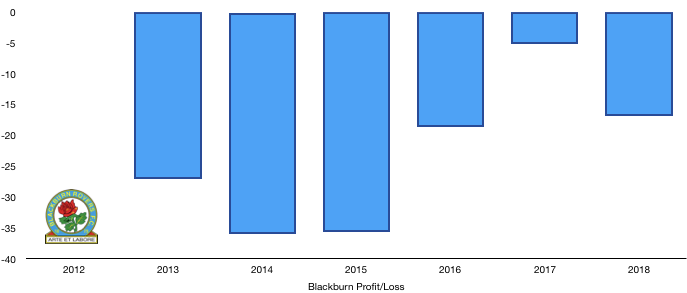

Blackburn had to endure a season in League One following relegation in 2017, but immediately bounced back to the Championship via automatic promotion following a second-placed finish.

A season in League One for a team not used to being that far down the football pyramid will no doubt have a significant financial impact and it did. Blackburn saw their losses more than triple, increasing from £5.2m to a sizeable £16.8m.

Despite this increased loss and the growing Financial Fair Play concerns, promotion back to the Championship should calm down these concerns as their finances should begin to improve.

Let’s delve into the numbers.

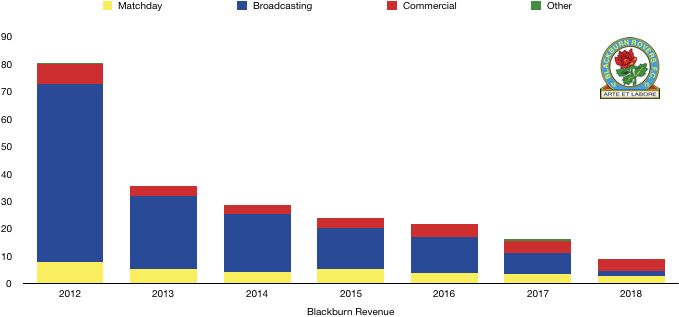

Revenue Analysis

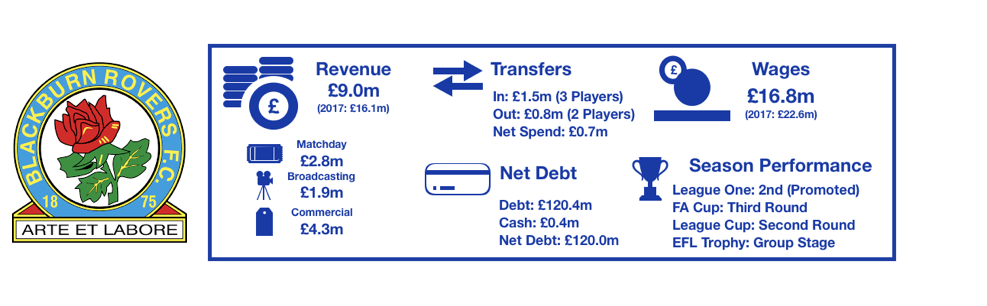

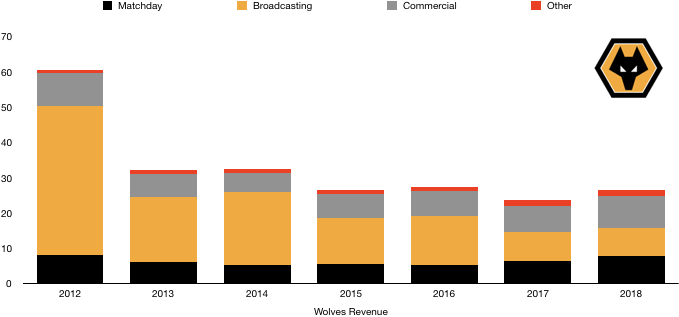

Blackburn unsurprisingly saw a steep fall in revenue following their relegation, with revenue falling from £16.1m to £9.0m (44%).

