Birmingham have shown ambition in recent years, spending relatively heavily for the Championship. This investment has failed to produce any goods so far with two consecutives 19thplaced finishes and a revolving managerial door after a very disappointing season.

The investments to date have been a gamble that hasn’t paid off and as such Birmingham are financially unstable. Following a loss this year of a huge £37.5m, Birmingham have a huge cumulative loss of £60m over 3 years and as such are in breach of Financial Fair Play rules for the Championship and are currently under a transfer ban as well as facing potentially fines and penalties for breaking Financial Fair Play rules.

Birmingham are in a financial mess and their directors begin the accounts with a lot of commentary on the financial situation the club finds itself in after poor financial controls. The directors admit that Birmingham are in financial trouble unless the owners continue to inject cash to help the club financially. As such their status as a going concern is under threat however should be okay for now.

Let’s delve into the numbers.

Revenue Analysis

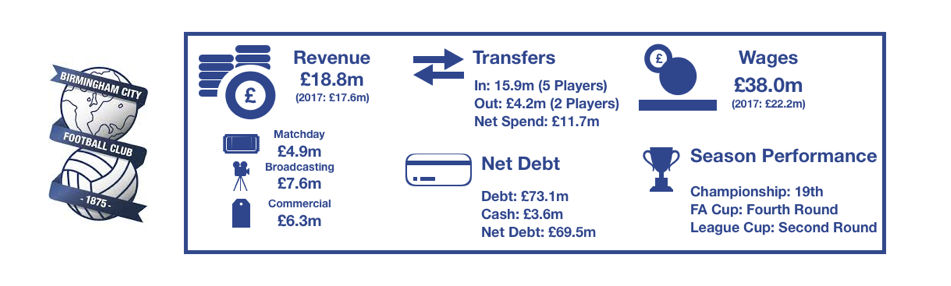

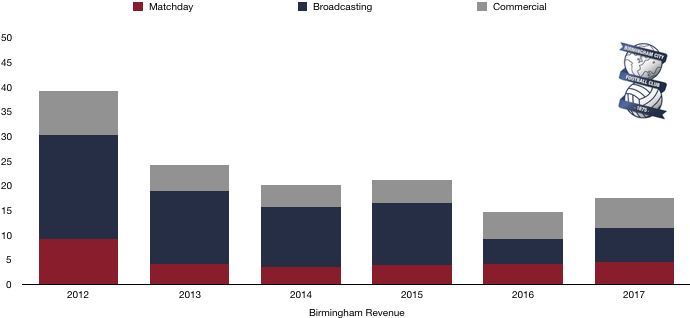

Birmingham finished in the same position as last year and their revenue remained fairly stable due to this. Overall revenue rose from £17.6m to £18.8m (9%).

Matchday revenue rose from £4.5m to £4.9m (9%) as fans started the season optimistically despite a poor start due to the investment in the club and the adrenaline from their relegation battle the previous season.

Broadcasting revenue also rose, increasing from £7.0m to £7.6m (9%) as the distribution of prize money from the EFL rose meaning Birmingham received more income despite finishing 19thagain. Birmingham also went slightly further in the domestic cups which supplemented this income.

Commercial revenue rose slightly, increasing from £6.1m to £6.3m (3%). This remained fairly stable as the commercial team failed to drum up any additional sponsorship interest. Birmingham however can take pride from having a relatively high commercial income for the Championship.

Looking to next year, Birmingham should see a jump in revenue after an upturn in form this season has led to a promotion chase by the club which will likely see the club at least manage a top half finish, a considerable improvement on last season which will boost broadcasting revenue. This may enable the club to benefit from increased takings on matchdays and also commercially.

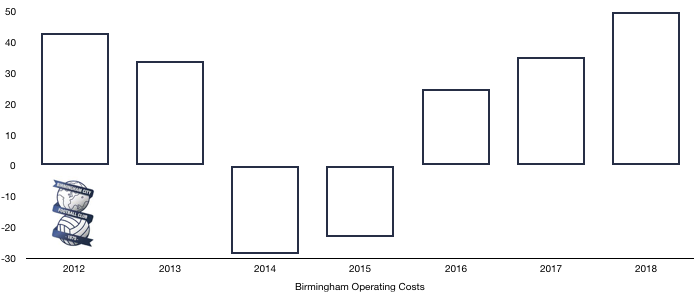

Expense Analysis

After investing heavily as already mentioned, Birmingham saw their costs balloon, rising from £35.3m to £58.1m (65%). This rise significantly outstrips the 9% rise in revenue causing the massive loss of £37.5m.

