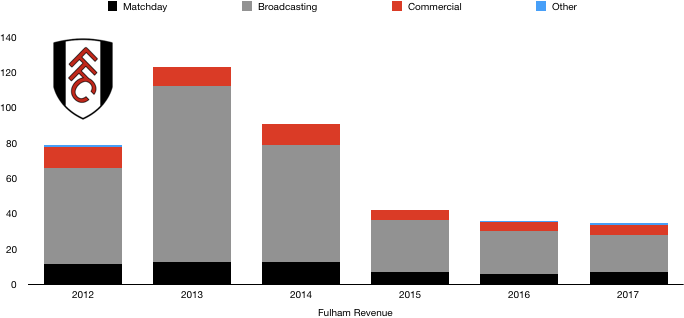

Fulham earned matchday revenue of £7m in 2018 in the Championship. Promotion to the Premier League will bring higher ticket prices and attendances rose from 19,896 to 24,371 (22%) as fans clamoured to see their team in the top flight for the first time in five years.

When Fulham were last in the Premier League, matchday revenue was £12m, and that was five years ago. We expect matchday revenue to reach similar levels and increase by around £5m.

Commercial Revenue

Fulham’s commercial revenue was £8m in the Championship, relatively high at that level due to their historic performances and London status.

Fulham had the same kit manufacturer (Adidas) as in 2018 however they signed a new lucrative deal with DafaBet (replacing Grosvenor Casinos) which will see a significant boost in commercial revenue.

Promotion is likely to see performance related clauses activated in existing partnerships while there is likely to have been a host of new commercial partnerships owing to their (short-lived) Premier League status.

Based on this, we expect commercial revenue to rise to around £13m. Commercial revenue was £12m in their most recent Premier League campaign (2013/14).

Broadcasting Revenue

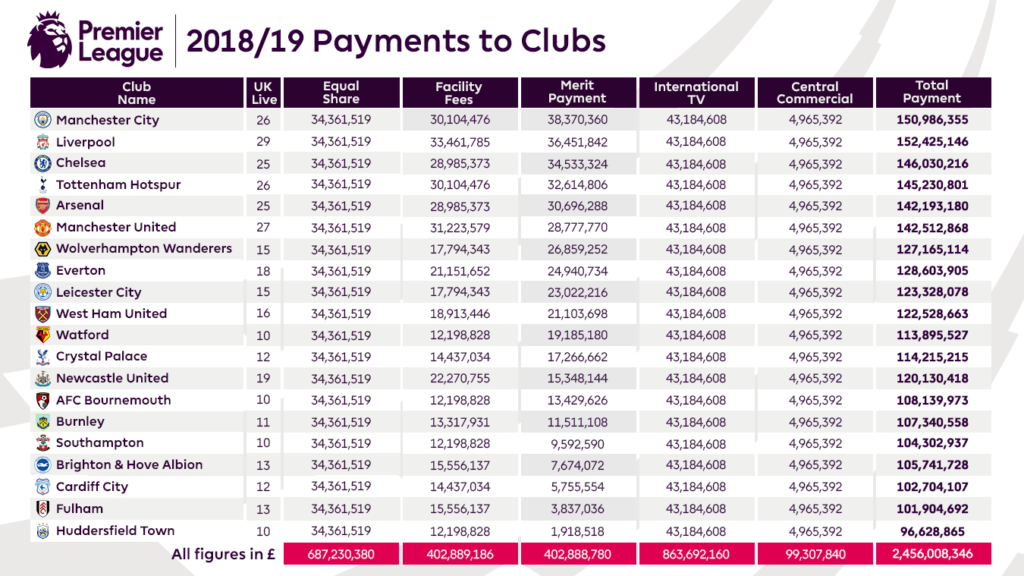

Fulham earned broadcasting revenue of £23m in 2018, largely from the English Football League (EFL) for their Championship performance (3rd). This is where Fulham will see a huge uplift in revenue, with Fulham earning Premier League distributions of £102m after finishing 19th and being featured on TV 13 times during their relegation battle.

Domestic cup performances were very similar to as in 2018 and therefore no material financial impact is expected.

Based on this, Fulham will likely see an increase in broadcasting revenue of £80m to £103m, a 348% increase in broadcasting revenue, showing once again the huge riches available on promotion.

Total Revenue

Total revenue was £38m for Fulham in 2018. Based on the above predictions, Fulham will see a huge £90m in revenue to around £128m. This increase may be even larger if commercial revenue rises by more than we expect.

