QPR suffered their third consecutive season in the Championship following relegation from the Premier League. It was another disappointing season in the Championship after finishing 16thas the club’s performances and finances continue to deteriorate after years of financial mismanagement.

This came to head in the form of a huge fine for the club from the EFL for Financial Fair Play (FFP) transgressions which has severely impacted their finances. QPR recorded a loss of £37.5m, and interestingly, for the records for the past 20 years we could obtain, shows the club have never posted a profit which shows their history for poor financial performance and management.

Let’s delve into the numbers.

Revenue Analysis

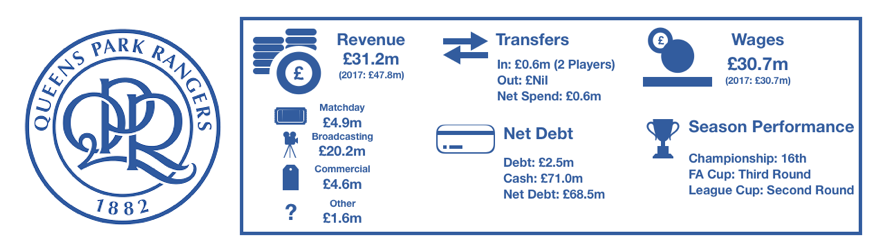

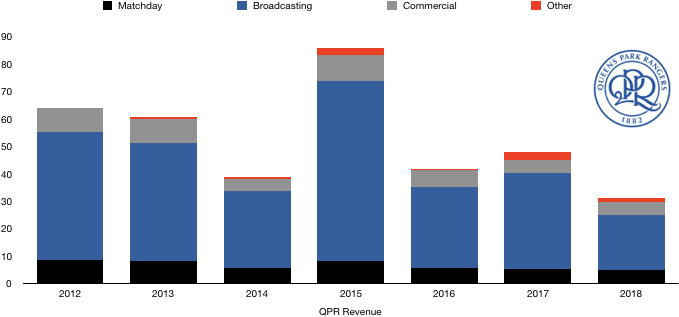

Revenue sank yet again, dropping from £47.6m to £31.5m (35%) as the club continued to languish in the Championship.

Matchday revenue fell only slightly, falling from £5.2m to £4.9m (6%) as the general dissatisfaction by fans reduced spending at matches and attendance as a whole.

Broadcasting revenue dropped significantly from £35.2m to £20.2m (43%) as a third year in a row in the Championship meant a further fall in parachute payments for QPR which could not be offset by a 2-place improvement in the league.

Commercial revenue was stable at £4.6m and it seems there is little hope of this figure increasing any time soon for a club in stand still, showing little to create a buzz for QPR fans or the football fans in general.

Looking ahead, QPR are likely to see revenue drop once more as parachute payments fall for again before they run out completely after next year. The club are likely to see stable matchday revenue and may see a drop in commercial revenue as current sponsorship deals run out and the club will find it difficult to attract new sponsors on lucrative terms.

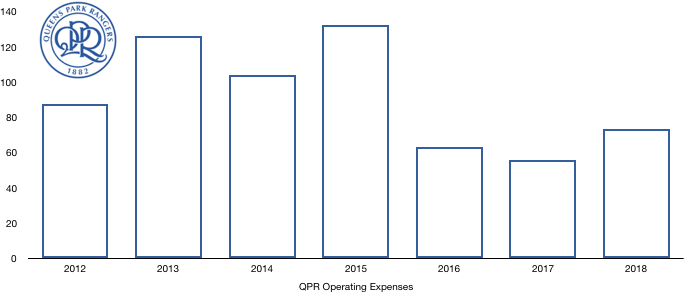

Costs Analysis

QPR saw costs increase at the same time as revenue was falling, reducing profitability considerably. Costs rose from £56.0m to £73.7m, however if their huge fine of £20m (£42m in total – more on this later) is not taken into account, there is a small fall in costs.

Amortisation declined, decreasing from £11.3m to £9.1m (19%) as player investment was virtually non-existent again. QPR’s poor finances has held the club back in recent times and meant the club have been unable to invest into the club and has meant significant under investment after a period of excessive and poorly used investment.

