Brighton entered their second successive season in the Premier League wary of the infamous ‘second-season syndrome’ and they were worried for much of the season as the club hung around the drop zone for the majority of the season.

A terrible run of form towards the end of the season led to some tense, nail-biting situations, however a few points were plucked here and there, and Brighton managed to stay up by the skin of their teeth in 17thplace and secure a third Premier League season.

A run to the FA Cup Semi Final was a welcome boost to the club with relegation never far away.

The season wasn’t without its casualties, with Chris Hughton losing his job after performing admirably during his time there but a breath of fresh air was needed for everyone around the club.

This article aims to predict how last season affected Brighton and their finances and what the future holds.

Let’s delve into the numbers.

Revenue Prediction

Matchday Revenue

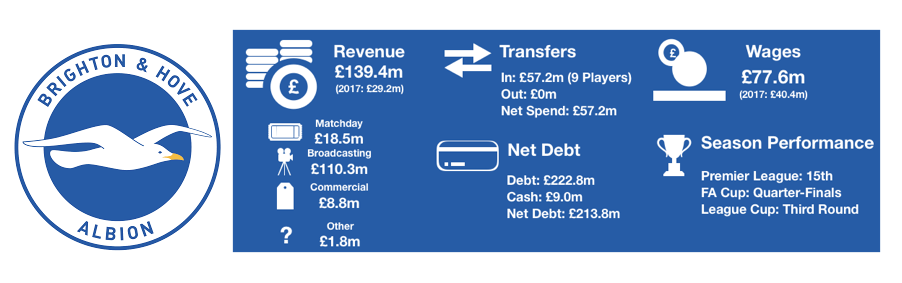

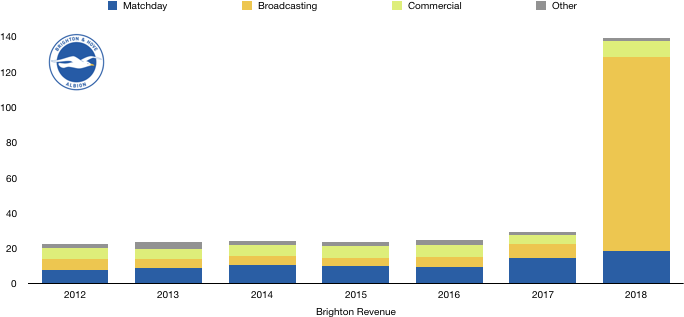

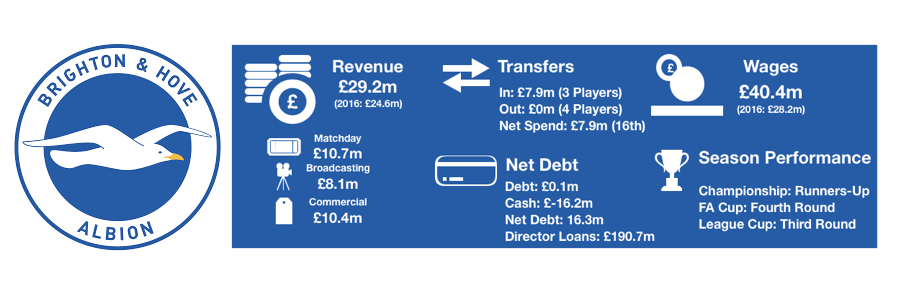

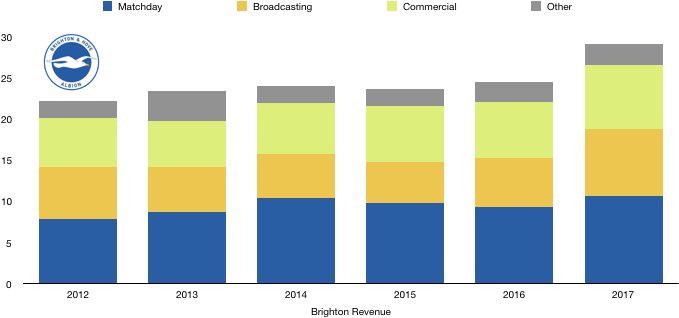

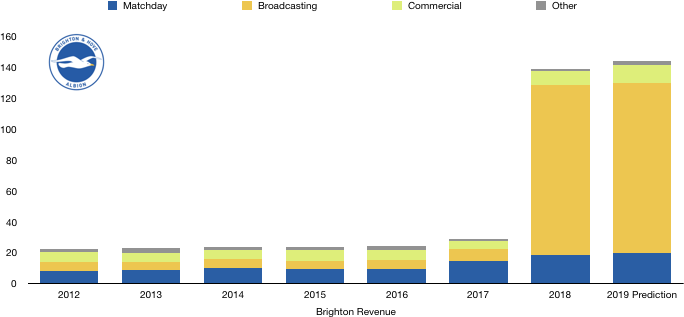

Brighton have fairly high matchday revenue for a club their size at £19m which saw a sizeable boost following promotion.

