Burnley had a spectacular 2018, finishing 7thand securing a preliminary spot in the Europa League for 2019. This seemed to promise newfound riches in what was their first season in Europe for 51 years.

However, qualifying was harder than expected with a half fit squad barely back from their holidays and with the headache of balancing their early Premier League fixtures, Burnley found themselves out in the Play-off round against Greek club Olympiacos.

This was disappointing not only due to the failure to make the groupstage, but it was a sign of things to come as Burnley struggled to match their previous season performances following a lack of significant investment, nearly seeing the side relegated before they steered clear to a 15thplaced finish.

This article analyses the effects of Burnley’s (short) European adventure and their disappointing domestic campaign on their finances.

Revenue Prediction

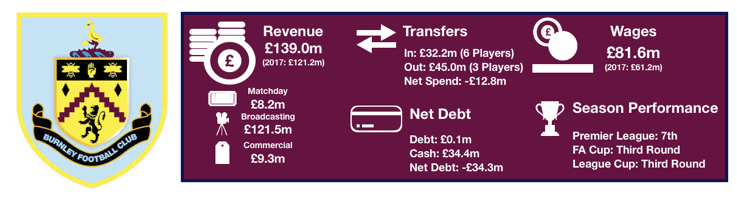

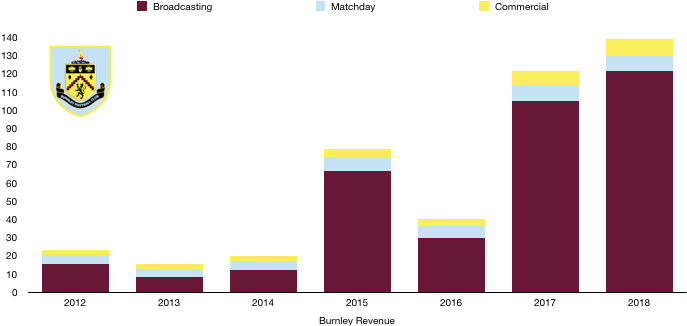

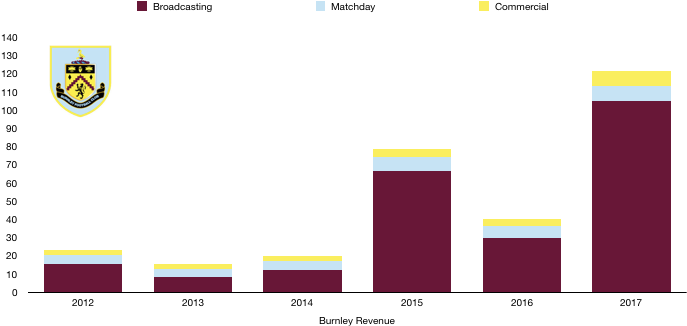

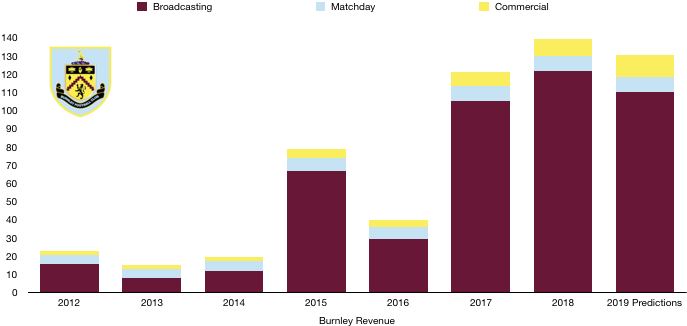

Burnley saw their revenue rise to record levels of £139m in 2018 following their remarkable 2018 achievements given their budget. Things were not so rosy in 2019…

Matchday Revenue

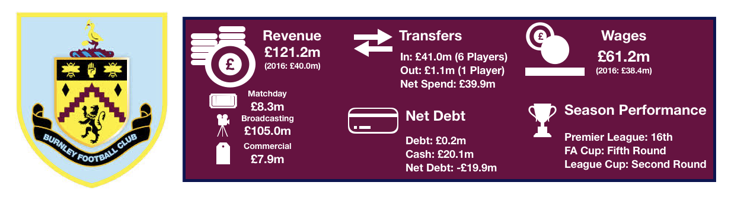

Burnley saw a nice boost to matchday revenue from £7m to £8m following promotion in 2017, at which level it has remained since.

