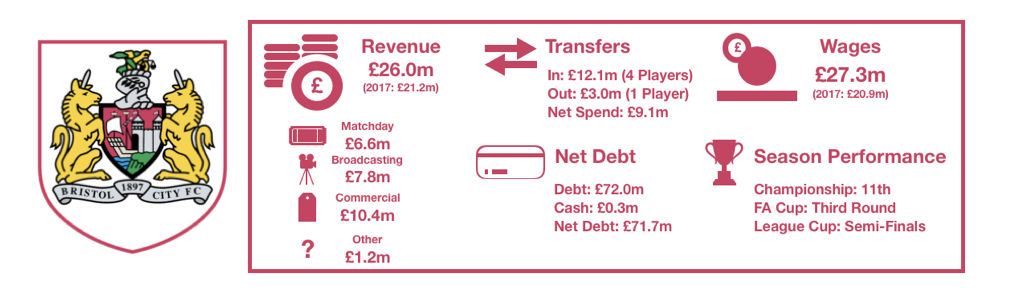

Bristol City had a solid 2017/18 season, finishing 11thin a strong Championship campaign which gave fans hope of a potential play-off place before eventually finishing a few places short.

Fans were however ecstatic after a sensational run to the EFL Cup Semi-Finals before ultimately succumbing to a 5-3 aggregate defeat to Manchester City in a valiant effort by The Robins.

The season will fondly be remembered by their fans after beating 3 three Premier League teams on their cup run, including a shock win over Manchester United.

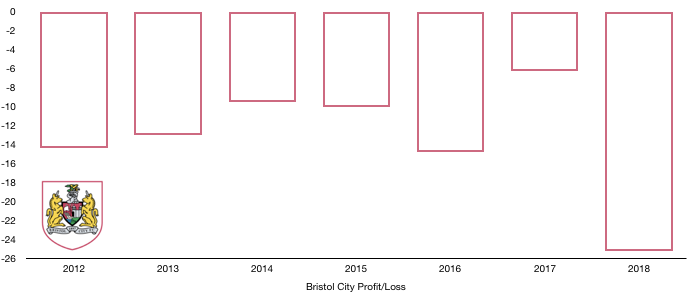

Despite a good season, losses tripled from £6.3m to a record-high of £25.2m (300%) due to rising costs and a the lack of profitable player sales compared to 2017, putting the club at risk of Financial Fair Play penalties as cumulative 3-year losses rose to £46.3m.

Let’s delve into the numbers.

Revenue Analysis

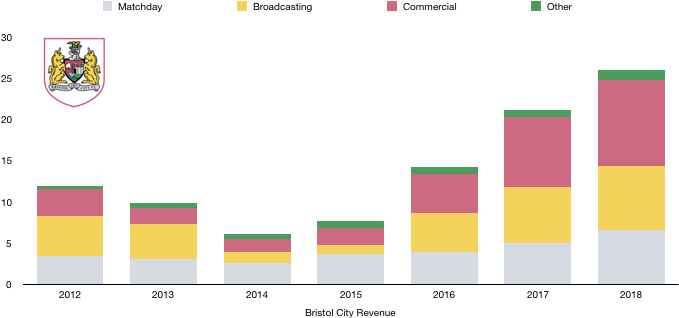

Bristol City saw revenue rise to record levels despite their rising losses, with revenue increasing from £21.2m to £26.0m (23%).

Bristol City saw revenue rise to record levels despite their rising losses, with revenue increasing from £21.2m to £26.0m (23%).

Matchday revenue was a major reason for the rise in revenue, increasing from £5.0m to £6.6m (32%) due to their EFL Cup run that netted the club 5 Premier League ties (including two legs versus Manchester City). This revenue was split as £3.4m (2017: £2.1m) of matchday revenue and £3.2m (2017: £2.9m) in season ticket sales.

Attendances also rose from 19,256 to 20,952 (8%) due to an upturn in form on the pitch in both the EFL Cup and Championship.

