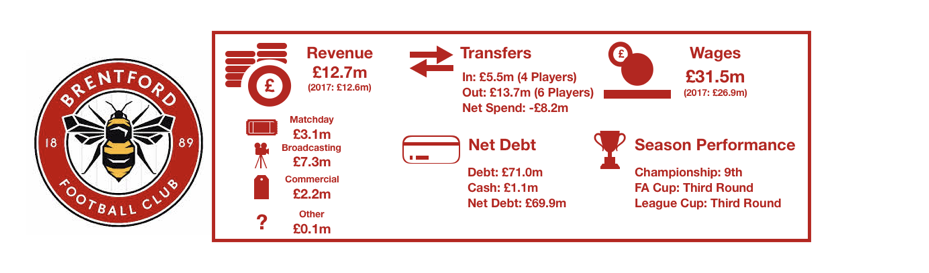

Brentford enjoyed their 4thconsecutive season in the Championship, securing a 9thplaced finish which was their 4thsuccessive top ten finish since their return to the league, a great achievement.

Having narrowly missed out on the play-offs but will be fairly happy with the continued progress and performances on the pitch considering the departure of key players over the last couple of seasons.

The only downside of an otherwise solid season was third round exits in both domestic cup competitions.

Off the pitch, Brentford are in fairly good shape, losses did rise from a measly £1.0m to from £3.9m as costs rose but despite this, Brentford are well within Financial Fair Play regulations at a time that many Championship clubs are on the brink of breaking them.

Looking to the future, Brentford have begun development for a new stadium that should boost finances in the long run. A peculiar arrangement for this development is in the works that will boost finances. However, may not be the best course of action as explained later.

Let’s delve into the numbers.

Revenue Analysis

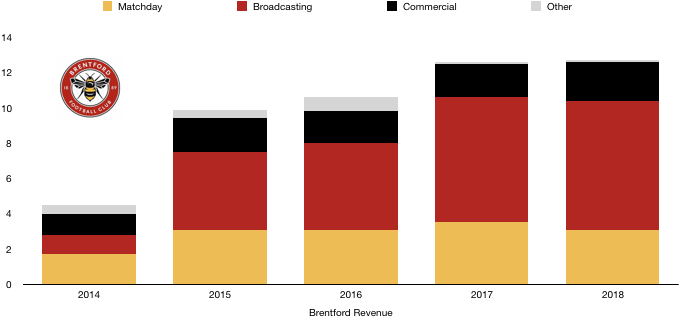

Brentford saw their revenue remain stable, increasing slightly from £12.6m to £12.7m due to a similar season to last.

Matchday revenue fell from £3.5m to £3.1m (11%) despite average attendances increasing by 11% to 10,581. The ticketing mix changed slightly as season ticket sales fell from 5,840 to 5,828 which cannot explain the sizeable difference. The main reason was matchday revenue last year was boosted by their FA Cup Third Round match with Chelsea. Another reason is likely to be due to less takings on matchday in food and beverage sales as ticket prices remained flat.

Broadcasting revenue increased from £7.1m to £7.3m (3%) due to an increase in general distributions from the EFL and the fact Brentford finished 1 place higher in the Championship. In the domestic cups the changes in fortunes in the FA Cup (exiting one round earlier) and League Cup (exiting two rounds further) cancelled out to a large extent, although the marquee tie last year against Chelsea was financially missed.

Commercial revenue increased from £1.9m to £2.2m as another solid season as a top half Championship club paid dividends. Going forward, Brentford will want to exploit their close proximity to London to increase commercial income.

Other revenue was stable at £0.1m.

Looking ahead, revenue is likely to increase slightly despite a much poorer, mid-table campaign in the Championship this year. A fifth round FA Cup campaign should help bridge any shortfall in revenue from their fall in the Championship table. Matchday revenue should increase slightly after the additional FA Cup games, while commercial revenue should also increase slightly.