Average attendance at Premier League games fell slightly from 20,688 to 20,534 (1%). Despite this, Burnley’s adventures into Europe yielded an additional 3 home games and although it ended quickly, Burnley should see matchday revenue rise slightly but remain at the £8m level (when rounded).

Broadcasting Revenue

Burnley saw broadcasting revenue reach record levels of £122m in 2018 following their 7thplaced Premier League finish, which made up a huge 88% of their total revenue in 2018.

The majority of broadcasting revenue is Premier League revenue for Burnley, accounting for £120m of the £122m in 2018. Following a drop of 8 places to 15thin 2019, Premier League revenue dropped £13m in 2019 to £107m. This is despite Burnley seeing an extra televised game (11) in 2019 following their relegation battle.

Burnley didn’t fare much better in the domestic cups. Burnley went one round further in the FA Cup to the 4thRound, netting approximately £136k extra from this. League Cup performances were just as bad as 2018, exiting in the Third Round.

Now, the Europa League was meant to be a nice boost to Burnley’s finances in 2019, with a place in the group stage potentially worth £7-10m based on performances.

However, an exit in the Play-Off round meant none of this was realised and Burnley can only expect to receive around £1m for their troubles, a disappointing figure.

Therefore, Burnley should see a sharp drop of around £12m in broadcasting revenue to £110m in 2019, adversely affecting their bottom line.

Commercial Revenue

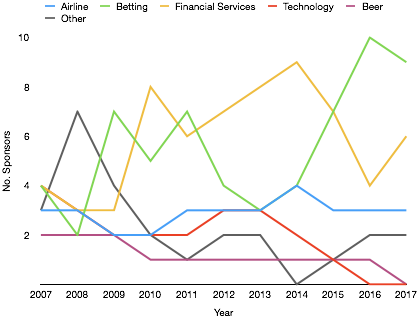

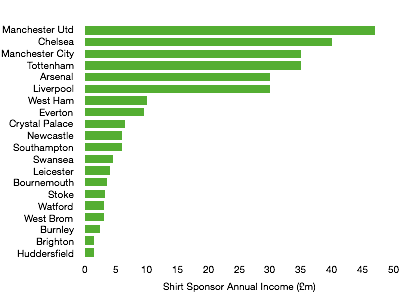

Burnley have seen commercial revenue more than double since promotion, rising from £4m in 2016 to £9m in 2018.

This trend is likely to continue on the back of the successes of 2018, with a new, slightly more lucrative deal agreed with Laba360 (£3m a year), who replace Dafabet (£2.5m a year) as their main sponsor.

This, plus many smaller partnerships should see a boost to around £11/12m in commercial revenue, a £3m rise.

Total Revenue

Overall, it wasn’t the season Burnley were hoping for and as such, it will have a negative impact on their revenue, primarily due to the sharp drop in the Premier League table.

Combining the above adjustments, revenue is likely to fall by around £9m to £130m, showing that clubs cannot rest on their laurels as the pace of the Premier League club is brutal. Burnley were never expected to repeat 2018’s heroics and a drop off was expected, however the failure to reach the Europa League group stage saw revenue fall by a greater amount than was expected.

Any improvement on last season’s 15thplaced finish in 2019/20 will see a rise in revenue.

