Aston Villa had an interesting season that ultimately ended in disappointment, failure and fear following a narrow 1-0 loss in the Play-off final to Fulham after finishing 4th in the Championship.

This condemned Aston Villa to their third successive year in the Championship and after the level of investment immediately following relegation, was a huge failure and unplanned disaster for the club.

The huge financial gamble (in failing to control costs) taken led to questions of the financial viability of the club going forward that needed the intervention of billionaires Nassef Sawiris and Wes Edens to save the club from what seemed to be financial meltdown.

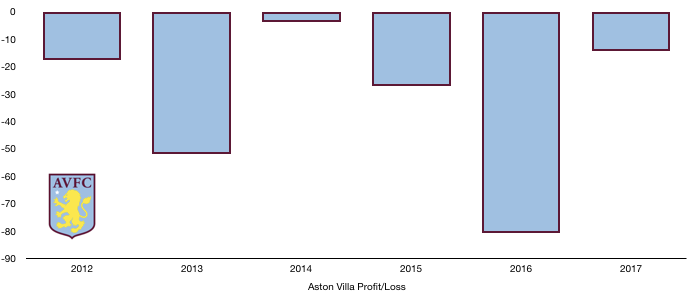

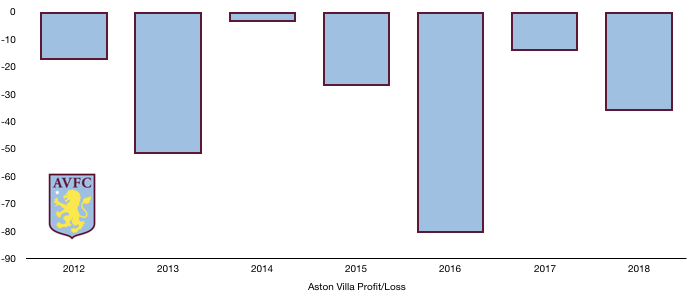

The investments made and the failure to secure promotion meant there was no way of recouping any of their investment this season and after a loss of £36.1m, Aston Villa were in a spot of bother. This isn’t the end of their troubles despite significant investment. A cumulative loss over the last 3 years of £131.3m is well over the EFL’s Financial Fair Play limits and Aston Villa may be penalised as a result.

Let’s delve into the numbers.

