After significant investment, West Ham had a steady 2018/19 season, finishing 10th in the Premier League. The introduction of Manuel Pellegrini and some significant signings saw renewed optimism at West Ham.

However, it was another disappointing season in the domestic cups, exiting both competitions in the Fourth Round.

Despite a slight improvement in performances on the pitch, performance of it deteriorated with a profit of £17m turning into a loss of £27m, a huge swing in finances following significant investment into the playing squad.

Let’s delve into the numbers.

Revenue Analysis

West Ham’s improved performances on the pitch in the league contributed to a rise in revenue from £175m to £191m (9%).

Matchday revenue

Matchday revenue rose from £25m to £27m (8%) as the club saw average league attendance rise from 56,923 to 58,325 (2%) after the club won a legal dispute allowing them to sale tickets in all 60,000 seats in the stadium, after the presence of a slight restriction previously.

With the club already close to capacity, any additional matchday can only come from increased home games, or via ticket price rises, with the latter not really an option given current fan sentiment for their owners.

Therefore, matchday revenue is likely to remain at a similar level to its current levels.

Broadcast revenue

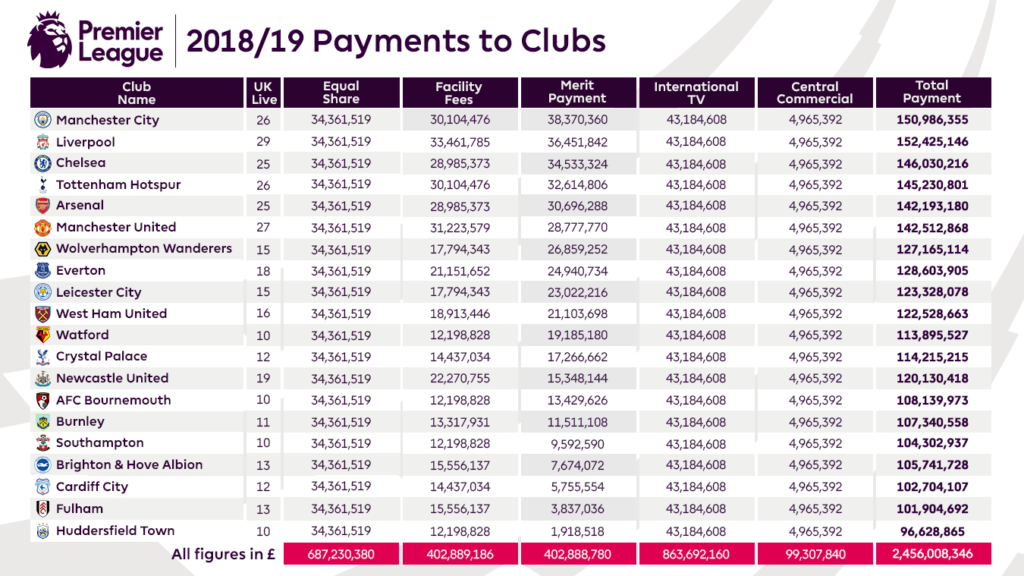

West Ham saw broadcast revenue increase from £119m to £127m (7%), after finishing three places higher in the Premier League than the prior season.

West Ham’s Premier League prize money increased from £116m to £123m (6%), accounting for almost the entire gain in broadcast revenue, with the remainder from an increased FA Cup prize money fund.

Commercial revenue

Commercial revenue increased from £32m to £36m (13%) after the club extended its Betway deal on more favourable terms and signed a sleeve sponsorship deal with Basset&Gold.

West Ham continue to attempt to increase commercial revenue, looking to build out their corporate hospitality offerings at the London Stadium and also attract new lucrative corporate partnerships.

West Ham are likely to see a continuing positive trend in commercial revenue as long as the club remain in the Premier League.

What does the future hold?

Looking ahead, West Ham are likely to see revenue remain at similar levels to this year with the club likely to stay between the £185-£195m bracket depending on their final Premier League position.

Cost Analysis

West Ham saw their operating costs rise from £184m to £229m (24%). This large increase owed to significant investment into the playing squad and the management staff and was the reason for the large loss incurred in 2019.