Cost Predictions

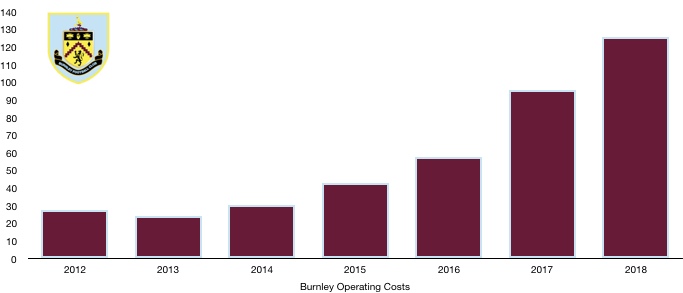

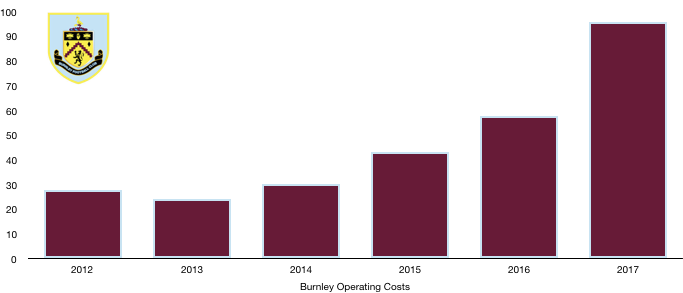

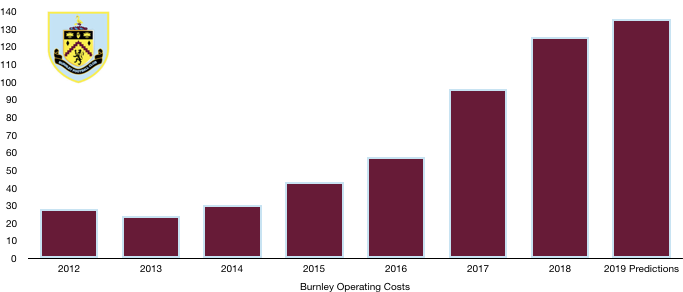

Burnley somehow secured a 7thplaced finish with costs of only £126m in 2018, a ridiculously low figure. By comparison, Everton and Leicester had costs of £287m and £193m respectively, showcasing the huge achievement it was.

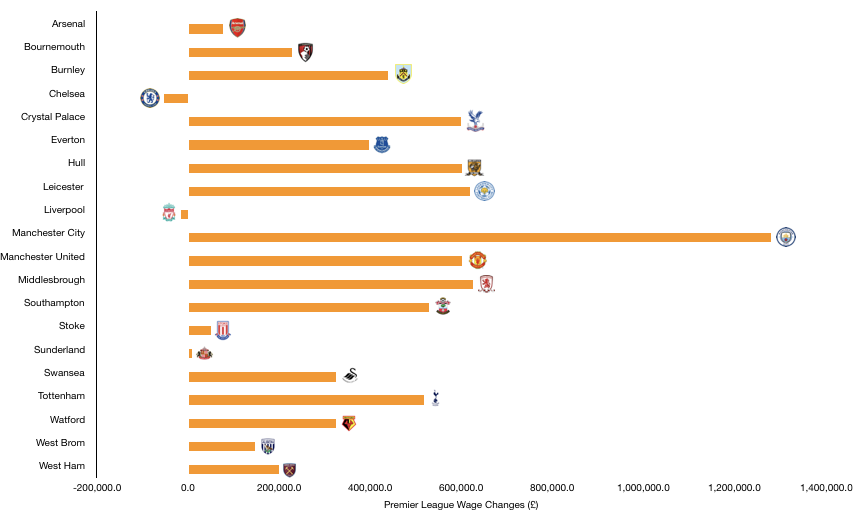

Despite revenue being likely to drop in 2019, costs continue to increase as the cost to compete and survive in the Premier League continue to grow…

