Mike Ashley’s time at Newcastle has polarized opinion, the businessman has a poor relationship with the Toon army to say the least. Since buying the club for around £136m in 2007, Mike Ashley has invested a further £144m net (which is still owed to him) according to Newcastle’s most recent accounts, meaning a total investment of around £280m.

A rumoured sale is in the works as Mike Ashley looks to part ways with Newcastle to the delight of Newcastle fans. It is quite possible (and fairly likely), that Mike Ashley will make a loss on the sale of Newcastle with many suitors valuing the club at around the £200-£250m mark.

This article analyses the position Mike Ashley leaves the club in and what any potential buyer will be purchasing.

The financial data used is based on Newcastle United’s most recent accounts, being the year ended 30 June 2017 (So the 2016/17 season) for the company named Newcastle Limited. The financial data for other current and former Premier League clubs is based on the 2016/17 season and those clubs most recent financial accounts.

Domestic Performance

Premier League

Newcastle were a mainstay in the Premier League prior to relegation in 2017, even being a European contender as recently as 2012. After 2012, Newcastle continually flirted with relegation and became a bottom-half team with no finishes above 10thin recent times. Relegation was rock bottom for such an illustrious club however an immediate return and a respectable 10thplace finish was achieved in 2018. This year Newcastle are firmly in a relegation battle and a bottom half finish is very likely while relegation is a possibility, it is still unexpected at this stage due to the quality of the manager and a decent playing squad.

FA Cup

Newcastle have won 6 FA Cups, however that is not evident by their recent record in the competition. Newcastle have failed to pass the Fourth round in any of the last 7 years with survival and a higher placing in the Premier League being the main priority, especially in the second half of the season. Any new owner of Newcastle will be hoping with investment, for an improvement in Newcastle’s cup performances which shouldn’t be too difficult given recent efforts.

League Cup

Newcastle have performed better in the League Cup. This is probably due to the timing of the competition being in the first half of the season when Newcastle face less relegation pressure and the players are fresher. Newcastle have reached the Quarter-finals twice in the last 7 years and the Last 16 another two times also. Newcastle will be hoping, with fortunate draws that the club could go even further given Burton’s run to the Semi-finals this year. The League Cup probably represents Newcastle and their potential new owners’ best chance at a trophy in the next few years.

Profitability

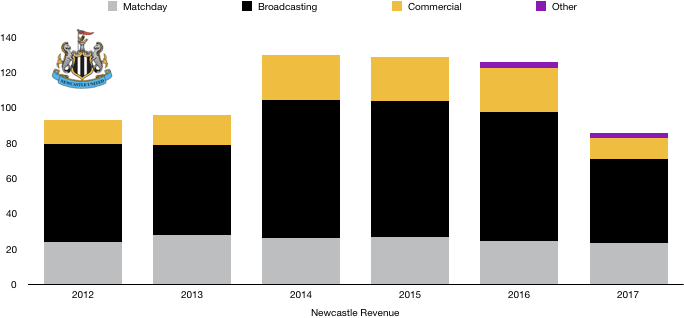

Now onto the finances. Newcastle were profitable in the 5 years up to relegation in 2017, recording on average a profit of £13.4m, before a huge loss of £41.3m in 2017 after relegation, showing the huge costs of suffering relegation.

The largest years of profit for Newcastle were 2014 and 2015 where Newcastle recorded profits of £18.7m and £32.4m respectively. These profits were mainly due to an uplift in Premier League TV Money ahead of the 2013/2014 season where the total TV received by the Premier league increased from £3bn to £5.1bn. This led to a huge increase in revenue for Newcastle and all Premier League clubs while in 2014 Newcastle also negotiated new and improved sponsorship deals with Puma and Wonga.

These revenue increases were supplemented with income from profits on players sales of £14m and £17m respectively.

These profit levels were wiped out by 2016 as costs grew to match the rising revenues.

In 2017, following relegation costs continued to rise due to increasing wages and a promotion bonus following promotion led to costs rising nearly £40m, while revenue fell by £40m (32%) leading to a huge loss in 2017.

Another relegation is likely to have a similar impact on profits, revenue and costs and is why many potential suitors are worried of such a fate and have priced this into their valuation of the club which is why the club is being priced fairly low.

Revenue

Revenue increased year on year up to 2014 before stabilising once the record-breaking TV deal was in effect. As mentioned above, revenue fell a third following relegation however an instant return means that Newcastle’s revenue will recover to 2016 levels and is likely to surpass this even due to a more rewarding distribution system.