This season, matchday revenue should remain robust at a similar mark, especially considering the club had 22 home games once again.

The FA Cup Semi Final at Wembley will boost matchday revenue so a slight increase to £20m seems an adequate prediction given average attendance increased by a whole 19 people to 30,426 in 2019.

Broadcasting Revenue

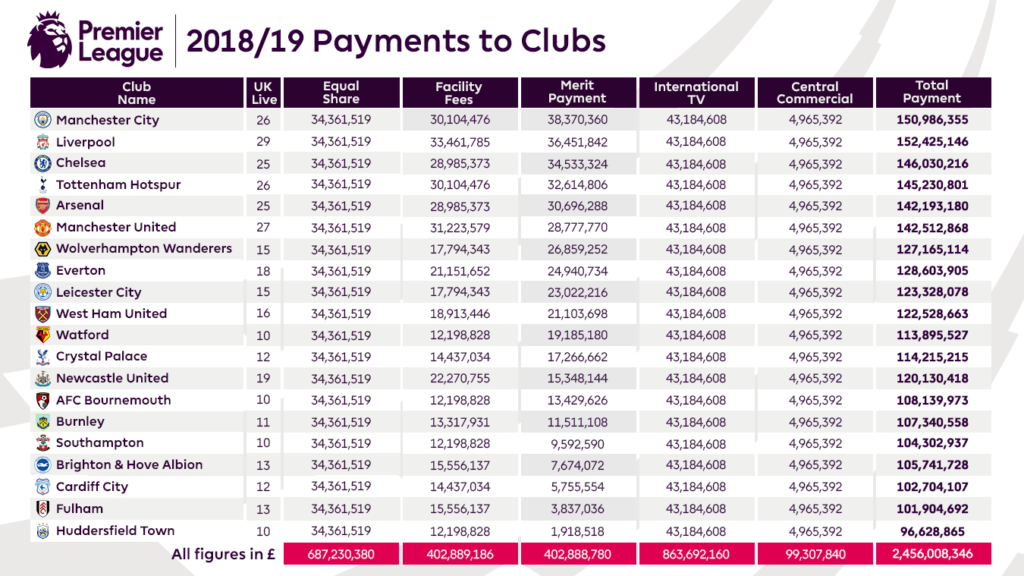

Brighton’s broadcasting revenue was £110m in 2018, of which a huge £108m related to Premier League TV payments after finishing 15thin the Premier League.

Despite increased distributions overall in the Premier League, a drop of two places to 17thmeant that Brighton saw their Premier League revenue drop £2m to £106m. Brighton featured in the same number of live games as they did in 2018 (13).

However, a magical run to the FA Cup Semi-Final and Wembley boosted revenue by around £1.6m in prize money as compared to their Quarter Final appearance in 2018, essentially eliminating the fall in revenue from their lower Premier League position.

The League Cup offers silverware and not much else so an earlier second round exit will not materially affect finances.

Therefore, overall, we expect broadcasting revenue to remain at £110m as their FA Cup run minimises the impact of their fall in Premier League revenue.