Amortisation (the key indicator of investment in players) rose from £3.0m to £8.0m (167%). The fact that this amount more than doubled shows the relative size of their investment compared to previous more conservative years and the risks taken recently.

The club also had net finance expenses of £0.9m of which the majority related to transfer fees due in the future.

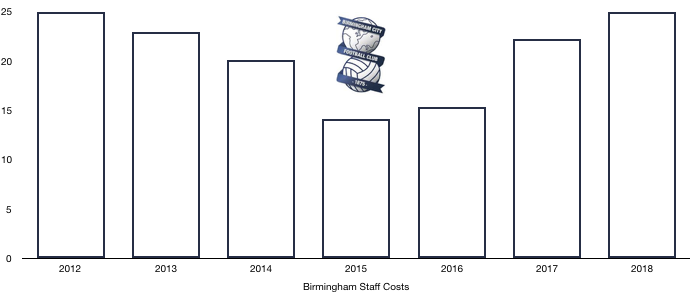

Wages grew significantly, rising from £22.2m to £38.0m (71%) due to the after mentioned player investments. This huge rise equates to an eye-watering extra £438k a week, a huge sum for a Championship side.

Related to this, directors saw their pay fall from £406k to £386k after a poor season.

Looking forward, Birmingham are likely to see a fall in costs after their Financial Fair Play problems meant they were under transfer restrictions and pressures to reduce costs. This is likely to mean amortisation and wages fall however this may be offset by any severance pay due to Harry Redknapp after his sacking.

Transfer Analysis

Talking of the player investment we finally come to Birmingham transfers. Birmingham spent £15.9m bringing in Jota (£5.9m), Roberts (£3.6m), Colin (£2.9m), Dean (£1.9m) and Gardner (£1.6m).

Out went Shotton (£2.9m) and Frei (£1.3m) for a combined £4.2m.

This led to a transfer net spend of £11.7m, a 31% increase on last year and 7thhighest in the Championship last year despite finishing 19th.

The players signed found it difficult adapting and the managerial upheaval early on in the season did not help. This season the earlier investment has started to pay dividends and it may have just been a period of adjustment was required.

Birmingham recorded an accounting profit on player sales of £2.0m due to the sale of Shotton which boosted reported earnings slightly.

From a cash perspective, Birmingham spent actual cash this year of £12.1m in transfers and recouped cash of £2.9m meaning a net cash outlay of £9.2m.

Worryingly for the club’s future financial health, Birmingham still owe £11.1m in transfer fees for this and previous windows, of which £7.3m is due in the next 12 months. On the flipside they are only owed £2.4m in transfer fees of which £1.9m is due in the next 12 months meaning further net cash will be required by the club.

Further to this issue, Birmingham may owe another £6.1m should certain contingent clauses in players contracts are met such as performance related fees and appearance fees.

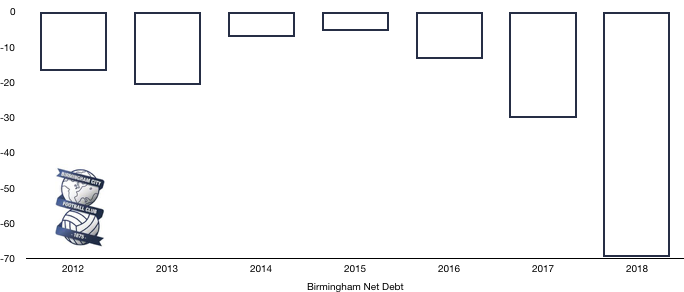

Debt Analysis

As you can see, Birmingham are in a bit of financial bother and their issue conclude with their rising debt levels.

Cash wise, levels remain as standard. Cash rose from £3.3m to £3.6m. A huge loss of £37.5m was offset by a cash injection in the form of a loan from their owners of £39m which was used for this and to fund transfers and club improvements.

Debt hence rose from £33.4m to £73.1m (119%) on the back of this cash injection. The cash needed to keep the club running doesn’t look like slowing down due to the financial mess the club have created due to overindulgence and the club are currently in a position where they cannot survive without external funding. Luckily it seems this will be available for the foreseeable future and they should be okay subject to any Financial Fair Play punishments they may receive (for more on this have a read of our article on the potentially punishments they could face).

This has led to net debt more than doubling from £30.1m to £69.5m (131%) as a usually conservative club count the costs of ambition and poor financial management.

Thanks for reading, share with a Birmingham fan!