Revenue Analysis

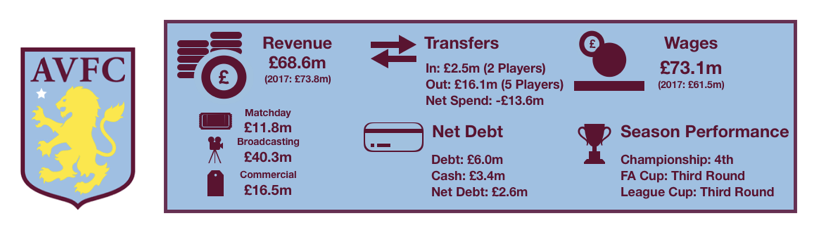

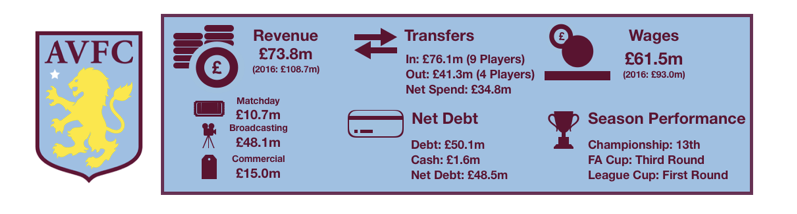

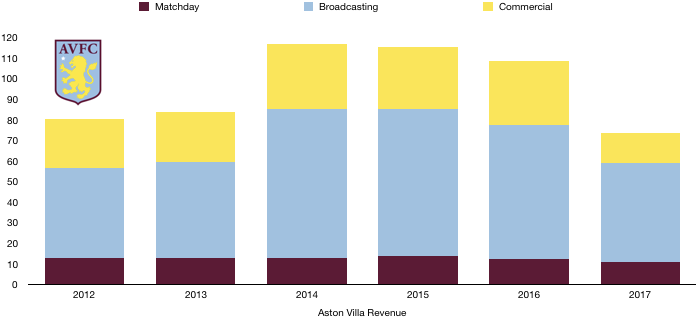

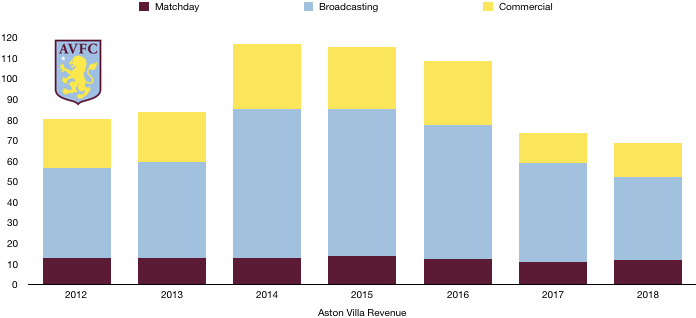

Aston Villa saw a fall in revenue despite improved performances in the Championship this season. Revenue decreased from £73.8m to £68.6m (7%).

Matchday revenue increased from £10.7m to £11.8m (10%) despite revenue being relatively stable, increasing slightly from 32,018 to 32,095, signalling higher prices or a change in the mix of season tickets and matchday sales. The play-off matches also would have significantly boosted matchday revenue.

Broadcasting revenue fell from £48.1m to £40.3m (16%) as despite finishing 9 places higher last season, the fall in parachute payments majorly overrode this increase. This will only fall further next year, making a return to the Premier League of the upmost importance.

Commercial revenue increased from £15.0m to £16.5m (10%) signalling a good year for Aston Villa considering they remain in the Championship; however, they are still a long way off the £30m+ they used to attract while in the Premier League.

Looking ahead, Aston Villa are likely to see a further drop in revenue following a difficult season where the Play-offs is looking more and more like an unlikely possibility. Even with a play-off appearance, revenue is likely to fall on the back of parachute payments declining again. Aston Villa will be hoping to sneak into the play-offs and also that their commercial department can make up any shortfall in revenue as they look to attract more lucrative sponsors comparable to their Premier League days of around £30m.

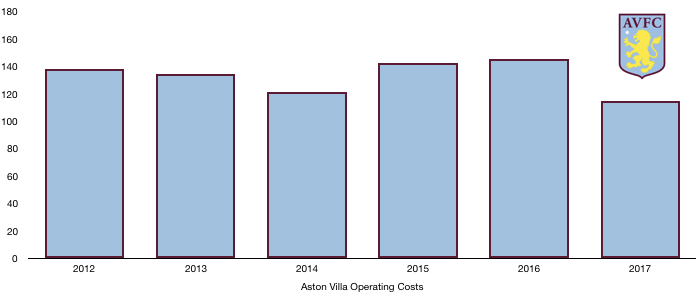

Costs Analysis

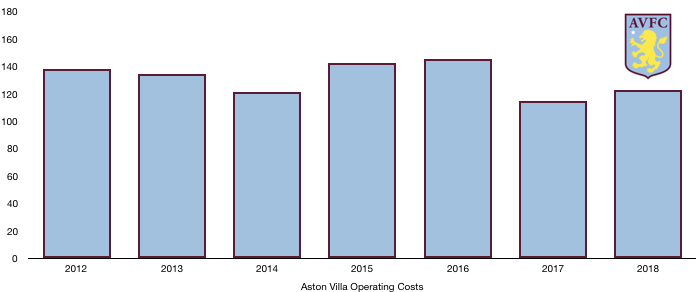

Aston Villa saw their already substantial costs rise further, increasing from £114.9m to £122.6m (7%). This fall is largely at the same rate as revenue, meaning that profitability has largely remained unaffected.

Amortisation remained relatively stable at £23.8m (2017: £23.7m) as transfer spending slowed considerably on the back of their financial instability.

On a positive note, Aston Villa invested £10.7m, nearly double the already sizeable amount of £5.9m (81%), showing that hopefully their future will be bright.

