Swansea saw their 7th consecutive season in the Premier League end in relegation after a loss on the final day of the season sealed their fate and a return to the Championship.

A disappointing season had the one positive of a FA Cup Quarter Final run that lifted the mood around the club but may have proven a costly distraction in their Premier League survival bid.

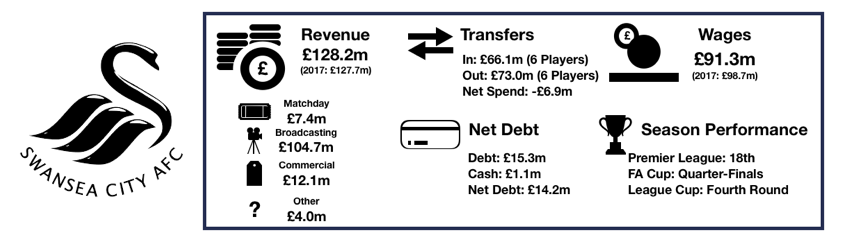

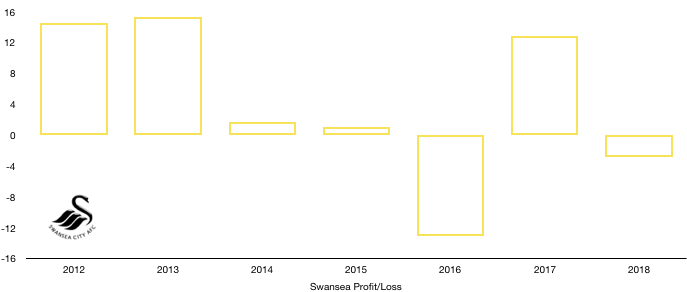

A disappointing season was compounded off the pitch with a £12.9m profit in 2017 turning into a £2.8m loss this year, although they did have the great news that they have purchased the Liberty Stadium from the Council that should enable development of the ground at a later date.

Let’s delve into the numbers.

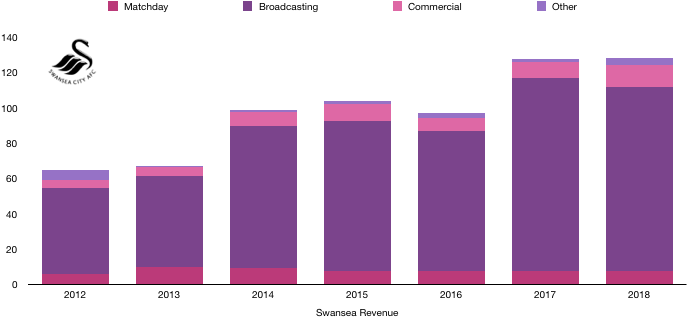

Revenue Analysis

Swansea saw their revenue remain fairly stable, even increasing slightly from £127.8m to £128.2m (0.3%) despite a disappointing season on the pitch.

Matchday revenue remained stable at £7.4m despite an increase in games due to their FA Cup run. With attendances remaining stable, increasing from 20,619 to 20,623 it would seem fans are spending less at games due to a poor campaign.

Broadcasting revenue fell from £109.4m to £104.7 (4%) as Swansea fell from 15th to 18th in the Premier League. This fall in revenue would have been more pronounced if not for the Swans run to the FA Cup Quarter Finals.

Commercial revenue rose from £9.4m to £12.1m (29%) as Swansea managed to exploit their Premier League status successfully one last time. This growth in commercial revenue has been promising and it’s a shame this growth will be halted by relegation.

Other revenue increased from £1.6m to £4.0m (150%). What this relates to is not disclosed.

Looking ahead, Swansea will see a huge drop in revenue following relegation. A difficult season in the Championship hasn’t helped either. Parachute payments will significantly offset the loss in revenue, however revenue will still fall by at least a third and probably to around £60-70m as matchday and commercial revenue suffer, although the major fall will be due to broadcasting revenue falling by around 40-50%.

