Cardiff secured their second season ever in the Premier League after an unexpected promotion-winning campaign in 2018 under Neil Warnock.

The season was always expected to be a difficult one in attempting to avoid relegation, however it proved even more emotional due to the sad passing away of Sala following his signing in the January transfer window.

Despite an emotional campaign, Cardiff put up a good fight in attempting to remain in the Premier League, showing signs of revival until a controversial loss to Chelsea halted their momentum and relegation was shortly after confirmed.

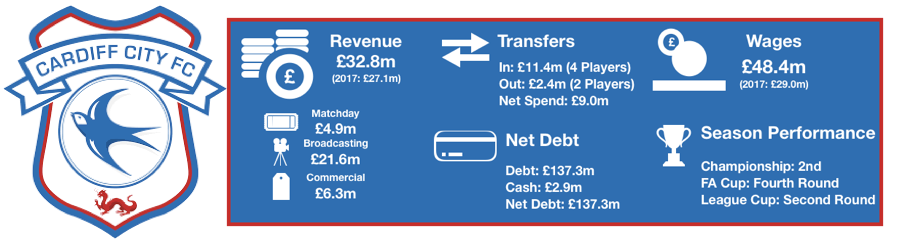

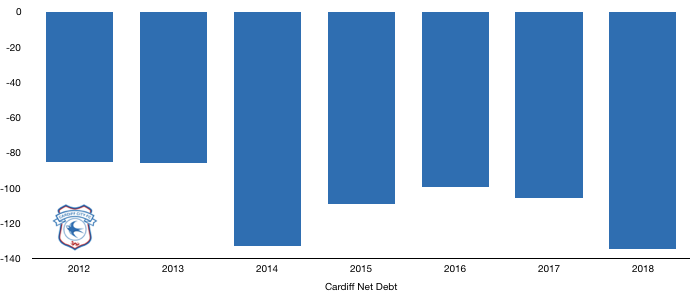

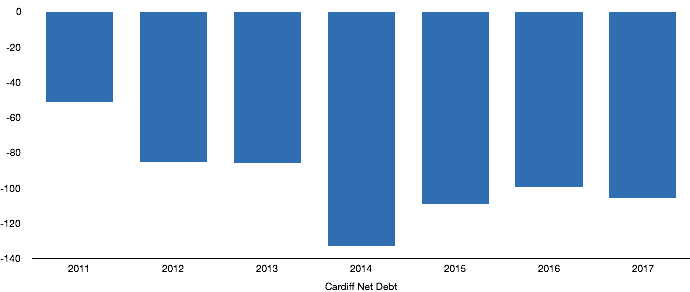

The riches of the Premier League are apparent throughout these predictions with a swing in their financial situation detailed below in what proved to be a financially successful season for Cardiff despite relegation.

Let’s delve into the numbers.