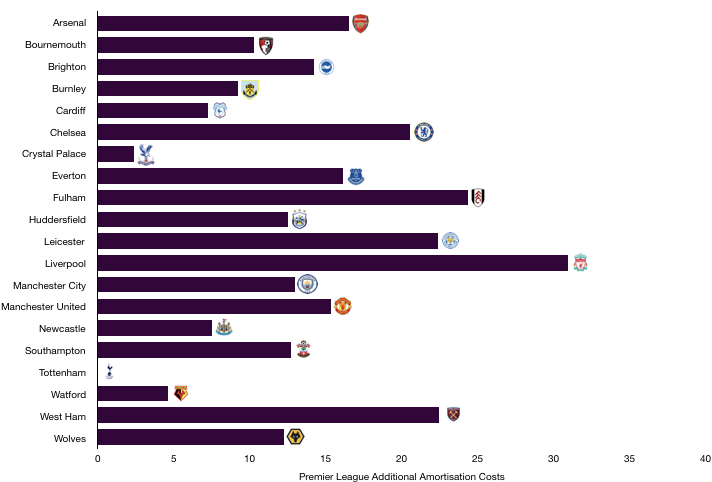

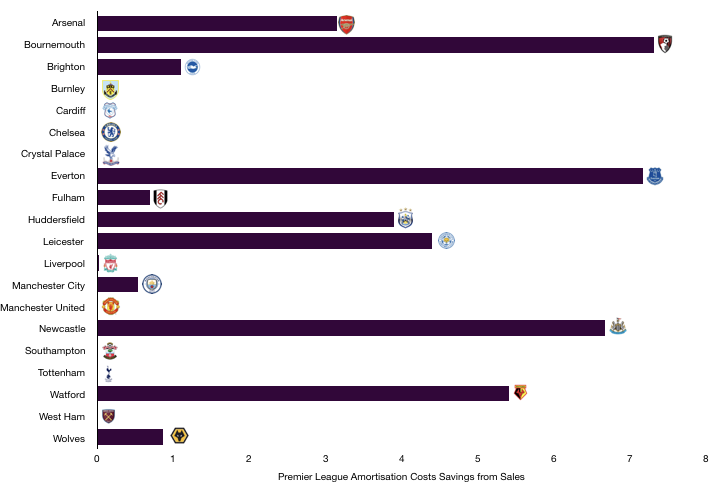

Amortisation

Burnley had amortisation of £28m in 2018, a relatively low figure. Player investment was greater than in recent years despite being nothing major in comparison to their rivals and will see amortisation rise.

Based on the transfer fees and contract lengths of the new signings and those sold, we expect amortisation to rise by around £8m to £36m for Burnley.

Wages and Other Costs

Other expenses such as stadium maintenance, lease costs etc. amounted to £16m in 2018. These costs rose by £2m from £14m in 2017 and we expect a similar rise this year to £18m.

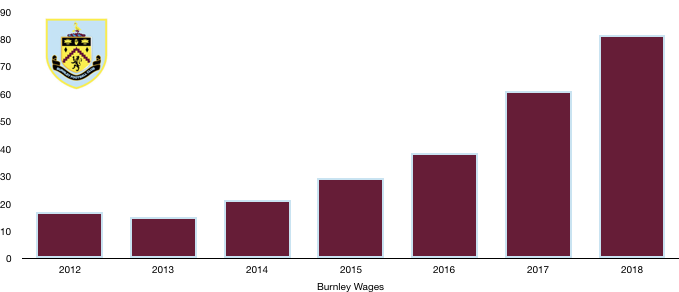

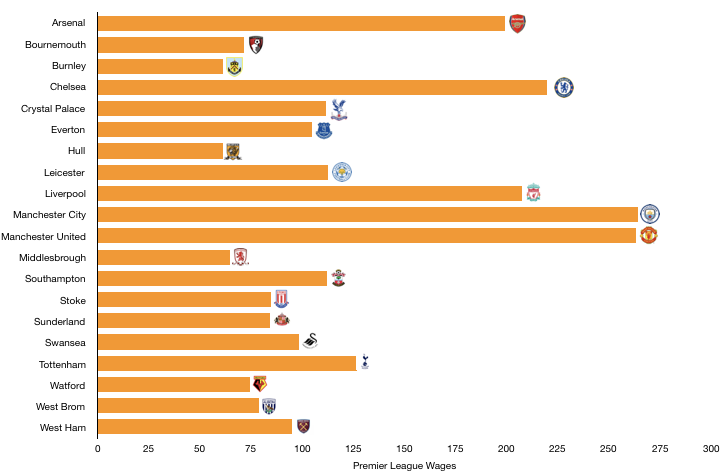

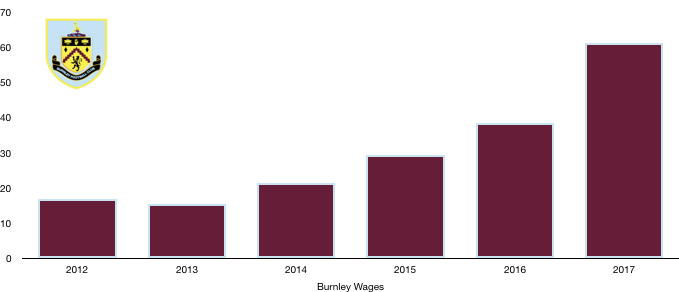

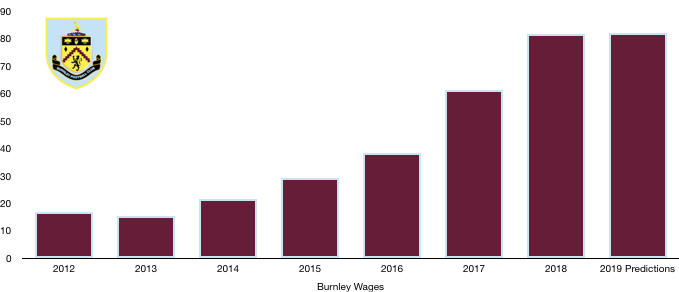

Wages are the most difficult area of finances to predict due to the opaque nature and privacy of these amounts. Burnley’s wage bill was £82m in 2018.