Relegation will see revenue begin to fall right back down after their short-lived Premier League stay. A drop of 30-40% is likely in 2020.

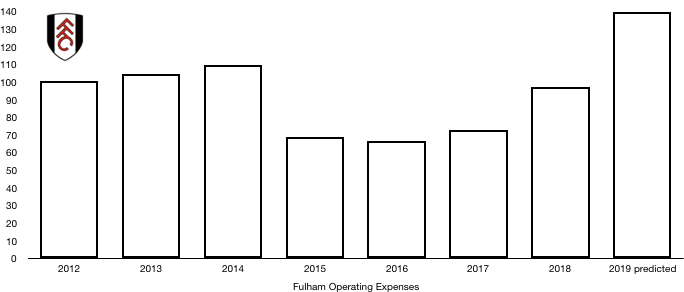

Costs Prediction

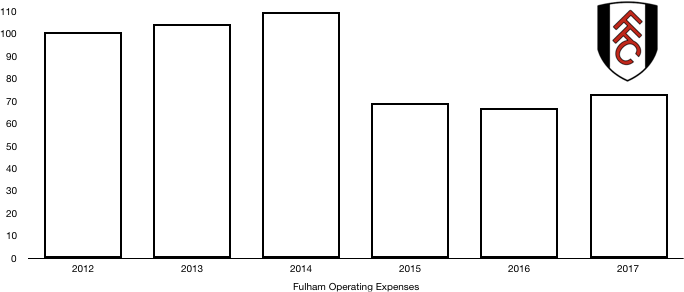

Amortisation

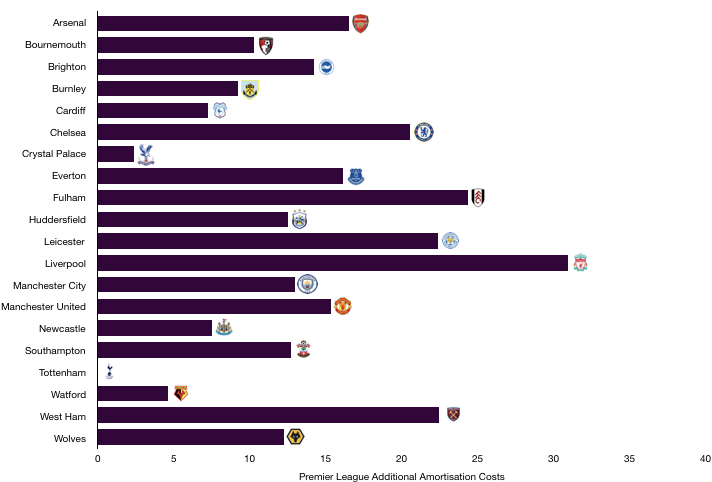

Fulham had amortisation of £19m in 2018 which was already relatively high for a Championship club. After a huge transfer spend of just over £100m ahead of their first Premier League campaign in five years saw eight new signings enter Craven Cottage.

Based on the reported transfer fees and contract lengths, amortisation is likely to rise by between £20-£25m to around £40m, more than double the 2018 numbers.

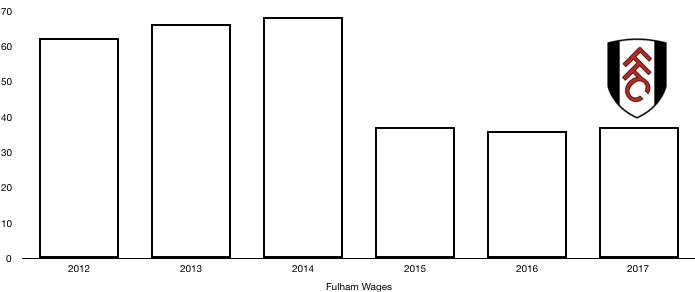

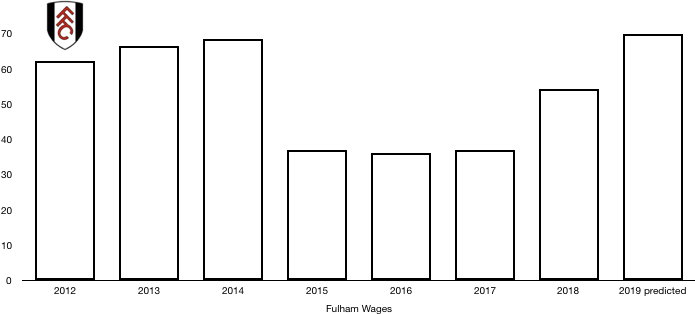

Wages

Fulham spent £54m on wages in 2018. This does include promotion wage bonuses that will not be present in 2019.