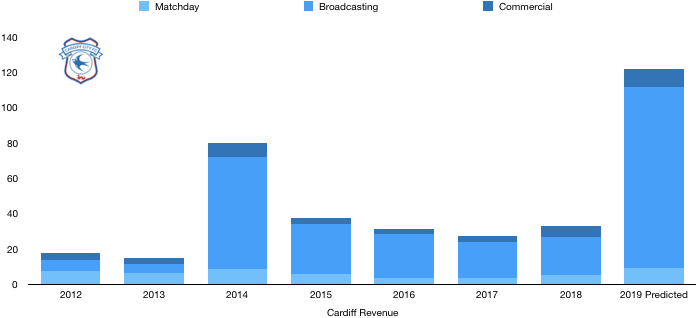

Revenue Prediction

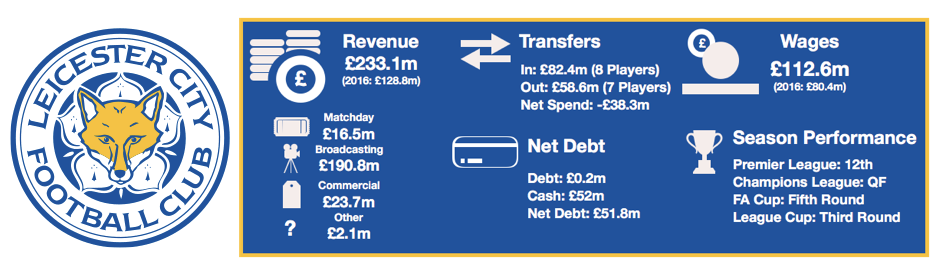

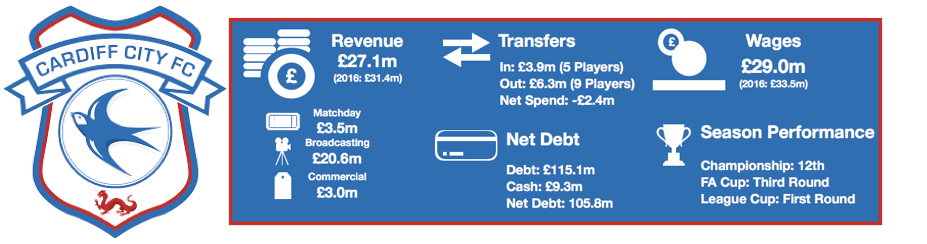

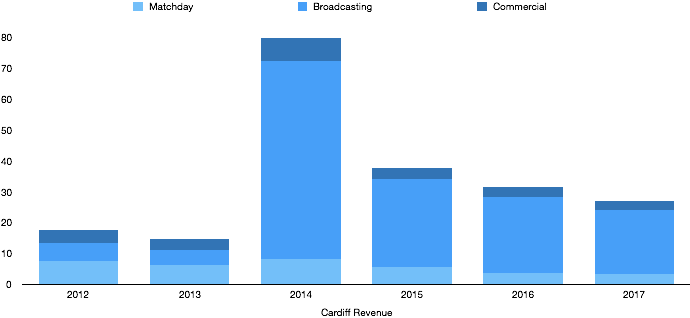

Cardiff would have been predicting a large increase in revenue following promotion and won’t be disappointed with a huge increase likely on last season’s £33m revenue.

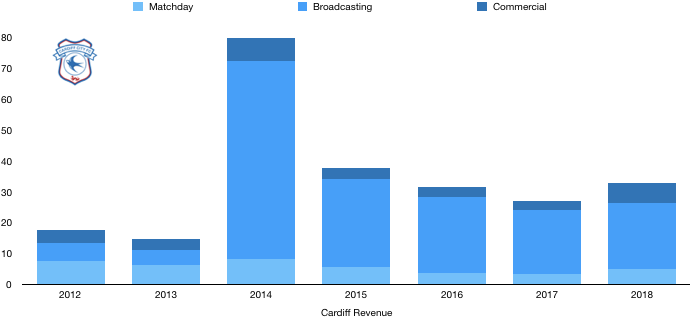

Matchday Revenue

Matchday revenue is usually the most stable revenue source for clubs with attendances staying fairly constant year on year. However, this wasn’t the case for Cardiff who saw average attendance rise from 20,146 to 31,229 (55%) as fans clamoured to see their team back in the big time for the first time since 2013.

This, combined with the higher ticket prices from their Premier League status, is likely to see a sizeable increase in their matchday revenue to around £9m from £5m. In comparison, Cardiff had matchday revenue of £8m last time they were in the Premier League in 2013/14.

Commercial Revenue

Commercial revenue has slowly deteriorated since relegation where commercial revenue was £7m (2013/14). Commercial revenue went as low as £3m prior to 2018 where promotion saw commercial revenue increase to £6m.

Despite their main sponsor (Visit Malaysia) and kit manufacturer (Adidas) remaining the same, new deals with a variety of partners including a new sleeve sponsor (JD) and official betting partner (1XBet) will see a sizeable rise in commercial revenue to around £10m.

This however may be reduced by any relegation clauses negotiated with these sponsors.