Burnley signed Gibson, Vydra and Hart while Vokes and a host of fringe players left (Long, Arfield, Marney). New contracts were provided to McNeil and Hendrick which will see wages rise slightly.

Loans of Wells and Walters are likely to however reduce the wage bill. Based on the data available, wages are likely to remain at £82m and perhaps even fall based on the release of fringe players on decent wages and the players signed not commanding huge wages.

Burnley are also likely to see a significant fall in bonuses which may actually see wages fall to around £80m, however due to the opaqueness of this, our best bet is wages flatline.

Total Costs

Based on these additional costs, we expect total costs to increase by around £10m from £126m to £136m, largely due to amortisation rising.

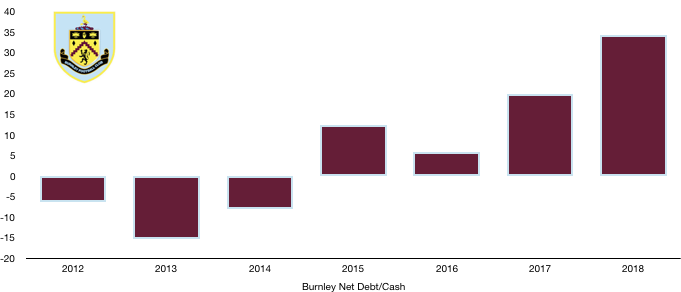

This means that before taking into account transfers, unlike 2018, Burnley will be losing money, approximately £6m, should this continue into the future (which we don’t think it will) this could quickly cause financial issues.

However, Burnley are a well-run club that brilliantly live within their means to great success and we expect Sean Dyche and Co to continue thriving in the difficult Premier League arena.

