Swansea earned yet another season in the Premier League having battled with relegation for much of the season, their sixth consecutive season in England’s top flight.

The season was not without its troubles, twice having to change manager to secure the Premier League survival that is so important to the club’s financial stability and future.

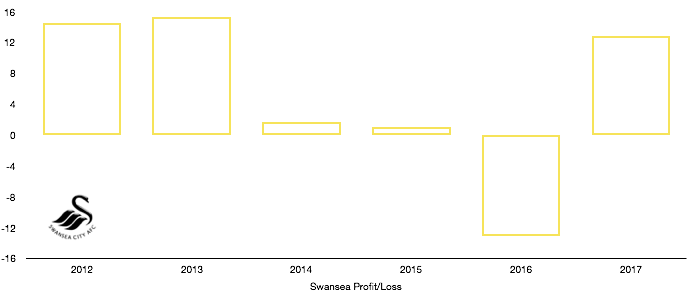

Having secured survival they can look with delight at their finances, returning to profit with a huge £25m swing from a loss of £13m to profit of £12m on the back of significant profit on player sales. With Premier League survival secured, the club have even agreed to take ownership of their Stadium, the Liberty Stadium from the Swansea City council for £300k a year after lengthy discussions, a move that brings Swansea much more power over how to best shape the fan experience and increase revenue, including the potential to sell naming rights.

Lets delve into the numbers.

Revenue Analysis

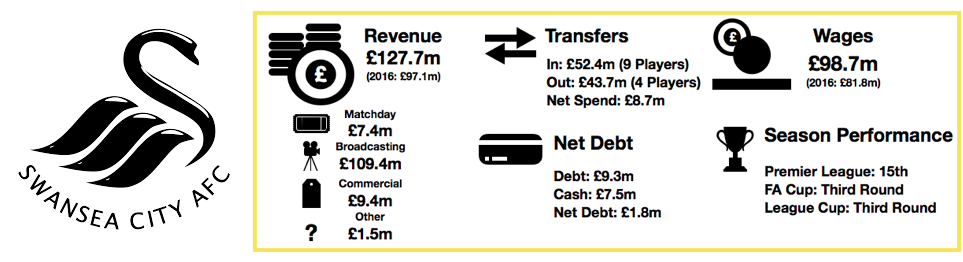

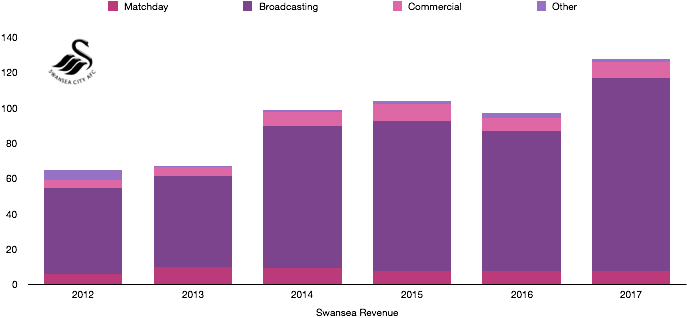

Revenue increased significantly, rising from £97.1m to £127.7m (23.5%), driven mainly by the increased Premier League TV deal this season, a common theme among all Premier League clubs.

Matchday revenue remained fairly stagnant, falling slightly by £100k to £7.4m, a 1.3% drop. This was due in part to the introduction of an away game ticketing pricing cap, whereby all Premier League clubs can charge a maximum ticket prices to fans of £30 on away days. Matchday revenue has stayed in the £7.5m range for the past 3 seasons after experiencing a significant drop from their early Premier League years under Brendan Rodgers, when revenue was around £9.5m, signalling less optimism by the club since his departure to Liverpool.

Commercial revenue rose significantly from £7.4m to £9.4m after a succession of new sponsorship deals. The club agreed a couple major new sponsorship deals, first a new kit manufacturer in Joma, replacing household name Adidas, Joma are paying a higher price as they look to build a presence in the Premier League. The club also agreed a main shirt sponsorship deal with betting company BetEast, this only lasted a year, being replaced by Letou for the upcoming season which is sure to boost revenues once again.

Broadcasting revenue grew from £79.3m to £109.4m due to the increased size of the Premier League TV deal, this is despite Swansea finishing 3 places lower in the Premier League than last season.

Other revenue dropped by half to £1.5m on the back of lower loan fees and other such payments.

Revenue should stay around the same level as last year, with the big caveat of Premier League survival, something that looked precarious not too long ago. However once again a huge upturn in form has come about on the appointment of a new manager in Carlos Carvahal who has led the Welsh club to having a good chance of survival.

Another good commercial campaign, and the possibility of a stadium naming right sale, may lead to 3rd consecutive season of revenue growth.

Expense Analysis

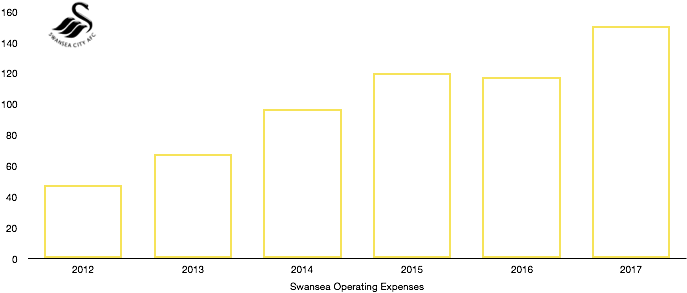

Operating expense showed a large increase, moving from £117.6m to £150.8m (28.2%), driven mainly by increases in amortisation costs and wages.