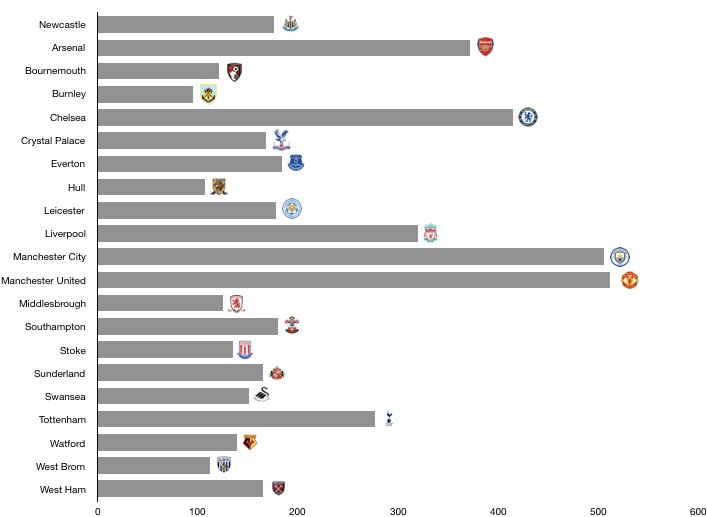

The new owners will be taking over a club with robust revenue. The fall in revenue by Newcastle following relegation still meant they had the most revenue in the Championship by a distance. Last year’s commercial revenue of £12.1m would put them 13thplace in that regard in the Premier League, more than the likes of Crystal Palace, Southampton and Burnley.

Matchday revenue of £23.4m is even more impressive, placing them 8thamong teams competing in the Premier League due to their stadium size and fan support (despite their current discontent), placing them above all teams except the usual ‘Top 6’ and West Ham.

Both matchday revenue has remained stable despite relegation, falling by only £1m following the event. Commercial revenue on the other hand halved following relegation meaning there is plenty of scope for this to increase following promotion something any new owner will see as a clear opportunity to add value to the club.

Costs

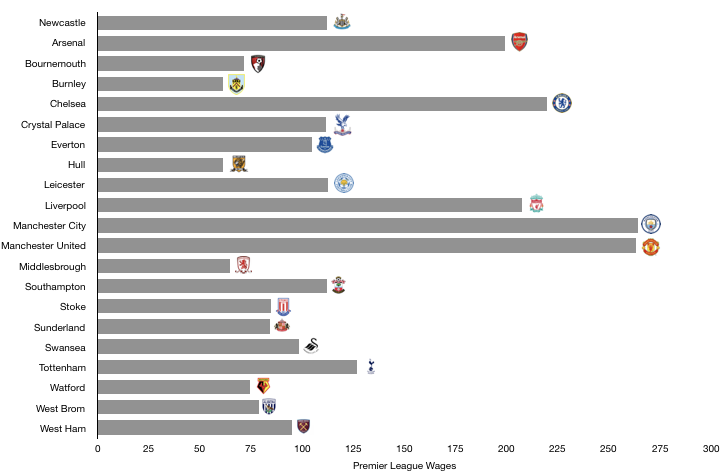

Newcastle have seen their costs balloon as of late to £177m, enough to put them 10thcompared to 2016/17 Premier League clubs despite Newcastle being in the Championship, it is worth noting that £10m of this relates to promotion bonuses (if these are excluded Newcastle drop to 12th).

These costs are made predominately of wages for which Newcastle spent £112m, the 9thhighest in England despite being in the Championship. Such a large wage base is concerning however due to some recent departures it can be assumed this is likely to be falling in 2018. This will still concern any potential new owner; however, it does bring the opportunity to unload players and replace using the excess wage budget without too much investment being need (potentially).

As seen, relegation immediately crashes revenue, however costs tend not to fall so easily or quickly. Players have contracts, and some have managed to negotiate deals without relegation wage drop clauses. Such events mean that profitability is severely affected as costs remain high or increase, relative to revenue.

The Playing Squad

Newcastle are famed for the quality players they have had over the years. The likes of Shearer have graced St James Park, however in recent years the star players have not been joining or staying at Newcastle due to a fall in status and poor recruitment.

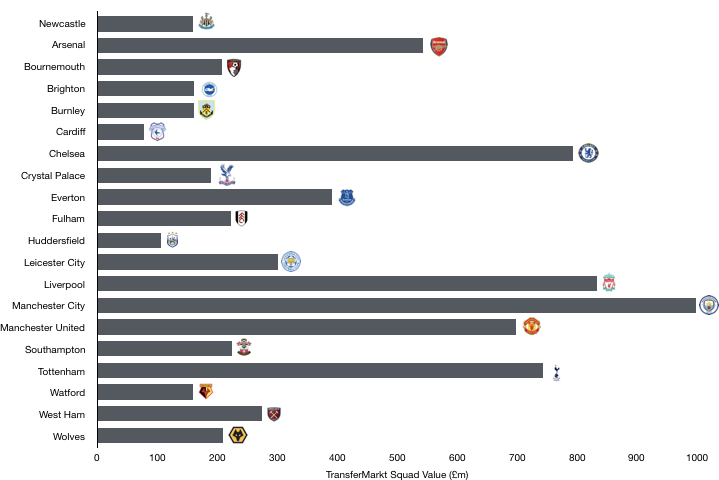

According to Transfermarkt.com, Newcastle’s squad is worth only £159m, the 18thlowest in the Premier League in 2018/19, with Lascalles, Shelvey and Rondon (on loan) being the most valuable at £13.5m each.