Based on reported wages of their new signings and new contracts for their promotion heroes, wages are likely to rise by between £15-20m to around £70m, on the basis that promotion wage bonuses had already been recorded in 2018.

Other Operating Costs

Other operating costs were £26m in 2018. Promotion to the Premier League is likely to see such costs rise a few million pounds to £30m.

Total Costs

Fulham recorded total operating costs of £99m in 2018. Based on the above, total costs are likely to rise by around £40m to £140m as the club spent big in a bid to retain their Premier League status.

The rise in costs (£40m) is less than halve the expected rise in revenue (£90m), therefore a huge improvement in profitability is expected.

The rise in costs however could be greater if reported wages are wide of the mark. Wages will drop significantly following relegation due to outgoing players and relegation wage drop clauses, a necessity if Fulham are to comply with EFL Financial Fair Play (FFP) regulations.

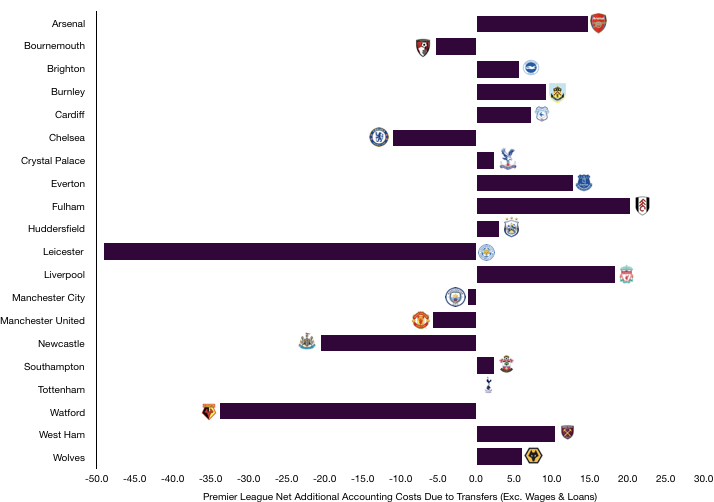

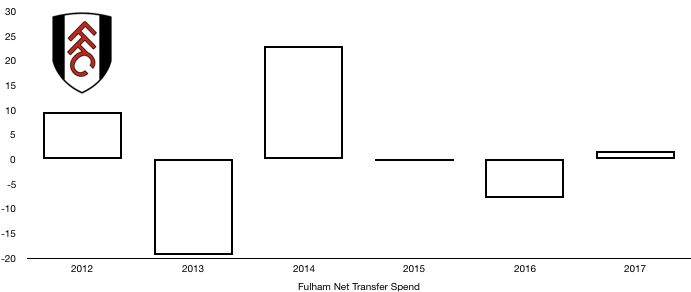

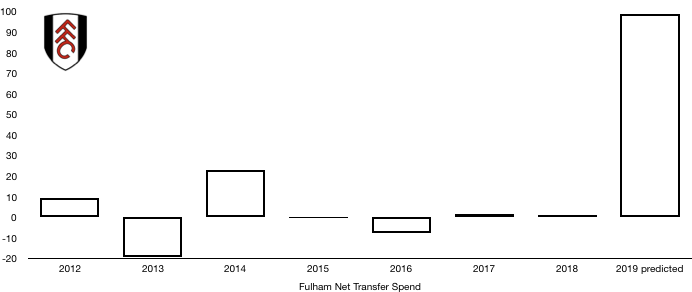

Transfers Analysis

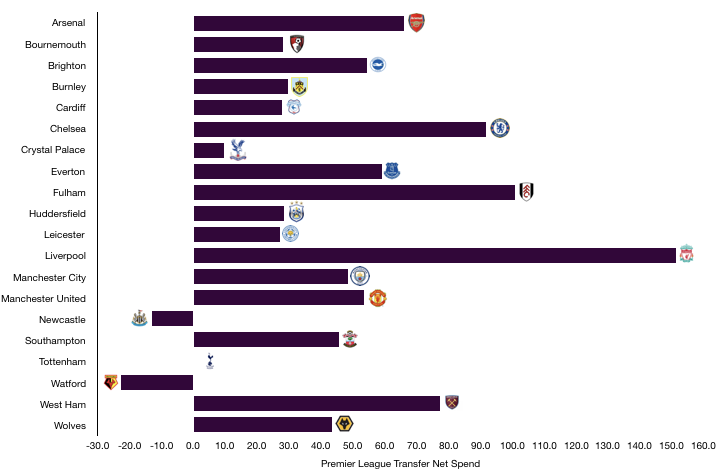

Fulham had a busy summer ahead of the 2018/19 season spending over £100m on eight players who were meant to secure Premier League survival .