Matchday revenue dropped from £3.3m to £2.8m (15%). This was despite average attendances actually increasing from 12,688 to 12,832 (1%), indicating a fall in ticket price due to the lower standard in League One. Attendance of 12,832 is still well below the full capacity of 31,367 at Ewood Park, so there is plenty room for growth in this area, although a return to the Premier is probably needed for any of this to be realised.

Broadcasting revenue plummeted, falling from £7.9m to a measly £1.9m (76%) after a huge reduction in the prize money received in League One, showcasing the importance of at least remaining in the Championship for Blackburn.

Commercial revenue fell from £4.4m to £4.3m (2%), proving relatively robust despite relegation with the majority of sponsors remaining with the club. Blackburn will be hoping that since they managed to maintain commercial revenue following relegation, a return to the Championship will enable commercial revenue to grow.

There was no other revenue in 2018 (2017: £0.5m).

Looking ahead, Blackburn will obviously see a huge increase in revenue back to around 2017 levels, hopefully higher. Blackburn look likely to remain in the Championship so will therefore finish higher than they did in 2017. Prize money has also increased since then so broadcasting revenue should be £8m at the minimum. Average attendances have increased so matchday revenue is likely to be around £4m while commercial revenue could increase to around £5m.

All in all, revenue should be between £17-20m, around double revenue this year.

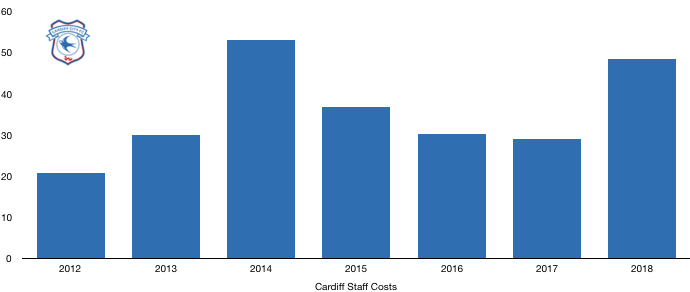

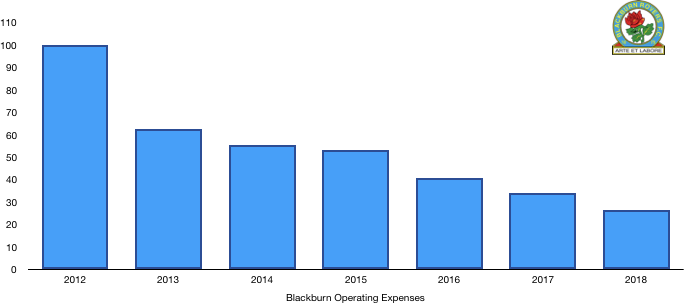

Costs Analysis

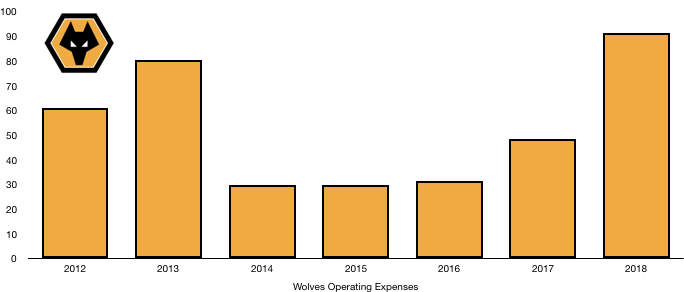

Blackburn managed to reduce costs following relegation, decreasing them from £34.1m to £26.5m (22%). Despite cutting costs well, the fall in costs was half that of revenue, hurting profitability considerably, hence the large loss.

Amortisation increased slightly, rising from £0.7m to £0.8m (14%) after spending in the summer, having not signed anyone in 2017 for a transfer fee.

Interest costs dropped a third from 0.6m to £0.4m (33%) due to a smaller overdraft while other interest costs also fell slightly.

