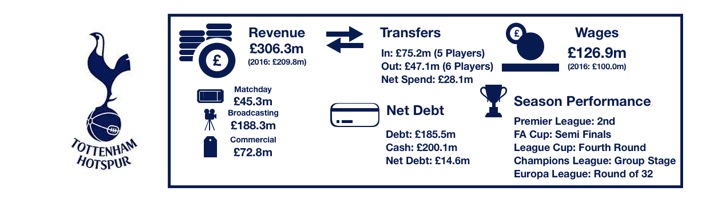

Tottenham enjoyed another fine season of progression, finishing second in the league, finishing above Arsenal for the first time in many years in the progress.

The season was not without its disappointments, crashing out at the group stages of the Champions League after failing to come to grips with playing at Wembley for their ‘home’ games’, while also missing out on FA Cup glory after the anguish of a semi-final exit.

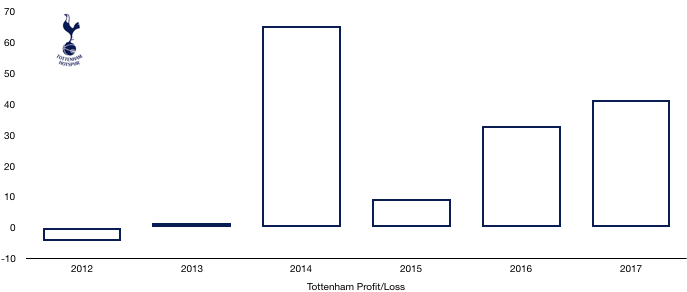

Off the pitch the club continues to impress with growth in key areas leading to an increase in profits from £33.0m to £41.2m (24.8%), netting Chairman Daniel Levy a sizeable increase in his salary.

Revenue Analysis

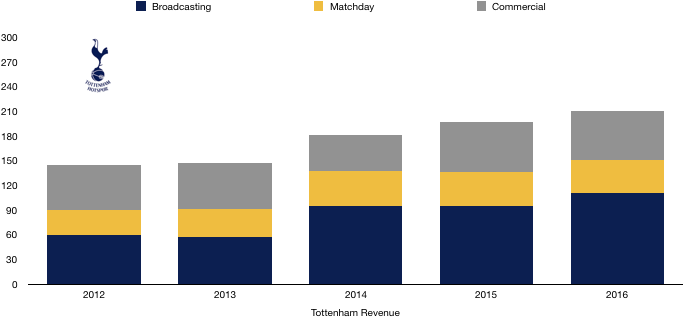

Revenue rose to record levels, breaking the £300m barrier. Revenue increased from £209.8m to £306.3m (31.5%) with revenue increasing in all areas of the club.

Matchday revenue rose from £40.8m to £45.3m (11%) due to the added bonus of playing Champions League games at the 90,000 seater Wembley Stadium, this plus a fine FA Cup run increased matchday takings despite the closure of the North East corner of White Hart Lane, reducing capacity and match earnings for Premier League games.

Broadcasting revenue rose remarkably, increasing from £110.4m to £188.2m (70.5%), with Champions League revenue bringing in £44.6m despite their early exit. This combined with the huge new Premier League TV deal, in a season they finished second, has increased broadcasting revenue considerably. Tottenham also gained £5m in prize money from their domestic cup performances.

Commercial revenue also rose impressively, increasing from £58.6m to £72.8m (24.2%) as the club’s global popularity continues to rise, with sponsorship revenue accounting for £57.4m of this revenue while merchandise sales accounted for £14m.

Tottenham will expect revenue to continue to rise to match the continued improvements shown by their side. Progression slightly further into Champions League will enhance broadcasting revenue, offsetting any loss from a slightly lower finish in the Premier League. Commercial revenue is likely to continue rising as the shrewd Daniel Levy continues to impress with his business acumen.

Also, with the club playing a full season at the 90,000 Wembley Stadium, matchday revenue will rise significantly due to the increased capacity although this rise is likely to be temporary as they will experience a 30,000 drop in seats when they settle at New White Hart Lane next season.

Expenses Analysis

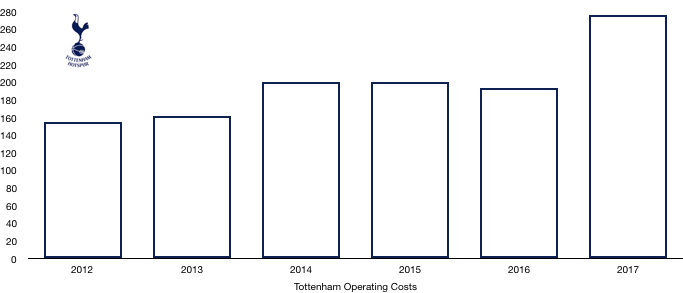

As the club continues to grow, so are their expenses, rising from £194.2m to £276.7m (42.5%) on the back of their player and stadium investments.

Depreciation on their assets rose hugely, increasing from £6.4m to £32.8m, an increase of over 5 folds. This has to do with the accounting treatment around their new stadium build.