Broadcasting Revenue

Broadcasting revenue has languished at between £20-30m since relegation from the Premier League, with Cardiff recording broadcasting revenue of £22m in 2018 following a 2ndplaced Championship season.

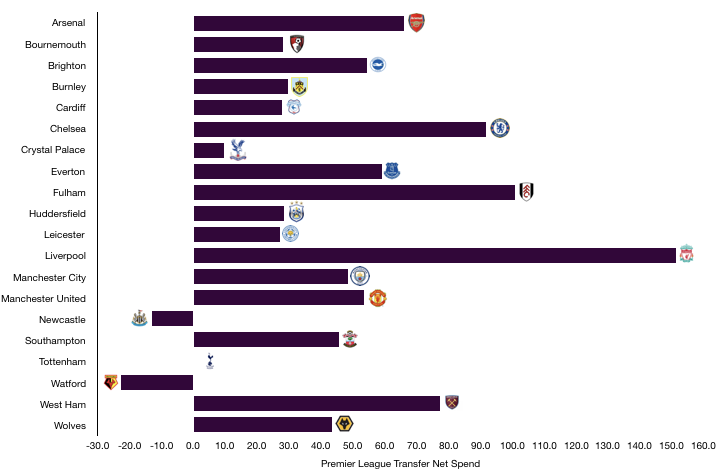

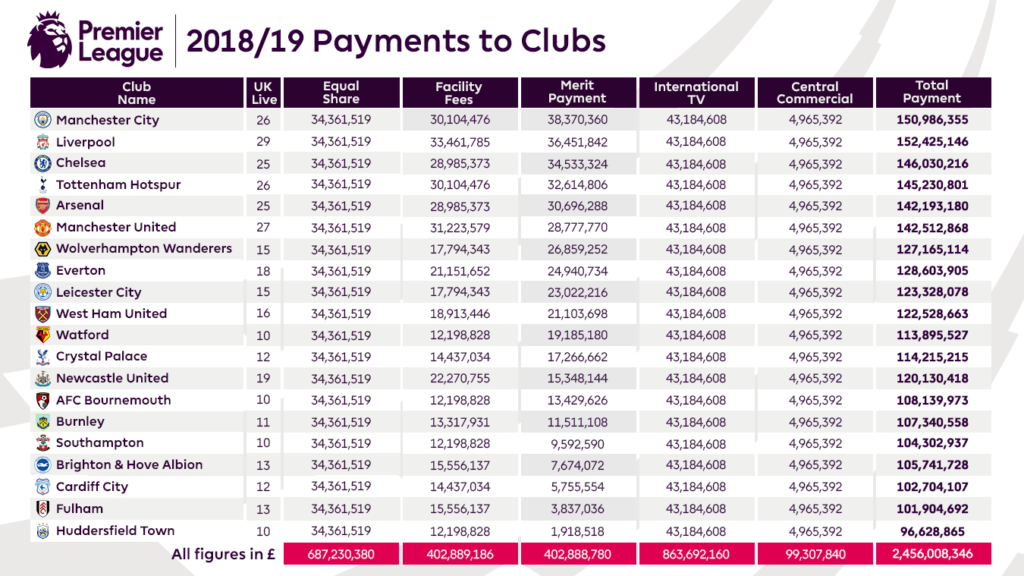

Now, following a season in the Premier League, Cardiff will benefit in a sharp rise in revenue due to receiving £103m from the Premier League for their 18thplaced finish and for featuring on TV 12 times.

This will be the majority of Cardiff’s broadcasting revenue due to insignificant domestic campaigns with exits by the Third Round in both.

At £103m, this represents a £81m, 368% increase in broadcasting revenue.

Total Revenue

Based on the above predictions, matchday revenue and commercial revenue will increase by around £4m each while broadcasting revenue will increase by around £81m give or take.

This will see total revenue increase to approximately £122m, an £90m increase from 2018, showcasing the huge riches on offer for securing promotion to the Premier League.

This affect won’t last long following relegation, although parachute payments will soften the blow. However, despite parachute payments, Cardiff can expect their revenue to fall by around 30-40% following relegation.