Broadcasting revenue rose from £6.8m to £7.8m (15%) due to additional prize money received from finishing 6 places higher in the Championship and the additional EFL Cup prize money.

Commercial revenue rose from £8.5m to £10.4m (22%) as the club benefitted from the exposure of their giant-killing status and an increase in commercial interest and merchandise sales.

Other revenue rose from £0.9m to £1.2m (33%).

Looking ahead, another solid season saw Bristol City narrowly miss out on the play-offs, finishing 8thplaced and 4 points off the play-off places. Roles were also reversed in the EFL Cup with Bristol City shocked in the 1stRound by Plymouth.

The increased Championship distributions and higher finish should see broadcasting revenue rise, while they also reached the Fifth Round of the FA Cup, which may be just as lucrative, if not more so than their EFL Cup run last year.

Matchday revenue is likely to fall due to less home games this season, while commercial revenue is likely to stabilise at around £10m. Overall revenue is unlikely to increase significantly.

Expense Analysis

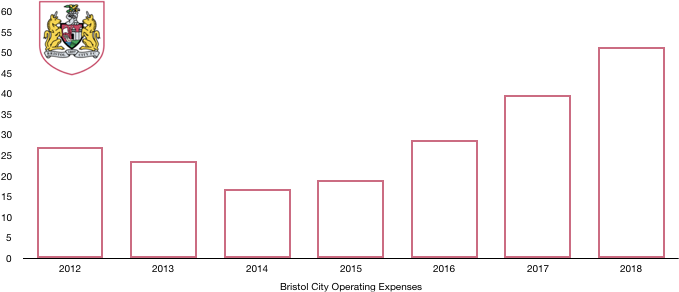

Rising revenue was met by rising costs with expenses increasing from £39.7m to £51.2m (29%) as the costs to compete in the Championship continue to rocket due to the prize on offer with promotion.

The growth in costs (29%) was slightly higher than that of revenue (23%), harming profitability.

Amortisation increased from £5.2m to £7.8m (50%) due to the new level of spending the club are currently experiencing, spending £23.4m in the last two seasons compared to £7.5m in the five years before that.

Interest costs increased from £0.9m to £1.3m (44%) as interest costs on their overdraft and borrowing rose by £0.4m.

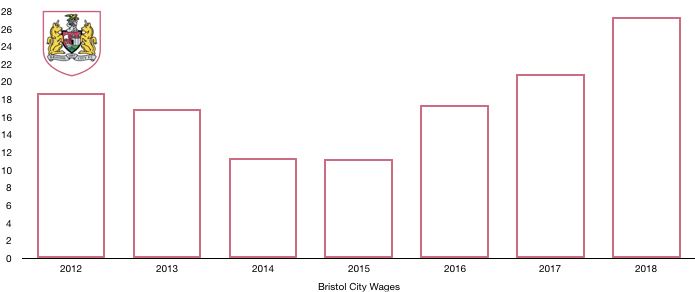

Wages rose significantly, increasing from £20.9m to £27.3m (31%) on the back of their new spending power and the influx of new players.

This wage increase worked out an extra £123k a week, relatively mediocre compared to other Championship clubs. The Championship continues to grow financially with clubs’ willingness to ramp up risk with high wages in the hope of gaining promotion.

Crazily, wages are more than revenue, which means Bristol City are losing money before taking into account any other costs, a financial unstable position that needs to be swiftly remedied and partly explains the sale of key players in 2018/19.

Directors on payroll at the parent company were paid slightly less this year, with renumeration falling from £115k to £109k (5%) despite improved results.

However, key management were paid elsewhere in the group and saw their wages rise from £1.0m to £1.4m (40%) due to these results.

Looking ahead, costs are likely to be at a similar level and may even fall after the likes of Reid, Flint and Bryan left freeing up wage savings that don’t seem to be have been used in full this year. The growing concerns of Financial Fair Play seem to have led to Bristol City curbing spending which may see an improved, more profitable team in the 2019 accounts.