Commercial Revenue

Brighton have one of the lowest commercial revenues in the Premier League, lower than some Championship clubs even.

However, their continued presence in the Premier League will continue to boost revenue, which increased from £5m in 2017 to £9m last year.

Survival means that this trend will continue and a rise to around £12m should be easily achievable, with rises in excess of this dependant on survival bonuses and further commercial activity.

The rise is unlikely to be much higher than this due to their ongoing contracts already in place with Nike and America Express which are their most lucrative deals.

Other Revenue

Brighton had other revenue of £2m in 2018 and are best guess here is it will remain at this level with not much else to go to predict this amount.

Total Revenue

A steady year for Brighton means revenue will not change a great deal however we predict that on the basis of matchday and broadcasting revenue remaining at similar levels to last year, commercial revenue growth will help Brighton to increase revenue by around £4m to £143m from £139m in 2018.

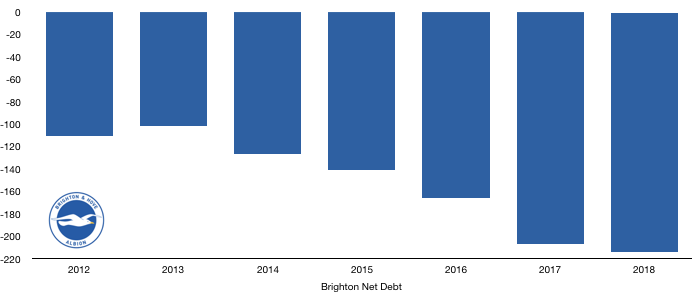

Survival is obviously the main goal with around 75% of Brighton’s revenue dependant on Premier League survival. This revenue will make it possible for Brighton to continue investing into the club and players.