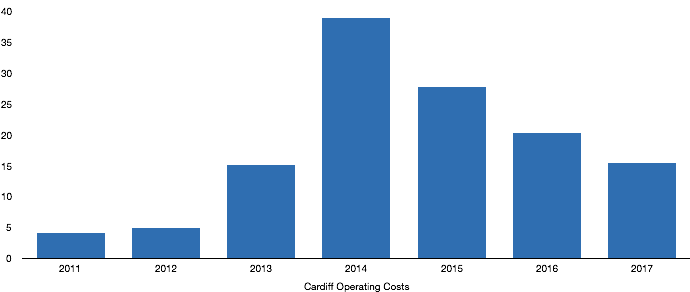

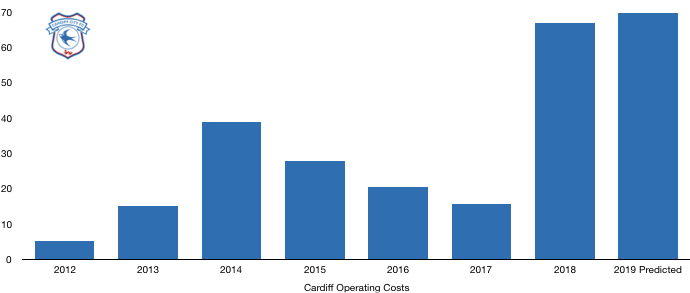

Costs Prediction

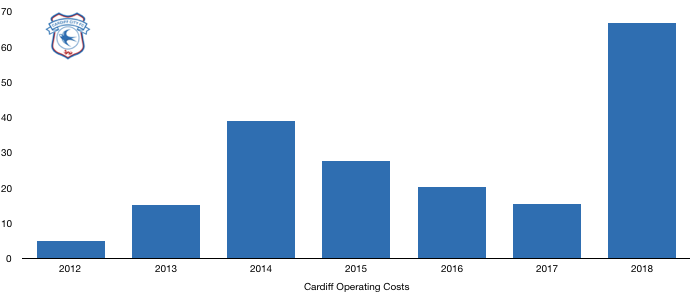

With promotion, costs are expected to increase significantly in order to compete and try and survive in the Premier League. A conservative Cardiff however seemed to play it financially safe as detailed below.

