Watford met their target for the 2016/17 season – survival. Despite this, the season will go down as disappointing after yet another year of upheaval for the club in a season that started full of promise.

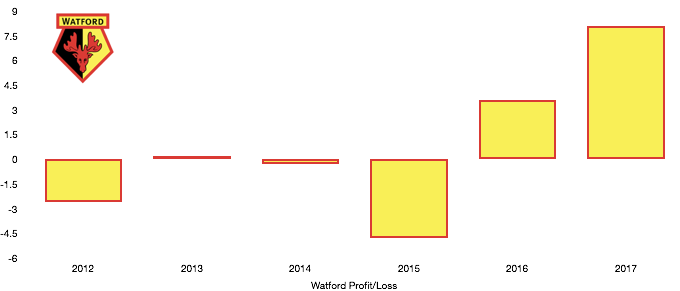

Off the pitch, it was a great season with record profit levels and a second consecutive year of profit. This was helped, as with all clubs by the massive new Premier League TV deal.

Let’s delve into the numbers.

Revenue Analysis

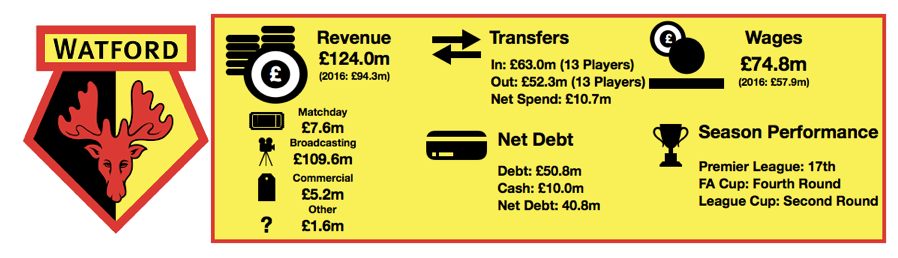

Revenue increased significantly this year, increasing 31.3% to £123.9m from £94.4m.

As mentioned broadcasting revenue was always going to increase due to the new Premier League TV deal and this was the case, rising from £79.6m to £109.6m (37.7%), this increase was dampened slightly by a lower league finish and a poor domestic cup campaign resulting in less TV money in these competitions.

Commercial revenue on the face of things more than doubled, increasing from a low £2.5m to a more respectable £5.2m. However last year’s figure was lower than anticipated due to a payment needing to be made against this revenue due to a clause in their sponsorship agreement of £2m. So comparing to actual revenue, last year’s results were a more modest 28% revenue rise.

Matchday revenue actually fell, declining to £7.6m from £8.4m (9.5%), due to early cup exits and the introduction of the away ticket price cap. Introduced last season, Premier League clubs were capped at a ticket price of £30 for all away games, limiting the revenue available on away match days.

Other revenue compromises of loan fees for players and other income not related to the above three sources. This fell significantly last year, falling from £3.8m to £0.8m (78.9%) as loan fees fell and also the lack of an International tournament. Watford received payments last year for the participation of their players at EURO 2016, which they obviously didn’t receive this year.

There is a good chance of a rise in revenue for Watford in 2018, with the club well placed to improve on last year’s 17th placed finish while they progressed further in the domestic cups. A successful commercial campaign could be the difference to yet another year of financial improvement.

Expense Analysis

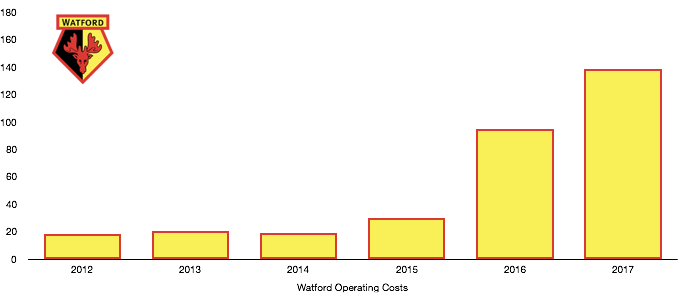

As revenue rosefor Watford, so did expenses, increasing a dizzying 46.3% from £94.9m to £138.8m due to rises in all areas of costs to the club.

Rising the most was amortisation costs, nearly doubling from £15.4m to £28.5m (85.1%) on the back of significant investment in the playing squad as detailed in the next section.