Cost Prediction

Amortisation

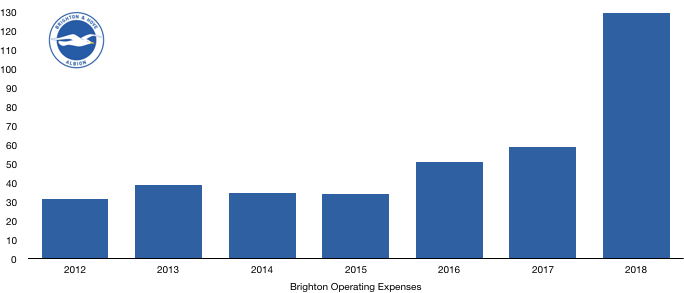

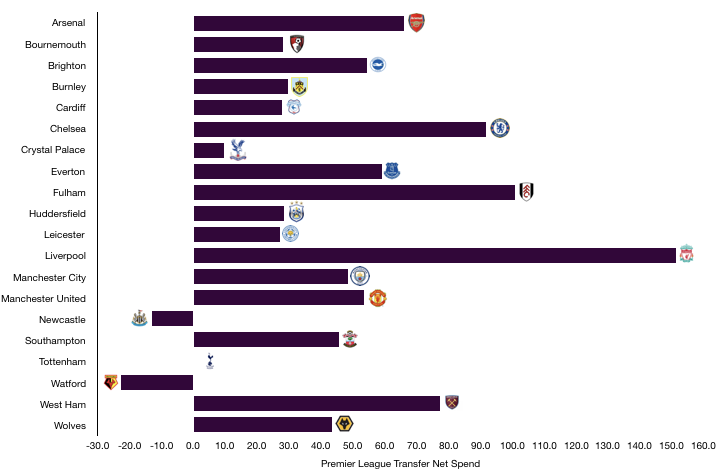

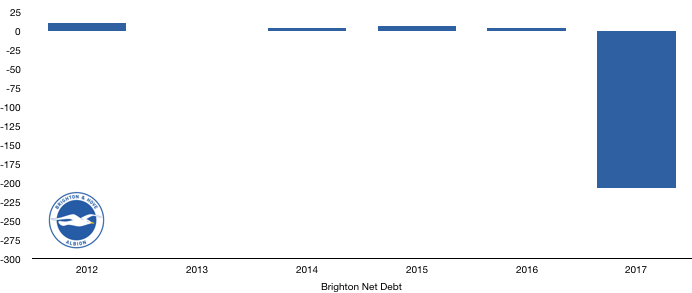

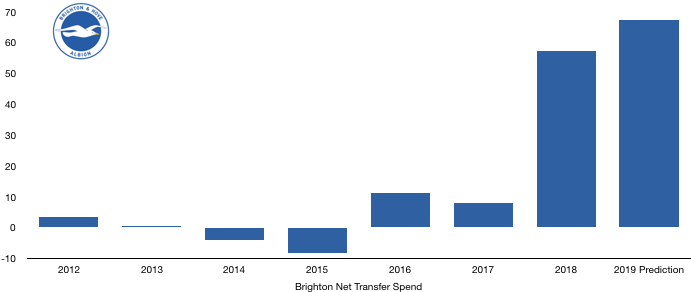

Brighton had a big summer, spending just shy of £80m on new players in 2019, having already spent £57m in the previous summer to stay up.

Brighton signed an astonishing 14 players with the standouts being club record signing Jahanbaksh (£17m), Bissouma (£15m), Bernardo (£9m) and Montoya (£6m) as they went on a spending spree.

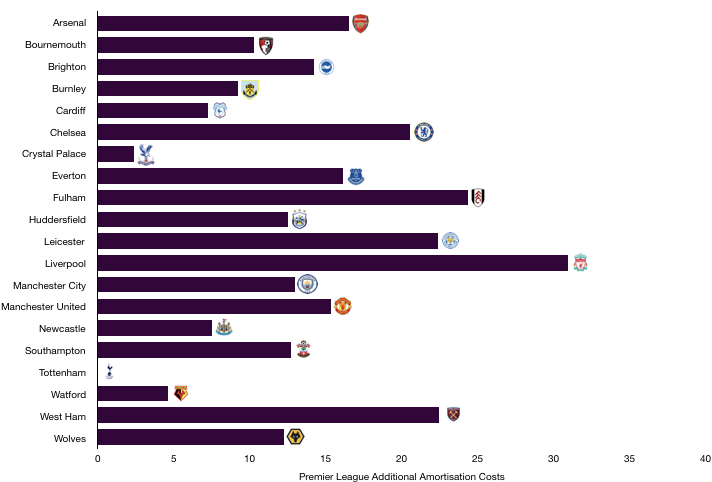

This spending, something Brighton are not accustomed too, is likely to increase amortisation from £19m to £35m, based on transfer fees and contract lengths.