Amortisation

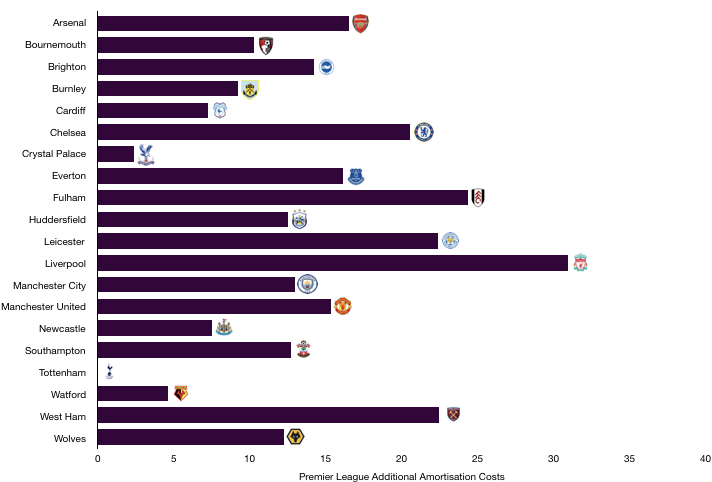

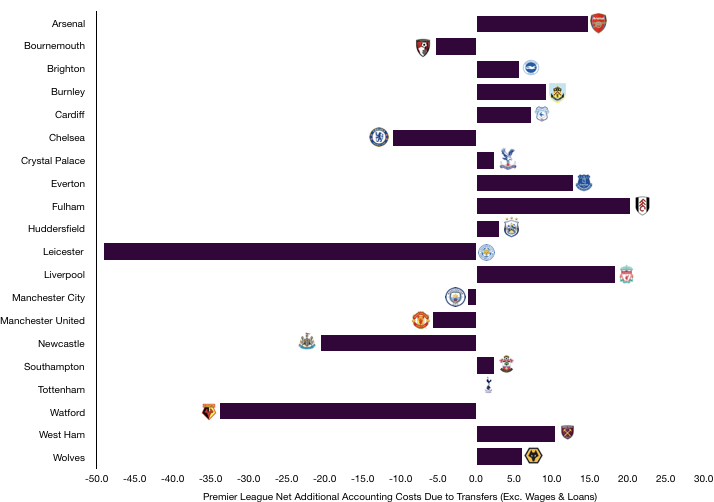

Cardiff recorded amortisation of £5m in 2018 and after spending £46m in the summer saw a large increase on this total.

(Due to the sensitivity and uncertainty surrounding Sala, any financial analysis has omitted his transfer fee and wages).

Based on the transfer fees recorded and their reported contract lengths, we expect amortisation to rise by around £8m to £13m.

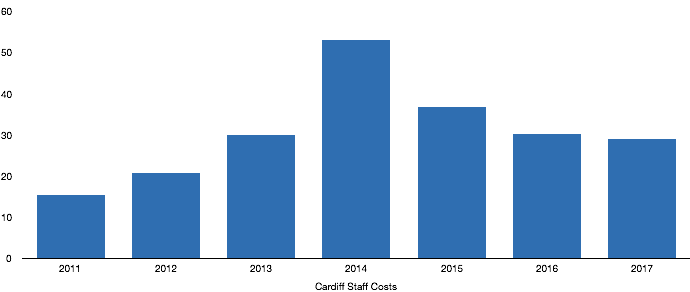

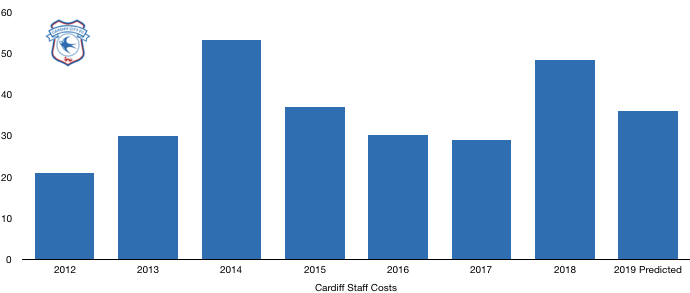

Wages

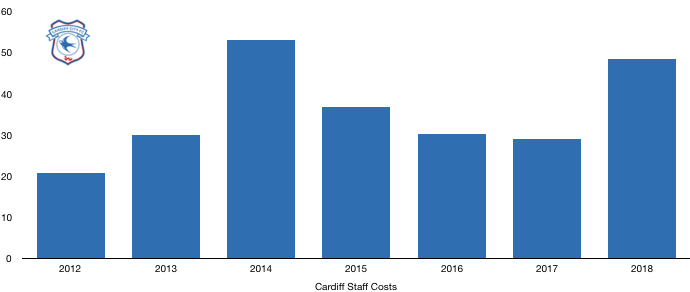

Cardiff saw a large rise in their wages in 2018, from £29m to £48m (66%), largely due to exceptional costs relating to promotion bonuses to players and staff which won’t be incurred this year.

Based on available information on their signings’ wages, new contracts and also due to the lack of outgoings, we expect underlying wages to rise by around £10m. However, due to the promotion bonuses recorded, actual wages is likely to fall by £13m from 2018, an unusual situation but one that does occasionally happen (Newcastle saw their wages drop following promotion).

Other Costs

Cardiff had over costs of £14m in 2018. Following promotion to the Premier League, these costs are likely to increase significantly due to the extra costs of functioning as a Premier League club due to additional administrative, broadcasting and security costs.

We expect costs to increase to around £20m on the back of these assumptions.

Total Costs

Based on the above predictions, we expect costs to increase slightly to around £70m from £67m, a relatively small 4% increase.