Net interest costs rose significantly from £0.1m to £0.9m as the club had interest charges on their bank overdraft and other short-term loans needed to save their financial future over the summer prior to the investment received.

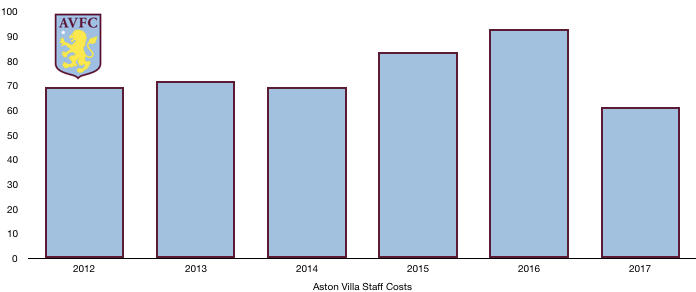

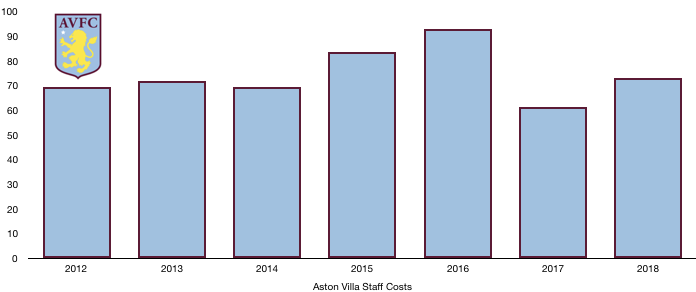

Aston Villa have failed to control their wages and costs since relegation in the hope an immediate return would mean they wouldn’t have to worry about it. This Premier League return has failed to materialise so far, and wages are still rising, increasing from £61.5m to £73.1m (19%).

Aston Villa’s wages alone are greater than their revenue meaning they’re already at a loss before other expenses are taken into account. Therefore, Aston Villa can only be profitable currently by selling players which is far from sustainable.

The wage rise this year works out a large £223k, an additional amount that Aston Villa cannot really afford at the moment.

Maybe rightfully so, but interesting nonetheless, Aston Villa claim no directors received a salary in 2018 as the club underwent a restructuring among key management, which is defined by Aston Villa themselves. Therefore, it is entirely possible that they have paid their key directors but have decided they aren’t ‘key management’ so have not disclosed this amount.

Looking ahead it does not look likely that Aston Villa will reduce their costs despite the need to next year. New signings were made last year and although there were outgoings, the wage structure is unlikely to have fallen (nor will amortisation). This means that further investment will be needed by their owners to keep Aston Villa afloat.

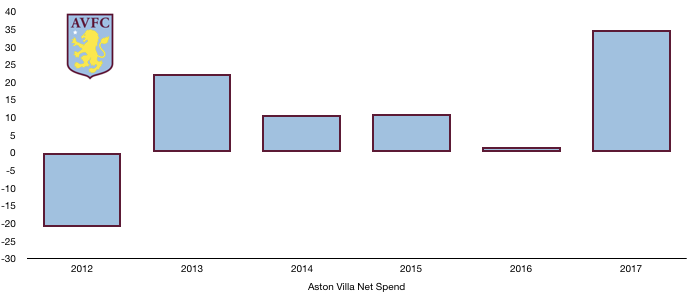

Transfers Analysis

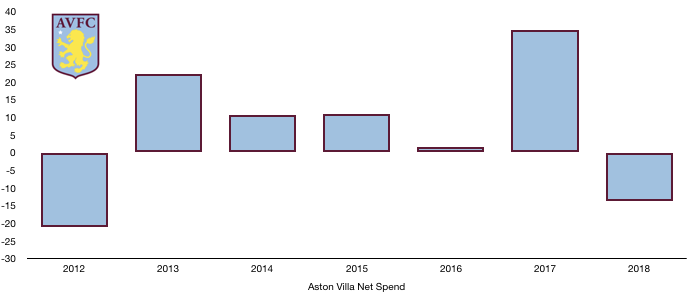

It was a quiet transfer window by Aston Villa’s standards.