Amortisation

West Ham saw amortisation charges rise from £41m to £57m (39%) signifying significant player investment after the club spent the most they have ever done so in a single season at that point.

With West Ham once again spending significantly this season, West Ham are likely to see amortisation rise.

Stadium lease

West Ham saw a slight increase in their lease costs of the stadium and other infrastructure, rising from £2.9m to £3.1m (7%).

Net interest expense

West Ham’s net interest expenses rose from £3.7m to £4.2m (14%) after an increase in secured loans (see debt analysis) and their associated costs.

Wages

West Ham saw wages rise significantly from £107m to £136m (27%) after significant player investment.

The high profile signings of Felipe Andersen, Yarmelenko and Wilshere among others on considerable wages.

These players contributed to West Ham adding over half a million (£562k) a week on their wage bill, a huge sum for a mid table Premier League side, showing their aspirations to challenge in the top half.

The highest paid director saw their wages rise from £898k to £1,136k (27%).

What does the future hold?

After another couple of transfer windows of huge activity in the 2019/20 season, West Ham are likely to see another substantial rise in their operating costs, with wages and amortisation to increase significantly.

With revenue unlikely to rise significantly, this will only lead to West Ham recording larger losses next year. However, losses next will be in part offset by the sales of Arnautovic as well as the sale of a few fringe players.

Transfer Analysis

It was a busy season for West Ham in a transfer window, recording their highest transfer spend in history (exceeded in 2020) at the time.

In came Felipe Andersen (£28m), Diop (£23m), Yarmelenko (£18m), Fabianski (£7m), Perez (£4m), Balbuena (£4m) and Xande Silva (£1.4m) for a combined £85m.

Departing the Olympic Stadium were Kouyate (£10m), Burke (£1.5m), Quina (£1m), Edmilson Fernandes (£0.8m) and Oxford (£0.5m) for a combined £13m.

This led West Ham to a net transfer spend of £72m.

West Ham’s signings were a mixture of brilliance and frustration, performing well at various points of the season but failing to be consistent. Felipe Andersen and Fabianski were the highlights, while Diop showed huge potential. Yarmelenko found himself injured unfortunately for the majority of the season.

The sales of Kouyate and other fringe players contributed to West Ham recording a profit on player sales of £13m, down from £29m in 2018 and this contributed to the rising losses.

As mentioned in the previous section, the sale of Arnautovic and other fringe players in 2019/20 will help West Ham potentially return to profitability in 2020, subject to the level of rising costs.

Cash

In cash terms, West Ham spent cash of £72m on players and only received cash of £23m, a net cash outlay on transfers of £49m which required additional funding to support.

Debt

In debt terms, West Ham are owed £18m in transfer fees, of which £15m is owed in 2020.

However, West Ham owe a much larger £87m, of which £44m is owed in 2020.

This is a net transfer debt of £69m, of which £29m is owed in 2020. This transfer debt appears not to have altered transfer plans in 2019/20, however if performances on the pitch don’t improve, West Ham’s finances may deteriorate and transfer activity may be constrained.

Debt Analysis

West Ham typically operate with a healthy sum of cash reserves of between £20-30m. In 2019, West Ham saw their cash levels fall from £31m to £13m (138%). This was driven by larger operating losses and increased transfer spending in 2018/19. This was partly offset by net new loans of £13m, which without West Ham would have zero cash reserves.

Debt levels hence rose from £65m to £78m (20%) as West Ham obtained new secured loans (against future Premier League payments) of £13m to help with the running of the club. With West Ham already having a large transfer bill to pay, before even taking into account 2019/20 spending, West Ham are likely to need further funding in 2020.

West Ham have struggled in 2020, costing Manuel Pellegrini his job, being replaced by David Moyes, showing the importance of Premier League survival. However, given the spending levels of the club, it is quite clear that is not the objective.

Going forward, West Ham must improve on the pitch in both the league and cup competitions to ensure their finances do not deteriorate or the club may find themselves in difficulties that could lead to more problems in the future, on and off the pitch.

Thanks for reading – Share with a Hammers fan!