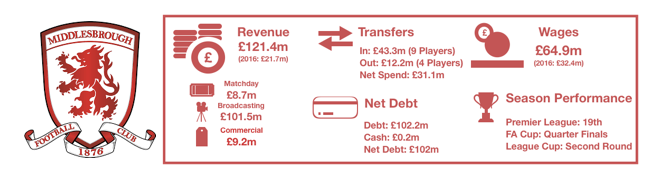

Middlesbrough were playing in their first Premier League campaign since 2009 with their fans excited to be back after such a long hiatus. Their return ended in disappointment, immediately dropping back down to the Championship after struggling for goals throughout the season, ultimately leading to the sacking of their manager Aitor Karanka.

Middlesbrough did however excite their fans with a lengthy run to the FA Cup Quarter Finals however Premier League survival was the only goal that mattered due to the riches on offer.

In their brief return, Middlesbrough did return to profitability for the first time interestingly since their last Premier League campaign, recording a healthy profit of £11.5m after losing £25.9m in their promotion winning season.

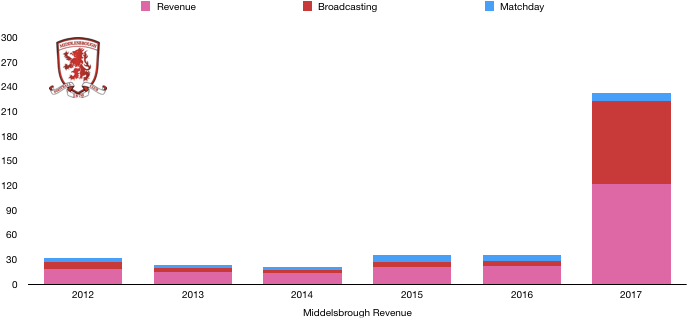

Revenue Analysis

Middlesbrough will be counting the costs of relegation after seeing their revenue boom on their Premier League return, increasing 5-fold from £21.7m to an astonishing £121.4m (459%).

Broadcasting revenue was the principal reason for the insane rise in revenue, increasing from £6.4m to £101.5m, an incredible 1,486% increase in broadcasting revenue. Middlesbrough benefitted from a timely return to the Premier League with the new Premier League TV deal now in effect, showing the huge financial treasures available to Premier League clubs even in a poor campaign.

Matchday revenue also rose despite a disappointing season with fans flocking to see their promotion winners in the Premier League for what may be their only season back for awhile if their previous relegation is anything to go by. Middlesbrough also benefitted from their FA Cup run which will have provided extra matchday revenue.

Commercial revenue also increased as Middlesbrough exploited their short lived Premier League status to secure new sponsorship deals. Commercial revenue rose from £8.0m to £11.2m (40%).

Middlesbrough will be hoping their sponsors stick with them despite their relegation.

Middlesbrough are undoubtedly going to see revenue drop off a very steep cliff next season after relegation, with revenue more likely to increase slightly from their previous season of £21.7m, being closer to the £30m mark. Middlesbrough also failed to enjoy any sort of FA Cup run which will compound the drop while matchday and commercial revenue will also suffer from relegation.

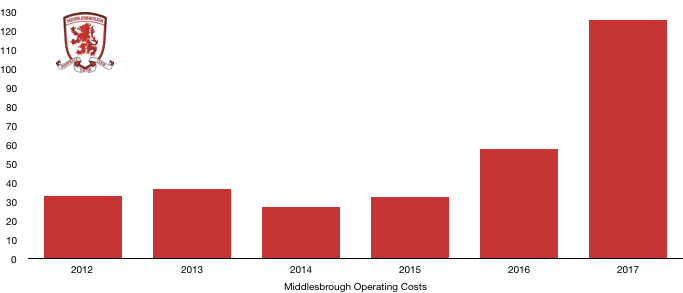

Expense Analysis

Middlesbrough saw expenses more than double from £57.9m to £125.6m (117%) after significant player investment on their return to the Premier League.

Player amortisation costs rose from £13.1m to £28.3m (116%) after all the new additions that

were needed to equip Middlesbrough with a chance of Premier League survival.