Entering Villa Park were Whelan (£1.5m) and Elmohamady (£1.0m) for a combined £2.5m.

There were a few more departures as the following left Villa Park: Veretout (£6.3m), Baker (£3.9m), Sanchez (£2.7m), Amavi (Loan: £1.8m) and Bacuna (£1.4m) for a combined £16.1m.

This led to a negative net spend of £13.6m, a far cry from the net spend of £34.8m last season.

The signings were helpful to their promotion charge as their familiarity with Steve Bruce’s tactics was vital to their chances. The departures were mostly high earners and were not missed it would seem during their season.

The sale of those players helped Aston Villa record a profit on player sales of £15.9m which was still nowhere near enough to dent Aston Villa’s significant loss last year.

Aston Villa were still paying significant amounts of cash on previous transfers as cash of £41.1m was paid despite only signing £2.5m worth of players last year. Aston Villa did at least also receive £37.1m in cash from other clubs.

Aston Villa are also owed a further £18.1m in transfer fees from other clubs. However, Aston Villa owe £27.3m in transfer fees, of which £20.5m is due this year. This net burden of £9.2m is far from insignificant and will impact any spending by Aston Villa going forward.

Aston Villa could also potentially owe a further £2.0m in transfer fees should certain clauses be met by players.

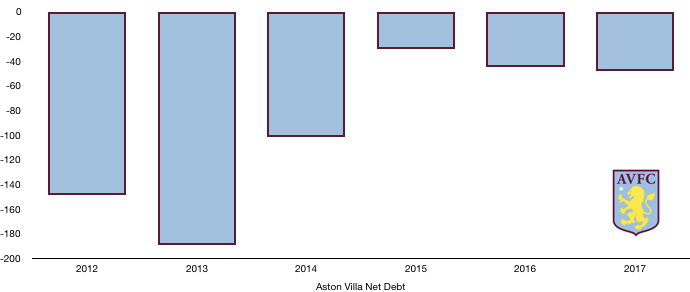

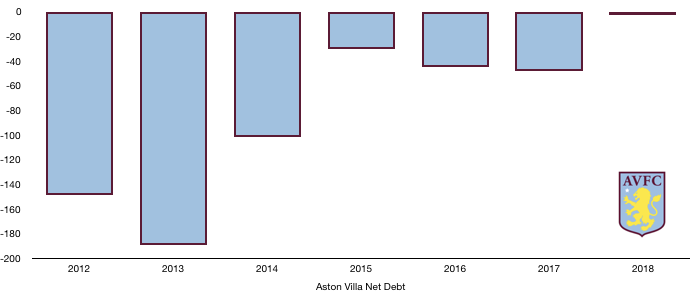

Debt Analysis

Under their new owners, Aston Villa have seen a huge change in their debt profile.

Aston Villa saw cash levels more than double from £1.6m to £3.4m (113%) as the previous owners invested a net £21.5m in the club to help the clubs’ cash levels after the huge loss experienced and transfer fees due.

Debt fell from £50.1m to £6.0m as Aston Villa’s previous owners were repaid their owner loans of £48m and this was replaced with equity funding of £69.5m meaning the club now only have £6m in external debt as the owner changed the debt profile of the club, probably due in part to Financial Fair Play pressures and the sale of the club in June.

It remains to be seen whether the debt within the group will rise under new ownership or if it will similarly be investment by equity funding – meaning the new owners could only be repaid by a sale of the club and not the repayment of debt.

Net debt hence fell from £48.5m to £2.6m (95%).

Aston Villa interestingly are being sued by a former employee for unfair dismissal which may affect their finances further, no amount has been disclosed at the potential size of this lawsuit.

Aston Villa will now worry about Financial Fair Play which they will struggle to comply with this year and going forward unless promotion is secured or costs are significantly cut. Any Financial Fair Play sanctions will mainly hurt the owner, however due to the instability of the club, they will be hoping any threats of sanctions does not make their new owners get cold feet about the club as this could threaten Aston Villa’s long-term future.

Thanks for reading – Share with an Aston Villa fan!