In came Seri (£27m), Anguissa (£22m), Mitrovic (£22m), Mawson (£15m), Bryan (£6m), Fabri (£5m), Le Marchand (£4m) and Babel (£2m) for a combined £103m.

The only departure was Button for £4m.

This led to a huge £99m transfer net spend, the largest ever by a promoted side. Unfortunately for Fulham, the signings (other than Mitrovic and Babel), failed to perform as expected as the new signings struggled to settle in England with five of the signings experiencing English football for the first time.

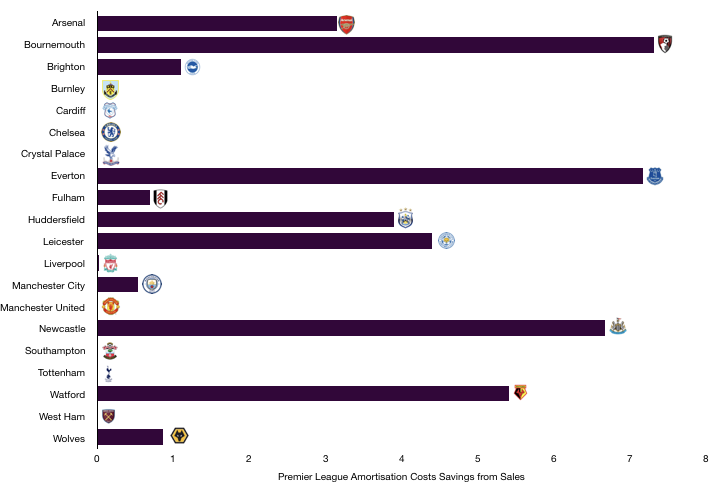

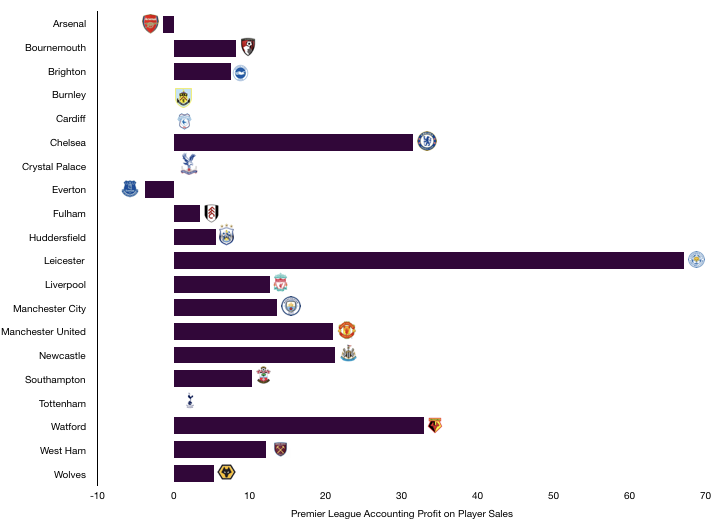

Fulham recorded a profit on player sales of £14m in 2018, this is likely to fall by around £10m after the only sale in 2019 being Button for £4m, who is likely to see a profit of around £3m recorded on his sale.

Fulham also owed £19m in transfer fees in 2019, this was however largely offset by being owed £12m, with the £7m net not affecting transfer plans significantly.

Profit/Loss Prediction

Fulham recorded a significant loss in 2018 of £46m after paying promotion related bonuses under low revenue conditions.

Based on the above predictions, Fulham are likely to still be in a slight loss making positon of between £5-10m despite a £90m rise in revenue.

A profit could be recorded if commercial revenue rises by more than expected or wages/amortisation rise by less than expected which is possible. However, for Fulham, their financial position is likely to be one around the break-even point due to heavy spending in 2018/19.

It looked to have paid off following promotion, but poor signings and an immediate return to the Championship mean that the club are likely to be under FFP players immediately on their Championship return.

The sale of youth prospect Sessegnon in 2019 will go a long way to easing this financial pressure but it will be interesting to see how Fulham balance the goal of returning to the Premier League with the financial scrutiny they may be under by the EFL.

Thanks for reading – Share with a Fulham fan!