Other operating costs rose also, increasing from £23.9m to £30m (25.5%) due to increases in youth and community expenditure, depreciation costs and stadium maintenance costs as the club continually expand socially and commercially through improvements to the local community and the club’s facilities.

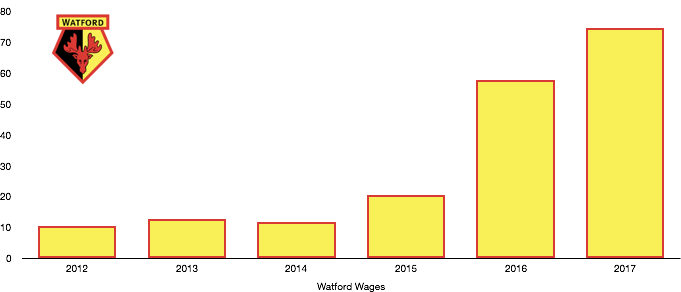

Wages also rose significantly from £57.9m to £74.8m (29.2%) due to player investment as detailed later. This wage increase amounted to an increase of £325,000 a week over the year.

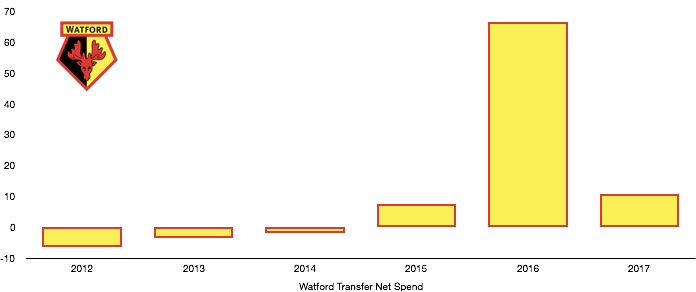

Transfer Analysis

Watford had huge upheaval as usual in their playing squad over the 16/17 season bringing in 13 players and letting go of the same number on either permanent or loan deals.

Incoming were Success (£13.5m), Perrerya (£11.7m), Kums (£8.1m), Janmaat (£8m), Kabasele (£6.3m), Okaka (£6.3m), Kabul (£3.6m), Dja Djedje (£3.2m), Zarate (£2.5m), Niang (£0.7m Loan fee), while Agbo, Mariappa and Sinclair all arrived on free transfers. This cost watford £62.3m in transfer fees working out at a low average of £4.8m per player.

Leaving the club were Ighalo (£21m), Vydra (£8.5m), Layun (£5.4m), Guedioura (£4.7m), Anya (£4.2m), Nyom (£4.2m), Abdi (£3.2m) and Jurado (£1.1m), while various other players left on loan. This brought back into the coffers £52.3m.

This left Watford with a net spend of only £10m which is quite low by Premier League standards.

The players had a mixed degree of success with many only coming into their own this season and commanding a starting position as they acclimatised to the Premier League’s demands.

The club made a huge profit on players disposals this year compared to last year of £22.4m (2016: £5.6m), increasing by 300%!

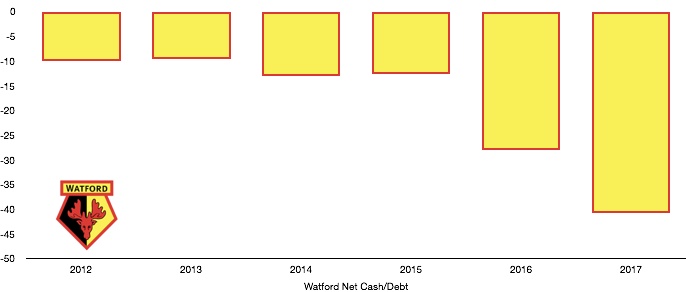

Watford’s net debt levels have risen for the second consecutive year as the owners pump more money into the club to maintain their Premier League status.

Debt levels rose from £28m to £40.8m (45.7%) as the owners pumped an extra £12.2m into the club with the rest of the rise from bank loans.

Cash also fell by 13.8% to £10m after investments into the club outstripped cash income slightly showing ambition to move the club forward.

The club have also seen contingent transfer liabilities rise, with a potential £19.8m payable to clubs if certain agreed clauses are met, a 51.1% increase on last year.

The club looked to repay some debt after the accounts were released with some director loans repaid, which may lead to a much lower debt figure in 2018.

Thanks for reading – Share with a Watford fan !