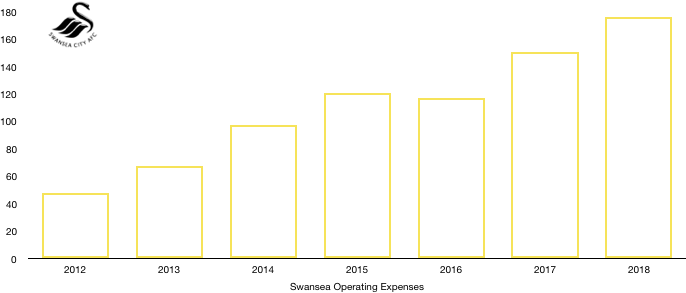

Costs Analysis

Swansea saw a large rise in costs despite revenue flatling, meaning profitability was hurt significantly as Swansea attempted to stave off the threat of relegation. Costs increased from £150.8m to £176.2m (17%) which was not enough to aid their survival push.

Amortisation increased from £24.2m to £37.1m (53%) as Swansea ramped up spending, however it proved too little to late as they reinvested the cash received from the sales of Sigurdsson, Llorente and Cork poorly.

Relegation also saw the value of some of their players crash. This led to Swansea impairing player value by £14.8m, a cost of their relegation (this is likely to relate in the main to Andre Ayew). Interestingly, without this impairment Swansea would have made a profit of a similar level to last year, proving relegation was the main reason for their losses.

Swansea will then be hoping for a quick return to the Premier League, although 2019 has proven too soon after a disappointing season back in the Championship that has at least ended strongly.

Interest costs increased from £0.6m to £1.1m (83%) as interest costs on players signed increased due to the number of instalment deals negotiated this year while their costs on other loans also rose.

Swansea paid minimal tax due to the club making a loss this year.

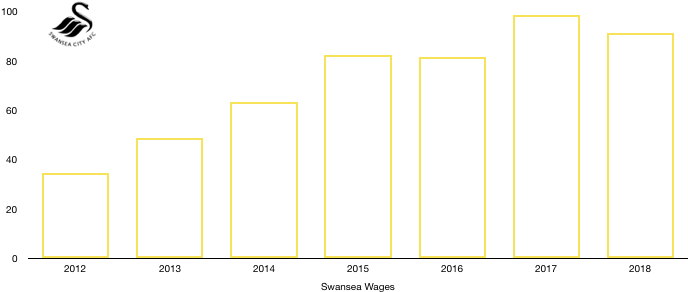

Wages surprisingly fell, dropping from £98.7m to £91.1m (7%) as despite the incoming signings, the departure of key players and high earners actually saw wages fall. Relegation wage drops would have also come into effect right at the end of the season which would have contributed to this fall.

Having already begun reducing wages as they braced themselves for the Championship, Swansea should be well placed financially to further reduce these wages and and maintain current levels of profitability to some degree which is vital for Financial Fair Play and their overall financial health.

The fall in wages works out at a cool £146k per week saving in wages, a decent sum that will help the club going forward.

Directors saw their wage increase slightly despite relegation, increasing from £634k to £655k (3%).

Looking ahead, costs will fall out of necessity. Wages will fall as relegation wage drops come into effect and high earners depart while amortisation will also fall after a large drop in the level of player investment following relegation.

Transfers Analysis

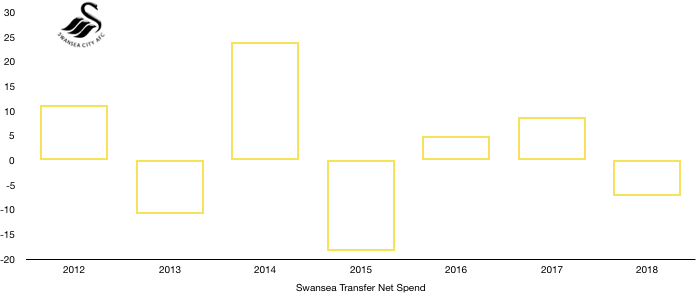

A busy transfer season was imposed on Swansea following the loss of their talisman Gylfi Sigurdsson with 6 players entering and 6 departing the Liberty Stadium.

In came Andre Ayew (£20.5m), Clucas (£14.7m), Bony (£11.7m), Mesa (£11.3m), Sanches (Loan – £7.7m), Harries (£0.3m) for a combined £66.1m.