Outside of this there are very few players that have been good enough aside from the above and Dubravka.

Any potential owner will have a job on their hand to improve the playing squad and significant investment is likely to be required after acquisition, which further explains the pricing as the new owner will have to set aside additional cash to inject into the club for transfers.

Key to the playing squad as it currently is staving off relegation is the quality of Newcastle’s manager, Benitez. The Spaniard is working on a shoestring budget and still getting some good performance out of the players despite the lack of quality in many areas. The owner will have to convince him to stay in the summer to spearhead a revival. This shouldn’t be too hard given he has stayed throughout the tribulations of Mike Ashley’s reign so we would expect him to continue on under new management.

Transfers

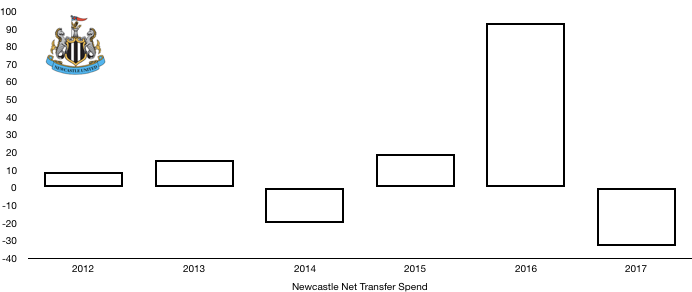

Newcastle have seen an inconsistent spending pattern of late with a worrying downward trend in recent times. Either side of a huge net spend of £93.2m in 2016 (prior to the arrival of Benitez), Mike Ashley has been stingy with Newcastle’s cash spending less than £20m net in any of the last 6 years and recording a transfer profit in 2 of them. In 2017, Newcastle recorded a net profit of £33m despite the club being in desperate need of investment. Any new owner will risk the wrath of the Newcastle fans if they follow a similar path.

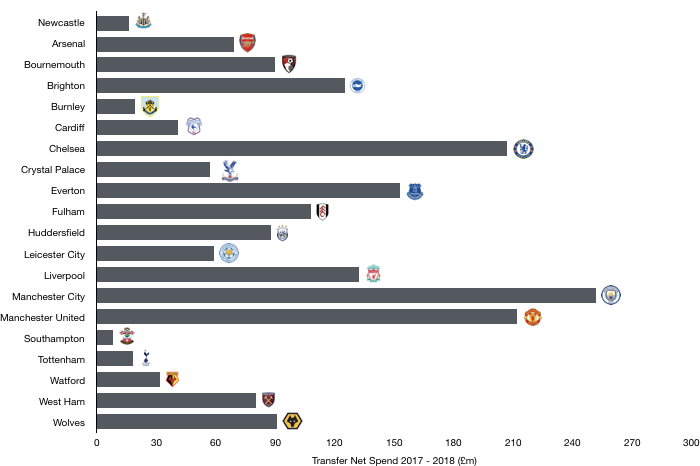

From 2017 to the end of 2018, Newcastle are right near the bottom in terms of net spends, spending a mere £16m way below the average net spend (excluding the top 6) of £69m. This is a recipe for disaster as despite having a world class coach, the club continually slip towards the relegation zone as the lack of investment starts to show.

It will be difficult for the new owner to make up for lost time however a much bigger investment of £50m+ will most likely be immediately required to bolster the squad and its value.

Debt

Newcastle’s debt levels had been slowly fallen since 2013 until relegation meant a large increase in debt as Mike Ashley began loaning more money to Newcastle in a bid to firstly avoid relegation with £47m loaned in 2016 and a further £17m following relegation.

In total, Mike Ashley has invested roughly £144m net in the club. This amount will most likely be incorporated into the purchase price of Newcastle and either paid to Mike Ashley as part of this or taken over by the new owner and written off; in both cases Newcastle will no longer have this debt in their finances.

Above the loans owed to Mike Ashley, £xm is owed to banks in the form of loans and overdrafts, the amount is fairly minimal so isn’t something either the club nor a new owner should worry about.

Thanks for reading, share with a Newcastle fan!