Blackburn paid no tax due to making a loss, a situation which will continue for the foreseeable future in all likelihood.

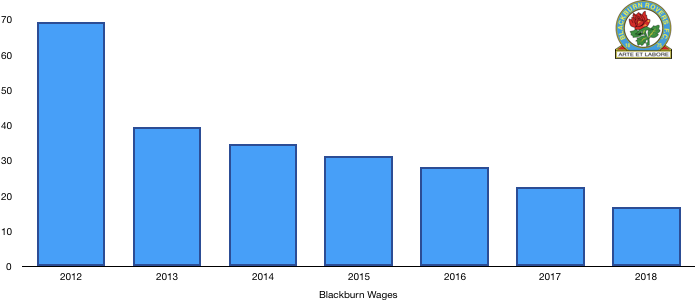

Wages fell a quarter from £22.6m to £16.8m (26%) as high earners departed the club following relegation. Relegation wage drop clauses would have also come into effect, reducing existing players salaries considerably.

Blackburn managed to cut wages well, saving roughly £112k a week, a nice saving for anyone!

Directors interestingly saw their renumeration increase significantly, rising from £166k to £282k (70%) despite relegation. It is possible these include bonuses from promotion last season which would make more sense. They may have also been rewarded for the financial savings made that helped restrict the losses to what they were (despite how large they appear to be).

Looking ahead, costs will rise following promotion, not only has spending increased (increasing wages and amortisation) but promotion wage clauses will also see wages rise (plus new contracts).

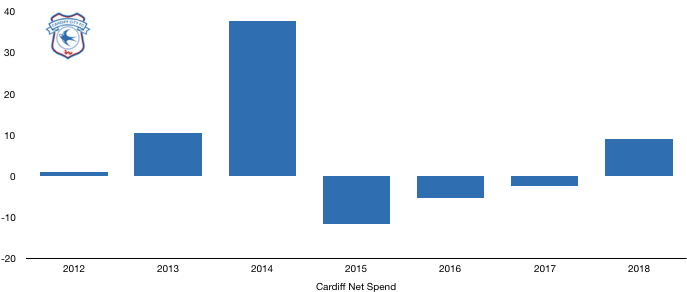

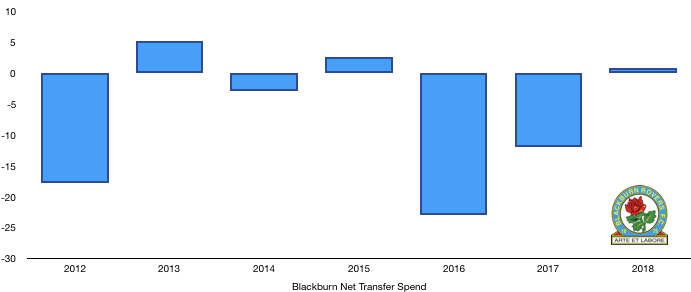

Transfers Analysis

It was a fairly quiet transfer window for Blackburn as three players arrived at Ewood Park and 2 departed.

In came Dack (£0.8m), Samuel (£0.5m) and Bell (£0.3m) for a combined £1.5m (rounds down).

Out went Steele (£0.5m) and Brown (£0.2m) for a combined £0.7m.

This led to a low net transfer spend of £0.8m following two years of sizeable negative net spends.

Dack proved to be one of the signings of the season across all 4 top divisions in England and was a major reason for their promotion. Samuel and Bell both contributed as well to the expected but still impressive promotion.

Blackburn also recorded a profit on player sales of £1.1m, although this includes the sale of Marshall at the end of the season as well.

In cash terms, Blackburn spent cash of £1.1m and received cash of £0.7m, a net cash outlay of £0.4m, not much to write home about.

Blackburn owe a further £1.3m in transfer fees, however this is completely cancelled out by the fact that are also owed £1.3m (£1.2m of which is due this year), so this should have no impact on future transfer plans.