Middlesbrough also saw their minimal interest expense balloon from £7k to £293k, which is still a relatively minor expense to the club.

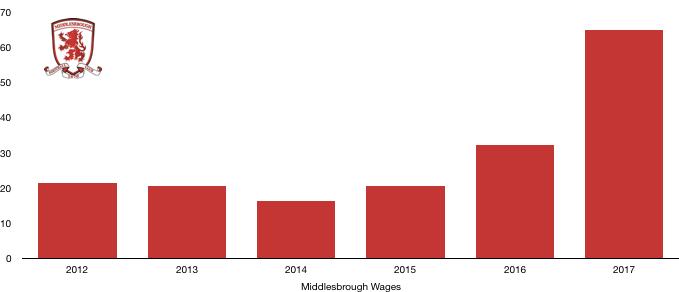

Wages doubled from £37.4m to £64.9m (100%) after additions to the playing squad and wage uplifts for existing players on promotion came into effect.

These extra wages works out at an astronomical extra £625k a week, an amount that was still not enough to save the Teesside club from the jaws of relegation.

The club also paid their directors £1.4m through another company that also manages two other non-footballing companies so the figure is probably a bit lower for the football related payments.

The highest paid director was paid £654k.

The club also received £4.6m in tax relief due to the losses they had incurred during their Premier League-less seasons, this was down from £6.1m last year.

Middlesbrough will be hoping to see some drop-in wages as relegation wage drop clauses come into effect, however the club spent heavily in the summer hoping to achieve an immediate return to the Premier League which may see wages fall only slightly.

Transfers Analysis

No one can accuse Middlesbrough of not trying in their battle for Premier League survival with the club spending heavily on players that were ultimately not good enough.

In came De Roon (£9.5m), Traore (£7.4m), Gestede (£6.4m), Bamford (£6.2m). Guedioura (£4.7m), Fischer (£4.6m), Barragan (£2.4m), Fabio (£2.1m) and Soisalo (£0.2m), all joining for a combined fee of £43.3m.

Out went Reach (£5.3m), Adomah (£3.2m), Nugent (£2.6m) and Nsue (£1.1m) for a combined fee of £12.2m.

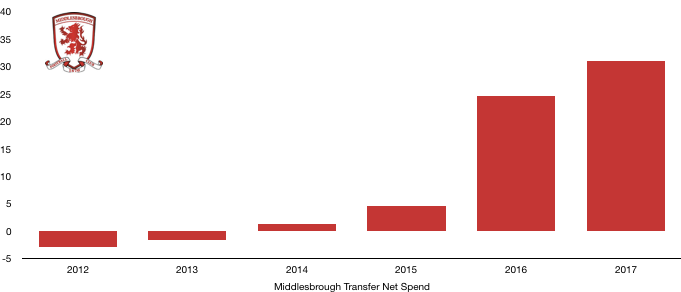

This led to a net spend of £31.1m, up 26.4% from last season’s £24.6m spend that was required to gain promotion in the first place.

Middlesbrough showed ambition on their Premier League return and continued their year on year net spend growth however the tactic of quantity did not bring the necessary quality with a huge 9 players joining for transfer fees.

The club did see a decrease in their profit on player sales, with the total falling from £17.4m to £15.2m (12.6%).

Middlesbrough also have contingent transfer fees payable of £11m while they also must pay transfer fees of £11.9m with respect to current signings with £0.8m due in the year.

Asset/Liability Analysis

Middlesbrough are a debt heavy team, holding little cash usually while debt continues to increase at a small but steady rate.

Cash levels fell from £1.0m to a measly £0.2m (80%) on their Premier League return as they looked to maximise the use of all their cash to achieve Premier League survival.

Debt levels once again rose, increasing from £98.6m to £102.2m (3.7%) on the back of further investment from their ambitious owners.

However, these increasing debt levels may make their owners increasingly wary in future, even if this does not seem the case in 2018 after significant player investment once again as the club continue to experience year on year rises in debt.

This led to net debt rising from £97.6m to £102.0m, a modest 4.5% increase.

Thanks for reading – Share with Middlesbrough fan!