Costs Analysis

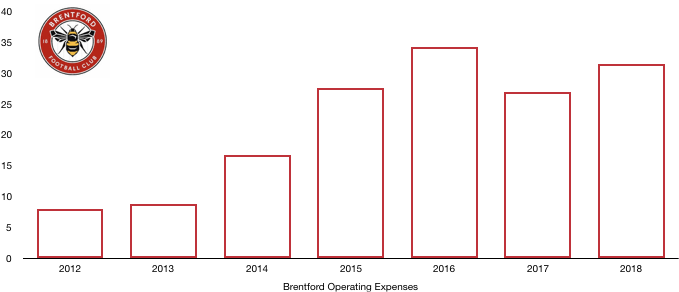

Brentford saw their costs rise despite revenue flatlining, hurting profitability as the costs of being competitive in the Championship continue to rise, causing many Championship clubs financial troubles.

Costs rose from £26.9m to £31.5m (17%) as Brentford strived for a play-off place.

Amortisation increased from £4.3m to £5.6m (30%) as Brentford reinvested some of the vast sums realised of late in the transfer market. Further investment is required if Brentford are to move back up the table.

Brentford saw a net interest expense of £0.2m turn into a net interest income of £0.5m this year due to an increase in the interest due to them from transfers. Brentford factored some receivables last year to receive money owed to them sooner than they were due, however this was not needed this year and the associated costs were not therefore present.

Brentford paid no tax after making a loss this year. The accumulated losses over the last few years will be useful should Brentford make a profit next year, as they can be used to reduce any tax bill faced.

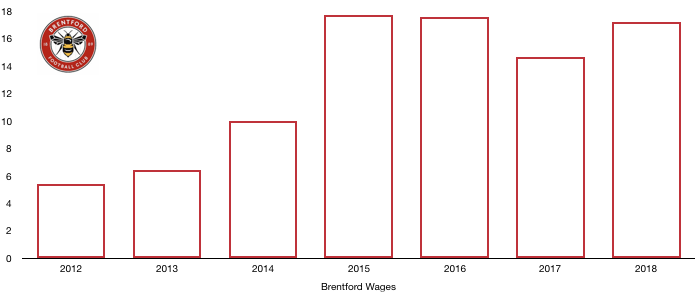

Wages were on the rise, increasing from £14.7m to £17.2m (17%) as the general wage levels in the Championship rose. Brentford rewarded their key players with new contracts while new signings also attracted higher wages.

This wage increase works out at an extra £48k a week, which isn’t a great deal for an established Championship club.

Directors saw their remuneration increase from £0.2m to £0.3m (50%) as they were rewarded for another top half finish.

Looking ahead, costs are likely to increase by a similar amount to this year as wages continue to rise in the league. Further high profile departures may reduce this impact and keep costs at around £18m.

Transfers Analysis

Brentford were fairly busy in the transfer market this year, seeing 4 signings and 6 departures, with some key players unfortunately leaving Griffin Park.

In came Watkins (£1.8m), Maupay (£1.8m), Dalsgaard (£1.0m) and Mokotjo (£0.9m) for a combined £5.5m.

Departing were Jota (£5.9m), Colin (£2.9m), Vibe (£2.0m), Dean (£1.9m), Gogia (£0.7m) and Hofmann (£0.2m) for a combined £13.7m.

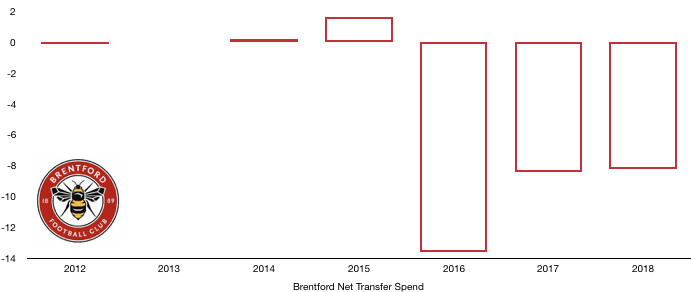

This led to a net transfer income of £8.2m, similar to the £8.4m income last year, the third year in a row of negative net transfer spends (four after this season) as Brentford continue to be a selling club.