Finances costs fell from £5.7m to a £5.0m finance income due to accounting rules around the FFP fine. In addition to this, the club paid no interest to their owners this year which hasn’t been the case in recent years.

Now to the big one, the FFP fine. The EFL have fined QPR £42m due to breaking FFP rules. This fine consists of:

- A cash fine of £17m

- Legal costs of £3m

- The owners having to capitalise (essentially write-off) £22m of debt the club owe him. This debt was unlikely to be repaid any time soon anyway unless the club was sold for a large sum (which is unlikely in its current state)

- A January 2019 transfer ban

This fine has had a significant effect on QPR and its finances, increasing their losses by £20m, however now that it has been finalised, QPR can move forward and plan for a healthier financial future.

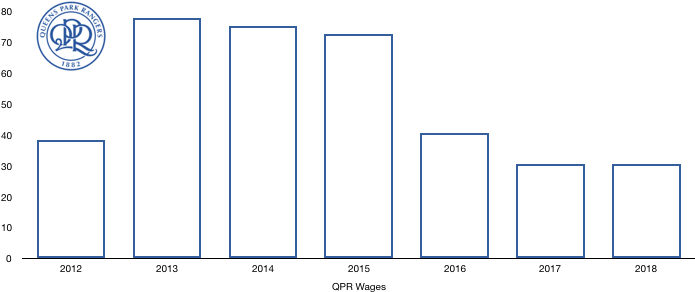

Wages remained stable at £30.7m, falling by a measly £29k due to no major movement in or out of the club. Currently the club is restrained by FFP rules and the EFL from increasing their wages, the fine will however not be taken into account when setting the cap for this year for QPR.

Looking ahead, QPR are likely to see a full in costs, not least due to there being no fine to pay next year. Wages are likely to decline, and a further lack of investment will see amortisation fall also.

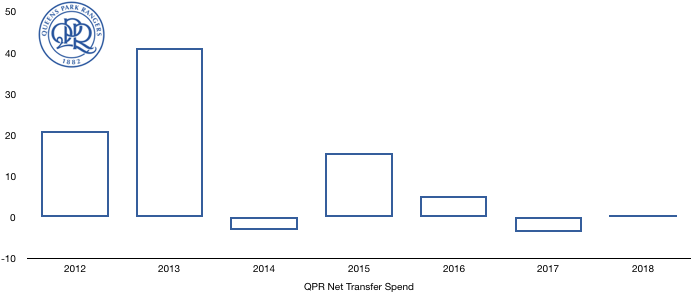

Transfer Analysis

QPR have had little transfer activity due to their current finances. The club saw Wheeler (£0.5m) and Smyth (£0.1m) join for a combine £0.6m. There were no fee-bearing transfers out of the club.

Despite this minimal net spend, there was some significant movement in terms of cash flowing in and out of QPR.

QPR saw a timely cash boost of £7.7m in terms of transfers from previous windows while they also had to spend £4.8m on previous transfers that they most likely regretted.

QPR will also earn a few more pounds as they are owed £1.2m in transfer fees still, of which £923k is due this year. In comparison, they only owe £64k themselves.

Debt Analysis

QPR’s current financial situation is a cause for concern due to the shaky foundation underneath it and their run-ins with the EFL and the FFP rules.

As with most Championship clubs, cash reserves are low. Their cash levels fell from £4.4m to £2.5m (43%) due to the increased loss incurred this. However, this was in part paid for by transfers fees (detailed above) and the owners plunging in a further £10m to steady the ship, they also had to repay £4m of bank loans.

Debt levels increased significantly, rising from £50m to £71m (42%) due to the new loan of £10m from their owners which took the debt owed by QPR to its owners to £56m.

The rest of the debt is the £15m (discounted figure) owed to the EFL for their FFP failures, with £4.7m due this year and the rest at a later date.

Hence, net debt levels rose from £45.6m to £68.5m (50%) as the club’s finances continue to cause worry. QPR will hope that the ending of the FFP saga will enable them to move forward. Of most importance is survival in the next two years as the acclimatise to life without parachute payments and begin to control their finances to a greater degree.

If this balance can be achieved, there is no reason why QPR fans can’t dream of a return to the Premier League in the next 5 years (on more stable footings than the last time).

Thanks for ready – share with a QPR fan!