Transfers Analysis

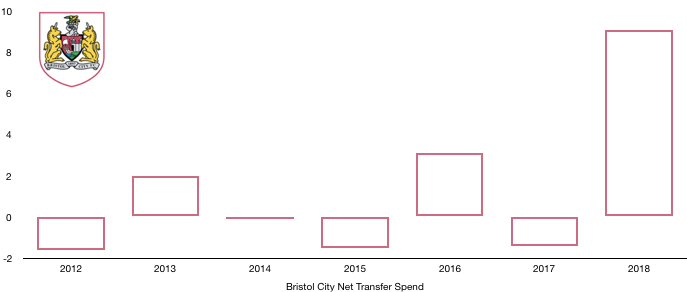

Bristol City saw their biggest transfer net spend to date in 2018, spending £12.1m and only bringing in £3.0m as 4 players arrived at Ashton gate and one departed.

In came, Diédhiou (£5.4m), Baker (£3.9m), Eliasson (£1.8m) and Walsh (£1.0m) for a combined £12.1m.

The only player to depart was Tomlin for £3.0m.

This led to a net transfer spend of £9.1m, up from a net transfer income of £1.4m in 2017.

The signings did okay with existing players leading the way in their promotion push with Diédhiou at least adding a few goals up front to supplement Bobby Reid who had a great season.

The sale of Tomlin netted Bristol City a modest £0.3m profit on player sales compared to the £13.6m recorded in 2017 due to the sale of Kodjia. This explains the majority of the increased losses, with the rest due to the larger rise in costs than revenue.

This loss is likely to be turned into a decent profit next year due to the sales of Reid, Flint and Bryan for sizeable profits.

In cash terms, Bristol City spent cash of £10.6m on transfers and received £7.3m, a net cash outlay of £3.3m, a manageable amount.

Bristol City are due a further £4.7m in transfer fees however owe £6.2m (£5.1m of which is due this year), a net creditor position of £1.5m which constrained transfer spending slightly in 2019 (although Financial Fair Play was a bigger concern).

Bristol City could also owe a further £0.3m in contingent transfer fees, however they could be owed £1.0m from other clubs themselves.

Debt Analysis

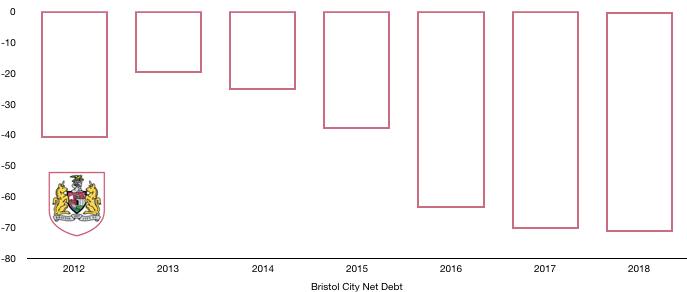

Bristol City operate with minimal cash reserves with their shallow cash pool depleted further, falling from £0.5m to £0.3m (40%).

Rising losses were funded with new funds of £19.0m comprising of £18.7m in capital from their owners and £0.3m in bank loans.

These funds were also used to fund their transfer spending and infrastructure improvements of £1.1m.

The funds provided by their owners were from an issue of new shares and hence are not repayable by the club as their owners show ambition by ploughing money into the club in the hope of promotion.

Debt levels hence increased ever so slightly, rising from £71.2m to £72.0m (1%), due to a £0.3m new bank loan and an increase in their overdraft.

Net debt levels hence rose from £70.7m to £71.7m (1%) as the majority funds were provided by equity, sparing the club from repaying them.

Going forward, further investment will be necessary for The Robins to gain promotion to the Premier League. Signs are mixed currently following the sale of key players in a bid to recoup previous spending and meet Financial Fair Play regulations.

The club are continuing to invest in their future. Following the successful redevelopment of Ashton Gate, Bristol City are at an advance stage in revamping their training ground which should help take them to the next level.

Bristol City are at a cross road on whether to push hard and take financial risk to reach the Promise Land, only time will tell which path they choose…

Thanks for reading – Share with a fan!