Out went Sigurdsson (£44.5m), Llorente (£13.6m), Cork (£8.2m), Kingsley (£3.0m), Gomis (£2.3m) and Barrow (£1.5m) for a combined £73.0m.

This led to Swansea recording a net transfer income of £6.9m for the first time in 3 years.

The Sigurdsson money was reinvested in former players with Ayew and Bony returning to the club and confirming that former players should never go back after both disappointed. The signing of Mesa was also poor with the Spaniard never settling. Clucas was a decent purchase and while Sanches looked an inspired loan signing, it just never quite worked out.

Sigurdsson and Llorente were missed hugely, proving costly departures with the loss of their Premier League status likely to prove far costlier than the cash their sales brought in.

The sales of these key players did help Swansea record a profit on player sales of £46.1m, up from £36.9m in 2017. This does however show that without selling players, Swansea would have recorded huge losses, explaining to some extent the need for these departures. This will be even more vital in the Championship due to the drop in revenue.

In cash terms, Swansea spent cash on transfers of £38.5m but received a chunky £54.4m, a net cash inflow of £22.8m, a nice bumper on their return to the Championship.

Swansea are also owed a further £30.0m in transfer fees. However, Swansea owe £43.0m (£32.1m due this year), a net creditor position of £13.0m which has clearly affected Swansea in the transfer market this year.

Swansea could potentially also owe a further £12.7m in contingent transfer fees should certain clauses be met relating to signings.

On top of this, Swansea have signing on bonuses that could become payable should players stay for at the club for a specific period. These amounts may reach £8.2m.

Both these figures above are unlikely to ever become payable in full.

Debt Analysis

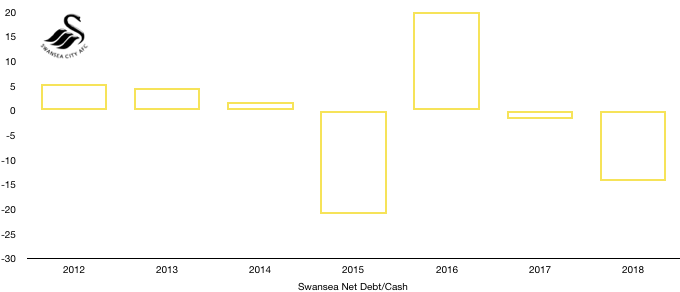

Swansea saw their cash reserves depleted after a difficult season. Cash levels fell from £7.5m to £1.1m (85%) plus Swansea now have an overdraft of £0.8m, effectively leaving them with actual cash of their own of £0.3m.

Cash levels were severely affected by the losses incurred this year which were funded for by the sales of Sigurdsson and Llorente as well as new loans of £4.5m. These new loans did also enable Swansea to spend £1.8m on improving club infrastructure, although this was about halve the £3.9m spent last season, a worrying trend.

Debt increased from £9.2m to £15.3m (66%) as their new owners plunged a bit more money into the club following relegation to keep the club ticking along. The level of debt within Swansea is very low compared to their rivals and isn’t an area of concern although relegation may see their debt rise out of necessity.

Net debt hence rose from £1.7m to £14.2m (735%), a huge increase from the previous lowly figure.

Swansea are in an important period financially with the ability for their finances to go either way.

The club have to be smart and invest well so they can secure a swift return to the Premier League. This season hasn’t gone to plan although the Swans form has improved since the turn of the year and promotion should be an achievable target depending on signings made.

A failure to return to the Premier League in the next couple of years will make it increasingly difficult to then return as parachute payments will taper off and revenue will be much lower, meaning their costs will also have to fall in line and investment will have to drop to avoid Financial Fair Play issues.

Taking The Liberty

The Liberty Stadium was purchased from the Swansea Council for free with operating control now with Swansea who will pay Swansea Council an annual fee for the Stadium and will also receive a share of any naming rights placed on the stadium.

As part of the deal Swansea will also purchase a number of 3G pitches for the local community in an all round good deal for all parties.

The purchase of the stadium now gives Swansea the ability to expand the stadium as they wish and consider naming rights should a lucrative deal appear. Recently the club have also purchased the land behind the stadium which will be used to expand the Liberty Stadium but only once the club are back in the Premier League, making a return even more exciting and important.

Thanks for reading – Share with a fellow football fan!