Transfers Analysis

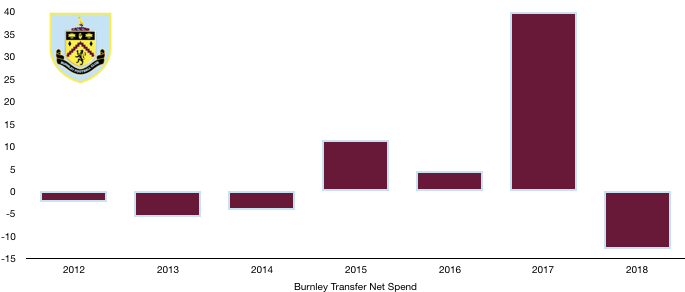

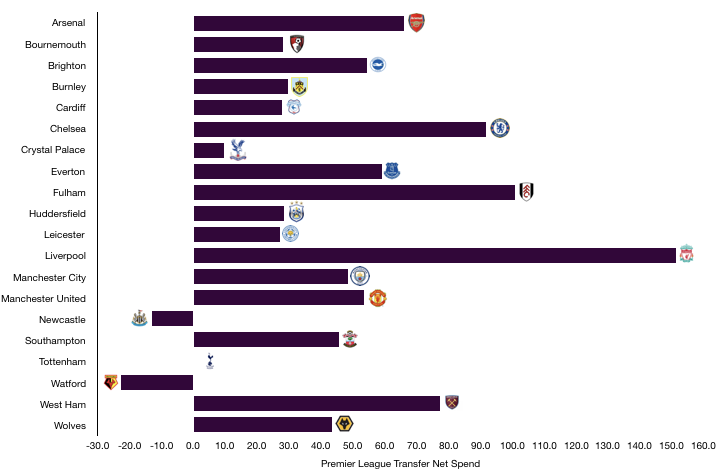

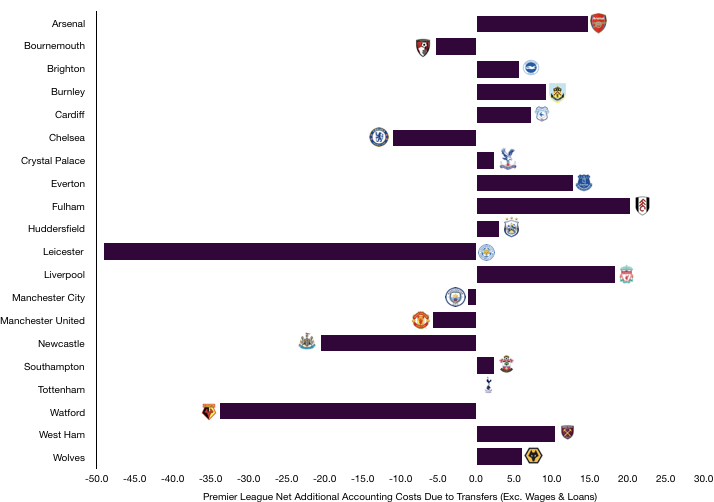

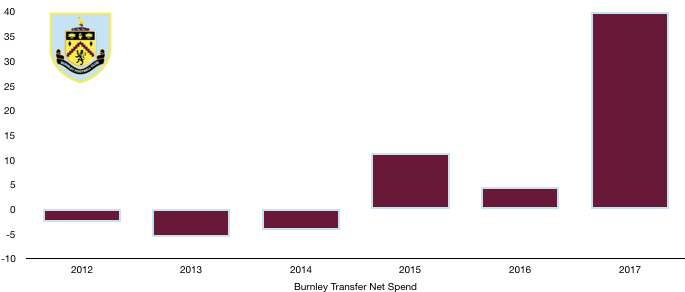

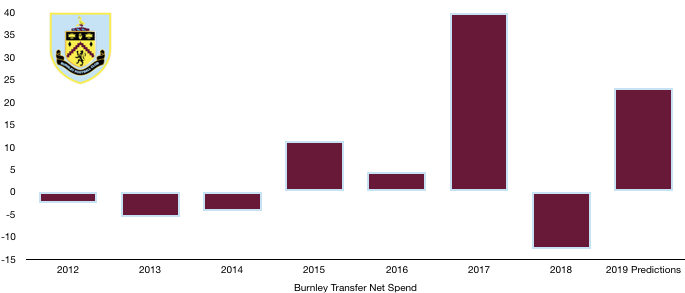

Burnley spent only £30m to build on their 7thplaced finish in 2018, purchasing Gibson (£15m), Vydra (£11m) and Hart (£4m) while the only monetary departure as Vokes for £7m.

This led to a net transfer spend of £23m, a £36m swing on 2018’s net income of £13m (another showcase of how remarkable their 2018 campaign was).

The signings were uninspiring to say the least. Gibson failed to readapt to the Premier League and struggled to get into the side. Vydra provided relatively little goals and Hart fell out of favour following a series of errors.

This meant that Dyche once again relied predominately on the same players as last year which proved difficult with everyone else improving and some of their dependable players suffering dips in form.

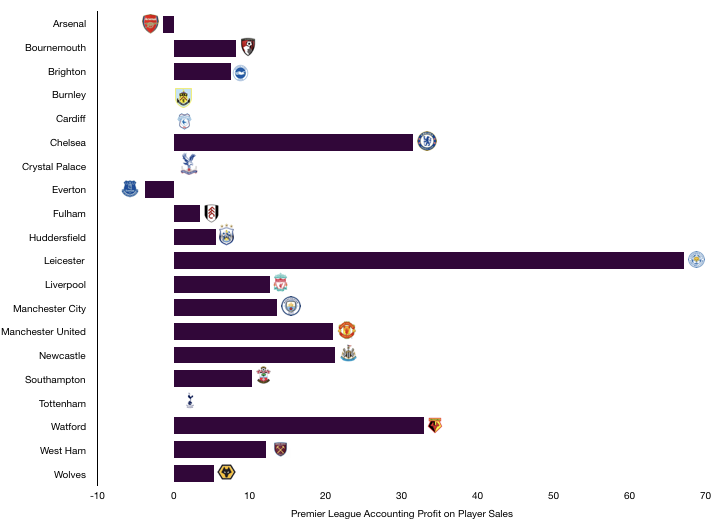

In 2018, Burnley realised a profit on player sales of £30m following the sales of Keane and Gray, which significantly boosted profits.