Despite key players departing, the signings proved inspired with Watkins and Maupay proving a prolific partnership worth several times the fees paid now.

The departures earnt Brentford a profit on player sales of £14.1m, up 10% on last year as Brentford continue to benefit from great scouting and selling players at a premium.

Without these sales over the past 3 years, Brentford would have recorded large losses that would have surely bought about Financial Fair Play issues, explaining the number of departures. In order to not have to sell these players, Brentford need to work on improving their profitability, primarily by boosting revenue (matchday and commercial in particular), by reducing costs (not feasible) or by gaining promotion (the ideal scenario).

In cash terms, Brentford spent cash of £11.5m but received cash of £14.9m on transfers, a net cash inflow of £3.4m, much smaller than the net transfer income of £8.2m as many of the deals were negotiated with instalments.

This means Brentford are still owed £10.5m in transfer fees (£8.7m is due this year) while they only owe £2.7m (all due this year), a net debtor position of £7.8m, a good position to be in that will boost their cash balance next year and will assist their development and future transfers.

Brentford may also have to pay £3.5m in transfer fees should certain clauses be met based on their league performance and player appearances although it is unlikely this will all become payable.

After selling £31.5m of players this year, a big profit on player sales is expected that should see Brentford record a profit next year.

Debt Analysis

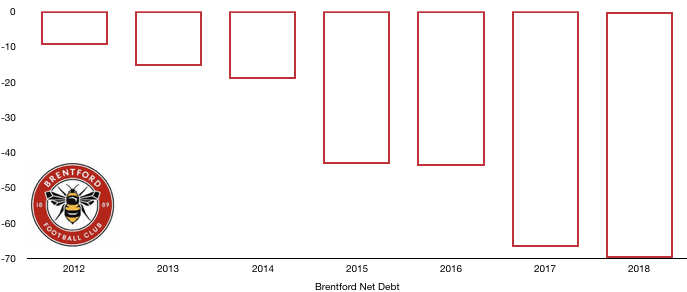

Brentford saw a similar debt profile to last year as their owners invested a bit more in the club.

Cash levels remained fairly low, falling from £1.3m to £1.1m (15%). The loss this year was funded by player sales that brought in £3.4m net, while new loans of £12.3m also allowed Brentford to spend £4.5m on club infrastructure as they look to develop for the long term.

Debt levels hence increased from £59.7m to £71.0m (19%) after these new loans, which took Matthew Benham’s investment in the club to £113.9m. Transfer sales this year were large and should mean further loans are not required in the short run and due to profit likely to be recorded next year from transfers, there is less pressure to sell key players.

Net debt hence increased from £58.4m to £69.9m (20%). Brentford are financially in decent shape with no Financial Fair Play issues surrounding the club at a time many clubs are sweating over their compliance. Player sales over the last few years have helped stabilise the club and have been reinvested well in the most part.

Brentford are primed to move forward and should hope to be a financially sustainable club in a couple years, with promotion then becoming a real possibility.

Brentford began preparing for a new stadium in 2018, looking to boost matchday revenue despite having a capacity utilisation of only 85% last year.

The stadium arrangement is a peculiar one, with Brentford entering a development agreement with a third party (not named) who the club will sell Griffin Park to and also the land for the new stadium. Griffin Park is to be sold for £30m while the new stadium is being sold to the developer for £52m. This will raise a huge sum of cash for Brentford and a brand spanking new ground which the club will then have to lease each year rather than own, reducing the initial cash needed significantly.

This will see Brentford record a massive profit on the sale of the stadium, meaning Brentford will probably record profits not only for themselves, but also for a Championship club next year.

The only issue here is obvious, they will not own their stadium. This may make expanding at a later date difficulty and will also mean they may have little power at a later date if the developer wishes to use the stadium for other uses (e.g. other sporting events etc.). Brentford would be wise to have a number of safeguards in place (which I’m sure they do). It will be interesting to see how this develops (no pun intended) going forward.

Thanks for reading – Share with a football fan!