Along with this, player amortisation costs also rose significantly from £31.5m to £42.9m (36.2%) on the back of player investment over the year.

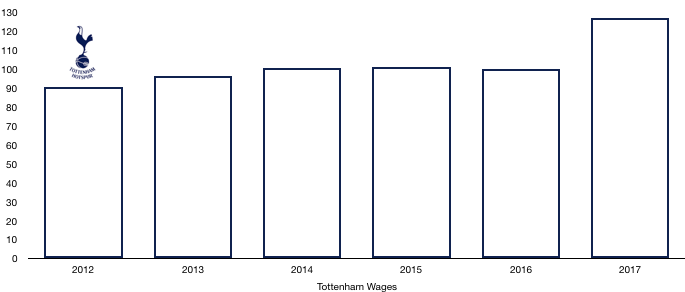

Wages rose considerably too, increasing from £100.0m to £126.9m (26.9%) on the back of player pay rises and new signings. Contributing to this figure was Daniel Levy who has more than doubled his pay from £2.8m to a cool £6m after another stellar year of growth. This won’t however stop players, agents and fans questioning the large rise which works out at £115k a week for a club with tight wage controls.

The increase in wages works out at an eye-watering extra £517k a week.

Finance costs rose significantly on the back of new financing, increasing from £4.2m to £11.7m (179%) which will be a concern if these continue to rise and the club have to tighten their purse strings.

Tottenham had a sizeable tax bill, paying £16.7m in tax working out a high effective tax rate of 28.8% compared to the actual tax rate of 19% – this is due to certain costs (such as the hugely increased deprecation costs) not being deductible for tax purposes.

Transfer Analysis

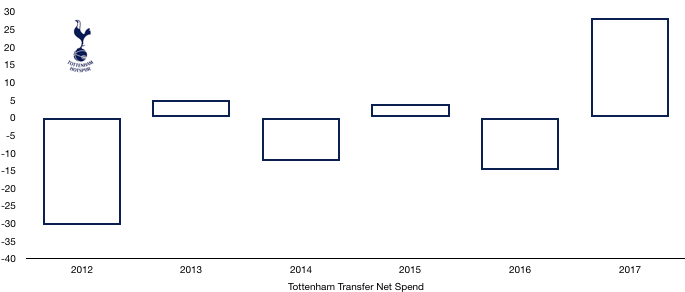

Tottenham had a rather modest transfer spending compared to what their league position suggested.

In came Sissoko (£31.5m), Janssen (£19.9m), Wanyama (£13.0m), N’Koudou (£9.9m) and Lopez on loan (£1m) for a combined £75.2m.

Out went Mason (£13.9m), Chadli (£13.7m), Pritchard (£8.5m), Yedlin (£5.3m), Carroll (£4.7m) and Fazio on loan (£1.1m) for a combined £47.1m.

This worked out at a relatively low net spend of £28.1m compared to net income of £14.9m last season.

Of Tottenham’s signings, only Wanyama impressed with Janssen and Sissoko subject to particular ridicule by rival fans. This failed to derail Tottenham’s domestic campaign with their existing stars pulling the club forward, however the lack of quality depth may have cost the club in the cups.

Tottenham made a profit on player disposals of £40m, up 47.6% on last years total.

Tottenham paid £61.7m in cash for players this season, receiving £67.5m due to previous sales just being paid now.

Assets/Liabilities Analysis

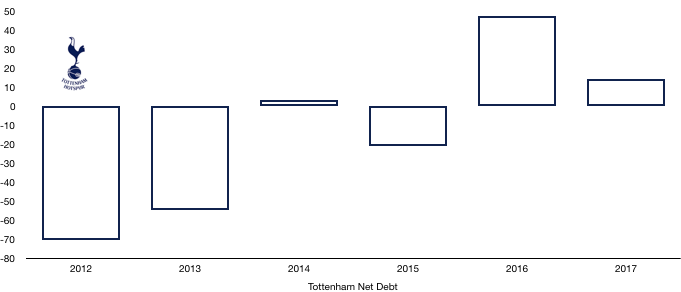

Tottenham are starting to see the effects of financing a new stadium already with their current net cash position diminishing despite cash reserves increased significantly from £172.6m to £200.1m (15.9%). Tottenham’s increased profits helped to boost cash levels whilst significant cash received from transfers as mentioned and new loans of £157.6m (despite repayments of £102.0m). contributed to this figure.

Debt levels rose a great deal also with those new loans that came in, increasing from £125.0m to £185.5m (48.4%) with bank loans making up most of this increase as mentioned above.

This led to their net cash position falling, decreasing from £47.6m to £14.6m, a huge 69.3% deterioration which is a sign of things to come as financing a new stadium comes at a significant cost.

Tottenham can look forward to potentially pocketing £43.8m in future transfer fees if ex players meet certain clauses while they only have £11.5m payable for such clauses on their current players.

Thanks for reading, share with a Tottenham fan!