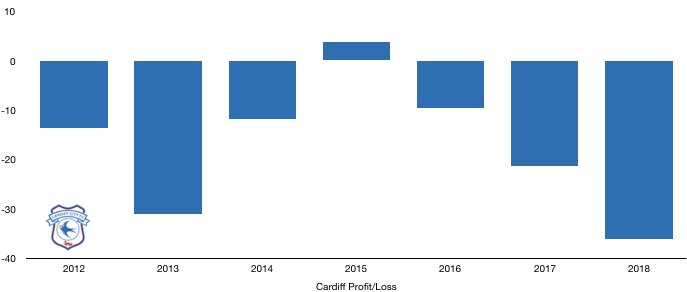

With revenue increasing by such a large extent absent of a significant rise in costs, profitability should improve hugely for a club that has incurred a loss in 6 out of the last 7 seasons.

This also means that there should be less pressure on Cardiff to reduce their costs and wage bill following relegation which may well position them for an immediate return to the Premier League.

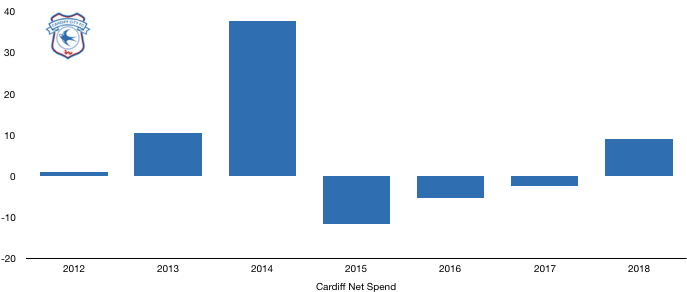

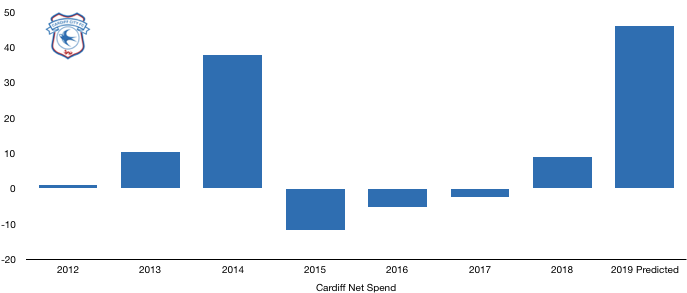

Transfers Analysis

Cardiff saw a number of incoming signings from the Championship, a league they and their manage are familiar with and hence had trust in them to potentially make the step up to the Premier League.

In came Murphy (£10m), Reid (£10m), Cunningham (£4m), Smithies (£4m) and Bacuna (£3m) for a total of £46m, more than their transfer outlays in the last 4 seasons combined.

There were no significant outgoings for transfer fees as Warnock looked to keep the majority of his group together.

The signings all did fairly well but proved limited in some areas which saw the club relegated despite their best efforts.