With only the sale of Vokes in 2019, this will fall significantly. Vokes was brought in 2012 and no longer attracts amortisation and therefore the full £7m will be recognised as profits; this is still a £23m drop in profits compared to last year.

In terms of transfer fees owed, Burnley were still owed around £28m (predominately from Everton and Watford) of which £7m was due in 2019 and later.

In comparison Burnley owe £23m in transfers in 2018, of which £9m was due 2019 and later. There is not much between these figures and therefore this should have no impact on future transfer plans.

Another season of little sales will see a similar level of profit on sales as is expected in 2019, with the only summer departure being Heaton for £8m. Similarly, to Vokes, this will all be profit.

Profit/Loss Prediction

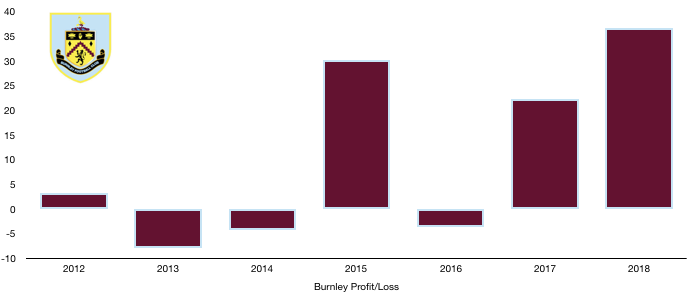

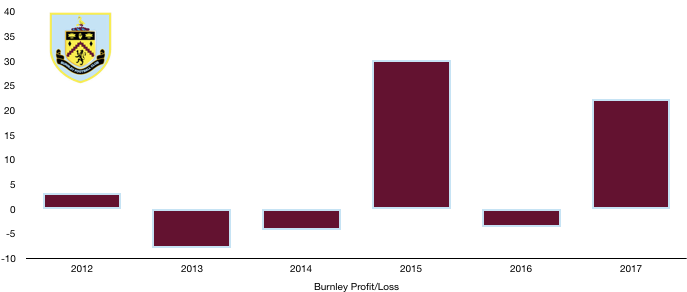

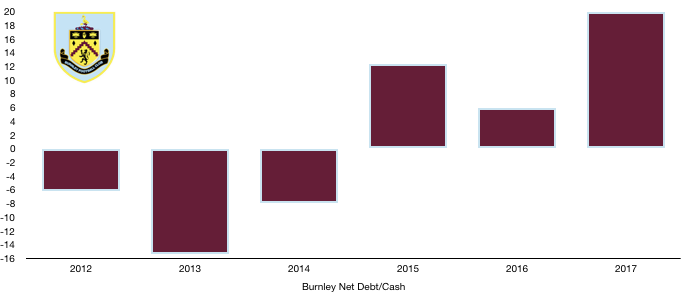

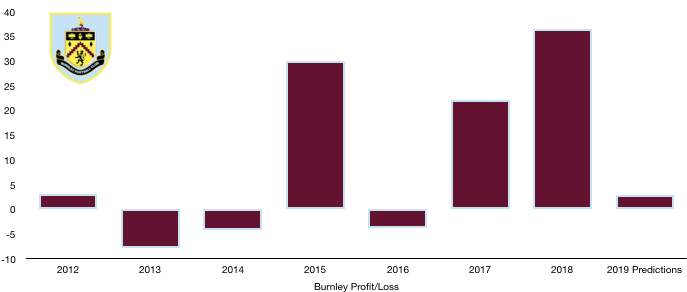

Burnley made a profit before tax of £45m in 2018 (£37m after tax) and this will see a significant drop in 2019.

With revenue falling by around £9m and costs likely to rise by around £10m, profits before transfers are taking into account will fall to around £26m.

Then taking into account the lack of sales in 2019 and hence a much lower profit in player sales, profit are likely to fall by a further £23m to around £3m, a £42m drop.

These drops in profitability may be a common theme of 2019 for most mid-table Premier League clubs with the costs of competing in the top flight rising considerably. Clubs look like only recording profits currently based on player sales rather than underlying financial stability.

Burnley can however still be positive as they are still very financially stable with many of their rivals likely to record losses on the back of similar seasons.

Burnley are run very sustainably and are in safe hands and look primed to have a more successful season this time out, although the priority is still survival.

I hope you enjoyed this article! Share with a Burnley fan and look out for when the actual finances are released to see how we fared!