Amortisation costs rose from £17.3m to £24.2m (40%) after significant investment in the playing squad, with 9 incoming signings and 4 outgoing.

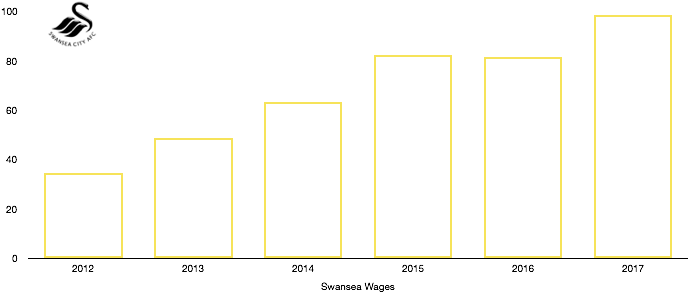

Wages rose significantly too, increasing from £81.8m to £98.7m (20.7%) with new contracts for key players and also the wages of all their new signings. The rise in wages equals a respectable £325k a week in wages by the club.

Net interest costs rose by two-thirds to £500k, a minimal costs to Swansea. The rise is on the back of new loans to the tune of £9m as the club look to continually expand.

The club also paid £365k in taxes to the Government, an effective tax rate of only 2.8% having utilised the losses in the club in previous years, including as recent as last year’s £13m loss.

Transfers Analysis

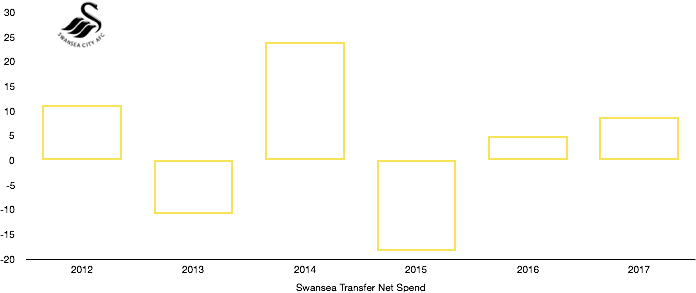

There were significant ins and out of Swansea with a then record signing in Borja Baston (£16.2m) being the highlight incoming signing, while two key players in Andre Ayew (£21.7m) and club captain Ashley Williams (£12.6m) both departed to Premier League rivals.

Swansea signed Baston (£16.2m), Mawson (£5.3m), Llorente (£5.3m), Jordan Ayew (£5.3m), Fer (£5m), Carroll (£4.7m), Olsson (£4.1m), Narsingh (£4.1m) and Van Der Hoorn (£2.3m) for a combined outlay of £52.4m, an average of just £5.8m a player.

Leaving the club were only 4 players in Andre Ayew (£21.7m), Williams (£12.6m), Paloschi (£5.4m) and Euro 2016 winner Eder (£4.1m) for a combined £43.7m, an average of £10.9m a player.

This left the club with a net spend of just £8.7m, making Premier League survival a great achievement.

Outside of the club record signing, the new signings could be marked a success, coming into their own towards the end of the season after an adjustment period with Mawson, Ayew and Llorente particularly impressing, with the latter sealing a big money move to Tottenham on the back of his Swansea exploits.

Transfers played a huge role in Swansea returning to profit, with the sales of Williams, Ayew, Paloschi and Eder bringing in £36.9m in profit compared to just £6.1m last year, a 505% increase! This profit increase of £30.8m eclipses the profit increase of £25m made. This means that without these transfers, Swansea were staring at a loss albeit a smaller one than the previous season, which is still an improvement.

Asset/Liability analysis

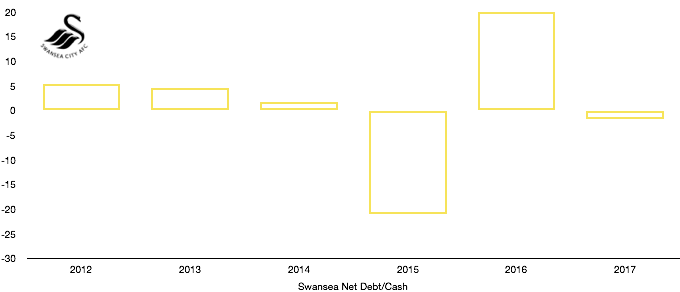

Net debt rose significantly in the year, from a net cash position of £19.9m to a net debt position of £1.8m, a 109% change. This was due to significant changes in both Swansea’s debt and cash levels.

Debt rose from a measly £0.3m to a much larger £9.3m on the back of new loans taken out in order to improve the squad, the new loans harbour an interest rate of 3.5%.

Cash levels dropped as the club used more than half of their £20.2m in order to improve facilities and the playing staff, ending with a cash balance of £7.5m, a 62.9% fall.

A large reason for this was a large cash outlay on players of £54.6m, with only £25.4m coming back into the club’s coffers during the year, with the rest of the transfer fees owed due in later periods.

Swansea have continued to invest in the club, committing £935k to improving facilities by purchasing new fixed assets.

On the transfer front, the club have potential liabilities of £11.2m should certain transfer clauses happen that have been agreed, rising from £6.7m last year on the back of new transfers, a 67.2% increase.

On a better note, loyalty bonuses owed to players, should they stay at the club for an agreed amount of time or due to other clauses, has fallen 52.8% to £11.6m from £24.6m on the back of Andre Ayew and Ashley Williams’ exits.

I hope you enjoyed the article – Share with a Swansea fan !