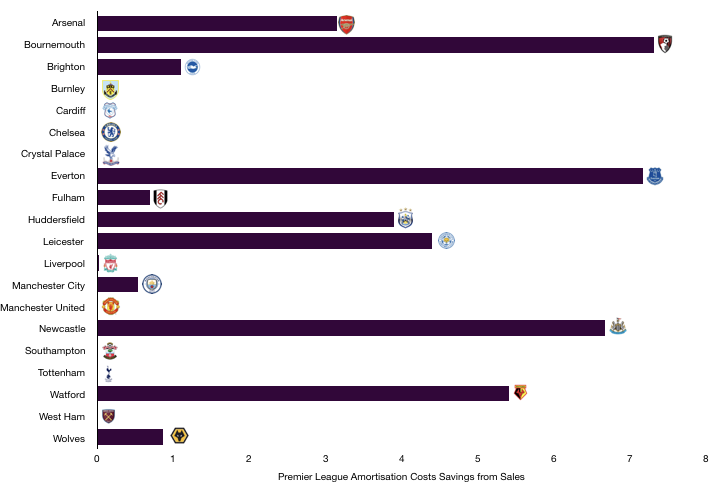

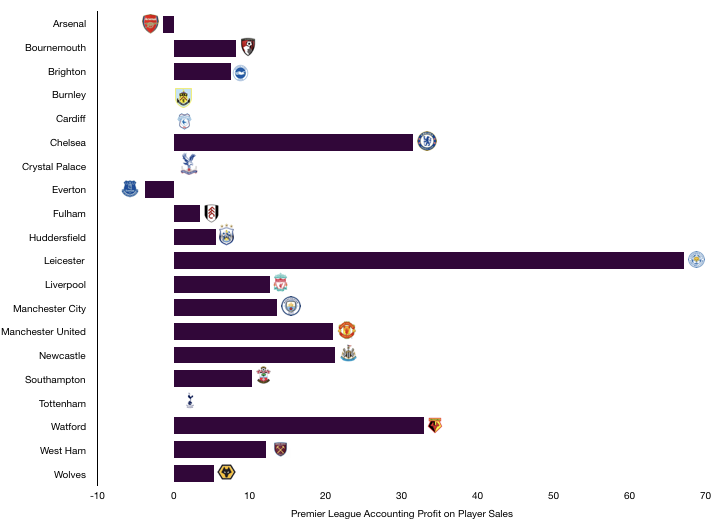

Cardiff had no player sales in 2019 and hence no profit on player sales. In 2018 Cardiff recorded a profit on player sales of £2m.

In terms of transfer fees owed, Cardiff are owed around £0.5m and owe roughly £2m, a £1.5m net creditor position. This isn’t a significant amount and gives Cardiff greater financial freedom in the transfer market, although this is likely to have increased following their signings unless the majority were paid up front, which is possible given the Premier League cash they received.

Cardiff may potentially also face some contingent transfer fee clauses, these were £2m in 2018 and are likely to have increased a fair bit.

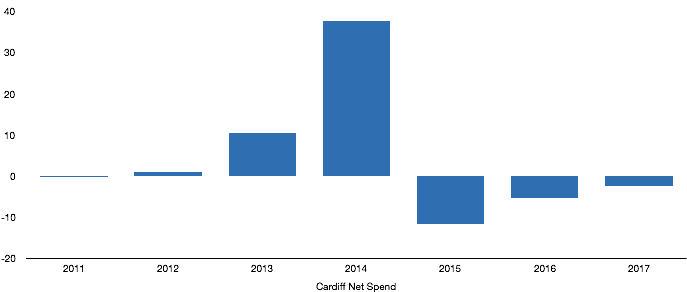

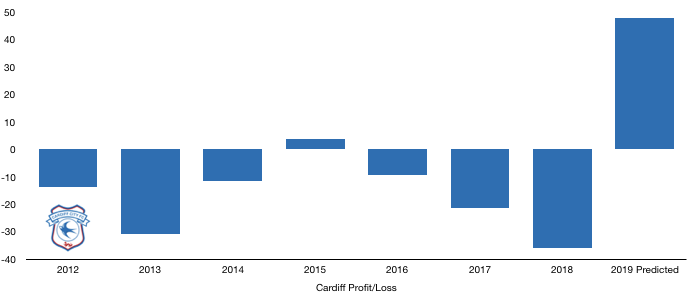

Profit/Loss Prediction

Cardiff recorded a huge £36m loss in 2018 following promotion (a large portion does however relate to promotion bonuses of £23m). Following promotion and their newfound Premier League riches, Cardiff are likely to record a profit of £40-50m, an outstanding amount considering no player sales.

This is largely due to a conservative approach following promotion in which the club chose not to overspend to attempt to secure survival, potentially due to the odds seemingly being stacked against them from the beginning.

This financially safe approach does put them in good stead to be financially secure back in the Championship and sustainably build for a return to the Premier League in the next few years. It also will help with Financial Fair Play compliance which shouldn’t be an issue with their current financial health.

Thanks for reading – Share with a friend!