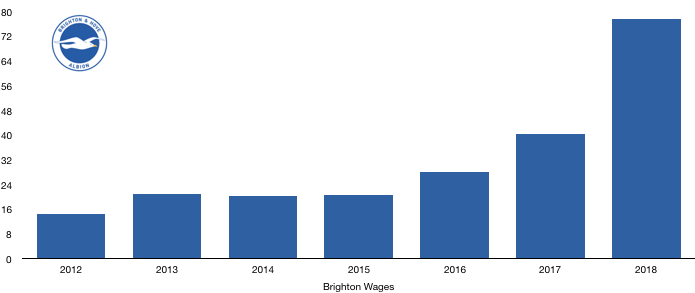

Wages

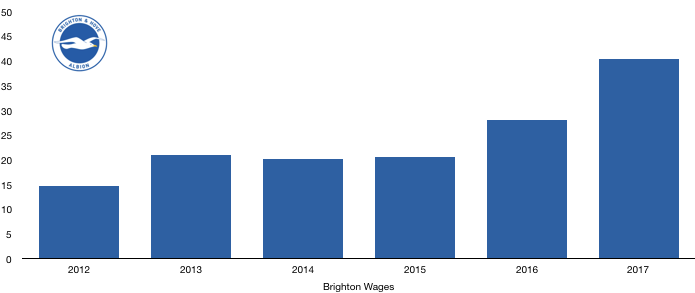

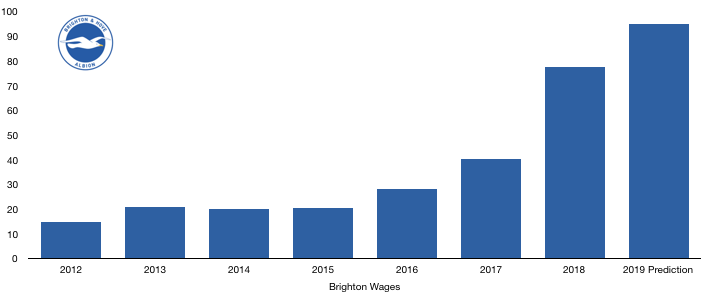

Brighton commendably have one of the lowest wage bills in the Premier League and despite this spending, that is likely to still be the case. Despite a host of new signings, many went out on loan with wages being recouped with the first team additions all being on relatively humble wages compared to their Premier League rivals.

Based on this, an increase from £78m to £95m is possible, however I suspect they will not break the £100m barrier this season, although it won’t be far away with the costs to compete in the Premier League growing at an astonishing pace.

Other Costs

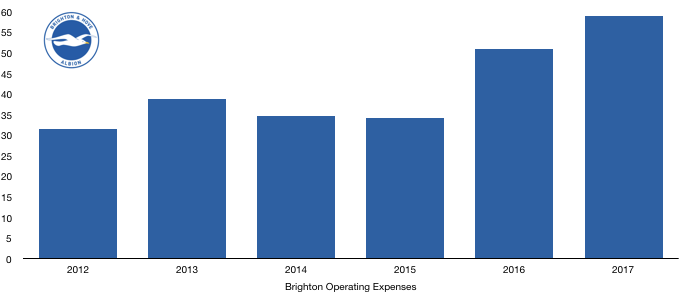

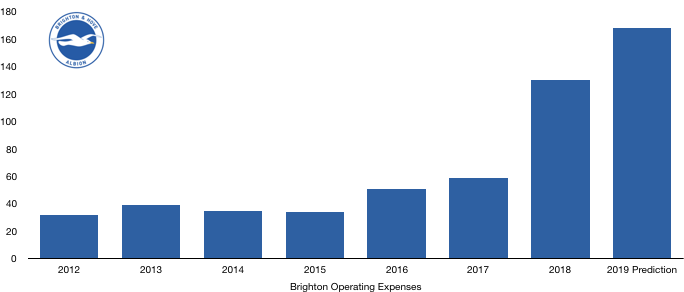

Brighton’s other expenses to run a Premier League were £33m in 2018 following promotion, 2017 was much lower due to being in the Championship so a further jump of around £5m to £38m is likely.

Total Costs

It was an expensive year for Brighton as they successfully battled for their Premier League place and it did come at a cost, with total costs likely to increase from £139m to around £168m based on the above.

These costs are likely to continue rising as they remain in the Premier League with the costs of the Premier League continually rising.

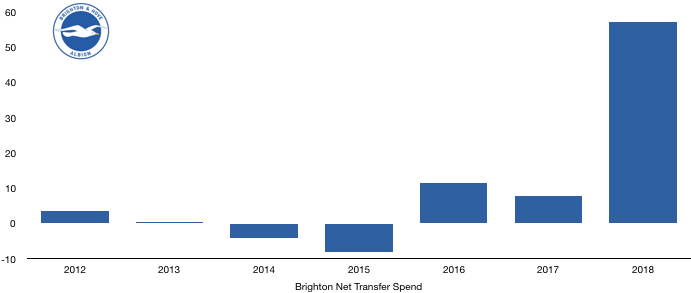

Transfer Analysis

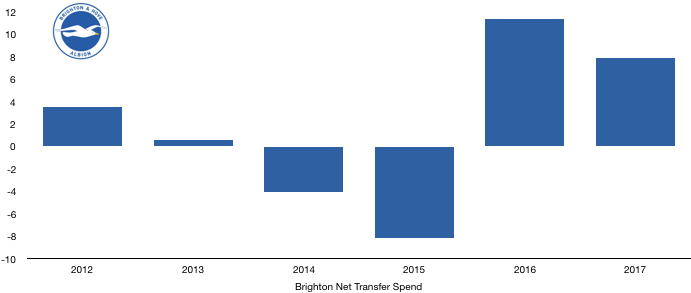

Last summer was the biggest summer in Brighton’s history as they spent huge sums they have never spent before.