Blackburn could also have to pay players, agents and other clubs a further £2.1m in transfer fees should certain clauses be met.

Interestingly, Blackburn also disclosed that they paid players £0.8m cash to leave the club following relegation. This is likely to have been paid to the likes of Akpan, Lowe and Stokes, all who left on free transfers following relegation.

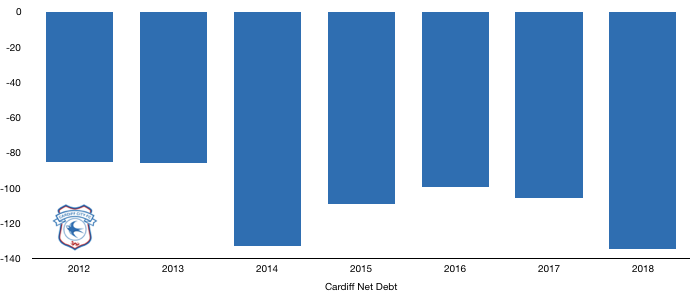

Debt Analysis

Blackburn saw their modest cash levels double from £0.2m to £0.4m (100%) despite sizeable losses. Their owners provided new loans of £13.9m to fund these losses and pay for those players who were released.

Blackburn also spent £0.4m on infrastructure, the same level as last year. Blackburn should aim to increase this to better invest in their long-term future.

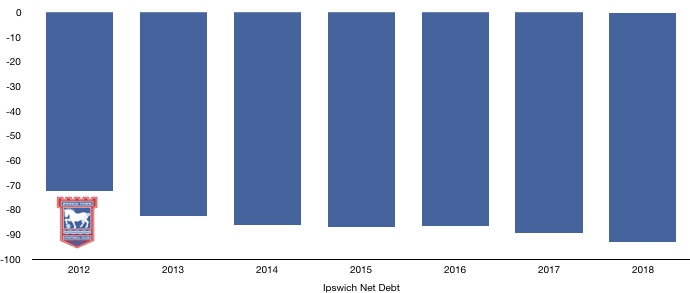

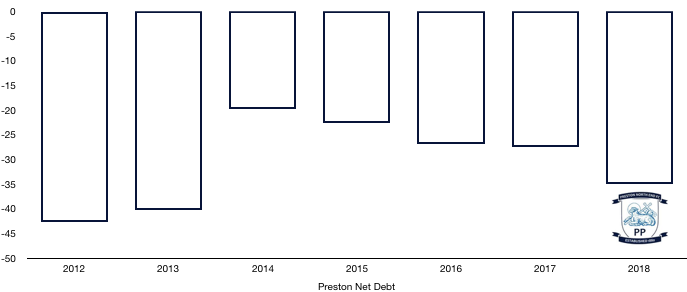

Debt levels rose from £106.7m to £120.4m (13%) after new loans of £13.8m from their owners, while their overdraft fell by £0.1m to £1.7m.

These new loans were necessary due to relegation, although they may also need further investment following promotion to be competitive in the Championship and even more so should they wish to make an overdue return to the Premier League.

Net debt increased then from £106.5m to £120.0m (13%). The level of ambition of their owners is important now. Should they wish to consolidate as a Championship side, some investment is needed, however they should become self-sufficient fairly quickly.

Should they wish to make a return to the Premier League significant investment will be needed, although this may be restricted due to Financial Fair Play.

Blackburn have made cumulative losses of £40.7m over the last 3 years, which is around the upward limit allowable. They should be okay as long as their losses next year don’t exceed £20m, meaning the club cannot go too wild even if their owner wants to.

They could still be in trouble due to financial Fair Play issues from 2015 where their 3-year cumulative losses were an astronomical £98m. It remains to be seen whether sanctions have already been agreed in relation to these as they were a few years ago and they were punished in 2013 for Financial Fair Play transgressions.

Thanks for reading – Share with a Blackburn fan!