In came Jahanbaksh (£17m), Bissouma (£15m), Bernardo (£9m), MacAllister (£7m), Montoya (£6m), Andone (£5m), Button (£4m), Burn (£3m), Tau (£3m), Mlakar (£3m), Baluta (£3m), Dreyer (£2m), Gwargis (£1m) and Arce (£1m) for a combined £80m.

Out went Baldock (£4m), Goldson (£3m), Norwood (£2m), Murphy (£1m) and Skalak (£1m) for a total £12m.

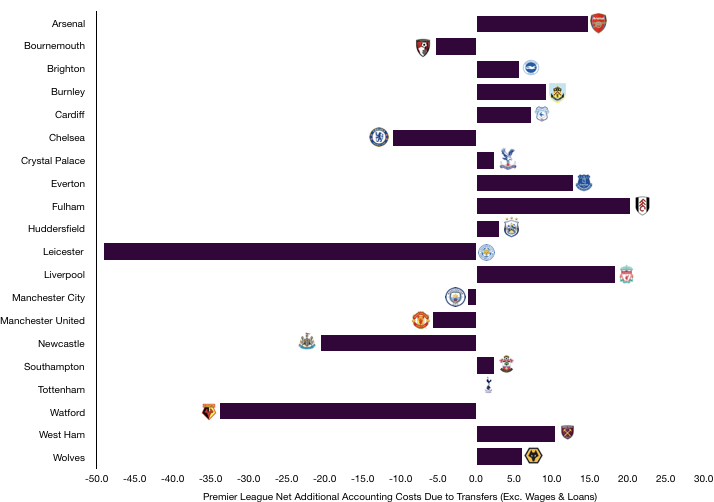

This meant Brighton had their highest net spend in their history at £68m, eclipsing the £57m net spend in 2018.

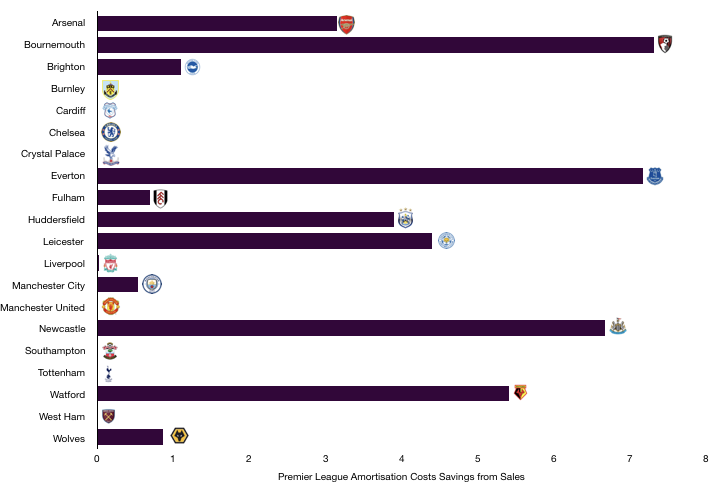

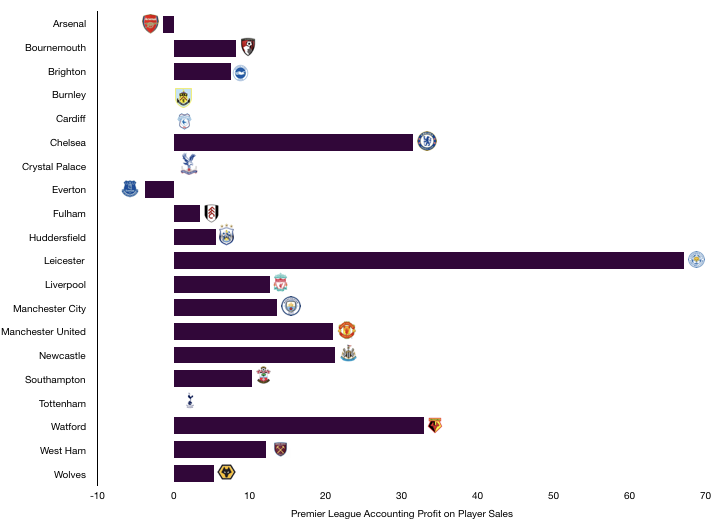

Brighton also recorded a measly profit on player sales of £3m in 2018. 2019 is likely to be a little bit higher due to increased sale activity and based on transfer fees paid and received on these departures and their original contract lengths, a profit of around £10m is likely, a £7m increase.

Based on the 2018 accounts, Brighton were owed a measly £2.9m in transfer fees with only £1.5m due in 2019, which will hardly help given their large spending.

In contrast, Brighton owe clubs £19m in transfer fees with £10m due in 2019, a net creditor position of £8.5m, adding to last summer’s outlay.

This is likely to mean their cash levels of £9m in summer 2018 are likely to fall.

Profit/Loss Prediction

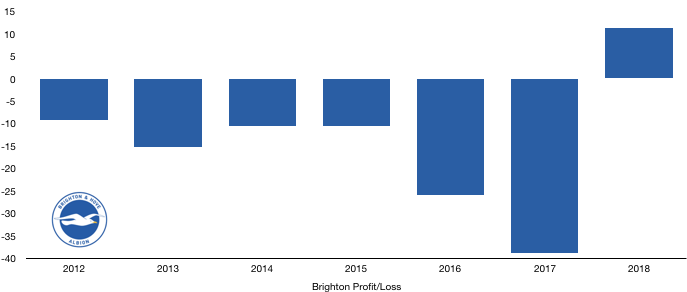

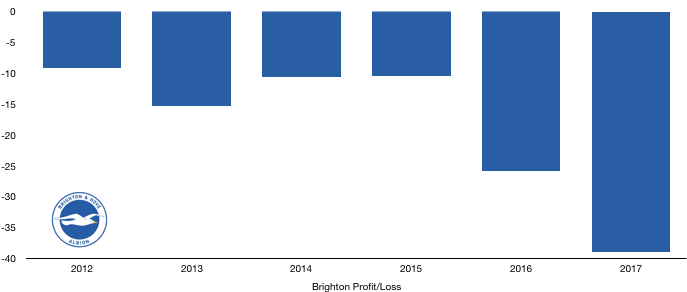

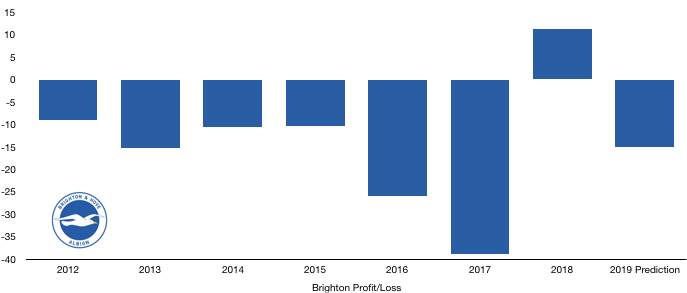

Based on all of the above, despite a small rise in revenue being predicted and an increase in profit on player sales, the rise in the costs of competing in the Premier League significantly outweigh this and a £11m profit in 2018 is likely to turn into a loss of around £15m.

The increased spending and wages are to blame for this; however, such spending was required to show ambition, and more importantly, survive.

2019/20 poses to be an interesting season for the club under a new regime under the impressive Graham Potter who will bring his own ideas and needed his own players, leading to another expensive summer window where the club spent over £60m, showing that costs are only going to continue rising as long as Brighton remain in the Premier League, something they would very much like to do.

I hope you enjoyed this article! Share with a Brighton fan and look out for when the actual finances are released to see how we fared!